Partial Credit Guarantee Scheme – Need, Issues, Way Ahead

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

The Central government has extended the Rs.45,0000 crore Partial Credit Guarantee Scheme 2.0 by another three months and has allowed the banks to invest more in better-rated NBFCs. The scheme was announced as a part of the ‘Atmanirbhar Bharat Abhiyan’ Package to provide liquidity support to weaker NBFCs, housing finance companies and microfinance institutions.

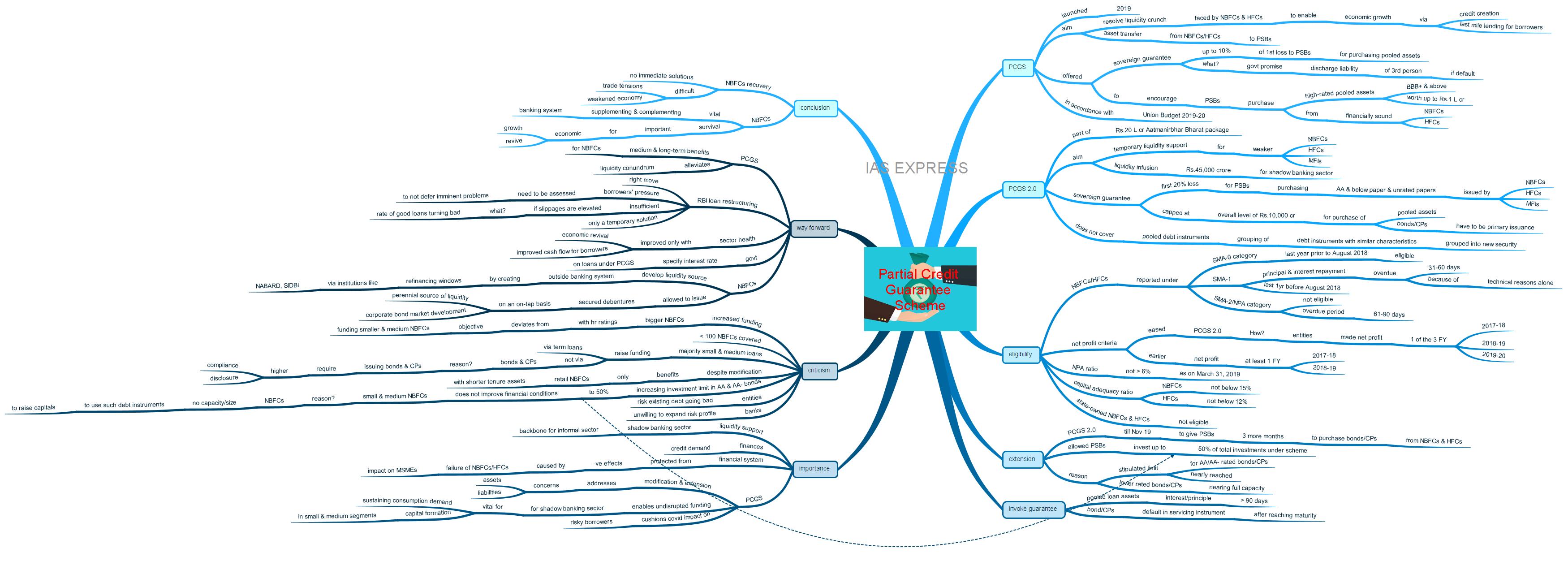

What is Partial Credit Guarantee Scheme?

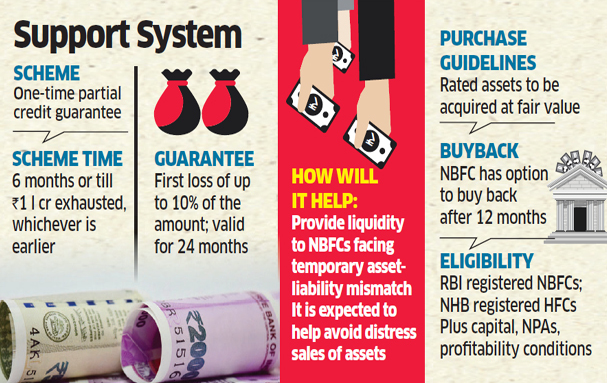

- Partial Credit Guarantee Scheme was launched in 2019 to encourage the public sector banks (PSBs) to purchase high-rated pooled assets from financially sound Non-Banking Financial Companies (NBFCs) and Housing Finance Companies (HFCs).

