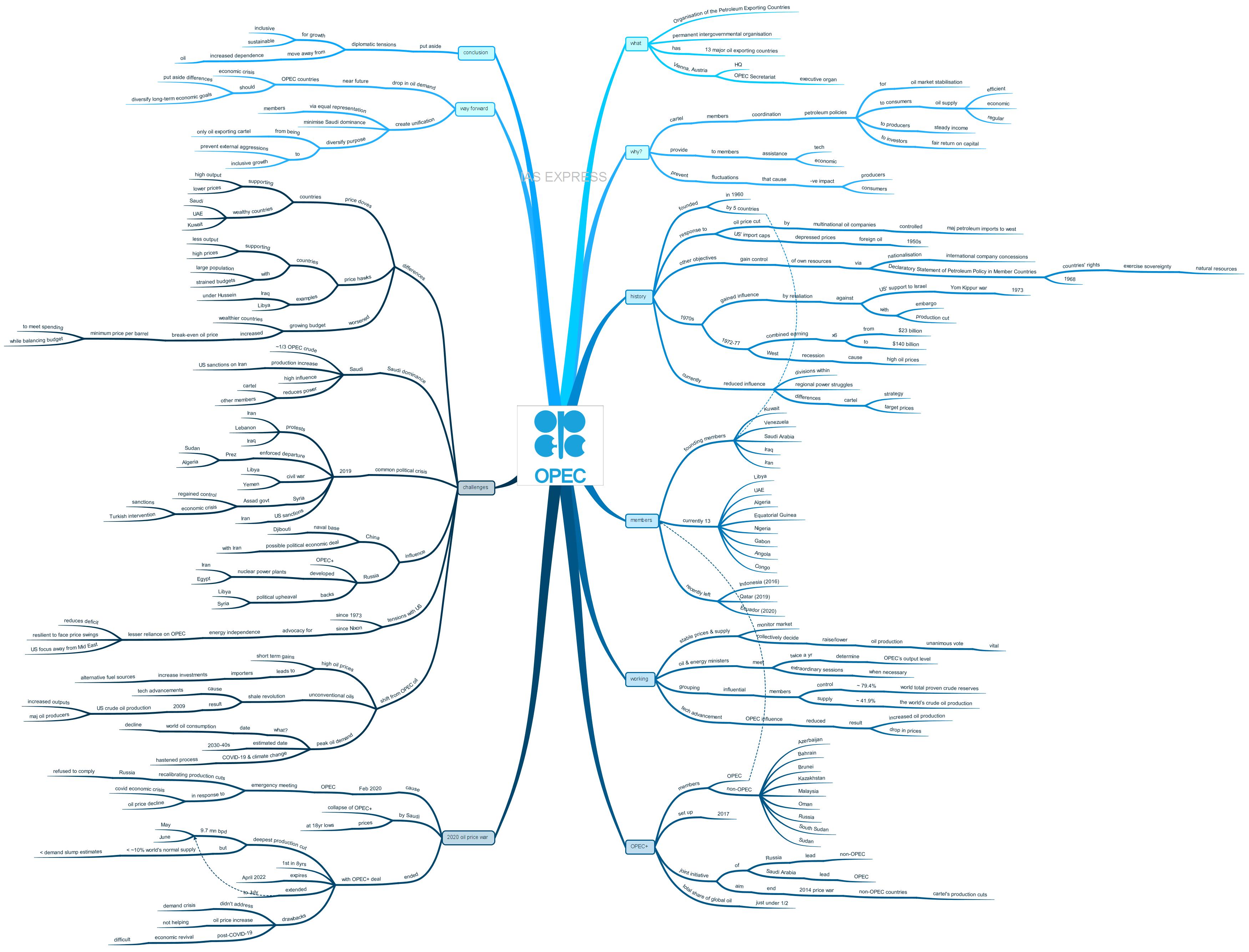

OPEC and OPEC+ – Issues, Challenges, Way Ahead

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

The historic deal by the OPEC+ countries to reduce oil productions to stabilise prices and address the economic crisis caused by COVID-19 did not help the member countries. This shows the vulnerability of oil-exporting countries during the economic crisis. This situation is worsened by the differences among the OPEC countries, which are exacerbated by the internal political crisis and also diplomatic tensions within and outside the region.

