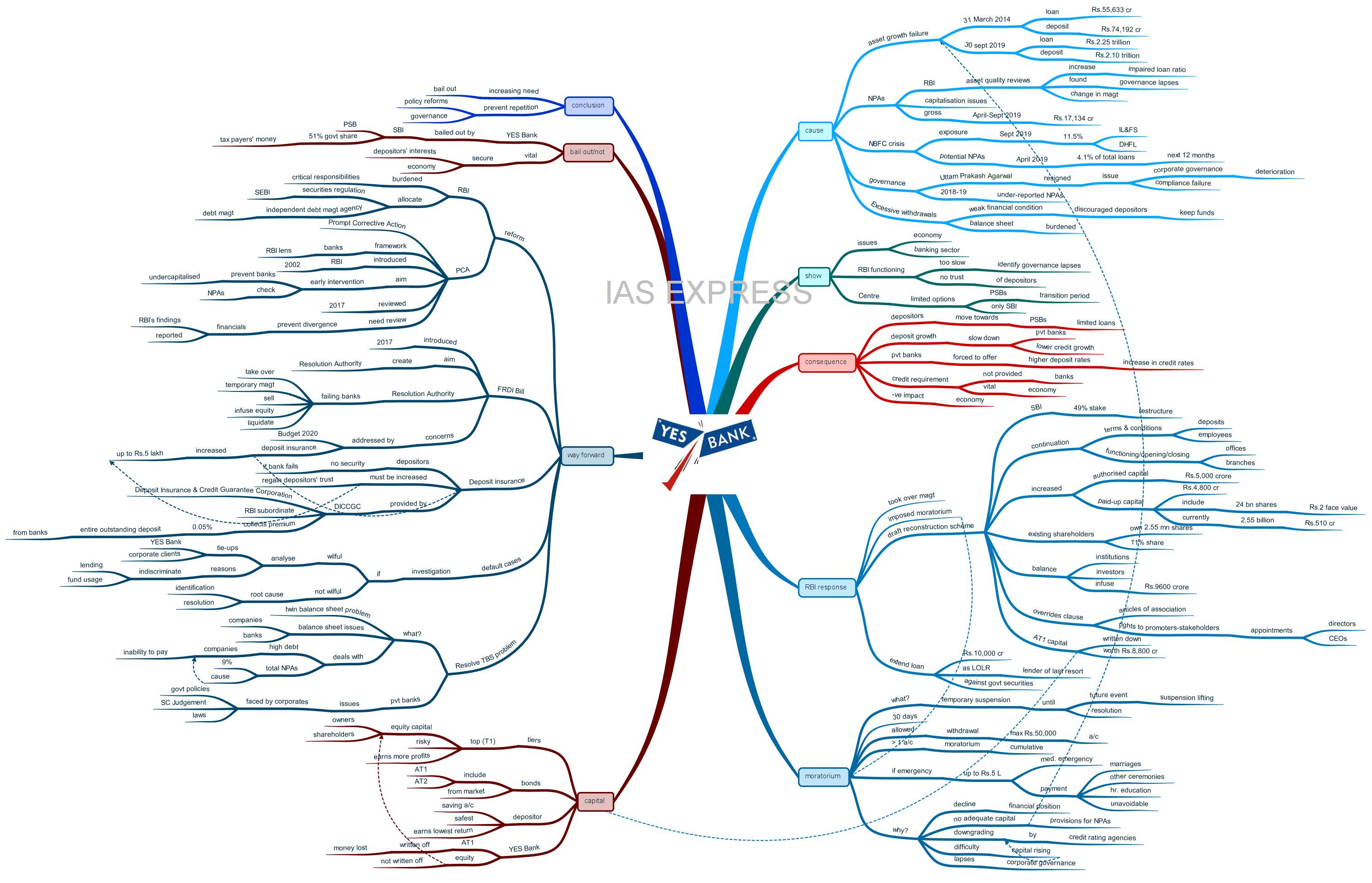

Yes Bank Crisis – Causes, Consequences & Measures

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 80+ questions reflected

On 5th March 2020, the Reserve Bank of India (RBI) had imposed a 30-day moratorium on the YES Bank, superseded the bank’s board and appointed Prashant Kumar, who was serving as chief financial officer and deputy managing director at the State Bank of India (SBI) as an administrator. Under the moratorium, deposit withdrawals were capped at Rs.50,000 per person. The apex bank had also proposed a reconstruction plan under which the SBI shall take a maximum of 49% stake in the restructured capital of the bank. The YES Bank crisis is not unique or unprecedented as it came due to the growing number of bad loans caused by the issues faced by the country’s economy, which ranges from real estate to power and NBFCs. Thus, ensuring necessary reforms in the governance, policies, etc., to safeguard the country’s financial sector are a need of the hour.

