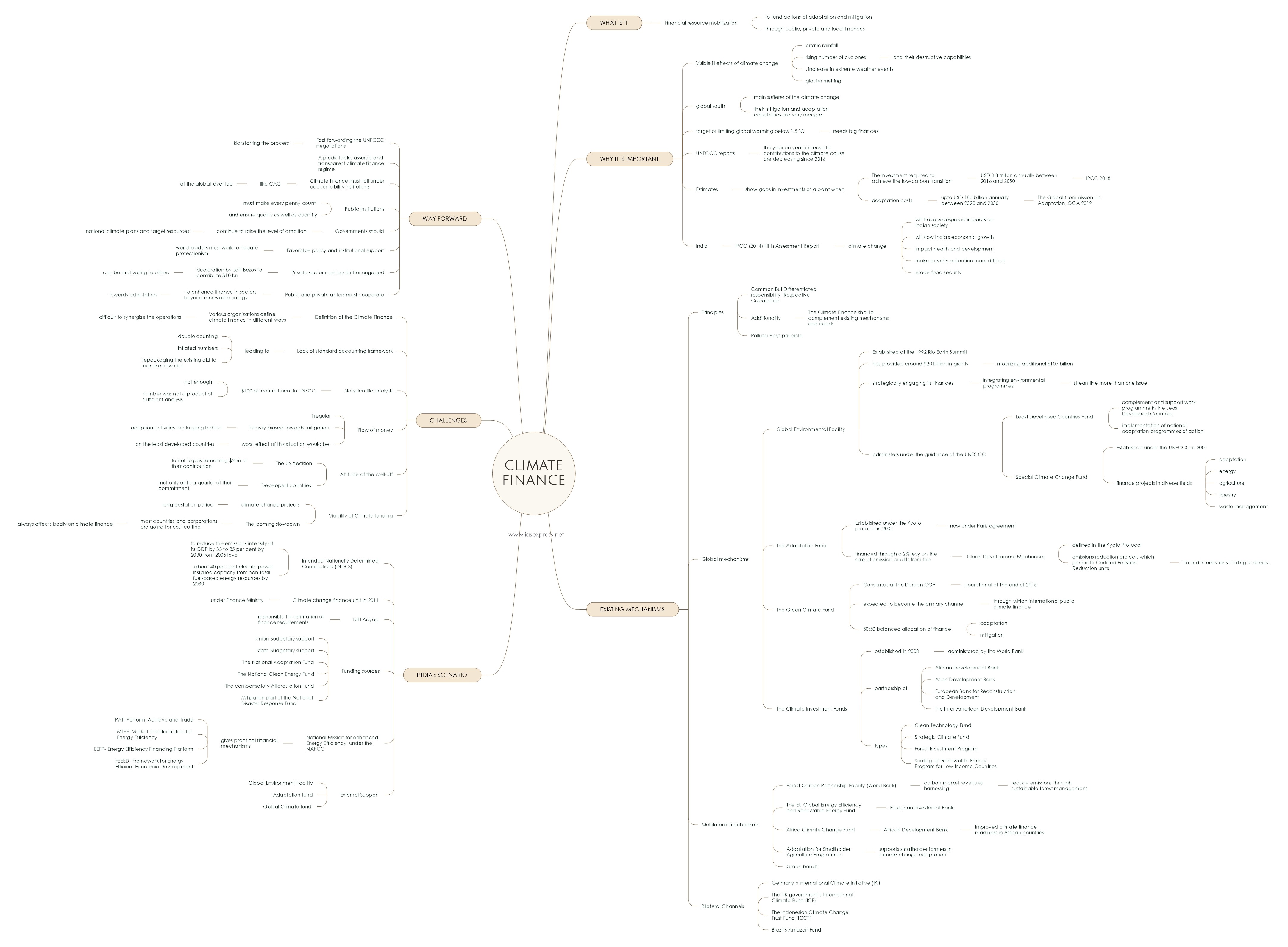

Climate Finance – Need, Mechanism, Challenges, India’s Efforts

Four and a half years after nations negotiated the Paris Climate Agreement (now ratified by 187 of them), the global climate change action is taking place at a slow pace. Though there is incremental progress in the activities, the finance issue is still looming large as the main contributors, the developing countries are yet to meet their obligations. In this background, it is important to take stock of the Climate finance regime as we are lagging behind the targets and the gap between what is to be done and what is being done is increasing.

