Domestic Systemically Important Banks (D-SIBs): Criteria, Challenges

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

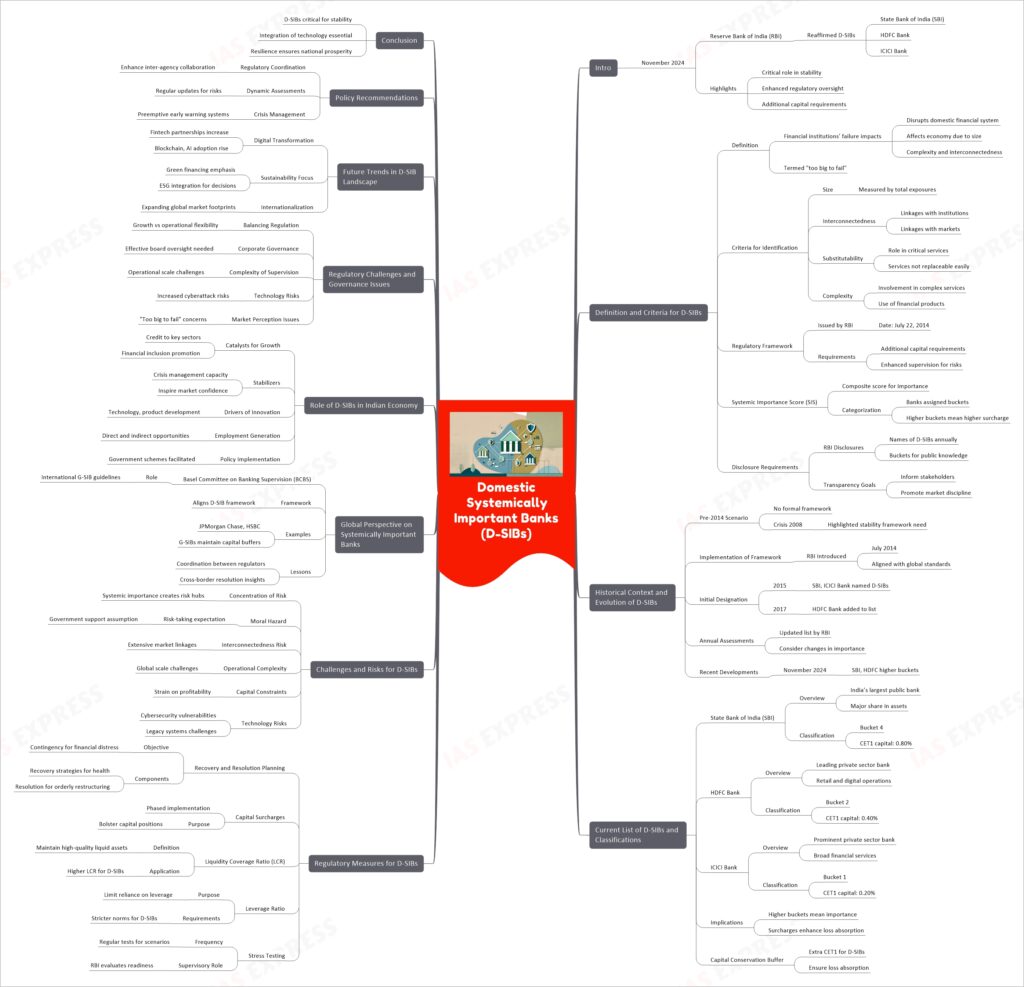

In November 2024, the Reserve Bank of India reaffirmed State Bank of India, HDFC Bank, and ICICI Bank as Domestic Systemically Important Banks (D-SIBs), highlighting their critical role in ensuring financial stability. These “too big to fail” institutions are subject to enhanced regulatory oversight and additional capital requirements, reflecting their systemic importance. This move underscores the need for robust frameworks to safeguard the economy from disruptions arising from potential financial distress in such key entities.

1. Definition and Criteria for Domestic Systemically Important Banks (D-SIBs)

- Definition of D-SIBs:

- D-SIBs are financial institutions whose failure could disrupt the domestic financial system and economy due to their size, interconnectedness, and complexity.