What are the reasons behind the Yes Bank crisis?

Failure in asset growth:

- The YES bank’s loan on 31st March 2014 was Rs.55,633 crore and its deposits were Rs.74,192 crore.

- Since then, the loan has grown to nearly four times as much, at Rs.2.25 trillion as of 30th September 2019.

- At the same time, however, the bank’s deposit has failed to grow at the same rate as it had increased at less than three times to Rs.2.10 trillion.

- The YES bank’s asset quality also worsened and it came under the RBI’s scrutiny.

- The YES Bank faced issues after the RBI’s asset quality reviews in 2017 and 2018, which led to an increase in its impaired loan ratio and uncovered significant governance lapses, which resulted in a complete change of management.

- Later, the YES bank struggled to address its capitalisation issues.

- Its gross NPAs between April and September 2019 had doubled to Rs.17,134 crore.

Consequences of the NBFC crisis:

- The Non-Banking Financial Companies (NBFC) crisis started with the unravelling of the crisis faced by the Infrastructure Leasing & Financial Services (IL&FS) and then extended to Dewan Housing Finance Limited (DHFL).

- The YES bank’s total exposure to IL&FS and DHFL was 11.5% as of September 2019.

- In April 2019, the bank had classified approximately 4.1% of its total loans as potential non-performing loans over the next 12 months.

Governance:

- The YES bank faced several governance-related issues that led to its decline.

- On January this year, Uttam Prakash Agarwal, one of the independent directors, had quit citing the deterioration of corporate governance standards and compliance failure at the lender.

- In 2018-19, the bank under-reported NPAs, prompting the RBI to dispatch R Gandhi, one of its former deputy governors to the board of the bank.

- Rana Kapoor, one of the founders of the YES bank, was asked to step down as the chief executive in January 2019.

Excessive withdrawals:

- The YES bank’s financial condition discouraged many depositors from keeping funds in the bank over the long term.

- As a result, the bank showed a steady withdrawal of deposits, which burdened its balance sheet and added to its distresses.

What does this crisis show?

- The YES Bank crisis came as a result of the mounting bad loans due to problems faced by the Indian economy.

- The YES Bank crisis reflects badly on the RBI functioning. It showed that apex bank was too slow to identify governance failure among IL&FS, DHFL and YES Bank.

- RBI’s takeover of YES Bank did little to regain the depositors’ trust on the YES Bank. The moratorium used by the apex bank to address the crisis only made the depositors even warier

- Choosing SBI as the investor to address this crisis shows the scarcity of options the government has in this situation.

- This is because, after the recent merger of banks, the majority of the PSBs are in the transition period. Thus, the onus has fallen on India’s largest bank, SBI, to bail out the YES Bank.

- Apart from these, the crisis also reflects the issues faced by the banking sector.

What are the consequences of YES Bank crisis?

The YES Bank crisis may result in the following situations:

- The depositors may move towards public sector banks, which are currently more hesitant towards providing loans.

- The crisis may lead to slowing down of deposit growth for select private banks, leading to lower credit growth.

- Private sector banks will be forced to offer higher deposit rates, which in turn may increase the credit rate.

- Both private and public banks will not be able to provide for the credit requirements, which is vital to realise India’s objective of becoming a $5 trillion economy by 2024-25.

- The YES Bank crisis may harm the Indian economy, which is drastically slowing down.

How did the RBI respond to this crisis?

- The RBI, after taking over the YES Bank’s management, had imposed a moratorium.

- It had also announced the draft “Scheme of Reconstruction”, which involves the following:

- All deposits with the YES Bank will continue in the same manner and with the same terms and conditions, completely unaffected by the scheme.