What is OPEC?

- The Organisation of the Petroleum Exporting Countries (OPEC) is a permanent intergovernmental organisation consisting of 13 major oil-exporting countries.

- It is headquartered in Vienna, Austria, where the OPEC Secretariat, the executive organ, carries out the day-to-day business.

- The member nations coordinate policies on oil prices and production levels at regular and emergency meetings around the world, often at the Vienna headquarters.

- Delegations are usually led by member countries’ oil ministers.

Why was OPEC formed?

- OPEC is a cartel that was founded to enable member countries to coordinate their petroleum policies and ensure stabilisation of oil markets to secure an efficient, economic and regular supply of petroleum to consumers, a steady income to producers and a fair return on capital for investors.

- To also aims to provide the member nations with technical and economic assistance.

- Its purpose is also to prevent fluctuations that might adversely impact economies of both the producing and purchasing countries.

How did OPEC come to be?

- OPEC was established in 1960 by Iran, Iraq, Kuwait, Saudi Arabia and Venezuela.

- Through this grouping, the founding members sought to build a united front to respond to oil price cut imposed by the multinational oil companies that controlled the majority of petroleum imports into western countries and also the US’ import caps that depressed prices of foreign oil in the 1950s.

- These countries also sought to gain greater control over their own resources via nationalisation of international company concessions.

- The OPEC adopted a ‘Declaratory Statement of Petroleum Policy in Member Countries’ in 1968, which emphasised the right of all countries to exercise the permanent sovereignty over their natural resources in the interest of their national development.

- Most of the OPEC members own all their oil reserves.

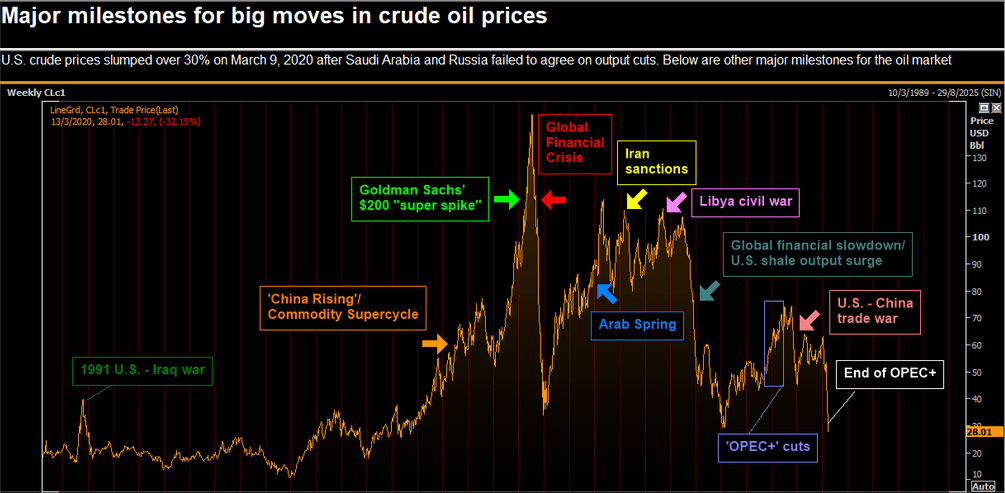

- In the 1970s, OPEC became one of the influential intergovernmental organisations when it retaliated against US’ support to Israel during the Yom Kippur war of 1973 with an embargo and production cut.

- From 1972 to 1977, the combined petroleum earnings of the members sextupled, from $23 billion to $140 billion.

- During the same period, the West was facing a recession due to high oil prices.

- This is seen as a victory over the West by the ‘Third World’ countries.

- Yet, this power is waning in recent years due to divisions within the group.

- Some of these were driven by regional power struggles and others were due to differences in opinion over strategy and target prices for the cartel.

