e-Pharmacies- Significance, Regulation & Challenges

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

Recently, the government issued show cause notices to over 20 leading e-pharmacies. This brings into highlight, the subject of online sale of medicines in India and the challenges in regulating them.

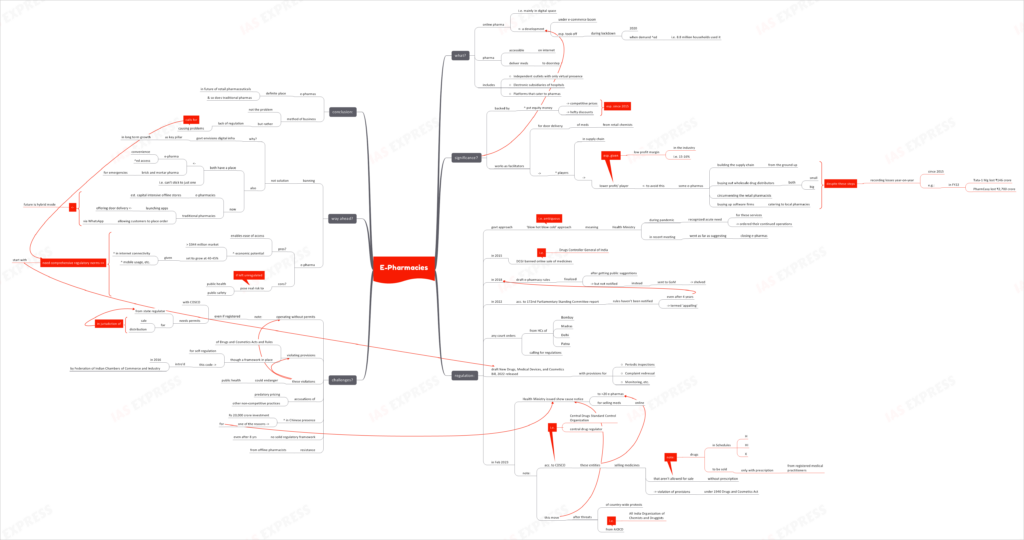

What are e-pharmacies?

- E-pharmacies are online pharmacies i.e. mainly operate in the digital space. These entities are accessible on the internet and they deliver medications to the customers’ doorstep.

- These include:

- Independent outlets with only virtual presence

- Electronic subsidiaries of hospitals

- Platforms that cater to pharmas

- These entities are one of the developments under the e-commerce boom in India.

- The pandemic and the subsequent lockdown in 2020 marked a watershed moment for these e-pharmaceuticals. The demand for doorstep delivery of medicines sky-rocketed, with some 8.8 million households using these services during lockdown.

Why are e-pharmacies significant?

- The e-pharmacies are backed by huge amounts of private equity money and are hence able to offer medicines at competitive prices. They have been offering hefty discounts especially since 2015 in order to gain a larger market share.

- These entities often function as ‘facilitators’ for doorstep delivery of medicines from retails chemists with whom they have tie-ups. This means that more players are involved in the supply chain.

- Already, profit margins in the industry are very thin i.e. 15-16%. The e-pharmacy model lowers this even further for the players.

- To avoid this, some e-pharmacies are building the supply chain from the ground up. They are buying out wholesale drug distributors- both big and small- and circumventing the retail pharmacists. They are also buying up software firms that have been catering to local pharmacies for decades.

- Despite these steps, e-pharmacies are recording losses year-on-year since 2015. For eg: in FY22, Tata-1 Mg recorded a loss of ₹146 crore and PharmEasy lost ₹2,700 crore.

How is the government regulating e-pharmacies?

- The Health Ministry has been using a ‘blow hot blow cold’ approach (i.e. ambiguity) towards e-pharmacies.

- For instance, the ministry recognized the acute need for these services during the lockdown and ordered the e-pharmacies to continue operations.