- These banks are colloquially referred to as “too big to fail” due to their systemic importance.

- Criteria for Identification:

- Size: Measured by the bank’s total exposures, including on and off-balance sheet items.

- Interconnectedness: Assessed through the bank’s linkages with other financial institutions and markets.

- Substitutability: Evaluated based on the bank’s role in providing critical services that are not easily replaceable.

- Complexity: Determined by the bank’s involvement in complex financial products and services.

- Regulatory Framework:

- The Reserve Bank of India (RBI) issued the framework for dealing with D-SIBs on July 22, 2014, outlining the methodology for identifying and regulating these banks.

- The framework mandates additional capital requirements and enhanced supervision for D-SIBs to mitigate systemic risks.

- Systemic Importance Score (SIS):

- The SIS is a composite score derived from the above criteria, determining a bank’s systemic importance.

- Banks are categorized into different buckets based on their SIS, with higher buckets indicating greater systemic importance and corresponding capital surcharges.

- Disclosure Requirements:

- The RBI is required to disclose the names of banks designated as D-SIBs and their respective buckets annually.

- This transparency aims to inform stakeholders and promote market discipline.

2. Historical Context and Evolution of D-SIBs in India

- Pre-2014 Scenario:

- Prior to 2014, India lacked a formal framework for identifying and regulating systemically important banks.

- The global financial crisis of 2008 highlighted the need for such a framework to safeguard financial stability.

- Implementation of the D-SIB Framework:

- In July 2014, the RBI introduced the D-SIB framework, aligning with international best practices and the Basel Committee on Banking Supervision’s guidelines.

- The framework aimed to identify banks whose distress or failure could pose systemic risks to the Indian economy.

- Initial Identification of D-SIBs:

- In 2015, the RBI designated State Bank of India (SBI) and ICICI Bank as D-SIBs based on their systemic importance scores.

- HDFC Bank was added to the list in 2017, reflecting its growing systemic significance.

- Annual Assessments and Updates:

- The RBI conducts annual assessments of banks’ systemic importance, updating the D-SIB list and their respective buckets accordingly.

- These assessments consider changes in banks’ size, interconnectedness, and complexity over time.

- Recent Developments:

- In November 2024, the RBI reaffirmed SBI, HDFC Bank, and ICICI Bank as D-SIBs, with SBI and HDFC Bank moving to higher buckets, indicating increased systemic importance .

3. Current List of D-SIBs and Their Classifications

- State Bank of India (SBI):

- Overview:

- SBI is India’s largest public sector bank, with a significant market share in assets, loans, and deposits.

- Classification:

- As of November 2024, SBI is placed in Bucket 4, requiring an additional Common Equity Tier 1 (CET1) capital of 0.80% of its risk-weighted assets .

- Overview:

- HDFC Bank:

- Overview:

- HDFC Bank is a leading private sector bank known for its extensive retail banking operations and digital initiatives.

- Classification:

- HDFC Bank has been moved to Bucket 2, necessitating an additional CET1 capital of 0.40% of its risk-weighted assets .

- Overview:

- ICICI Bank:

- Overview:

- ICICI Bank is a prominent private sector bank offering a wide range of financial services, including investment banking and insurance.

- Classification:

- ICICI Bank remains in Bucket 1, with an additional CET1 capital requirement of 0.20% of its risk-weighted assets .

- Overview:

- Implications of Bucket Classifications:

- Higher bucket classifications indicate greater systemic importance and entail higher capital surcharges to enhance the bank’s loss-absorbing capacity.

- These measures aim to reduce the probability of failure and mitigate potential systemic risks.

- Capital Conservation Buffer:

- The additional CET1 requirements for D-SIBs are over and above the capital conservation buffer mandated for all banks.

- This ensures that D-SIBs maintain a robust capital position to absorb potential losses.