- The scheme offered a sovereign guarantee of up to 10% of the first loss to the PSBs for purchasing pooled assets rated BBB+ or above worth up to Rs.1 lakh crore.

- A sovereign guarantee is a promise by the government to discharge the liability of a third person if he/she defaults.

- This is to resolve the issue of liquidity crunch faced by the NBFCs and HFCs so as to enable them to continue contributing to credit creation and ensuring last mile lending for borrowers, which together will play a critical role in boosting economic growth.

- The scheme is in accordance with the Union Budget 2019-20 when the Centre announced its intension to purchase high-rated pooled assets of NBFCs, amounting to a total of 1 lakh crore during the last fiscal.

What is the Partial Credit Guarantee Scheme 2.0?

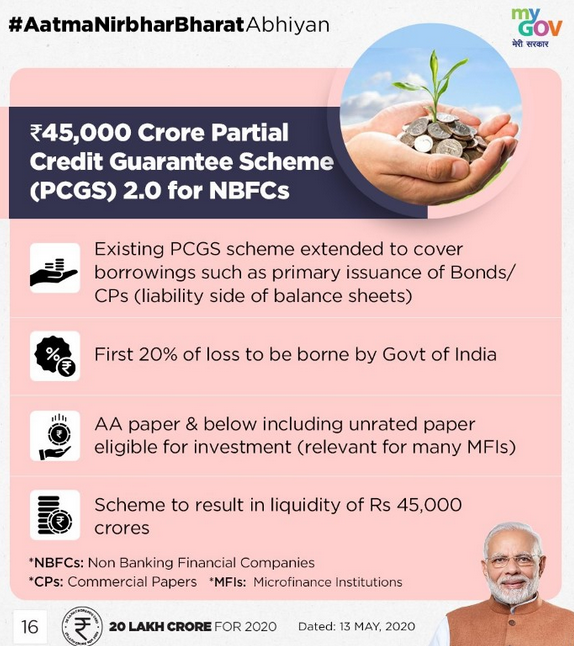

- As a part of its Rs.20 lakh crore Aatmanirbhar Bharat package, the Central government launched Partial Credit Guarantee Scheme 2.0 to provide liquidity support to weaker NBFCs, HFCs and microfinance institutions.

- Under this scheme, the government provided a sovereign guarantee for the first 20% loss to the PSBs purchasing AA and below paper issued by NBFCs, HFCs or MFIs.

- Partial Credit Guarantee Scheme 2.0 will facilitate 45,000 crore liquidity infusion into the shadow banking sector.

- As the scheme covered papers with ratings of AA and below, including the unrated papers, it provided fresh liquidity support for non-bank lenders.

- While the 2019 edition of PCGS supported the transfer of assets from NBFCs/HFCs to PSBs, the PCGS 2.0 focuses on providing temporary liquidity support.

- The Centre has capped the guarantee at an overall level of 10,000 crore, including guarantees for the purchase of pooled assets and guarantees for bonds/Commercial Papers (CPs).

- Under the PCGS 2.0, all the purchased bonds/CPs will have to be of primary issuance.

- The scheme does not cover pooled debt instruments. A pooled debt instrument is the grouping of debt instruments with similar characteristics, like mortgages, into a new security.

Which are the entities that are eligible for this scheme?

- NBFCs and HFCs have to be reported under SMA-0 category during the last year before August 2018.

- Those entities that have been reported under the Special Mention Account (SMA-1) category because of technical reasons alone during the past one year period before 1st August 2018 will be eligible for benefit under this scheme.

- Under the earlier version of the scheme, those NBFCs and HFCs reported as SMA-1 or SMA-2 during a specific period were not eligible.

- The accounts within the SMA-1 category are those where the principal or interest payment remains overdue between 31 to 60 days.

