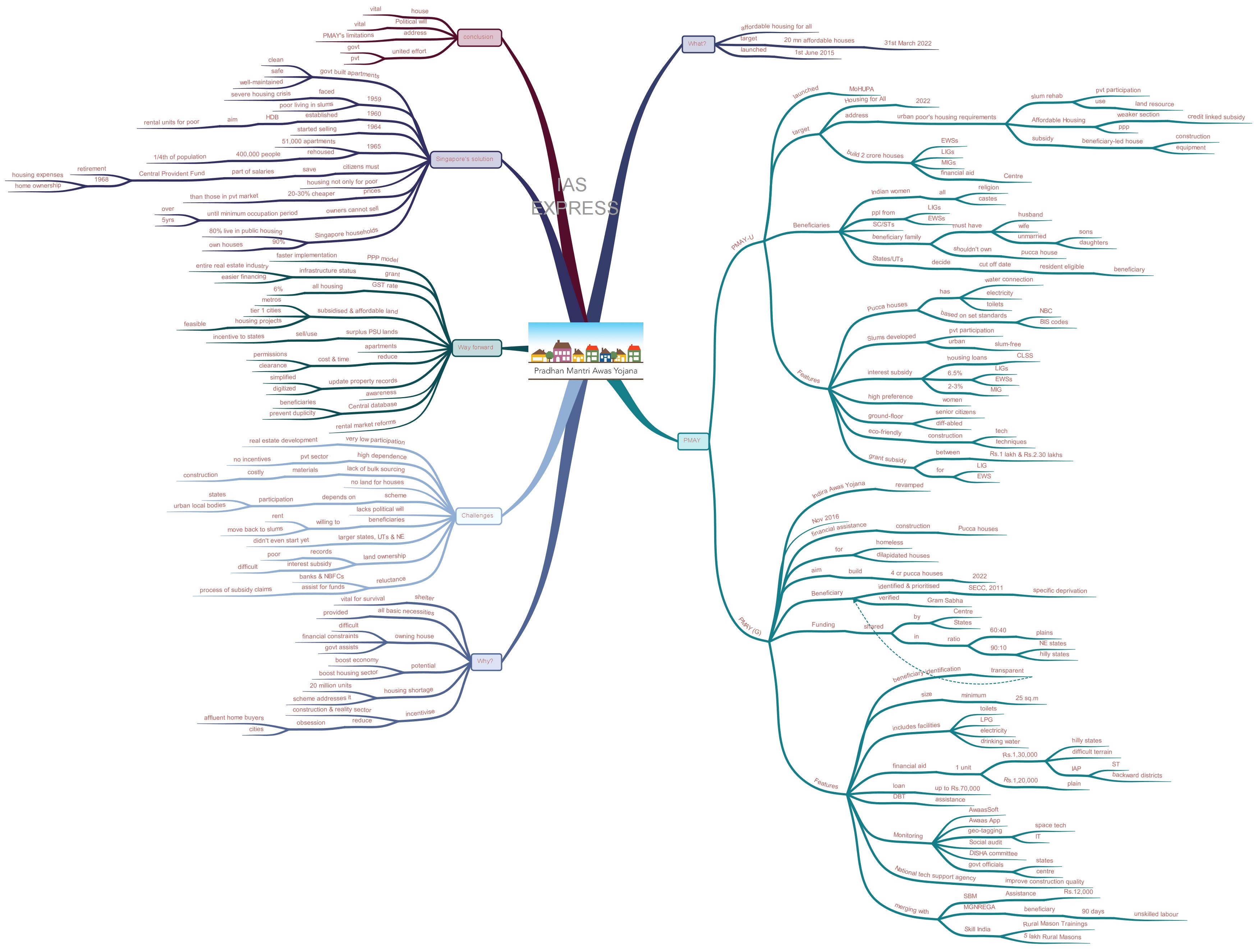

Pradhan Mantri Awas Yojana PMAY (Gramin & Urban) – Features, Challenges & Solutions

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 80+ questions reflected

Housing is one of the basic requirements of human survival. Normal citizen owning a house provides significant economic and social security status in society. For a shelter-less person, a house with basic necessity brings about a profound change in his existence, endowing him with an identity, thus integrating him with his immediate social milieu. With this in mind, the government had launched Pradhan Mantri Awas Yojana in 2015 to provide housing for all by 2022. Numerous challenges are faced by the government while undertaking this momentous scheme. These need to be addressed for this vision to be implemented within the deadline.

What is Pradhan Mantri Awas Yojana?

- Pradhan Mantri Awas Yojana (PMAY) is a government initiative that aims to provide affordable housing for all.

- Its target is to build 20 million affordable houses by 31st March 2022.

- Pradhan Mantri Awaas Yojana – Housing for all was launched on 1st June 2015.

- Under this scheme, affordable, eco-friendly houses will be built in the urban areas for the benefit of the poor residing in those places.

- Later, a similar scheme was launched in 2016 for the rural population with the goal of housing for all by 2022.