4. Regulatory Measures and Capital Requirements for D-SIBs (continued)

- Recovery and Resolution Planning:

- Objective:

- To ensure that D-SIBs have robust contingency plans for dealing with financial distress without requiring government intervention.

- Key Components:

- Development of recovery plans outlining strategies for restoring financial health during crises.

- Preparation of resolution plans to facilitate the orderly restructuring or liquidation of the bank, minimizing systemic disruptions.

- Objective:

- Capital Surcharges:

- Implementation:

- The additional capital requirements for D-SIBs are phased in over time to allow banks to adjust to the regulatory framework.

- Purpose:

- To bolster the capital position of systemically important banks, ensuring they can absorb shocks without jeopardizing financial stability.

- Implementation:

- Liquidity Coverage Ratio (LCR):

- Definition:

- A metric that ensures D-SIBs maintain a sufficient stock of high-quality liquid assets to meet short-term obligations.

- Application:

- The LCR requirements for D-SIBs are typically higher than those for non-systemically important banks.

- Definition:

- Leverage Ratio:

- Rationale:

- The leverage ratio serves as a backstop to risk-based capital requirements, limiting excessive reliance on leverage.

- Requirements for D-SIBs:

- The RBI mandates stricter leverage ratio norms for D-SIBs to mitigate systemic risks.

- Rationale:

- Stress Testing:

- Frequency:

- D-SIBs are required to conduct regular stress tests to assess their resilience under adverse economic scenarios.

- Supervisory Role:

- The RBI reviews the outcomes of these stress tests to evaluate the banks’ preparedness for potential financial shocks.

- Frequency:

5. Challenges and Risks Associated with D-SIBs

- Concentration of Risk:

- Definition:

- The systemic importance of D-SIBs often leads to a concentration of risk within the financial system.

- Impact:

- Any distress in a D-SIB can amplify systemic vulnerabilities, potentially triggering broader financial instability.

- Definition:

- Moral Hazard:

- Explanation:

- The “too big to fail” perception may encourage excessive risk-taking by D-SIBs, as they expect government support in times of distress.

- Mitigation Measures:

- Regulatory authorities emphasize stringent oversight and risk management to address this issue.

- Explanation:

- Interconnectedness Risk:

- Nature:

- The extensive linkages of D-SIBs with other financial institutions and markets exacerbate contagion risks.

- Examples:

- A liquidity crisis in a D-SIB could disrupt funding markets, leading to cascading effects across the financial system.

- Nature:

- Operational Complexity:

- Characteristics:

- The diverse operations and global presence of some D-SIBs make their management and regulation more challenging.

- Consequences:

- Operational failures, such as cyberattacks or IT outages, can have wide-reaching implications.

- Characteristics:

- Capital Constraints:

- Issue:

- The additional capital requirements for D-SIBs can strain their profitability and competitiveness.

- Balance:

- Regulators aim to strike a balance between ensuring financial stability and supporting the growth of these banks.

- Issue:

6. Global Perspective on Systemically Important Banks

- Basel Committee on Banking Supervision (BCBS):

- Role:

- The BCBS provides international standards and guidelines for identifying and regulating globally systemically important banks (G-SIBs).

- Framework:

- The D-SIB framework adopted by the RBI aligns with BCBS principles, incorporating country-specific factors.

- Role:

- Examples of G-SIBs:

- Major Institutions:

- Banks like JPMorgan Chase, HSBC, and Deutsche Bank are designated as G-SIBs due to their global systemic importance.

- Capital Surcharges:

- Similar to D-SIBs, G-SIBs are required to maintain higher capital buffers to address their systemic risks.

- Major Institutions:

- Lessons for India:

- Regulatory Coordination:

- International experiences highlight the importance of coordinated efforts between domestic and global regulators in managing systemic risks.

- Cross-Border Resolutions:

- The RBI can draw insights from global resolution frameworks to handle crises involving Indian banks with international operations.

- Regulatory Coordination:

- Global Financial Stability Board (FSB):

- Role:

- The FSB monitors and assesses vulnerabilities in the global financial system, focusing on G-SIBs.

