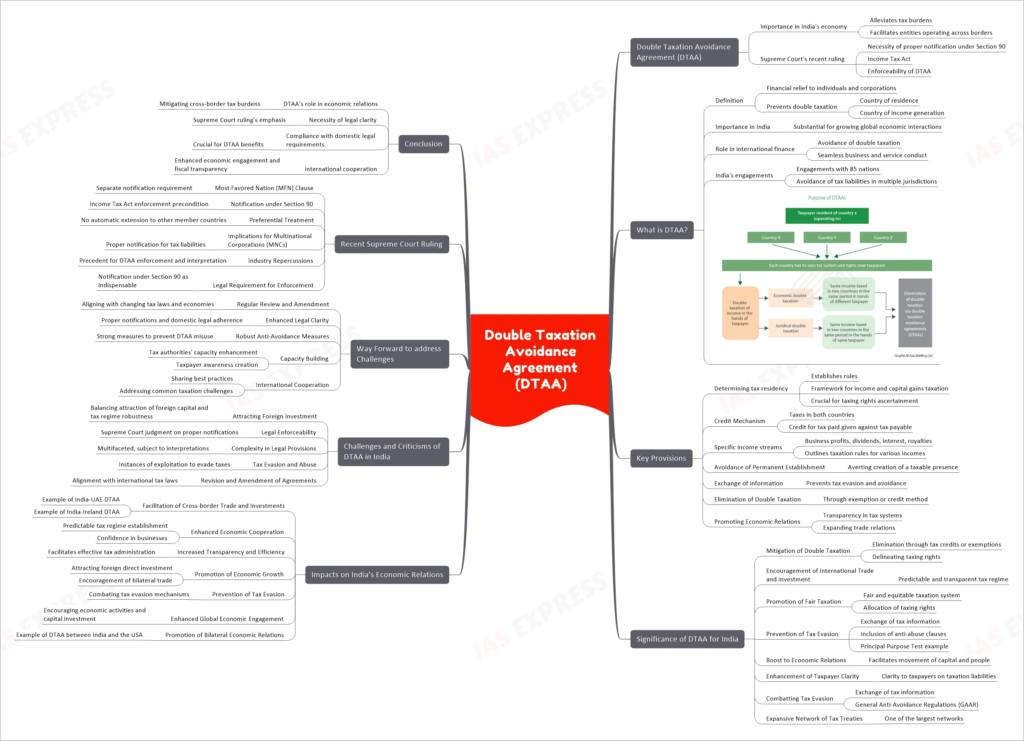

Double Taxation Avoidance Agreement (DTAA): Provisions, Significance, Impacts

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

The Double Taxation Avoidance Agreement (DTAA) has been a cornerstone in India’s international economic engagements, alleviating tax burdens for entities operating across borders. Recently, the Supreme Court of India underscored the necessity of proper notification under Section 90 of the Income Tax Act for enforcing a DTAA, spotlighting the legal intricacies involved in operationalizing these agreements. This ruling brings to light the legal enforceability of DTAAs, an aspect critical for ensuring tax compliance and fostering a conducive environment for international trade and investment.

What is DTAA?

