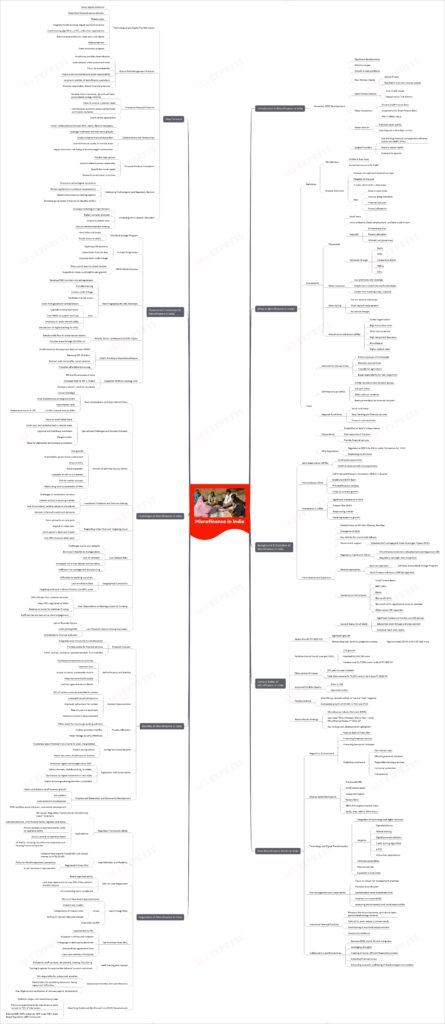

Microfinance in India – Definition, Benefits, Challenges

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

Introduction to Microfinance in India

In 2023, India’s microfinance sector witnessed significant developments, including a massive merger and substantial growth in loan portfolios. The sector added 87 lakh new women clients, reaching about 6 crore low-income women with over 3 lakh crores in credit across 729 districts. A major highlight was the ₹44.11 billion acquisition of Fincare Small Finance Bank by AU Small Finance Bank, signifying a substantial consolidation in the industry. Furthermore, the sector experienced growth in loan portfolios and improved asset quality, with total loans reaching Rs 3.48 trillion in FY23. Non-Banking Financial Company-Microfinance Institutions (NBFC-MFIs) emerged as the largest providers of microfinance, indicating the sector’s robust health and potential for further growth.

What is Microfinance in India? (Definition, Components & Types)

Definition:

- RBI Definition: The Reserve Bank of India (RBI) defines microfinance as collateral-free loans to households with an annual income of up to Rs. 3 lakh.

- Broader Definition: Microfinance is the provision of credit and other financial services in very small amounts, targeted at the poor in rural, semi-urban, or urban areas. It aims to raise income levels and improve living standards, acting as a tool for financial inclusion and poverty alleviation.

Components:

- Microcredit: Small loans given to those lacking collateral, steady employment, or a verifiable credit history, supporting entrepreneurship, poverty alleviation, and women’s empowerment. Delivered through various institutions like banks, RRBs, Cooperative Banks, NBFCs, and MFIs.

- Micro Insurance: Insurance with low premiums and coverage, catering to low income/net-worth individuals, covering a range of risks including crops and livestock.

- Micro Saving: Designed for low-income individuals, similar to savings accounts but with small deposit requirements and no service charges.

- Microfinance Institutions (MFIs): Varied organisations offering microfinance services, characterized by unique features like high transaction costs, short loan durations, high repayment frequency, no collateral, and higher default rates.

Types:

- Joint Liability Groups (JLGs): Informal groups of 4-10 people seeking mutually assured loans, typically for agriculture-related purposes. All members share equal responsibility for loan repayment.

- Self-Help Groups (SHGs): Groups of people in similar socioeconomic situations aiding each other, often without collateral. Banks have partnered with SHGs to enhance financial inclusion, especially in rural areas.

- Regional Rural Banks: Institutions serving rural areas with basic banking and financial services, focusing on boosting the rural economy.

- Cooperatives: Established at India’s Independence, these pool resources of the poor to provide financial services.

- MFIs Regulations: Depending on their structure, MFIs are regulated either as NBFCs by the RBI or under the Companies Act, 2013.

Background & Evolution of Microfinance in India

- Early Experiments (1970s): Microfinance in India began with small-scale experiments in the 1970s, aimed at providing credit to underserved rural populations.

- First Initiative (1974): The Self-Employed Women’s Association (SEWA) in Gujarat established the SEWA Bank in 1974, marking the first introduction of microfinance in India. SEWA Bank provided financial services to individuals in rural areas, focusing on growing their businesses.