- Implications for D-SIBs:

- Indian regulators can leverage FSB guidelines to enhance the resilience of D-SIBs.

- Role:

- Comparative Analysis:

- Similarities:

- Both G-SIBs and D-SIBs are subject to additional capital requirements and enhanced supervision.

- Differences:

- D-SIB frameworks are tailored to the specific needs and risks of domestic financial systems.

- Similarities:

7. Role of D-SIBs in the Indian Economy

- Catalysts for Economic Growth:

- Credit Disbursal:

- D-SIBs play a pivotal role in providing credit to key sectors, including infrastructure, agriculture, and SMEs.

- Financial Inclusion:

- Their extensive branch networks and digital initiatives contribute significantly to improving financial inclusion.

- Credit Disbursal:

- Drivers of Innovation:

- Technology Adoption:

- D-SIBs often lead the adoption of advanced technologies, such as AI and blockchain, in the banking sector.

- Product Development:

- Their innovative products and services cater to diverse customer needs, enhancing market competitiveness.

- Technology Adoption:

- Stabilizers of the Financial System:

- Crisis Management:

- D-SIBs have the capacity to absorb economic shocks, stabilizing the financial system during downturns.

- Market Confidence:

- Their robust capital positions and regulatory oversight inspire confidence among stakeholders.

- Crisis Management:

- Employment Generation:

- Direct Employment:

- D-SIBs are major employers, offering opportunities across diverse functions, from customer service to risk management.

- Indirect Employment:

- Their operations generate ancillary employment in sectors like IT, logistics, and consultancy.

- Direct Employment:

- Policy Implementation:

- Government Schemes:

- D-SIBs play a crucial role in implementing government initiatives, such as Jan Dhan Yojana and Mudra Loans.

- Crisis Interventions:

- During the COVID-19 pandemic, D-SIBs facilitated relief measures, including loan moratoriums and credit guarantees.

- Government Schemes:

8. Regulatory Challenges and Governance Issues in Managing D-SIBs

- Balancing Regulation and Growth:

- Regulatory Burden:

- The stringent capital and operational requirements for D-SIBs may affect their ability to compete with smaller banks or non-banking financial companies (NBFCs).

- These requirements can limit the banks’ flexibility in expanding their business or taking on new initiatives.

- Need for Proportional Regulation:

- Policymakers must ensure that regulatory frameworks do not hinder innovation or the growth potential of D-SIBs.

- Regulatory Burden:

- Corporate Governance Concerns:

- Board Oversight:

- Effective governance requires strong and independent boards to oversee D-SIB operations and mitigate conflicts of interest.

- Risk Culture:

- Cultivating a robust risk management culture is essential to prevent governance lapses that could lead to systemic risks.

- Transparency Issues:

- Ensuring transparency in decision-making processes, especially in lending and investment activities, is crucial for stakeholder trust.

- Board Oversight:

- Complexity of Supervision:

- Operational Scale:

- The large-scale and complex operations of D-SIBs pose significant challenges for regulators in monitoring their activities.

- Regulatory Arbitrage:

- D-SIBs might exploit gaps in domestic or international regulations, increasing systemic risks.

- Cross-Border Supervision:

- For Indian D-SIBs with international operations, aligning domestic regulations with host country requirements adds layers of complexity.

- Operational Scale:

- Technology and Cybersecurity Risks:

- Vulnerabilities:

- As D-SIBs increasingly adopt digital technologies, they become more susceptible to cyberattacks.

- Supervisory Expectations:

- Regulators mandate robust cybersecurity frameworks and periodic audits to safeguard against potential breaches.

- Technology Obsolescence:

- Legacy systems in D-SIBs can hinder their ability to adapt to evolving technological landscapes.

- Vulnerabilities:

- Moral Hazard and Market Perception:

- Too Big to Fail Doctrine:

- Stakeholders might assume implicit government support for D-SIBs during crises, reducing market discipline.

- Over-Reliance on Regulation:

- Banks may prioritize compliance over proactive risk management, leading to a false sense of security.