- The SMA-2 or non-performing asset category includes those with the overdue period exceeding 61 to 90 days. Entities under this category are not eligible even under the modified scheme.

- The net profit criteria were also eased under the new scheme. Those entities that have made a net profit in at least one of the last three fiscal years of 2017-18, 2018-19 and 2019-20 will be eligible.

- The earlier version necessitated the net profit in at least one of the fiscal years of 2017-18 and 2018-19.

- NBFCs and HFCs should not have a net Non-Performing Asset Ratio of more than 6% as on 31st March 2019.

- NBFCs and HFCs also should have a capital adequacy ratio not below 15% and 12% respectively as on 31st March 2019.

- The government-owned NBFCs and HFCs will not be eligible for this scheme.

What is the recent extension all about?

- On August, the government extended the PCGS 2.0 till November 19 to give PSBs three more months to purchase bonds and commercial papers from NBFCs and HFCs.

- The government also allowed the PSBs to invest up to 50% of total investments under the scheme in AA and AA- rated bonds. Earlier, the limit was 25% of the total investments.

- This decision was taken in keeping in view the progress under the scheme and the fact that the stipulated limit for AA/AA- rated bonds/CPs has been nearly reached while the lower-rated bonds/CPs is nearing full capacity considering their lower ticket size.

When can the banks invoke guarantee?

- For pooled loan assets, the guarantee can be invoked by the purchasing bank if the interest or principal instalment remains overdue for more than 90 days.

- For bond and commercial papers purchases, banks can invoke guarantee in case of default in servicing the instrument on its attaining maturity.

Why is this scheme important?

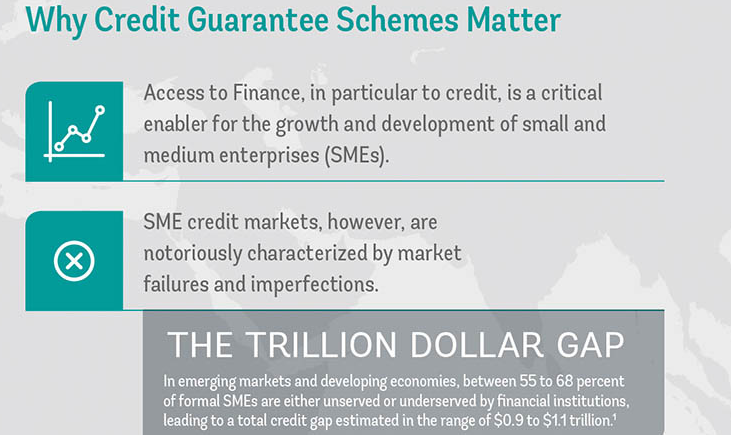

- The shadow banking sector in India has been in serious trouble for some time now, especially after the collapse of IL&Fs (Infrastructure Leasing and Financial Services), one of the largest NBFCs in the country.

- The scheme ensures liquidity support for this sector, which acts as a backbone for the informal sector.

- It provides for the financing of the credit demand of the economy.

- Through this scheme, the financial system is protected from any adverse contagion effects that may arise due to the failure of NBFCs and others, which would then result in a severe impact on the MSME sector.

- While the RBI moratorium provides relief on the asset side, it does not do much in addressing the liabilities side.

- The modification and extension of the PCGS ensure the addressing of both the asset and liability concerns.

- As NBFCs, HFCs and NFIs play a critical role in sustaining consumption demand as well as capital formation in small and medium segment, it is vital to ensure them getting the necessary funding without disruption. The Partial Credit Guarantee Scheme 2.0 provides for the same.

- This scheme also cushions the impact of the economic crisis on risky borrowers like the discoms.

- Banks generally do not directly lend to such firms as they do not have the necessary expertise in these business models or because the loan sizes are too small to attract their interests.

- Variety of micro and small enterprises providing various services usually turn to NBFCs as they tend to not have robust track records that would make them eligible to take commercial loans from banks.

Why was the scheme criticised?