Who are the members of OPEC?

- Apart from the five founding members, the other member countries include Libya, the UAE, Algeria, Nigeria, Gabon, Angola, Equatorial Guinea and Congo.

- As Qatar (2019), Indonesia (2016) and Ecuador (2020) suspended their membership, there are currently only 13 member countries.

How does OPEC work?

- Member nations monitor the market and collectively decide to raise or lower oil production to maintain stable prices and supply.

- A unanimous vote is needed to increase or decrease oil production.

- Oil and energy ministers from the member nations meet twice a year to determine the OPEC’s output level.

- They also meet for extraordinary sessions when required.

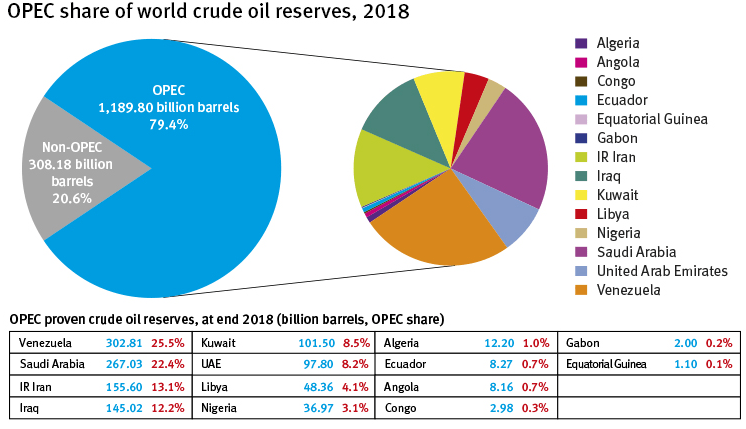

- OPEC has a significant influence on the market as the members control about 79.4% of the world’s total proven crude reserves.

- Together, these countries supply around 41.9% of the world’s crude oil production.

- As a cartel, the grouping has a strong incentive to keep the oil prices as high as possible while maintaining their shares in the global market.

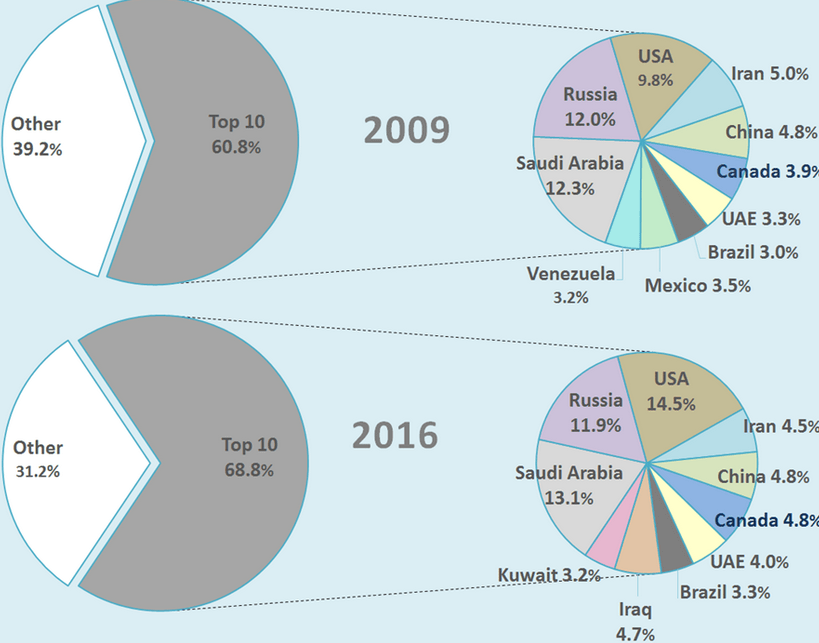

- With the development of new technologies, especially fracking in the US, the OPEC’s influence in the markets has been reduced, leading to a significant increase in oil production and a drop in prices.

What is OPEC+?

- OPEC+ is a group of oil-producing nations consisting of the 13 OPEC members and 10 other non-OPEC members.

