Self Help Groups (SHGs) in India – Functions, Advantages & Disadvantages

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

According to the latest statistics, about 25% of the Indian population belongs to the rural poor. Women make up one-third of the Indian labour force. However, social constraints have prevented them from having access to and making use of the available resources that may help them improve their living conditions. Self Help Group is seen by many as the catalyst for rural development, women, and social empowerment. Its importance in the Indian economy is seen through many success stories like the production of 13 different bioagents to support organic farming by Sabari Swasraya Sanghom of Nellarachal tribal hamlet, Kudumbashree SHG, etc. They are not only inspirational but also the obvious solutions to the existing socio-economic problems of India.

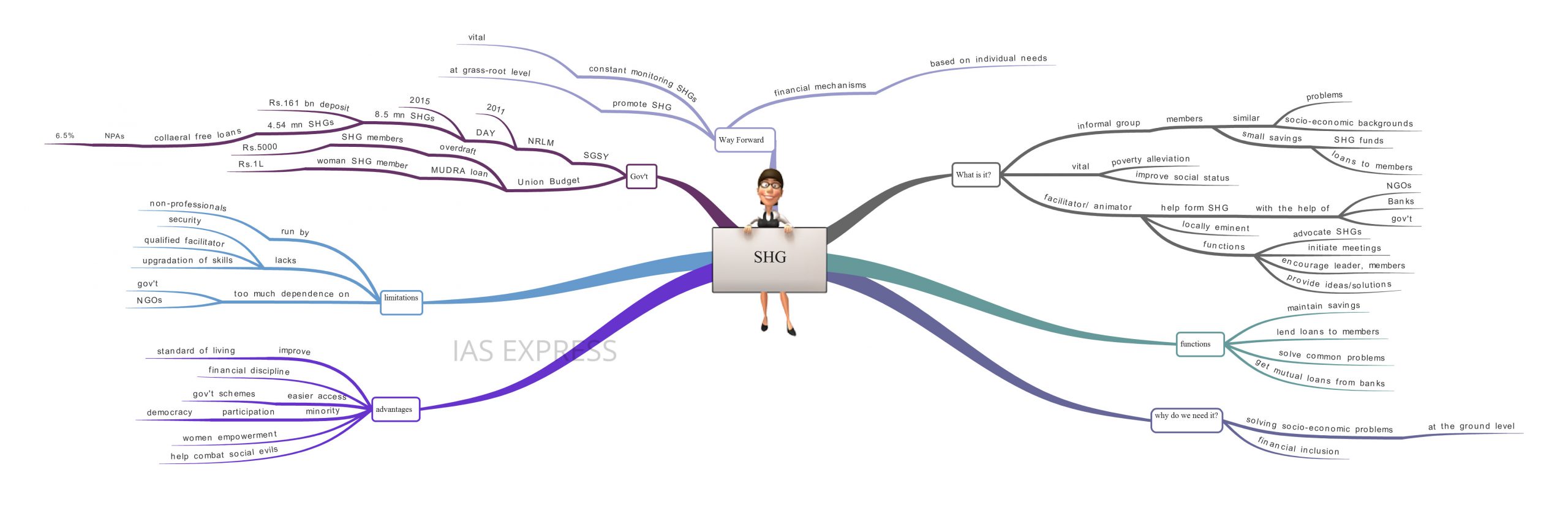

What are self-help groups?

- Self Help Groups (SHGs) are informal groups that consist of people who face similar problems.

- These people come together to form a group to overcome their common problems to improve their standard of living.

- They are mostly from a similar socio-economic background and are involved in undertaking small savings amongst themselves in a bank. This amount acts as the fund for the SHGs and is used to provide loans to its members.

- It is a vital tool to alleviate people from below the poverty line and improve social status through the promotion of self-employment.

Who helps in the formation of SHGs?

- Any local individual who has needed education or skills may help initiate the SHGs.

- This individual is involved in bringing together all those who are facing similar problems and advocating the benefits of the SHGs.

- This person is often called the “animator” or a “facilitator”.

- He or She is usually well-known within the community.

- A woman animator can play a significant role in woman empowerment in rural India.

- However, the animator cannot bring the people together into the SHGs by himself/herself.

- They are assisted by the following agencies:

- NGOs

- Developmental departments of the state governments

- Any of the locally available banks

- The functions of the animator include:

- Explain the benefits of the SHGs.

- Help initiate the first few meetings of the SHGs.

- Encourage the group and its leader.

- Provide innovative ideas and solve the problems of the SHGs.

How do the SHGs function?

Members:

- An ideal SHG should have about 10 to 20 members.

- This is because if the group is bigger, it will be difficult for an individual to undertake equal participation in a large group.

- The SHG shouldn’t have more than one member from a particular family.

- This allows the inclusion of many families.

- It should also have either only men or only women because it is found that the mixed groups are not successful.

- It is also found that the women SHGs are more successful because the members are better at savings and that they are making use of the loans more efficiently than men.

