Monetary Policy in India – Objectives, Framework, Committee, Instruments

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 80+ questions reflected

The Reserve Bank of India on 6th February 2020, had released the 6th Bi-Monthly Monetary Policy Statement 2020. After looking into the current macroeconomic situation, RBI’s Monetary Policy Committee had decided not to change the policy repo rate, which is at 5.15%, in accordance with its plan to maintain the accommodative stance until the economic growth is revived, and the inflation rate is within the target. Apart from this, several other steps were taken by the MPC to boost economic growth and demand. The accommodative stance taken by the RBI is a step in the right direction as it can support economic growth and reduce inflation exponentially.

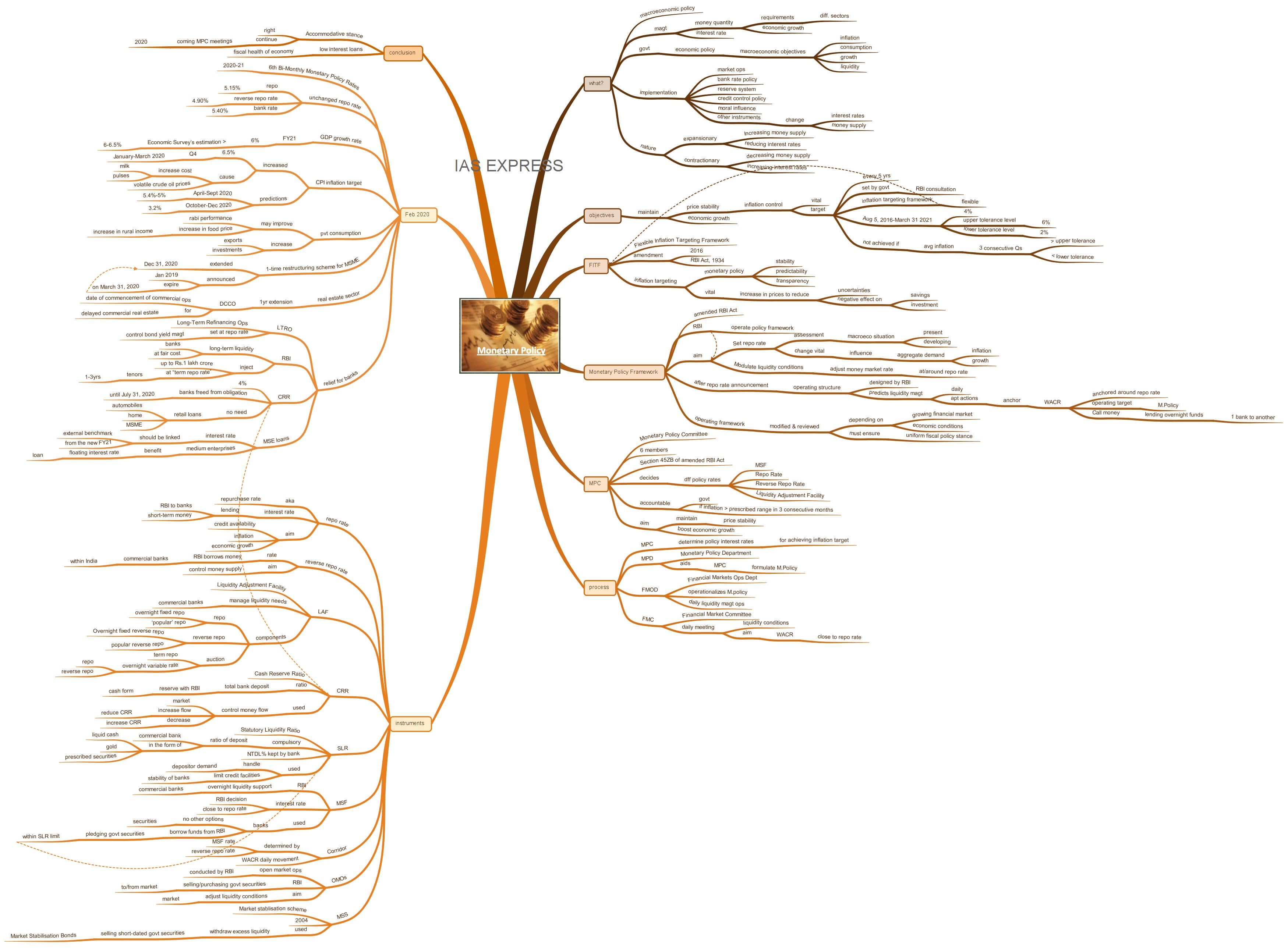

What is monetary policy?

- Monetary Policy is the macroeconomic policy laid down by the central bank (Reserve Bank of India).

- It involves the management of money supply and interest rate and is the demand side of the economic policy used by the government to achieve macroeconomic objectives like inflation, consumption, growth and liquidity.

- It aims to manage the quantity of money to meet the requirement of different sectors of the economy and increase the pace of economic growth.