- The non-OPEC members are Azerbaijan, Bahrain, Brunei, Kazakhstan, Malaysia, Mexico, Oman, Russia, South Sudan and Sudan.

- It is a joint initiative of Saudi Arabia and Russia to end the 2014 price war initiated by the former in response to non-OPEC countries benefiting from the cartel’s production cuts.

- While the OPEC bloc is nominally led by Saudi Arabia, the group’s largest oil producer, non-OPEC countries are led by Russia.

- The OPEC+ was set up in 2017 to coordinate oil production among the countries in order to stabilise prices

- Since then, the group has reached deals for members to voluntarily cut and ramp-up production in response to changes in global oil prices.

- While the OPEC alone accounts for around one-third of the world’s oil supply, the OPEC+ accounts for a total share of global oil to just under half.

- The leading oil producers like the US, China, UK, Canada and Norway are not part of this deal.

What is the 2020 oil price war?

- In response to the decline in the oil price caused by the coronavirus-led economic crisis, OPEC held an emergency meeting in February 2020 to recalibrate its production cuts for the rest of the year.

- However, Russia refused to agree to the deal so as to prevent US’ shale companies benefiting from the policy of supply restraint under the OPEC+ deal.

- This led to Saudi Arabia launching a price war, which resulted in the collapse of OPEC+ and oil prices falling to 18-year lows.

- A price war is an economic policy, which involves slashing oil prices to push out smaller and weaker firms from the market.

What was the deal agreed by the OPEC+ countries to address crude oil price crash?

- The 2020 price war ended when the OPEC+ countries agreed to reduce oil production by 7 million barrels a day in May and June, to stabilise the market that has been upended by the pandemic.

- This is the deepest cut ever agreed to by the group.

- After that, these countries will steadily ramp up production until the agreement expires in April 2022.

- This historic deal is unlikely to solve the demand crisis caused by the pandemic.

- The agreed reduction is only about 10% of the world’s normal supply of oil, far below the estimates of demand slump.

- This is the first OPEC deal in 8 years. It is expected to help Saudi Arabia, which is facing budget deficits after a record gap of $98 billion last year.

- The OPEC+ met again in June to continue cutting 9.7 million barrels per day through July.

- Under the original deal signed in April, the group was intending to increase production after June.

- The extension of the production cut shows that the recent surge in oil prices did not help avert the possibility of an oil market falling apart again.

- This is because the revival of the global economy post-COVID-19 would prove to be a difficult feat given the crisis caused by the pandemic.

- While the production cuts and voluntary closings of oil wells have helped to bring demand and supply closer to balance, there are still huge stocks of oil in tank farms and on ships that could flood the market.

What are the challenges faced by OPEC?

Differences among members

- OPEC members are divided between so-called price doves and price hawks.

- Price doves are those countries that push for higher output and lower prices, while the price hawks are those members will large populations and strained budgets.

- Historically, the doves have been OPEC’s wealthier countries that are willing to reduce oil prices to help preserve their dominant position in oil markets. These include Saudi Arabia, the UAE and Kuwait.

- The hawks are Iran in 1980s, Iraq under Saddam Hussein and Libya.

- This has further been complicated in recent years by growing budgets in some wealthy states, which have increased their break-even oil price – the minimum price per barrel that the country needs to meet its expected spending needs while balancing its budget.

- These differences, during certain instances, turned into violent conflicts, like the Iran-Iraq war that led to thousands of deaths.

The dominance of Saudi Arabia

- Saudi Arabia is the most powerful among the OPEC countries as it produces roughly a third of the group’s overall crude oil, which further increased by the US sanctions on Iran.

- Saudi Arabia’s disproportionate output has stirred discussion of how much influence other OPEC members have and the overall power of the cartel itself.

Political crisis

- Political instability is very common in the Middle East, which has been exacerbated in late 2019 by massive protests in Lebanon, Iran and Iraq, enforced departure of long-time presidents in Sudan and Algeria.

- The internationalised civil wars in Libya and Yemen seems to have no end in sight.