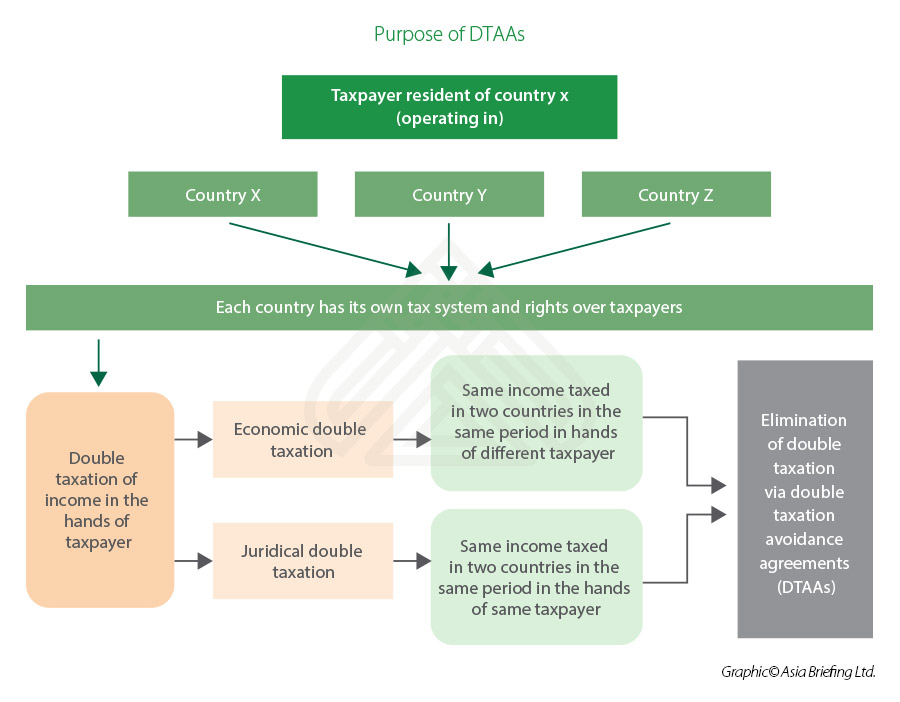

- The concept of Double Taxation Avoidance Agreement (DTAA) serves as a financial relief to individuals and corporations that generate income across borders.

- This arrangement aims to prevent the scenario where income is taxed in both the country of residence and the country of income generation.

- Specifically in India, the DTAA holds substantial importance given the country’s growing economic interactions on the global stage.

- The agreement is a crucial part of the international financial architecture that underpins the avoidance of double taxation and supports the seamless conduct of business and provision of services across countries.

- Through DTAA, India has systematically engaged with 85 other nations to ensure that taxpayers are not subjected to tax liabilities in multiple jurisdictions, thus fostering a conducive environment for international trade and personal income generation.

Key Provisions

The Double Taxation Avoidance Agreement (DTAA) embodies a set of provisions that are tailored to address the issues of double taxation, thus ensuring that individuals and corporations are not taxed twice on the same income in different countries. The key provisions of DTAA between India and other countries are elucidated below:

- Tax Residency and Income Taxation:

- The agreement establishes rules for determining tax residency and provides the framework for the taxation of income and capital gains.

- It is a crucial provision as it helps in ascertaining which country has the taxing rights over a particular income.

- Credit Mechanism:

- The credit mechanism is a pivotal provision of DTAA, wherein the income is taxed in both countries, but credit for tax paid in one country is given against tax payable in the other country.

- Specific Income Streams:

- The agreement encompasses provisions on business profits, dividends, interest, royalties, and other forms of income.

- These provisions are fundamental as they outline the taxation rules for various income streams.

- Avoidance of Permanent Establishment:

- This provision helps in averting the creation of a permanent establishment in the other country, which could otherwise lead to higher taxation.

- Exchange of Information:

- DTAA facilitates the exchange of information between countries to prevent tax evasion and tax avoidance.

- Elimination of Double Taxation:

- Provisions in the agreement ensure the elimination of double taxation either through the exemption method or the credit method, thereby preventing the same income from being taxed in both countries.

- Promoting Economic Relations:

- DTAA aims to foster economic and trade relations between countries by bringing transparency in the tax systems, which in turn creates a conducive business environment and helps in expanding trade relations.

These provisions form the cornerstone of the DTAA and play a vital role in facilitating international trade and investment, providing a fair and equitable taxation framework, and eliminating the impact of double taxation. Through these key provisions, the DTAA creates a structured pathway to address the challenges posed by international taxation and aids in the seamless conduct of cross-border economic activities.

Significance of DTAA for India

The Double Taxation Avoidance Agreement (DTAA) has been instrumental in fostering a conducive environment for both domestic and international economic engagements in India. The multifaceted significance of DTAA for India encompasses fiscal, economic, and trade facets as elucidated below:

- Mitigation of Double Taxation:

- The primary objective of DTAA is to eliminate the instances of double taxation that could occur due to cross-border economic activities.

- This is achieved by delineating the taxing rights between India and the other contracting country, thereby providing relief to taxpayers in the form of tax credits or exemptions for the taxes paid in one country against the tax payable in the other country.

- Encouragement of International Trade and Investment:

- DTAA serves as a trade-friendly treaty that propels international trade, investment, and the free flow of technology.

- By clarifying the tax liabilities for international entrepreneurs and investors, DTAA contributes to a more predictable and transparent tax regime, which in turn fosters a favorable business environment.

- Promotion of Fair and Equitable Taxation:

- The agreement outlines a fair and equitable system of taxation that ensures the reasonable allocation of taxing rights between the contracting countries.

- This promotes a sense of fairness and equity in international taxation, thus enhancing the attractiveness of cross-border economic engagements.

- Prevention of Tax Evasion:

- Through provisions like the exchange of tax information and the inclusion of anti-abuse clauses, DTAA helps in curbing tax evasion and avoidance.

- For instance, the revision in the India-Sri Lanka DTAA incorporated a Principal Purpose Test to deter tax evasions.

- Boost to Economic Relations:

- By mitigating the adverse effects of double taxation, DTAA promotes better economic relations between India and other countries.