Pradhan Mantri Awas Yojana (Urban) (PMAY-U)

This programme was launched by the Ministry of Housing and Urban Poverty Alleviation (MoHUPA).

Target:

- In the mission mode, it envisions provision of Housing for All by 2022, when the Nation completes 75 years of its independence.

- The mission seeks to address the urban poor’s housing requirements through the following programme verticals:

- Slum rehabilitation of Slum Dwellers with the participation of private developers using the land as a resource.

- Promotion of Affordable Housing for the weaker section through credit linked subsidy.

- Affordable Housing in Partnership with Public and Private Sectors.

- Subsidy for the beneficiary-led individual house construction/enhancement.

- This scheme aims to build 2 crore houses for the urban poor including the Economically Weaker Sections (EWS), Low Income Groups (LIG) and Middle Income Groups (MIGs) by the year 2022 through financial assistance from the Union government.

Beneficiaries:

- Indian women of all religions and castes.

- People who come from low income and economically weaker sections of society.

- SCs and STs

- The beneficiary family should consist of husband, wife, unmarried sons and/or daughters.

- The beneficiary family should not own a pucca house either in his/her name or in the name of any member of his/her family in any part of India.

- States/UTs, at their decision, may choose to cut off date on which the beneficiaries need to be the resident of that urban area for being eligible to obtain benefit from this scheme.

Features:

- Provides Pucca houses with water connection, toilet and electricity

- It provides houses that meet the requirements of the structural safety against natural disasters and is compliant with the National Building Code (NBC) and other relevant Bureau of Indian Standards (BIS) codes.

- Slum areas are developed with the help of private participation to make urban areas free from slums.

- The government will provide an interest subsidy of 6.5% on housing loans availed by LIGs and EWSs and interest subsidy of 2-3% on housing loans availed by MIG beneficiaries under the Credit Link Subsidy Scheme (CLSS).

- Higher preference is given to the women applicants for house allotment.

- Ground-floor of the houses will be given to the differently-abled and senior citizens.

- Construction techniques and technologies used are eco-friendly.

- The grant subsidy range anywhere between Rs.1 lakh and Rs.2.30 lakhs to LIG and EWS sections of the urban population.

Pradhan Mantri Awas Yojana (Gramin) (PMAY-G)

- To achieve the goal of Housing for All by 2022, the rural housing scheme Indira Awas Yojana was revamped and PMAY(G) was launched on November 20, 2016.

- Under this scheme, financial assistance is provided for the construction of pucca houses for all the homeless and households living in dilapidated houses in rural areas.

- Under this scheme, the government aims to build 4 crore pucca houses in total by the year 2022.

Identifying the Beneficiaries:

- The beneficiaries are identified and prioritized using the housing deprivation parameters in the Socio-Economic and Caste Census (SECC), 2011, which is verified by the Gram Sabhas.

- The SECC data identified the specific deprivation related to housing among the households.

- The obtained list will be presented to the Gram Sabha to identify the beneficiaries who have been assisted before or have become ineligible due to other reasons.

Funding:

The cost of unit assistance is shared between Central and State Governments is in the ratio 60:40 in plain areas and 90:10 for northeastern and hilly states.

Features:

- Beneficiary identification is based on the transparent process of SECC of 2011 and validation through Gram Sabha.

- Size of the Unit: The minimum size of the unit (house) is increased from 20 m2 (under IAY) to 25 m2.

- Inclusion of facilities: The finished house will be complete with facilities like toilets, LPG connection, electricity connection and drinking water.

- Financial aid: The assistance for a single unit given to the beneficiaries under the programme is Rs.1,20,000 in plain areas and Rs.1,30,000 in hilly states/difficult terrains/Integrated Action Plan (IAP) for Selected Tribal and Backward Districts.

- Loan: There is also the provision of Bank loan up to Rs.70,000 if the beneficiary desire.

- Direct Benefit Transfer: The houses are completed at a faster pace since the payments of assistance is through DBT.

- The implementation and monitoring of the PMAY-G are done through AwaasSoft and Awaas App.

- Geo-tagging: Space technology and Information Technology is used to monitor the whole construction process of this scheme. It identifies the beneficiaries and the construction stages as they are geo-tagged.

- Monitoring: The implementation of this programme is not only monitored electronically but also through community participation (Social audit), members of the parliament (DISHA committee), Central and the state government officials, etc.

- National Technical Support Agency is proposed for the improvement of the quality of construction.

- Merging of Swachh Bharat Mission: Assistance (Rs.12,000) is provided through convergence with the Swachh Bharat Mission.

- Merging with MGNREGA: The beneficiary of this scheme is qualified to 90 days of unskilled labour from MGNREGA.

- Merging with Skill India: Rural Mason Training has been organised to facilitate the availability of trained masons in rural areas. The programme provides for skilling of 5 lakh Rural Masons by 2019.

Why do we need it?

- The shelter is vital for survival.

- This scheme ensures the providing of all the basic necessities of life. This will ensure better standards of living to the Indian citizens.

- Owning a house is still a distant dream to many due to financial constraints. Financial assistance is provided by the government to make this dream a reality.