- While the Assad Government has regained control over Syria, it faces an economic crisis because of economic sanctions and Turkish intervention.

- The US sanctions on Iran’s oil exports is followed by hostile US-Iran bilateral ties, which led to a brink of war during certain instances.

- These along with frequent price wars create difficulty in ensuring stable oil prices for international consumers.

Issue of China and Russia

- China’s influence in the Middle East has grown in recent years, though it is still dependent on petroleum imports from the region.

- Its energy investments are mostly focused on Iraq and to some extent the UAE.

- It has a naval base at Djibouti at the mouth of the Red Sea.

- A possible massive economic-political deal between China and Iran creates the likelihood of greater influence of Beijing in the region.

- Russia, despite being a competitor of Gulf countries, is coordinating oil inputs with them via OPEC+ framework.

- It has developed nuclear power plants in Iran and Egypt. It is supporting political upheavals in Libya and Syria to maintain the crisis in the region for its own benefit.

Tensions with the US

- Since 1973, OPEC has often had a tense relationship with the US.

- Since the Nixon presidency, all US presidents advocated for energy independence.

- Those who support this stand argue that less reliance on OPEC oil reduces the trade deficit and makes the US economy more resilient in the face of oil price swings.

- They also point out the benefit of shifting the US’ focus away from the Middle East.

- Trump Administration is calling OPEC a monopoly and demanding the grouping to reduce oil prices.

- For those OPEC countries that see the group as more of a political club than an economic cartel, the US’ scaremongering enables maintenance of the myth of OPEC’s significance and keeping the Western policymakers focused on it.

Shift from OPEC oil

- While the OPEC countries view high oil prices as a short-term advantage, they also take into consideration of it leading to importing countries to increase investments in alternative fuel sources.

- The most notable challenge for OPEC is from unconventional oils like shale-based energy that became increasingly available as the result of technological advancements.

- In 2009, after nearly a 40-year decline in US crude oil production, shale and sand-based oil extraction has helped the US increase output to record high.

- The shale revolution has adversely impacted OPEC.

- The OPEC’s price reduction did little to prevent the US from becoming one among the world’s major oil producer in recent years.

- The OPEC+ is a counter to the US’ dominance in the oil market.

- The new OPEC+ coalition was formalised in 2019 despite the US’ objections, leading to several US allies in the cartel juggling competing demand from Russia and the US.

- In the long term, the advent of electric vehicles that are run on renewable energy resources represents an existential threat for the cartel.

- The date of ‘peak oil demand‘, at which world consumption of oil begins to decline was previously estimated to occur in 2030-40s.

- It is predicted to come earlier because of massive demand destruction caused by the COVID-19 pandemic and a slow economic recovery.

- The lesser demand for commuting and business travels, increasing fossil fuel costs, growing climate change concerns and government subsidies for renewables would lead to increased investments in the renewable energy sector.

What can be the way forward?

- Demand for fossil fuel is going to decline at a massive scale in the near future, creating an economic crisis for the OPEC+ countries if necessary measures are not taken to put aside their differences and diversifying their long-term economic goals.

- Divisions with OPEC are likely to continue existing, as the representations of the members are unequal because of Saudi Arabia’s dominance.

- In January 2019, Qatar officially withdrew from the grouping because of its disapproval over Saudi Arabia’s dominance and the on-going Saudi-led blockade on the country.

- If Riyadh continues to pursue the current aggressive foreign policy, it could be a challenge for the cartel to remain unified.

- This unification is vital now more than ever as the future economic crisis in the region is inevitable, given the demand for oil is decreasing because of the shift to renewable energy by the importers.

- In being united, the bloc can diversify the purpose of only being an oil-exporting cartel, prevent external aggressions from countries like the US and Russia and ensure inclusive growth of the people in the region.

Conclusion:

United efforts enable efficient addressing of crisis. The diplomatic tensions among member countries need to be set aside for the inclusive and sustainable growth of the region and moving away from increased dependence on oil.

Practice questions for mains:

What are the issues faced by major oil-producing countries during COVID-19 crisis? How can they be addressed? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.