- The YES Bank’s authorised capital will be increased to Rs.5,000 crore ( from Rs.600 crore )

- The paid-up capital will be increased to Rs.4,800 crore, comprising of 24 billion shares of Rs.2 face value. Currently, there are 2.55 billion fully paid-up shares issued, totalling Rs.510 crore.

- The SBI has agreed to purchase a 49% stake in the government’s expanded capital or 11.76 billion shares.

- The existing shareholders own 2.55 million shares, and they will end up with around 11% stake in the company.

- The balance may be held by other institutions and investors, who will need to infuse approximately Rs.9600 crore.

- The scheme also overrides certain clauses of the articles of association, which grants rights to promoters-stakeholders to appoint directors and chief executives.

- The scheme recommends reconstitution of YES Bank’s board with a new CEO and managing director.

- All employees of the reconstituted bank will continue with the same remuneration for at least a year.

- The offices and branches will also continue to function as before and the bank will be allowed to open new ones or close down the existing ones.

- Under the scheme, the bank’s instruments qualifying as Additional Tier 1 (AT1) capital under the Basel III framework will stand written down permanently. The bank’s AT1 bonds are worth Rs.8,800 crore.

- Separately, the RBI also decided to extend a loan of Rs.10,000 crore to the YES Bank as the lender of last resort (LOLR) against the government’s securities.

- This 90-day loan will be offered at a bank rate of 5.4% plus 3% to meet the immediate liquidity needs of the bank.

Why was a moratorium imposed on the Yes Bank?

- A moratorium is a temporary suspension of activity until future event warrant lifting of the suspension or related issues have been resolved.

- In case of the YES Bank, the RBI had imposed a month-long moratorium, which was scheduled to end on 3rd

- This moratorium allowed withdrawal of a maximum of Rs.50,000 during the said period from the bank accounts.

- If the depositor had more than one deposit account with the YES bank, then the moratorium applies to all of his/her accounts cumulatively.

- There is a small relief to depositors in case of emergencies.

- The RBI had allowed withdrawal of up to Rs.5 lakh in case of medical emergencies, higher education expenses, payment towards marriage, other ceremonies and “unavoidable” emergencies.

- This was done due to a steady decline in YES Bank’s financial position, mainly because of the lender’s inability to raise adequate capital to make provisions for potential NPAs.

- This failing led to downgrades by credit rating agencies, which resulted in the capital rising even more difficult.

- Additionally, there were serious lapses in corporate governance within the bank.

What happens to the YES Bank’s capital?

- In a bank, there are different tiers (hierarchies) of capital (money).

- The top tier or T1 has “equity capital”. This is the money put in by the owners and shareholders. This is the riskiest category of capital.

- Also, there are different types of bonds (AT1 and AT2), which are bought by the bank from the market.

- The last is the depositor, the one who deposits money in the banks’ savings accounts.

- The depositor’s money is the safest type of capital. When there is an issue, the depositor is paid back first and the equity owner the last.

- When the bank is at good financial condition, the depositor earns the lowest rate of return, while the equity owners earn the most profits.

- For the YES Bank, the RBI had stated that the Additional Tier 1 (AT1) capital raised by the YES Bank would be completely written off.

- This means that those who lent money to the YES Bank under the AT1 category of bonds would lose all their money.

- 10,800 crore falls under this category and many popular mutual funds like SBI Pension Fund Trust, UTI Mutual Fund etc., may lose their assets.

- Indirectly, many common investors would also lose out on their investments.

- This has become an issue, as the capital raised through AT1 bonds, which is in the same tier of capital as equity (Tier 1), will be written off even though equity will not be.

- The mutual funds’ owners argue that they are being unfairly written off and that equity capital should be written off before AT1.

What can be the way forward?

Reforming RBI:

- The RBI is in charge of too many responsibilities.

- The government can reform the RBI so that it is not burdened by numerous critical responsibilities related to the country’s finance.

- In this context, the Securities and Exchange Board of India (SEBI) can be made in charge of the securities regulation.

- The debt management can be brought under an independent debt management agency

Financial Resolution and Deposit Insurance (FRDI) Bill:

- FRDI Bill was introduced in 2017 to create a Resolution Authority.

- A Resolution Authority is necessary to take over failing banks and either manage them temporarily, sell them, infuse equity or, as a last resort, liquidate them.

- However, the Bill was delayed due to controversies.