- The PCGS is a step towards increasing funding for the bigger and better-performing NBFCs with higher ratings. This deviates from the actual objective of funding small and medium NBFCs.

- Less than 100 NBFCs are covered under this scheme.

- A majority of small and medium NBFCs turn to term loans, instead of raising funds via bonds and commercial papers.

- This is because issuing bonds or CPs to raise capitals has higher compliance and disclosure requirements under market regulators like SEBI.

- Moreover, the researchers are estimating that, even with the new loan assets qualifying under the scheme, the benefits are more likely to flow towards retail NBFCs with shorter-tenure assets, which include personal loans, microfinance and commercial vehicle loans.

- The government increasing the investment limit for banks in AA and AA- rated bonds to 50% does not help in ensuring the improvement of financial conditions of small and medium NBFCs.

- This is because the majority of the NBFCs have neither the capacity nor the size to use such debt instruments (bonds and CPs) to raise the capital.

- These entities, due to the economic slowdown and the pandemic-led economic crisis, face the risk of their existing debt going bad, as the RBI’s moratorium is set to expire by the end of September.

- Besides, the banks are also unwilling to expand their risk profile by purchasing bonds and other commercial papers.

- Thus, this scheme fails to provide the desired results.

What can be the way forward?

- The scheme will provide medium to long-term benefits for the NBFCs and will alleviate the liquidity conundrum to a certain extent.

- Certain simultaneous steps are necessary to provide for the needed assistance for the shadow banking sector.

- The RBI’s allowing of NBFCs to restructure loans is a step in the right direction.

- However, this would increase their refinancing requirements because of their large contractual debt repayments and deferment of scheduled cash inflow.

- While restructuring would relieve repayment pressure for the borrowers and help them to overcome any short-term stress, critical assessment of these assets is vital to prevent them from being used as an instrument to defer the imminent problems, as was done previously.

- Credit cost (the amount the bank expects to lose due to credit risks) pressure would be alleviated, as lenders have to provide 10% on the restructured debt. However, this may be insufficient in case slippages (the rate at which good loans are turning bad) were to be elevated.

- It should be noted that though the restructuring package would help the borrowers in managing their debt repayments, it is just a temporary solution to a problem caused by the COVID-19 pandemic.

- The overall health of the NBFCs could be improved only with the revival of the economy and the cash flow of the borrowers.

- However, this would prove to be a difficult feat in case of the second wave of the pandemic.

- Another nationwide lockdown would result in the borrowers’ inability to meet the restructured debt repayment terms, thereby increasing the credit cost and asset quality pressures.

- The government has done well in extending the sovereign credit guarantee, as banks would otherwise have been reluctant to support troubled borrowers.

- It could have specified the interest cap on these loans without leaving it to the individual lenders as each of them has its own rate structure.

- The government, through its Atmanirbhar package, is giving assurance for the lenders and borrowers that it is willing to backstop their commitments.

- This is the signal that the MSMEs and their lenders needed as liquidity is always there, but only for the most creditworthy borrowers.

- The NBFCs need to develop liquidity sources outside the banking system, considering the increasing level of risk aversion by the banks.

- This can be done by creating refinancing windows through institutions like NABARD and SIDBI.

- This is especially vital for the large number of small and medium NBFCs that do not have the high ratings and for whom the banks are the only sources of liquidity.

- The NBFCs should be allowed to issue secured debentures on an on-tap basis. This could become a perennial source of liquidity and also help in developing the corporate bond market.

- An on-tap bond is a mechanism that would let corporates use stock exchanges to sell bonds directly to the investors any time and as many times during a financial year.

Conclusion:

There are no immediate solutions to ensure overall recovery in the health of shadow banks. Also, the weakened economy and trade tensions are building up pressure on finance companies, hinting India’s NBFC crisis being far from over. The contribution of the NBFCs should be appreciated as they supplement and complement the banking system. Their survival should be of high priority for the government in order for the economy to revive and grow.

Practice question for mains:

How does the Partial Credit Guarantee Scheme provide relief for the shadow banking sector? What are the other measures necessary for strengthening the same? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.

Pls provide some platform for evaluation of answers(of practise questions given daily) as well