- The RBI implements the monetary policy through open market operations, bank rate policy, reserve system, credit control policy, moral influence and through many other instruments.

- Using any of these instruments will lead to changes in the interest rates and the money supply in the economy.

- The monetary policy can be expansionary or contractionary in nature. Increasing money supply and reducing interest rates indicates an expansionary policy and the reverse of this is a contractionary monetary policy.

What is the main objective of the monetary policy?

- The main objective of the monetary policy is to maintain price stability while ensuring economic growth. Price stability is vital for the sustainable growth of the economy.

- For maintaining price stability, controlling inflation is vital.

- The government sets inflation target for every five years.

- The Reserve Bank of India plays a crucial role in the consultation process pertaining to inflation targeting.

- India’s current inflation-targeting framework is flexible in nature.

What is Flexible Inflation Targeting Framework (FITF)?

- FITF was introduced in India following the amendment of the Reserve Bank of India (RBI) Act, 1934 in 2016.

- According to the RBI Act, the Indian government sets the inflation target every 5 years following the consultation with the RBI.

- Inflation targeting can bring more stability, predictability and transparency in deciding monetary policy. This is because the increase in prices can create uncertainties and negative effect on the savings and investments.

- India adopted an inflation target of 4% from August 5, 2016, to March 31, 2021, with an upper tolerance level of 6% and a lower limit of 2%.

- India does not achieve its inflation target if:

- The average inflation is more than the upper tolerance level of the inflation target for any three consecutive quarters, or

- The average inflation is less than the lower tolerance level for any three consecutive quarters.

What is Monetary Policy Framework?

- The amended RBI Act explicitly mandates the central bank to operate the policy framework of the country.

- The monetary policy framework’s goal is to:

- Set repo rate according to the assessment of the present and developing macroeconomic situation

- Modulate liquidity conditions to adjust the money market rates at/around the repo rates.

- The change in repo rate spreads to the entire money market, influencing the aggregate demand of the economy – an important factor of inflation and growth.

- Once the repo rate is announced, the operating structure designed by the RBI predicts liquidity management daily through apposite actions to anchor the weighted average call-money rate (WACR) around the repo rate.

- The Weighted Average Call-money Rate is the operating target of monetary policy. Call money is the overnight funds that are lent by one bank to another bank.

- The operating framework is modified and reviewed depending on the growing financial market and economic conditions while ensuring uniformity with the fiscal policy stance.

What is Monetary Policy Committee?

- Monetary Policy Committee (MPC) is a six-member committee set up by the central government under Section 45ZB of the amended RBI Act.

- This committee decides different policy rates including MSF, Repo Rate, Reverse Repo Rate and Liquidity Adjustment Facility.

- It is accountable to the Government of India if the inflation exceeds the range prescribed for three consecutive months.

- Its main objective is to maintain price stability and boost economic growth.

What is the process of Monetary Policy?

- The Monetary Policy Committee (MPC) determines the policy interest rates needed to achieve the inflation target.

- The RBI’s Monetary Policy Department (MPD) aids the MPC to formulate the monetary policy.

- The Financial Markets Operations Department (FMOD) operationalizes the monetary policy. This is mostly done through daily liquidity management operations.

- Financial Market Committee (FMC) meets daily to look into the liquidity conditions to ensure the operating target of the monetary policy (Weighted Average Lending Rate) is kept close to the policy repo rate. This parameter is also called the Weighted Average Call Rate (WACR).

What are the instruments used for implementing the monetary policy?

Many direct and indirect instruments are used to implement monetary policy. They are as follows:

- Repo Rate: Also known as repurchase rate, it is the key monetary policy instrument of the RBI. It is the rate of interest at which the RBI lends short-term money to banks to control credit availability, inflation and economic growth.

- Reverse Repo Rate: It is the rate at which the RBI borrows money from the commercial banks within India. It is a monetary policy instrument used to control the money supply in the country.

- Liquidity Adjustment Facility (LAF): It is a monetary policy instrument used by the RBI for managing the liquidity needs of the commercial banking system. The LAF works through various instruments devised by the RBI to inject liquidity into the banking system when the system/institutions need cash as well as to absorb liquidity when the banking system has excess money. The components of LAF are:

- Repo (overnight fixed repo or the ‘popular’ repo)

- Reverse Repo (Overnight fixed reverse repo or the ‘popular reverse repo

- Term repo (auction)

- Overnight variable rate repo (auction)

- Overnight variable rate reverse repo (auction)

- Cash Reserve Ratio (CRR): It is the ratio of total deposit that banks need to keep as a reserve with the RBI in the form of cash instead of keeping the amount with them. This is used to control the flow of money in the market. If the RBI wants to increase the flow of money in the market, it will reduce CRR; whereas, if RBI wants to decrease the flow of money in the market it will increase CRR.

- Statutory Liquidity Ratio (SLR): It is the ratio of the deposit that the commercial bank has to maintain in the form of liquid cash, gold, other securities prescribed by the RBI. It is a percentage of net time and demand liability (NTDL) kept by the bank. The SLR is maintained so that the bank will have an amount in the form of liquid assets, which can be used to handle a sudden increase in demand for the amount from the depositor. RBI uses this to limit credit facilities offered by banks to borrowers to ensure the stability of banks.