- Momentum in the 1990s: The 1990s saw significant momentum in microfinance institutions (MFIs). Pioneers like SEWA demonstrated the potential of microfinance in empowering women and fostering economic growth.

- Formalization and Expansion: The formalization of microfinance was marked by the establishment of organizations like SKS Microfinance and Bandhan, along with the emergence of Self-Help Groups (SHGs) as key vehicles for microcredit delivery. Government support through schemes like the Swarnajayanti Gram Swarozgar Yojana (SGSY) further propelled the sector.

- Regulatory Framework (2012): The Microfinance Institutions (Development and Regulation) Bill in 2012 provided regulatory oversight and recognition of the microfinance sector.

- Diverse Approaches: India follows two main approaches for microfinance services: the bank-led approach (Self-Help Groups-Bank Linkage Program) and the Micro Finance Institution (MFI)-led approach.

- Varied Sector Participants: The sector includes Small Finance Banks, NBFC MFIs, Banks, and Non-profit MFIs. Non-profit MFIs are mostly regulated as trusts or societies, while others are under RBI regulation.

- Current Status (As of 2022): As of 31 March 2022, microfinance programs cover significant numbers of families and SHG groups, with substantial credit linkage and disbursement, demonstrating the sector’s extensive reach and impact.

Current Status of Microfinance in India

- Sector Growth: In FY 2022-23, the microfinance sector in India saw significant growth. The outstanding loan portfolio of the microfinance institution (MFI) sector was projected to increase by approximately 20.3% at Rs 3.25 lakh crore compared to the previous fiscal year.

- Portfolio Growth: As of June-end 2023, there was a 21% growth in the sector’s portfolio, reaching Rs 3,58,700 crore, compared to Rs 2,96,487 crore in the previous year. The increase was over Rs 7,000 crores in the first quarter of FY 2023-24.

- Disbursement Increase: There was a 30% year-on-year increase in the total disbursement by all lenders, amounting to Rs 76,274 crore during the first quarter (April-June) of FY 2023-24.

- Improved Portfolio Quality: The microfinance sector not only grew in size but also saw improvements in the quality of its portfolio.

- Positive Outlook: India Ratings revised its outlook on the microfinance sector to ‘neutral’ from ‘negative’, anticipating a growth of 20-30% in both FY22 and FY23. This marked a significant improvement over the below 10% growth in assets under management in the preceding two years.

- Recent Review Findings: The Microfinance Industry Network (MFIN) launched the third edition of “Micro Matters: Macro View – India Microfinance Review FY 2022-23”, highlighting these key findings and developments in the sector.

How does the Microfinance Work in India

- Regulatory Environment: The Reserve Bank of India (RBI) plays a crucial role in promoting financial inclusion and protecting borrowers’ interests. The RBI’s guidelines emphasize fair interest rates, efficient grievance redressal, responsible lending practices, consumer protection, and transparency.

- Diverse Sector Participants: The sector comprises traditional MFIs, small finance banks, cooperative banks, and fintech firms. Each contributes to the sector’s diversity, catering to the financial needs of micro-entrepreneurs and low-income households. NBFC-MFIs hold the highest market share, followed by banks, small finance banks (SFBs), non-banking financial companies (NBFCs), and non-profit organizations (NFPs).

- Technology and Digital Transformation: The integration of technology and digital solutions is transforming the Indian microfinance industry. MFIs are adopting digital platforms, mobile banking, digital payment solutions, credit scoring algorithms, e-KYC, and online loan applications. This digital revolution enhances the accessibility of financial services and reduces barriers to entry, especially in rural areas.

- Risk Management and Sustainability: MFIs are focusing on robust risk management practices, including portfolio diversification and sophisticated credit assessment tools. Sustainability is becoming increasingly important, with the sector exploring ways to improve its environmental and social responsibility.

- Innovative Financial Products: The sector is innovating with products like micro-insurance, agricultural loans, and personalized savings schemes. These specialized financial tools are tailored to meet unique customer needs, contributing to economic empowerment and community resilience.