- It facilitates the movement of capital and people across borders, thereby enriching the economic interactions and collaborations.

- Enhancement of Taxpayer Clarity:

- DTAA provides clarity to taxpayers regarding their taxation liabilities, thereby bringing more certainty to the investment market.

- This clarity is particularly beneficial for taxpayers with foreign income or whose source of income is in another country.

- Combatting Tax Evasion:

- The provisions for the easy exchange of tax information among countries and the incorporation of certain rules and regulations like the General Anti- Avoidance Regulations (GAAR) in the DTAA help in identifying transactions done solely for the purpose of tax evasion.

- Expansive Network of Tax Treaties:

- India has established one of the largest networks of tax treaties with over 85 countries, which not only mitigates double taxation but also assigns taxation rights in accordance with the consensus per the DTAA.

- This expansive network exemplifies India’s proactive stance in engaging with the global community to create a robust framework for international taxation.

The DTAA, by addressing the challenges posed by international taxation, plays a pivotal role in enhancing India’s economic landscape. It not only alleviates the tax burden on individuals and entities engaged in cross-border activities but also significantly contributes to the broader economic and trade relations between India and other countries. Through a well-structured DTAA framework, India aims to create a more transparent, fair, and conducive environment for both domestic and international economic stakeholders.

Impacts on India’s Economic Relations

The Double Taxation Avoidance Agreements (DTAAs) have significantly influenced India’s economic relations with various countries. Through these agreements, India has managed to create a favorable environment for cross-border business activities, investments, and trade. Here are some of the notable impacts elucidated through specific agreements with the UAE, Ireland, and the general role of DTAAs:

- Facilitation of Cross-border Trade and Investments:

- DTAAs, by eliminating the risk of double taxation, create a conducive environment for cross-border trade and investments.

- For instance, the DTAA between India and the UAE has significantly reduced tax uncertainties and barriers, thus facilitating a seamless flow of trade and investments.

- Businesses have been able to expand operations, establish subsidiaries, and engage in joint ventures, promoting economic growth and creating employment opportunities.

- Similarly, the DTAA with Ireland has played a crucial role in promoting business and investments between India and Ireland by removing a significant barrier to cross-border transactions.

- Enhanced Economic Cooperation:

- The agreements promote economic cooperation by establishing a predictable tax regime.

- This predictability instills confidence in businesses, encourages joint ventures, and stimulates collaborations in various sectors.

- The India-UAE DTAA, for instance, serves as a catalyst for economic cooperation and trade, stimulating collaborations in technology, finance, and infrastructure sectors among others.

- Increased Transparency and Efficiency:

- DTAAs enhance transparency in tax obligations for residents engaging in cross-border transactions, which in turn facilitates effective tax administration and reduces potential tax evasion.

- They enable investors to structure their investments efficiently, thereby enhancing the attractiveness of the involved countries as investment destinations.

- Promotion of Economic Growth:

- By eliminating or reducing tax barriers, DTAAs foster economic growth, attract foreign direct investment, and promote bilateral trade.

- This is evident in the India-UAE DTAA where the agreement has encouraged cross-border investments, thereby fostering economic growth and enhancing bilateral trade between India and the UAE.

- Prevention of Tax Evasion:

- Provisions for the easy exchange of tax information among countries and the incorporation of certain rules and regulations help in combating tax evasion.

- The DTAAs also have robust exchange of information provisions and anti-abuse measures to ensure the integrity of the tax system.

- Enhanced Global Economic Engagement:

- DTAAs extend India’s engagement in the global economic arena by promoting economic activities between India and other nations, encouraging capital investment, trade in goods and services, and other economic activities by preventing international double taxation.

- Promotion of Bilateral Economic Relations:

- The DTAAs play a crucial role in promoting economic cooperation between nations, as seen in the DTAA between India and the USA, which facilitates cross-border transactions and economic cooperation between the two countries.

The systematic approach towards DTAAs has significantly contributed to bolstering India’s economic relations with other countries, paving the way for enhanced trade, investments, and economic cooperation. Through these agreements, India continues to foster a favorable environment for international economic engagements, reflecting its proactive stance in engaging with the global community for mutual economic benefit.

Challenges and Criticisms of DTAA in India

The Double Taxation Avoidance Agreements (DTAA) while being instruments of promoting fiscal clarity and economic cooperation, also come with their set of challenges and criticisms in the Indian context. Here are some of the significant challenges and criticisms associated with DTAA in India:

- Attracting Foreign Investment:

- The stringent tax regulations associated with DTAA can sometimes pose a challenge in attracting foreign investments. The aim is to prevent India from being perceived as a tax haven solely to lure foreign investments, thus establishing a fine balance between attracting foreign capital and maintaining a robust tax regime.