- Marginal Standing Facility (MSF): It is overnight liquidity support provided by the RBI to commercial banks. The interest rate for MSF borrowing is decided by the RBI from time to time and it was originally set at 1% higher than the repo rate. Subsequently, with the gradual reduction of the repo rate, the MSF rate has been brought closer to the repo rate. It is used by the bank after it exhausts its eligible security holdings for borrowing under other options like the LAF repo. Under MSF, banks can borrow funds from the RBI by pledging government securities within the limit of the SLR.

- Corridor: It is determined by the MSF rate and the reverse repo rate for the daily movement of Weighted Average Call-money Rate (WACR).

- Open Market Operations (OMOs): These are market operations conducted by the RBI by selling or purchasing government securities to or from the market to adjust the liquidity conditions in the market on an enduring basis.

- Market Stabilisation Scheme (MSS): It was introduced in 2004. It is used to withdraw excess liquidity by selling short-dated government securities in the economy. The issued securities are government bonds called Market Stabilisation Bonds.

What are the key takeaways of the recent monetary policy?

On February 2020, the RBI announced its 6th Bi-Monthly Monetary Policy Rates for 2020-21. The announcements made include the following:

Repo rate remains unchanged:

- The MPC has decided to keep the policy repo rate unchanged at 5.15% for the second time due to the rising concern of inflation.

- In December 2019, the Consumer Price Index (CPI) of 7.35% has crossed the RBI’s medium-term target inflation of 4%.

- Consequently, the reverse repo rate remains unchanged at 4.90% and the bank rate at 5.40%.

- This is in line with RBI’s decision to continue with the accommodative stance of monetary policy as long as it is necessary to revive growth.

- Accommodative Monetary Policy occurs when a central bank attempts to expand the overall money supply to boost economic growth. The policy is implemented to allow the money supply to increase in line with the national income and demand for money.

- It is an efficient way to encourage more spending from consumers and businesses by making money less expensive to borrow through the lowering of short-term interest rates.

Estimation of GDP growth rate in FY21:

- The RBI projected GDP growth for the FY21 at 6%. It was 5% in FY20. This is less than the Economic Survey’s estimation of 6 to 6.5%.

Consumer Price Index target:

- The RBI increased its CPI inflation target to 6.5% for the fourth quarter of the current fiscal year (January-March 2020) because of the increase in input costs for milk and pulses and volatile crude oil prices.

- The central bank also predicted an inflation target of 5.4% to 5% for the first half of 2020-21 (April-September 2020) and 3.2% for the third quarter of 2020-21 (October-December 2020).

- Private consumption is expected to improve especially in the rural economy due to the performance of rabi crops. The recent increase in the food prices was favourable towards agricultural trade. This can increase rural income.

- RBI expects an increase in exports and investments due to the softening of uncertainties of global trade.

Extension of one-time restructuring scheme for MSME:

- The RBI has extended the One-Time Restructuring Scheme for MSMEs by December 31, 2020.

- The recast scheme announced in January 2019 was to expire on March 31, 2020.

- This move comes in response to the government’s request to extend the debt-restructuring period by another year ending March 31, 2021.

Easing Real Estate sector’s woes:

- In the Union Budget, various schemes were introduced for the homebuyers to support the troubled real estate sector.

- Supporting the government, the RBI also brought in measures to ease the working of the sector.

- The RBI directed the banks to permit one-year extension of date of commencement of commercial operations (DCCO) for delayed commercial real estate.

- This means that stalled real estate projects’ promoters will get a year more before they come under the banks’ bad loans.

Relief for banks:

- The Long-Term Refinancing Operation (LTRO) has been set at repo rate to control the bond yield management.

- To give banks with long-term liquidity at a fair cost, the RBI will inject up to Rs.1 lakh crore at a “term repo rate”. These will bear tenors of 1 year and 3 years.

- This will allow banks to meet their obligation to repay maturing deposits.

- Cash Reserve Ratio is currently 4%. The RBI has freed the banks from this obligation until July 31, 2020.

- This means that banks need not set aside CRR on retail loans like car loans, home loans and loans to MSMEs. This will make loans available at a cheaper rate.

MSME/MSE:

- The RBI directed the scheduled commercial banks to link the interest rates on MSE loans to external benchmark from the new FY21.

- Thus, medium enterprises will benefit from the floating interest rate on loans.

Conclusion:

The RBI retaining the accommodative stance is a step in the right direction, given the slow economic growth and increasing inflation rate. It is expected to continue the status quo in the coming MPC meetings in 2020 for aiding growth. Allowing the banks and other financial institutions to provide loans at cheap interest rates can ensure improvement in the financial health of the economy in the current situation, promoting economic growth of the country.

Test Yourself:

What is Monetary Policy? How is the RBI’s current Accommodative Stance helping the Indian economy? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.