- To address the concerns pertaining to this Bill, the Union Budget 2020-21 raised the deposit insurance cap up to Rs.5 lakh.

- The government had also announced that the FRDI Bill would be re-introduced in the parliament.

Deposit insurance:

- In India, the depositors do not have much security if a bank fails.

- The Budget 2020 only covers deposits up to Rs.5 lakh via deposit insurance.

- The deposit insurance should be increased further to regain the depositors’ trust in the banking system.

- In India, the deposit insurance is provided by the Deposit Insurance and Credit Guarantee Corporation (DICGC), which is the subordinate to the RBI.

- The DICGC collects a premium of 0.05% of the entire outstanding deposit from banks and not from the depositors.

Default cases:

- The government and the RBI should investigate whether the default in the loans taken by the YES Bank’s clients is wilful or not.

- If it is done willingly, then a detailed investigation should be undertaken to analyse the relationship between YES Bank and its corporate clients.

- An investigation must also be conducted to find out the reasons behind indiscriminate lending and fund usage in the past three years. This was the time when the investment activities were limited and very few corporates sought loans.

- If the defaults were not wilful, then the root cause is because of the issues faced by the economy. These should be identified and resolved as soon as possible.

Resolve twin balance sheet problem (TBS)

- Twin balance sheet problem is about issues with balance sheets of both the Indian companies and the Indian banks.

- The twin balance sheet problem deals with the following:

- High debt accumulation on companies has resulted in their inability to pay interest payments on loans. Companies that are not earning enough to pay interests owe about 40% of the corporate debt.

- The total NPAs of India’s banking system is 9%. It is mostly due to the failure of the companies to repay their loans.

- The issues faced by banks are not only their fault but also the corporates who obtained loans from them.

- The government policies, laws, regulations, Supreme Court judgements etc., can sometimes hinder the smooth functioning of the corporates, preventing them from earning profits and repay loans.

Reforming Prompt Corrective Action (PCA)

- PCA framework is a framework under which banks with weak financial health are put under the RBI’s lens.

- The central bank introduced the PCA framework in 2002 so that they can intervene during the earlier stages when the banks become undercapitalised due to poor asset quality or loss of profits.

- The objective of the PCA is to check the issues of NPAs in the banking sector and alert the central bank and investors in case of troubles within the bank so that issues can be resolved before they worsen.

- This framework was later reviewed in 2017 based on the recommendations of the working group of the Financial Stability and Development Council on Resolution Regimes for Financial Institutions in India and the Financial Sector Legislative Reforms Commission.

- In recent years, the RBI is warning about the growing concerns about the divergence between the reported and RBI’s findings on the banks’ financials.

- The YES Bank crisis is a good opportunity for the RBI to review its Prompt Corrective Action (PCA) framework so that there are no differences between the financial findings and that all the concerned stakeholders are pre-warned about the imminent crisis.

Should the government continue bailing out crisis-ridden banks?

- Capital infusion into banks that face a crisis is happening at an almost continuous basis in recent times.

- Some of the recent examples include IDBI Bank crisis, PNB Bank crisis and PMC Bank crisis.

- In this case, YES Bank (a private bank) is bailed out by the SBI (a public sector bank).

- The SBI has 51% of the government’s share, which is the taxpayers’ money.

- There are concerns that the taxpayers’ money is frequently used to bail out the ailing private banks, while not resolving the core issues that are plaguing the economy.

- Yet, India currently does not have any other alternative to safeguard the depositors’ interests and the country’s economy.

Conclusion:

With the increasing need to bail out the private banks in case of a crisis, it is high time that the government and the RBI take necessary steps to prevent the repetition through policy reforms and governance.

Practice question for mains:

Critically examine the causes and consequence of the YES Bank crisis. What are the measures that need to be taken to prevent similar issues from taking place? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.

Writing off AT-1 bonds in Yes Bank is wrong, unjustified and possibly illegal too. These can’t be written off before writing off the equity. These bonds are better placed than equity under BASEL-111 norms even. QUESTION: Is Yes Bank “Private Owned Bank” or “RBI Controlled Private Bank.” 1. If it is or any other bank a Private Owned Bank, why should there be a RBI control. Let the owners run and face the consequences of defaults if any. Investors too should suffer since they would have invested knowing that this is a private bank and any thing can happen. 2.… Read more »