- Legal Enforceability:

- A recent judgment by the Supreme Court of India highlighted the legal hurdles related to the enforceability of DTAAs. The Court held that a DTAA cannot be enforced by any court, authority, or tribunal unless it has been duly notified by the Central Government under Section 90 of the Income Tax Act. This ruling underlines the necessity of appropriate notifications for the legal enforceability of DTAAs, and how the absence of such notifications can render the agreements non-enforceable in Indian courts.

- Complexity in Legal Provisions:

- The multifaceted legal provisions encompassed in the DTAA treaties often necessitate a thorough understanding and interpretations, which could be subject to varying interpretations. This complexity can lead to legal disputes and challenges in the enforcement of DTAAs.

- Tax Evasion and Abuse:

- Despite the mechanisms embedded within DTAAs to curb tax evasion, there have been instances where the provisions of DTAAs were exploited to evade taxes. For example, the India-Sri Lanka DTAA was revised in 2013 to incorporate provisions such as the Principal Purpose Test to combat tax evasions, reflecting the ongoing challenge of preventing tax abuse through DTAAs.

- Revision and Amendment of Agreements:

- The dynamic nature of international tax laws and economic relations necessitates periodic revision and amendment of DTAAs to ensure they remain relevant and effective. This process can be cumbersome and may lead to temporary uncertainties in cross-border tax liabilities.

Way Forward to address Challenges

Addressing the challenges associated with DTAA in India requires a multi-pronged approach:

- Regular Review and Amendment: Periodic review and amendment of DTAAs to align with changing international tax laws and economic scenarios.

- Enhanced Legal Clarity: Ensuring legal clarity and enforceability through proper notifications and adherence to the domestic legal framework.

- Robust Anti-Avoidance Measures: Incorporating strong anti-avoidance measures to prevent misuse of DTAA provisions for tax evasion.

- Capacity Building: Enhancing the capacity of tax authorities and creating awareness among taxpayers regarding DTAA provisions.

- International Cooperation: Engaging in international cooperation to share best practices and address common challenges in cross-border taxation.

Recent Supreme Court Ruling

The Supreme Court of India has recently delivered a significant judgment concerning the Double Taxation Avoidance Agreements (DTAA) which has far-reaching implications for the interpretation and enforcement of DTAAs in India. Here are the key points from the ruling:

- Most Favored Nation (MFN) Clause:

- The apex court ruled that the benefits under the Most Favored Nation (MFN) clause in DTAAs could only be availed if they have been separately notified by the Central Government.

- Notification under Section 90 of the Income Tax Act:

- The court asserted that a DTAA cannot be enforced unless it has been notified under Section 90 of the Income Tax Act.

- Preferential Treatment:

- It was clarified that the preferential treatment given to a country under a DTAA was not automatically extended to other member countries unless the earlier treaty with them was amended.

- Implications for Multinational Corporations (MNCs):

- The ruling could have significant implications for multinational corporations from various countries, as it necessitates proper notification for the enforcement of DTAAs which could affect the tax liabilities of these corporations operating in India.

- Industry Repercussions:

- The judgment has wider repercussions for the industry as it sets a precedent for the enforcement and interpretation of DTAAs, which is crucial for cross-border trade and investments.

- Legal Requirement for Enforcement:

- The issuance of a notification under Section 90 of the Income Tax Act, 1961 is deemed as an indispensable and obligatory requirement for a Court, Tribunal, or authority to give effect to a DTAA or any protocol altering its terms, thereby modifying existing provisions of law.

This ruling sheds light on the legal intricacies involved in the operationalization of DTAAs and emphasizes the need for clear legal frameworks to ensure their effective enforcement, thereby fostering a conducive environment for international trade and investment.

Conclusion

The Double Taxation Avoidance Agreement (DTAA) plays a pivotal role in bolstering India’s economic relations with the global community by mitigating tax burdens on cross-border income. However, the recent Supreme Court ruling underscores the necessity of legal clarity and proper enforcement mechanisms to reap the full benefits of DTAAs. Ensuring compliance with domestic legal requirements and fostering international cooperation are crucial steps towards leveraging DTAAs for enhanced economic engagement and fiscal transparency.

Practice Question for Mains

- Discuss the role of Double Taxation Avoidance Agreements (DTAA) in promoting international trade and investment in India. (250 words)

- Analyze the challenges faced by India in enforcing Double Taxation Avoidance Agreements (DTAA) and suggest measures to overcome these challenges. (250 words)

- Evaluate the impact of the recent Supreme Court ruling on the enforcement of Double Taxation Avoidance Agreements (DTAA) in India. (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.