What is Climate Finance?

Climate finance refers to the financial resources mobilised to fund actions that mitigate and adapt to the impacts of climate change, including public climate finance commitments by developed countries under the UNFCCC, Private sector Funding and local finances.

Why a robust Climate Finance regime is important?

- The ill-effects of climate change are already visible in erratic rainfall, rising number of cyclones and their destructive capabilities, increase in extreme weather events, glacier melting events.

- The global south is the main sufferer of the climate change ill effects. But their mitigation and adaptation capabilities are very meagre. They depend heavily on climate finance.

- The target of limiting global warming below 1.5 ˚C is possible only with fast-paced mitigation activities. It needs heavy investments in green technology.

- Keeping warming below the target level necessitates rapid, large-scale emissions reductions, and a corresponding transition away from high-carbon production and consumption, across all sectors.

- UNFCCC reports suggest that the year on year increase to contributions to the climate cause is decreasing since 2016.

- India and climate change

- IPCC (2014) Fifth Assessment Report argued that climate change will have widespread impacts on Indian society and its interaction with the natural environment.

- It has argued that climate change will slow India’s economic growth, impact health and development, make poverty reduction more difficult and erode food security.

- Estimates show that the gap between existing investment and what is needed represents an order of magnitude Following are some of the estimates-

- The investment required to achieve the low-carbon transition is to the level of USD 3.8 trillion annually between 2016 and 2050, for mitigation investments alone (IPCC 2018).

- Estimations of adaptation costs are up to USD 180 billion annually between 2020 and 2030 (The Global Commission on Adaptation, GCA 2019)

What are the existing mechanisms of Climate Finance?

Since climate change actions have started, the finance angle has been discussed with due consideration. The 1992 Rio earth summit can be called the pioneer in the climate finance regime as it started the institutional mechanism through Global environmental facility.

The climate finance regime follows the following principles by and large-

- The Common But Differentiated responsibility (adopted in the Rio Earth summit) which is now upgraded to Common But Differentiated responsibility- Respective Capabilities.

- Additionality- Climate Finance should complement existing mechanisms.

- Polluter Pays principle

Global Finance mechanisms

- Global Environmental Facility–

- Established at the 1992 Rio Earth Summit.

- The GEF has provided around $20 billion in grants while mobilizing an additional $107 billion for more than 4,700 projects in 170 countries.

- Further, it is strategically engaging its finances to catalyse transformational changes, integrating environmental programmes to streamline more than one issue.

- The GEF also administers the Least Developed Countries Fund (LDCF) and the Special Climate Change Fund (SCCF) under the guidance of the UNFCCC Conference of Parties (COP).

Least Developed Countries Fund (LDCF)-

- established to complement and support work programme in the Least Developed Countries (LDCs).

- carrying out the implementation of national adaptation programmes of action (NAPAs).

The Special Climate Change Fund (SCCF)-

- Established under the UNFCCC in 2001 to finance projects in diverse fields such as adaptation, energy, transport, industry, agriculture, forestry and waste management.

- The Adaptation Fund (AF)

- Established under the Kyoto protocol in 2001 (now under Paris agreement)

- financed through a 2% levy on the sale of emission credits from the Clean Development Mechanism.

Clean development mechanism-

- defined in the Kyoto Protocol

- Provides for emissions reduction projects which generate Certified Emission Reduction units that are traded in emissions trading schemes.

- The Green Climate Fund (GCF)

- Consensus at the Durban COP and became operational at the end of 2015.

- It is expected to become the primary channel through which international public climate finance will flow over time

- commitment to a 50:50 balanced allocation of finance to adaptation and mitigation.

- The Climate Investment Funds (CIFs)

- established in 2008 are administered by the World Bank.

- operate in partnership with regional development banks including the African Development Bank (AfDB), the Asian Development Bank (ADB), the European Bank for Reconstruction and Development (EBRD) and the Inter-American Development Bank (IDB)

- The CIFs have a total pledge of USD 8.08 billion. They include-

- Clean Technology Fund (CTF)

- Strategic Climate Fund (SCF)

- Pilot Program for Climate Resilience (PPCR)

- Forest Investment Program (FIP)

- Scaling-Up Renewable Energy Program for Low-Income Countries (SREP)

Multilateral climate finance mechanisms

- Forest Carbon Partnership Facility (World Bank)

carbon market revenues harnessing to reduce emissions through sustainable forest management

- The EU Global Energy Efficiency and Renewable Energy Fund (European Investment Bank).