- The members of the SHGs must have similar problems and backgrounds for it to be successful.

SHG Meetings:

- Ideally, the meetings should be held weekly or monthly so that the members become closer to each other.

- All members must attend the meetings for it to become successful.

- Membership register, minutes register, savings and loan register, etc., must be kept up to date so that it is easy to know about the SHGs and that there is transparency within the group.

What are the functions of the SHGs?

- Initiate and maintain savings within the group: All members must regularly save at least a small amount. These savings allow them to get future credits for their group.

- Lending loans to the members: The savings made by the SHG must be used to provide loans to members of the group. Everything related to the loan must be decided within the group.

- Solving common problems: SHGs mostly consist of individuals who face similar problems. The grouping should essentially help the individual overcome these problems through discussions and interactions within the group and overcoming the problems and finding a common and united solution to the problems.

- Bank Loans: SHGs must work on getting a collective guarantee system so that they can avail of loans from official sources.

Why does India need SHGs?

- The need to solve problems at the ground level: India is a country that has a diverse culture, traditions, historical backgrounds, etc. Therefore, it is difficult for the government to solve the socio-economic problems by itself. Thus, bringing together the people who face similar problems may be a game-changer for the Indian economy.

- Financial Inclusion: According to the NSSO data, 51.4% of the farmer households are not able to have access to formal credit. This has led to many negative implications such as poverty, farmer suicides Many in India are not able to obtain loans due to the absence of collateral. SHGs can help solve this problem.

What are the advantages of the SHGs?

The advantages of SHGs are as follows:

- Combating social evils: The SHGs play a crucial role in overcoming social evils like alcoholism, drug addiction, gambling, etc.

- Women empowerment: Women SHGs make their members independent from social constraints and allow them to make independent decisions. They can even actively participate in the gram sabha.

- Active participation in democracy: SHGs can actively participate in the aspects of local governance. This would mean the inclusion of weaker and marginalised sections of the society in the local governance.

- Increase employment opportunities in rural India: It allows for micro-level entrepreneurship within the rural society and reduces too much dependence on agriculture.

- Easier access to government schemes: The government schemes are mostly meant for the marginalised sections of the society. The inclusion and identification of these people are highly difficult. If they are grouped together, it is easier for the government to identify those who are in need of assistance quickly and efficiently. It also prevents the exploitation and corruption of the government at the ground level.

- Improves the standard of living: The collective team effort by the SHGs for financial inclusion allows for the improvement in the living standard, family planning, healthcare, of the vulnerable sections of the society.

- Financial discipline: The members of the SHGs are encouraged to open savings accounts in banks. This assures improved living conditions, increased spending on education, health, etc.

What are the limitations of SHGs?

- Too much dependence on government and NGOs: Many SHGs are dependent on the promoter agencies for their survival. In case these agencies withdraw their support, the SHGs are vulnerable to downfall.

- Lacks qualified facilitator: The facilitators do not have professional training with regard to organising SHGs.

- Lacks up-gradation of skills: Most SHGs are not making use of new technological innovations and skills. This is because there is limited awareness with regards to new technologies and they do not have the necessary skills to make use of the same. Furthermore, there is a lack of effective mechanisms that promote skill development in rural areas.

- SHGs are run by non-professionals: There is no professionalism within the SHGs. This does not promote the expansion and improvement of the SHGs. This does not allow for the increase of wages of the members and improvement in their living conditions. This also leads to errors in accounting and mismanagement of the funds.

- Lacks security: SHGs are mostly not registered. They are run based on the trust between the members. The savings made by the SHG members may not be safe, which brings in mistrust between the members.

What are the measures taken by the government to make SHGs more effective?

The government plays a crucial role as a facilitator for the SHGs. There are various government schemes dedicated to the promotion of the SHGs. Some of them are as follows:

- Swarn Jayanti Gram Swarojgaar Yojana (SGSY): It seeks to form SHGs and develop the skills of its members to promote self-employment in rural areas.

- This program evolved to be a national movement in 2011 to become the National Rural Livelihood Mission.

- National Rural Livelihood Mission (NRLM) is the largest poverty alleviation program in the world.

- It was launched by the Ministry of Rural Development in 2011.

- It was succeeded by Deendayal Antyodaya Yojana (DAY) in 2015.

- This scheme covers 100 million families through 8.5million SHGs.

- These SHGs have a total deposit of Rs.161 billion.

- 84 million SHGs received collateral-free credit of which 88% are rural women.

- There is an outstanding loan of over Rs.615 billion. The NPAs of the credit is 6.5%.

- This is much lesser than the total NPAs of the Indian Banks – 10.2%.

- In the Union Budget this year, the government allowed an overdraft up to Rs.5000 to every verified woman SHG member who has Jan Dhan Bank account.

- Also, one woman in every SHG will be allowed a MUDRA loan up to Rs.1Lakh.