- Collaborations and Partnerships: Collaborations between MFIs, banks, and fintech companies are growing, leveraging strengths to create a more inclusive and efficient financial ecosystem. These partnerships help extend financial access to remote and underserved areas, enhancing the economic well-being of disadvantaged communities

Regulation of Microfinance in India

- Regulatory Framework (2022): The RBI issued the “Regulatory Framework for Microfinance Loans” Directions in 2022, applicable to commercial banks, including small finance banks and regional rural banks, primary (urban) co-operative banks, state co-operative banks, district central co-operative banks, and all NBFCs, including microfinance institutions and housing finance companies.

- Loan Definition and Flexibility: Microfinance loans are defined as collateral-free loans to households with annual income up to ₹3,00,000. Regulated Entities (REs) must have a policy for flexible repayment periodicity as per borrowers’ requirements.

- Limit on Loan Repayment: A board-approved policy must limit loan repayments to a maximum of 50% of a household’s monthly income. All outstanding loans, including collateral-free microfinance loans and other types of loans, are considered in this computation.

- Loan Pricing Policy: REs must have a board-approved policy for pricing microfinance loans, covering interest rate models, components of interest rates, and a ceiling on interest rates and charges. Interest rates and charges must not be usurious and are subject to RBI supervision.

- Fair Practices Code (FPC): REs must implement an FPC, displayed in all offices and on websites, in a language understood by the borrower. A standard loan agreement form and a loan card incorporating key information must be provided to borrowers.

- Staff Training and Conduct: REs must have policies for staff conduct, recruitment, training, and monitoring, including training programs for appropriate behavior towards customers.

- Outsourced Activities and Loan Recovery: The REs are responsible for any outsourced activities, and must have mechanisms for identifying borrowers facing repayment difficulties. Recovery agents engaged must undergo due diligence and verification of antecedents.

- Qualifying Assets and Net Owned Fund (NOF) Requirements: The definition of qualifying assets for NBFC-MFIs aligns with the definition of microfinance loans, with minimum requirements for microfinance loans revised to 75% of total assets. Existing NBFC-MFIs must adhere to NOF requirements specified under the RBI’s Scale Based Regulation (SBR) framework.

Benefits of Microfinance in India

- Financial Inclusion: Microfinance plays a key role in financial inclusion, integrating the poor into the nation’s economic development and providing access to a range of financial services, including credit, savings, insurance, payment services, and fund transfers.

- Self-Sufficiency and Stability: By facilitating entrepreneurial activities, microfinance has made its beneficiaries self-sufficient, improving their lives and that of their families. It also provides stability by enabling access to steady and sustainable income, helping borrowers build assets and cushion against external shocks.

- Women Empowerment: Approximately 95% of certain microfinance products are extended to women, including those with disabilities. This has led to increased household incomes, improved self-esteem for women, and the rise of many rural entrepreneurs, showcasing the sector’s impact on women’s empowerment.

- Poverty Alleviation: Microfinance disrupts the cycle of poverty by offering credit for income-generating activities, thus enabling economic mobility and helping the poor manage their poverty more effectively.

- Savings and Social Benefits: Microfinance has raised awareness about financial instruments available for the poor and marginalized, fostering a culture of saving in rural households. Families benefiting from microloans are more likely to provide better education for their children and quality healthcare.

- Digitization and Sustainability: The sector has embraced digital technologies since 2017, using online delivery channels, mobile banking, and e-wallets, contributing significantly to the digital movement in rural India. This aligns with sustainability goals by making income-generating activities more sustainable through dependable credit.

- Employment Generation and Community Development: Microfinance funds have contributed to small business growth, leading to job creation and local economic development. Community-based approaches like SHGs have facilitated social cohesion and community development.

Challenges of Microfinance in India

- Over-Indebtedness and High-Interest Rates: One of the critical challenges facing the microfinance sector in India is the issue of over-indebtedness among borrowers, compounded by high-interest rates compared to mainstream banks. MFIs often charge interest rates ranging from 12-30% of the principal amount, significantly higher than mainstream banks, which typically range from 8-12%.

- Operational Challenges and Remote Outreach: The operational model of microfinance, focusing on small ticket loans to the urban poor and underbanked in remote areas, comes with logistical and field force overheads. This results in margin erosion and necessitates digitization and process automation to manage the expense of outreach effectively.

- Growth of Self-Help Groups (SHGs): The fast growth of SHGs, often promoted by government involvement, has brought stress to the microfinance institutions. This rapid expansion and the adoption of models like SHG or Joint Liability Group (JLG) without considering the specific situation increases the risk for weaker sections and adversely affects the long-term sustainability of MFIs.