- Too Big to Fail Doctrine:

9. Future Trends and Innovations in the D-SIB Landscape

- Digital Transformation:

- Emphasis on Fintech Collaboration:

- D-SIBs are increasingly partnering with fintech firms to enhance service delivery and customer experience.

- Examples include HDFC Bank’s digital lending platforms and SBI’s YONO app for integrated financial services.

- Blockchain and AI Adoption:

- Blockchain is being explored for secure and transparent transactions, while AI tools assist in fraud detection and personalized banking solutions.

- Emphasis on Fintech Collaboration:

- Focus on Sustainability:

- Green Financing:

- D-SIBs are playing a pivotal role in financing renewable energy projects and sustainable infrastructure.

- SBI’s issuance of green bonds to fund clean energy projects is a notable example.

- ESG Integration:

- Environmental, social, and governance (ESG) factors are increasingly being integrated into lending and investment decisions.

- Green Financing:

- Evolving Risk Management Practices:

- Advanced Analytics:

- D-SIBs are leveraging big data analytics for better risk assessment and management.

- Scenario-Based Planning:

- Banks are adopting scenario-based stress testing to prepare for potential disruptions in various economic conditions.

- Advanced Analytics:

- Shifting Consumer Preferences:

- Personalized Banking:

- Tailoring banking products and services to individual customer needs is becoming a priority.

- Mobile-First Approach:

- With the rise in smartphone usage, D-SIBs are focusing on mobile banking platforms for seamless access.

- Personalized Banking:

- Internationalization:

- Global Expansion:

- D-SIBs are expanding their footprints in international markets to diversify revenue streams.

- Example: ICICI Bank’s operations in the UAE, Canada, and the UK.

- Compliance with Global Standards:

- Adhering to international regulatory norms is vital for maintaining competitiveness in global markets.

- Global Expansion:

10. Policy Recommendations for Strengthening the D-SIB Framework

- Enhancing Regulatory Coordination:

- Inter-Agency Collaboration:

- Strengthening coordination between the RBI, SEBI, and other regulatory bodies is crucial for comprehensive oversight.

- Global Cooperation:

- Collaborating with international regulators to align domestic and global standards for D-SIBs.

- Inter-Agency Collaboration:

- Dynamic Assessment Criteria:

- Regular Updates:

- Revising the parameters for identifying D-SIBs to reflect changes in the financial landscape.

- Incorporating New Risks:

- Adding metrics for emerging risks, such as climate change and cybersecurity, into the systemic importance framework.

- Regular Updates:

- Incentivizing Risk Management:

- Rewarding Good Practices:

- Offering incentives for D-SIBs that demonstrate exemplary risk management and governance practices.

- Penalizing Non-Compliance:

- Imposing stricter penalties for lapses in compliance or risk management.

- Rewarding Good Practices:

- Promoting Financial Inclusion:

- Extending Reach:

- Encouraging D-SIBs to focus on underserved areas and populations to promote inclusive growth.

- Technology-Driven Inclusion:

- Leveraging digital technologies to extend banking services to remote regions.

- Extending Reach:

- Strengthening Crisis Management Mechanisms:

- Preemptive Measures:

- Establishing early warning systems to identify potential distress in D-SIBs.

- Resolution Frameworks:

- Developing robust frameworks for the orderly resolution of distressed D-SIBs without systemic disruptions.

- Preemptive Measures:

Conclusion

Domestic Systemically Important Banks (D-SIBs) are the backbone of India’s financial system, playing a pivotal role in economic stability, growth, and innovation. While they face challenges such as governance complexities and systemic risks, robust regulatory frameworks ensure their resilience. As India’s financial landscape evolves, integrating technological advancements and sustainability practices will be crucial for D-SIBs to continue driving inclusive growth while safeguarding the economy against potential disruptions. Their stability remains integral to national prosperity.

Practice Question

Discuss the significance of Domestic Systemically Important Banks (D-SIBs) in India’s financial system, highlighting their role, challenges, and regulatory measures to ensure stability and growth. (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.