- Then, in a recent meeting, the Health Minister went as far as suggesting that e-pharmacies be closed down.

- The DCGI (Drugs Controller General of India) banned online sale of medicines for the 1st time in December 2015.

- In 2018, the Health Ministry floated the draft e-pharmacy rules. However, despite being finalized after taking public suggestions into consideration, it wasn’t notified. It was referred to a Group of Ministers for further considerations and eventually, shelved.

- The 172nd Parliamentary Standing Committee report, released in 2022, termed the situation as ‘appalling’ as the rules haven’t been notified even after 4 years.

- There have been multiple court orders over the years calling for regulation of the e-pharmacies. The High Courts of Bombay, Madras, Delhi and Patna have issued such orders.

- The draft of New Drugs, Medical Devices, and Cosmetics Bill, 2022 was released by the Health Ministry. It has comprehensive provisions for:

- Periodic inspections

- Complaint redressal

- Monitoring, etc.

- In early February, the Health Ministry issued show cause notice to over 20 e-pharmacies for selling medicines online.

- The CDSCO (Central Drugs Standard Control Organisation), the central drug regulator, alleged that these entities were selling medicines that aren’t allowed for sale without prescription i.e. violation of provisions under the 1940 Drugs and Cosmetics Act.

- Note that drugs listed in Schedules H, HI, and X can be sold only with a prescription from registered medical practitioners.

- This move followed threats from AIOCD (All India Organisation of Chemists and Druggists) of a country-wide protest if the government fails to act against illegal online sale of medicines.

What are the challenges?

- Several e-pharmacies have been allegedly operating without the necessary permits. Note that even if an e-pharmacy is registered with the CDSCO, it needs permits from state regulators for sale and distribution within their jurisdiction.

- Though the Federation of Indian Chambers of Commerce and Industry framed a self-regulation code for e-pharmacies in 2016, these entities continue to violate provisions of the Drugs and Cosmetics Acts and Rules.

- Such violations can potentially endanger public health.

- There have been accusations of e-pharmacies resorting to predatory pricing and other non-competitive practices.

- The e-pharmacy space in India is witnessing a growing Chinese dominance. It is estimated that China has Rs 20,000 crore investment in the online sale of medicines in India. This is suspected to be one of the reasons behind the recent crackdown.

- A solid regulatory framework for e-pharmacies continues to elude the sector even 8 years after the 1st attempts were made.

- The resistance from the offline pharmacists is also a challenge.

What is the way ahead?

- Banning e-pharmacies cannot be the solution. This is especially so given how the government seeks to develop digital infrastructure as one of the key pillars of long term growth.

- Both e-pharmacies and brick-and-mortar retail pharmacies have a place in the market. For instance, patients still rely on their neighbourhood pharmacies in case of emergencies. Attempting to stick to just one way of doing business is futile.

- This is why e-pharmacy players are now opening capital-intensive offline stores across the country. At the same time, traditional brick-and-mortal pharmacies are beginning to launch their own apps and offer home delivery options. In some cases, these stores are allowing customers to place orders via WhatsApp.

- This shows that a hybrid mode is the most likely scenario in the coming years.

- E-pharmacies, while enabling ease of access to medicines, presents a significant economic potential in the form of a more than $344 million market. It is set to grow at 40-45%, considering the increasing internet connectivity, mobile phone usage, etc.

- However, these entities pose a real risk to public health and safety if left unregulated. The need of the hour is comprehensive regulatory norms.

- This can start with moving the New Drugs, Medical Devices, and Cosmetics Bill, 2022 forward.

Conclusion:

e-pharmacies have a definite place in the future of retail pharmaceuticals and so does the traditional brick-and-mortal chemist’s stores. It isn’t the method of doing business itself, but the lack of regulation that is causing problems. Hence, the need of the hour is a comprehensive regulatory framework.

Practice Question for Mains:

“Banning e-pharmacies would be like throwing the baby out with the bath water”. Comment. (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.