- Investment Validation and Decision Making: MFIs face challenges in investment valuation due to limited activity in the evolving markets they operate. The lack of consistent and reliable valuation procedures hampers the ability of MFI management teams to make informed investment decisions.

- Neglecting Urban Poor and Targeting Issues: A common mistake in the microfinance sector is the neglect of the urban poor, with a primary focus on the rural poor. This targeting issue limits the sector’s reach and impact, as only a small number of MFIs focus on the urban poor.

- Loan Default Risks: The sector faces challenges due to loan defaults, often resulting from the borrowers’ inability to manage their debts. The lack of collateral increases the risk of loan default and bad debts, while inefficient risk management and planning further exacerbate the issue.

- Geographical Constraints: Geographical factors create significant challenges for MFIs, especially when working with clients in remote areas. The difficulty in reaching customers due to a lack of infrastructure, particularly when targeting rural poor in Below Poverty Line (BPL) areas, hampers service delivery.

- Over-Dependence on Banking System for Funding: About 80% of the funds for microfinance institutions come from commercial banks, with many MFIs registered as NGOs and reliant on these banks for stabilized funding. This over-dependence can lead to inefficiencies and less active engagement with clients.

- Low Financial Literacy Among Customers: A major hindrance for microfinance institutions is the lack of financial literacy among the populace. The general lack of knowledge about basic financial concepts not only limits people from joining MFIs but also contributes to financial exclusion.

Government Initiatives for Microfinance in India

- SHG-Bank Linkage Program: This initiative links Self-Help Groups (SHGs) with banks to facilitate easier access to credit.

- E-shakti Programme: Aimed at digitizing the accounts of SHGs to streamline financial data and improve bank credit linkage.

- PM SVANidhi Scheme: Provides micro-credit loans to street vendors, helping them to sustain and grow their businesses.

- Pilot Programme for SHG Members: Aims to develop SHG members into entrepreneurs by providing training, enabling credit linkage, and facilitating market access. This includes:

- Priority Sector Lending and MUDRA Yojana: These initiatives focus on directing credit flow to under-served sectors and providing loans through the Micro Units Development and Refinance Agency Ltd. (MUDRA).

- SIDBI’s Funding to Boost Microfinance: The Small Industries Development Bank of India (SIDBI) released INR 10 billion funds to promote the microfinance sector, partnering with non-profits and social ventures for affordable borrowing.

- Expansion of Micro Lending Limit: The Reserve Bank of India (RBI) and the Government of India increased the micro-lending limit to INR 1.25 lakh, broadening the reach of the microfinance sector to new areas.

Way Forward

- Technological and Digital Transformation:

- Adopt digital platforms to improve financial service delivery, streamline operations, and reduce costs.

- Integrate mobile banking, digital payment solutions, credit scoring algorithms, e-KYC, and online loan applications.

- Enhance accessibility of financial services for clients in both urban and rural areas, thereby reducing barriers to entry and fostering economic progress.

- Robust Risk Management Practices:

- Emphasize portfolio diversification and sophisticated credit assessment tools to mitigate financial risks.

- Focus on sustainability to improve environmental and social responsibility, aligning with global sustainability objectives.

- Commit to long-term viability of microfinance operations while promoting responsible and ethical financial practices.

- Innovative Financial Products:

- Develop and offer micro-insurance, agricultural loans, and personalized savings schemes.

- Cater to unique customer needs, ensuring clients have access to necessary financial tools.

- Contribute to the economic empowerment and resilience of the communities served, reflecting a shift towards more client-centric approaches.

- Collaborations and Partnerships:

- Foster collaborations between microfinance institutions, banks, and fintech companies.

- Leverage the strengths of traditional and tech-savvy players to create a more inclusive financial ecosystem.

- Extend financial access to remote and underserved areas, positively impacting the economic well-being of disadvantaged communities.

- Financial Product Innovations:

- Addressing Technological and Regulatory Barriers:

- Overcome technological constraints that hinder the adoption of innovations, particularly for smaller MFIs.

- Revise regulations on collateral requirements among low-income borrowers to enable more extensive lending options.

- Consider reinstating successful government initiatives during ‘normal’ times to provide liquidity buffers to MFIs.

- Marketing and Customer Education:

Implementing these strategies can significantly enhance the microfinance sector’s ability to serve low-income and underserved communities in India, contributing to overall economic development and financial inclusion.

Practice Question for Mains

Evaluate the role of microfinance in achieving financial inclusion in India and discuss the challenges and opportunities it presents. (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.