India’s Banking Sector- How has it Evolved?

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 80+ questions reflected

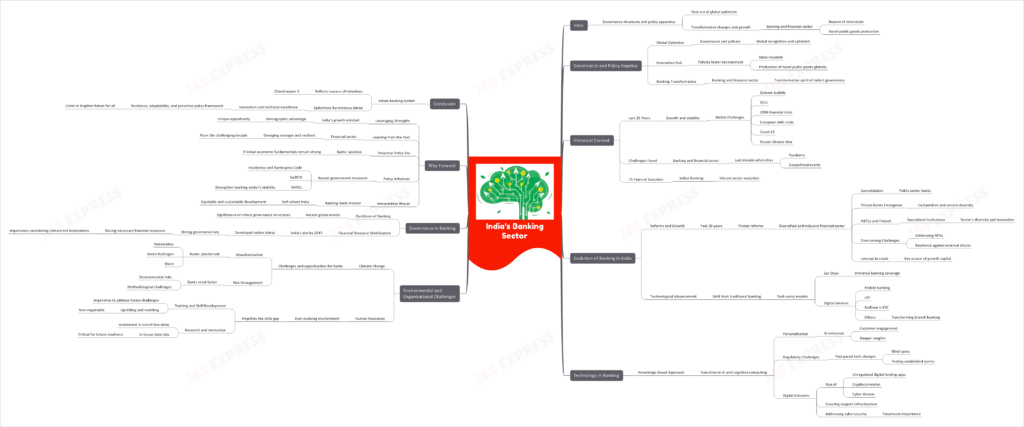

India’s governance structures and policy apparatus have ushered in a new era of global optimism. This is evident in the transformative changes and growth witnessed in the banking and financial sector, making India a beacon of innovation and novel public goods production.

Governance and Policy Impetus

- Global Optimism: India’s governance and policies have garnered global recognition and optimism.

- Innovation Hub: Policies have fostered an environment where ideas incubate, resulting in production of novel public goods globally.

- Banking Transformation: The banking and financial sector exemplifies the transformative spirit of India’s governance.

Historical Context

- Last 25 Years: Marked by growth and stability despite global challenges like the dotcom bubble, 9/11, 2008 financial crisis, European debt crisis, Covid-19, and Russia-Ukraine War.

- Challenges Faced: Banking and financial sector confronted adversities, especially in the last decade due to the pandemic and geopolitical events.

- 75 Years of Evolution: Indian banking matured into a vibrant sector over 75 years.

Evolution of Banking in India

- Reforms and Growth: Past 30 years saw pivotal reforms leading to a diversified and inclusive financial sector.

- Consolidation: In public sector banks.

- Private Banks Emergence: Contributing to competition and service diversity.

- NBFCs and Fintech: Specialized institutions enhancing the sector’s diversity and innovation.

- Overcoming Challenges: Addressing non-performing assets (NPAs) and resilience against external shocks.

- Internal Accruals: Now a key source of growth capital.

- Technological Advancement: Shift from traditional banking to tech-savvy models.

- Jan Dhan: Universal banking coverage.

- Digital Services: Mobile banking, UPI, Aadhaar e-KYC, and others transforming branch banking.

Technology in Banking

- Knowledge-Based Approach: Transition to AI and cognitive computing.

- Personalization: AI enhancing customer engagement and deeper insights.

- Regulatory Challenges: Fast-paced tech changes create blind spots, testing established norms.

- Digital Concerns: Rise of unregulated digital lending apps, cryptocurrencies, and cyber threats. Ensuring support infrastructure and addressing cybersecurity becomes paramount.

Environmental and Organizational Challenges

- Climate Change: Poses significant challenges and opportunities for banks.

- Decarbonisation: Banks play a pivotal role in initiatives for renewables, green hydrogen, and more.

- Risk Management: Banks must factor in environmental risks amidst methodological challenges.

- Human Resources: The ever-evolving environment amplifies the skills gap.

- Training and Skill Development: Imperative to address challenges of tomorrow. Upskilling and reskilling become non-negotiable.

- Research and Innovation: Investment in out-of-box ideas and in-house data labs critical for future readiness.

Governance in Banking

- Backbone of Banking: Recent global events underscore the significance of robust governance structures.

- Financial Resource Mobilization: As India aims for developed nation status by 2047, strong governance will be key to raising necessary financial resources. Importance magnifies considering the implications of climate risk.

Way Forward

- Leveraging Strengths: India’s growth mindset and demographic advantage offer a unique opportunity.

- Learning from the Past: The financial sector is emerging stronger and resilient from the challenging decade.

- Proactive Policy Era: Banks are well-positioned if Indian economic fundamentals remain strong.

- Policy Initiatives: Recent government measures like the Insolvency and Bankruptcy Code, NaBFID, and NARCL strengthen the banking sector’s stability.

- Atmanirbhar Bharat: Banking leads the mission for self-reliant India, promising equitable and sustainable development.

Conclusion

The Indian banking system, reflecting the success of initiatives like Chandrayaan-3, epitomizes the harmonious blend of innovation and technical excellence. With its resilience, adaptability, and proactive policy framework, it stands ready to usher in a brighter future for all.

Practice Question for Mains

What are the major challenges faced by India’s banking sector going forward? What is the way ahead? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.