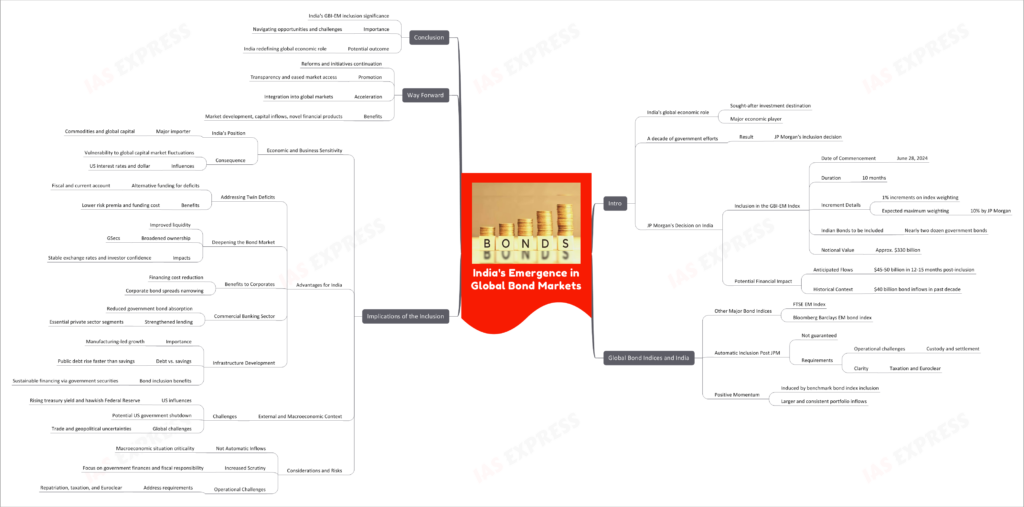

India’s Emergence in Global Bond Markets- What does the inclusion in Government Bond Index-Emerging Markets Index mean?

India is increasingly becoming a sought-after investment destination and a major player in the global economic landscape. After a decade of persistent efforts, the fruits of the government’s labor are beginning to manifest as JP Morgan has chosen to integrate India into its Government Bond Index-Emerging Markets (GBI-EM). This move promises to bring significant changes to India’s financial ecosystem.

JP Morgan’s Decision on India

Inclusion in the GBI-EM Index:

- Date of Commencement: June 28, 2024.

- Duration: Spanning over 10 months.

- Increment Details: 1% increments on index weighting. Anticipated to achieve a maximum weighting of 10% according to JP Morgan.

- Indian Bonds to be Included: Nearly two dozen government bonds.

- Notional Value: Approx. $330 billion.

Potential Financial Impact:

- Anticipated Flows: Between $45-50 billion in the subsequent 12-15 months post-inclusion.

- Historical Context: In comparison, India garnered bond inflows of roughly $40 billion over the past decade.

Global Bond Indices and India

- Other Major Bond Indices: FTSE EM Index and Bloomberg Barclays EM bond index.

- Automatic Inclusion Post JPM: Not guaranteed. India’s entry into these indices demands fulfilling stricter procedural requirements, such as:

- Handling operational challenges like custody and settlement.

- Ensuring clarity in areas like taxation and Euroclear.

- Positive Momentum: Inclusion in the benchmark bond index is predicted to induce a positive trajectory, catalyzing consistent, larger portfolio inflows.

Implications of the Inclusion

Economic and Business Sensitivity:

- India’s Position: Major importer of commodities and a significant importer of global capital.

- Consequence: India’s economic and business cycles are vulnerable to fluctuations in global capital markets, specifically US interest rates and the dollar’s performance.

Advantages for India:

- Addressing Twin Deficits:

- Alternative funding source for fiscal and current account deficits.

- Reduction in India’s risk premia and funding cost.

- Deepening the Bond Market:

- Enhanced liquidity.

- Broadened ownership of GSecs.

- Stability in exchange rates and increased investor confidence.

- Benefits to Corporates:

- Decrease in financing cost over time.

- Narrowing of corporate bond spreads due to positive sentiments.

- Commercial Banking Sector:

- Reduced necessity to absorb majority of government bonds.

- Strengthened capacity to lend to essential private sector segments.

- Infrastructure Development:

- Essential for manufacturing-led growth.

- Public debt has been increasing faster than savings rate.

- Bond inclusion can offer sustainable financing via investment in government securities.

External and Macroeconomic Context:

- Challenges:

- Rising US treasury yield and a hawkish US Federal Reserve.

- Prospective US government shutdown.

- Global trade and geopolitical uncertainties.

Considerations and Risks:

- Not Automatic Inflows: India’s underlying macroeconomic situation remains critical.

- Increased Scrutiny: Inclusion will draw attention to government finances and fiscal responsibility.

- Operational Challenges: Need to address repatriation of funds, taxation complexities, and international debt settlement platforms like Euroclear.

Way Forward

For India to fully capitalize on this opportunity, it must continue its reform initiatives, promote transparency, and ease market access. Such efforts will accelerate India’s integration into global markets, laying the groundwork for remarkable market development, consistent capital inflows, and the inception of novel financial products.

Conclusion

India’s integration into JP Morgan’s GBI-EM is a testament to its growing prominence in the global financial arena. While the path is laden with opportunities, it’s crucial to navigate the challenges effectively. With the right strategies, India stands poised to redefine its role in the global economic landscape.

Practice Question for Mains

Comment on the significance of India’s entry into the global bond market. What is the way ahead? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.