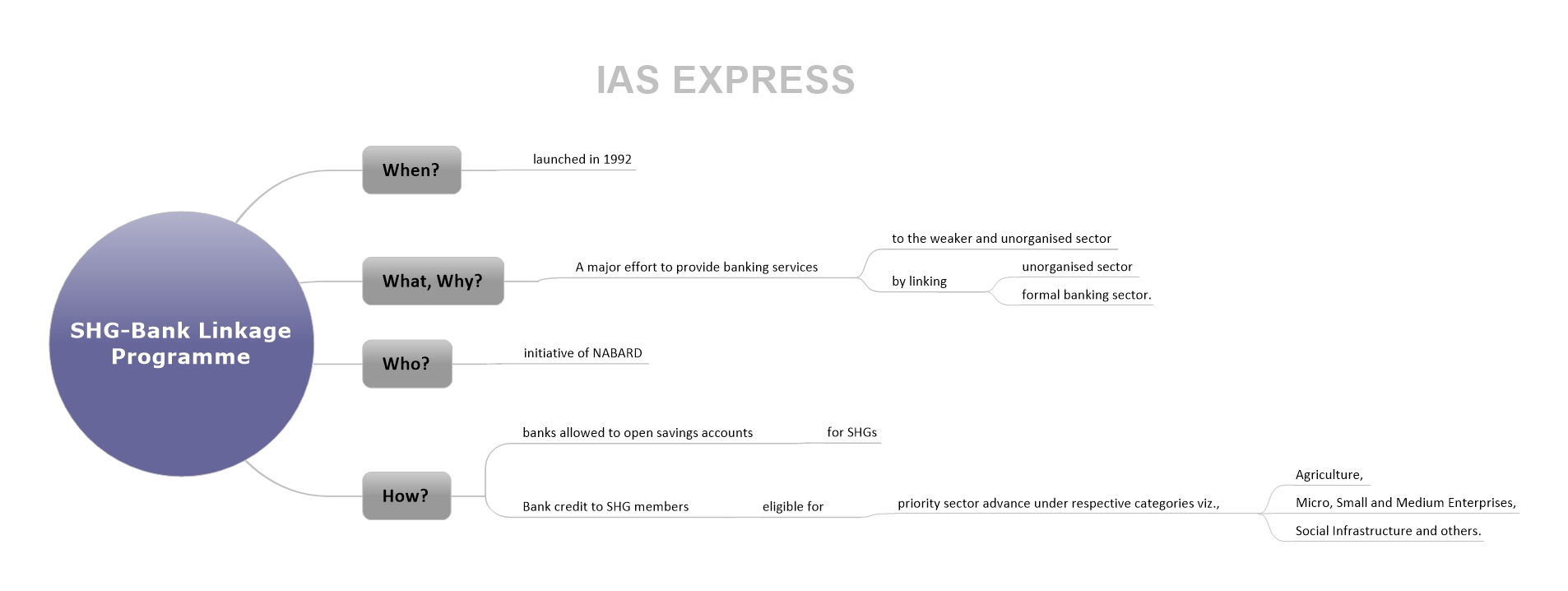

- SHG-Bank Linkage Programme *

Way Forward

- SHGs are seen as drivers of rural development. However, successful SHGs are only rarely seen as the living conditions in the rural areas remains underdeveloped.

- The government must take a proactive role in the promotion of the SHGs at the grass-root level.

- Constant monitoring of the SHGs is the need of the hour. A separate government body to monitor the functioning and the progress of the SHGs can make it more successful.

- New financial mechanisms based on the individual needs of the particular area is also essential for the SHGs to achieve their aims and objectives.

- Therefore, the private banks and National Banks for Agriculture and Rural Development (NABARD) in cooperation with the local governing bodies must ensure that financial inclusion is provided at the ground level – based on the diverse needs of rural India.

Updates

- To bring a sharper focus on taking women to the higher economic order, the government has launched a programme to create Lakhpati SHG women that will empower rural SHG women to earn at least Rs 1 lakh per year.

- Under the uniform interest subvention scheme, women SHGs will be eligible for loans up to Rs 3 lakhs at an interest rate of 7% per annum from 2022-23

- Economic Survey 2022-2023: It highlighted the significant role of women-led SHGs in India’s banking operation. With 12 million SHGs, mostly comprising women, these groups have been pivotal in microfinance and have achieved high repayment rates of over 96%. The government has set a target to increase each SHG’s income to Rs 1 lakh by 2024 as part of the NRLM. In response to the COVID-19 pandemic, the loan limit for collateral-free loans to SHGs was increased to Rs 20 lakh.

- Drone Scheme for Women SHGs: The Union Cabinet approved a scheme to provide drones to 15,000 women SHGs, with an outlay of Rs 1,261 crore for two years beginning 2024-25. This initiative aims to support sustainable business and livelihood for these SHGs, with an expected additional income of Rs 1,00,000 per annum.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.

Can you send me details of SHG in India and Telangana State

Complete information about SHGs,thanks

very good

SHGs can be employed or not

I can run SHGs I am eligible to run