- This scheme has the potential to boost the economy and the housing sector.

- Today, while developers in India’s metropolitan cities are sitting on lakhs of unsold residences costing upwards of Rs.50 lakhs, the country is estimated to have a shortage of nearly 20 million housing units by the rural and urban poor at far lower price points of Rs.5-15 lakhs. This scheme addresses this shortfall.

- With the increase in the subsidised loan amount, the scheme is expected to cover a higher proportion of the urban poor.

- This scheme may hopefully incentivise India’s construction and realty sector to reduce its traditional obsession with affluent home buyers in the cities.

What are the challenges?

- There is very low participation from real estate development.

- One of the reasons behind the slow implementation is due to the high dependence on the private sector and the private players don’t have the incentive to participate.

- There is a lack of bulk sourcing of the material leading to an increase in construction cost.

- The unattainability of land to build houses is one of the major restraints of this flagship scheme.

- The success of this scheme is dependent on the participation of states and urban local bodies in its implementation. While some states have participated, the others are not so willing due to political motivations.

- There are delays in the clearance of construction projects.

- Sometimes, the beneficiaries are willing to rent the obtained houses and move back to slums.

- Implementation in the larger states like Uttar Pradesh and Haryana is not even started yet. Most of the North-Eastern states and the Union Territories face similar problems.

- India has very poor records of land ownership. One cannot avail the interest subsidy in case of absence of title or ownership records for land.

- Also, this scheme is facing challenges in meeting the targets due to the reluctance of the banks and the NBFCs in entertaining requests from the ministry for assistance for more funds to process subsidy claims.

What can be the way forward?

- Including Private Sector under the Public-Private Partnership model can ensure better and faster implementation of the scheme.

- The government must grant the infrastructure status to the entire real estate industry to make long-term financing easier for the industry.

- The GST rate for all types of housing should be at 6%.

- The land must be made available at a subsidised rate in metros and tier 1 cities so that the housing projects are feasible.

- The cost and time for the permissions and clearances must be reduced.

- Availability of affordable land is one of the major challenges of this scheme. The surplus land held by the Public Sector Undertakings must be used to implement this scheme. The local government can sell unused land for this scheme.

- To solve the problem of land scarcity, the government can consider building apartments instead of pucca houses.

- The Centre can provide incentives to the states to allocate or sell this unused land for building affordable houses.

- The states need to digitize and simplify the process of updating the property records. This will allow the landowners to have the legal documents of their land and property.

- Awareness must be provided to the public about the benefits of this scheme.

- A central database must be created for all the beneficiaries under the scheme so that the same person is prevented from availing multiple benefits.

- Reforms must be made in the rental market so that it can be used to achieve “Housing for All by 2022”.

What can India learn from Singapore?

- Public housing is often considered to be of low in quality and high in crime.

- However, this is not the case in Singapore.

- Government-built apartments in Singapore are clean, safe and well-maintained.

- However, this was not how it was in the past.

- In 1959, when Singapore obtained independence, it was facing a severe housing crisis, struggling to accommodate the growing population.

- In 1960, Singapore’s first Prime Minister Lee Kuan Yew and his government had established the Housing and Development Board (HDB) – a public housing agency with a mission to develop rental units for poor.

- During this time, many immigrants, including those from Malaysia were living in unhygienic slums.

- By 1965, the HDB managed to build over 51,000 apartments, rehousing 400,000 people, a quarter of the total population in Singapore by managing to convince the Singaporeans of benefits of these housings through fast-paces proactive response to their problems.

- Singapore, upon its completion of its mission, became one of the very few countries in the world where a statutory board had successfully completed everything it had set out to do in its first five-year plan.

- Apart from renting out the apartments, it had also started selling them in 1964.

- The Singaporeans were required to save a part of their salaries in a state-managed plan called Central Provident Fund.

- At first, the fund only provided for retirement. Then in 1968, the government allowed the use of the fund for housing expenses, helping more people to become homeowners.

- Unlike many countries, Singapore housing is not only for the poor. Instead, it caters to the masses.

- Citizens within certain income ceilings can buy various types of property – from two-roomed apartments to up-market units in condominiums.

- Their prices are usually 20-30% cheaper than those in the private market.

- However, the citizens must first apply and order for the apartment and wait for its completion for several years.

- Also, the owners must not sell it until the 5-year minimum occupation period is finished.

- Currently, about 80% of Singapore households live in these apartments.

- Singapore is also one of the few countries in the world to achieve almost full homeownership status. Over 90% of the city’s households own their own homes.

- Thus, need-based, all-inclusive, government-funded apartments in Singapore fixed the housing problems and improved the living conditions of millions.

Conclusion:

A house is a basic necessity of humankind. But, to own or live in a good house is still a distant dream for many Indians. The political will to address this issue is far more important than other aspects that are hindering the dream from becoming a reality. The PMAY’s vision must be made into a reality by addressing many lacunas that still exist through the united efforts of both the government and private players.

Model Question:

What are the issues that need to be considered by the government while implementing PMAY and what can it do to address them?

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.