- Africa Climate Change Fund (ACCF)

Improved climate finance readiness in African countries by the African Development Bank.

- Adaptation for Smallholder Agriculture Programme–

supports smallholder farmers in climate change adaptation in rural development programmes.

- Market Mechanisms such as Green Bonds.

Bilateral Channels

- Germany’s International Climate Initiative (IKI)

- The UK government’s International Climate Fund (ICF)

- Together with Germany, Denmark and the EC, the UK also contributes to the NAMA Facility e. s nationally appropriate mitigation actions (NAMAs) in developing countries and emerging economies Regional and National funds

- The Indonesian Climate Change Trust Fund (ICCTF)

- Brazil’s Amazon Fund, administered by the Brazilian National Development Bank (BNDES), is the largest national climate fund.

- The Caribbean Catastrophic Risk Insurance Facility (CCRIF) through the support of the World Bank and other development partners.

What are India’s Efforts in Climate Change actions and Finance mechanisms?

India has always said that it follows the “vasudhaiv kutumbakam” mantra and is fully committed towards the climate change action.

- India’s Intended Nationally Determined Contributions (INDCs) under UNFCCC-

- It has to reduce the emissions intensity of its GDP by 33 to 35 percent by 2030 from 2005 level

- To achieve about 40 percent electric power installed capacity coming from non-fossil fuel-based energy resources by 2030.

To achieve this, it has been continuously building on to its climate finance mechanisms

The establishment of the Climate change finance unit in 2011 in the Finance Ministry gave shape to the climate finance mechanism. The NITI Aayog is primarily responsible for the estimation of finance requirements in the country.

- Climate finance in India comes through the following agencies-

- Union Budgetary support

- State Budgetary support

- The National Adaptation Fund

- The National Clean Energy Fund.

- The compensatory Afforestation Fund

- Mitigation part of the National Disaster Response Fund.

- The National Action Plan on Climate Change is a comprehensive response of India to the menace of Climate change.

The National Mission for Enhanced Energy Efficiency under the NAPCC gives practical financial mechanisms through its programmes like-

- PAT- Perform, Achieve and Trade.

- MTEE- Market Transformation for Energy Efficiency.

- EEFP- Energy Efficiency Financing Platform.

- FEEED- Framework for Energy Efficient Economic Development.

- External Support by Global Environment Facility, Adaptation fund, Global Climate fund etc.

What are the challenges to Climate finance?

- Definition of Climate Finance–

Various organisations define climate finance in different ways making it difficult to synergise the operations.

- Lack of standard accounting framework

It leads to double-counting, inflated numbers, repackaging the existing aid to look like new aids etc

- No scientific analysis

Many feel that the $100 bn commitment in the UNFCCC figure is not enough and the number was not a product of sufficient analysis.

- Flow of money

- The money flow for climate finance is irregular.

- It is heavily biased towards mitigation and the adaption activities are lagging behind.

- The worst effect of this situation would be on the least developed countries.

- The attitude of the well-off

- The US decision not to pay the remaining $2bn of their contribution is alarming.

- Developed countries had met only up to a quarter of their commitment.

- Viability of Climate funding

- The climate change projects have a long gestation period

- The looming slowdown does not help either as most countries and corporations are going for cost-cutting which almost always affects badly on climate finance

Way Forward

- Fast forwarding the UNFCCC negotiations and kickstarting the process.

- A predictable, assured and transparent climate finance regime is a necessary condition for it to materialise in a sufficient amount.

- Climate finance must fall under accountability institutions like CAG at the global level too.

- Public institutions, in particular, must make every penny count and ensure quality as well as quantity.

- Governments should continue to raise the level of ambition in national climate plans and target resources.

- Favourable policy and institutional support are necessary for climate finance. The world leaders must work to negate protectionism and work with each other.

- The private sector must be further engaged to make contributions. The recent declaration by Jeff Bezos to contribute $10 bn can be motivating to others.

- Public and private actors must cooperate to enhance finance in sectors beyond renewable energy generation towards adaptation.

Practice Question for Mains

What is Climate Finance? Discuss with reference to India’s INDCs whether the national and International finance regime is sufficient to put breaks to the global warming and climate change. (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.