Merger of Banks in India – Good or Bad?

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

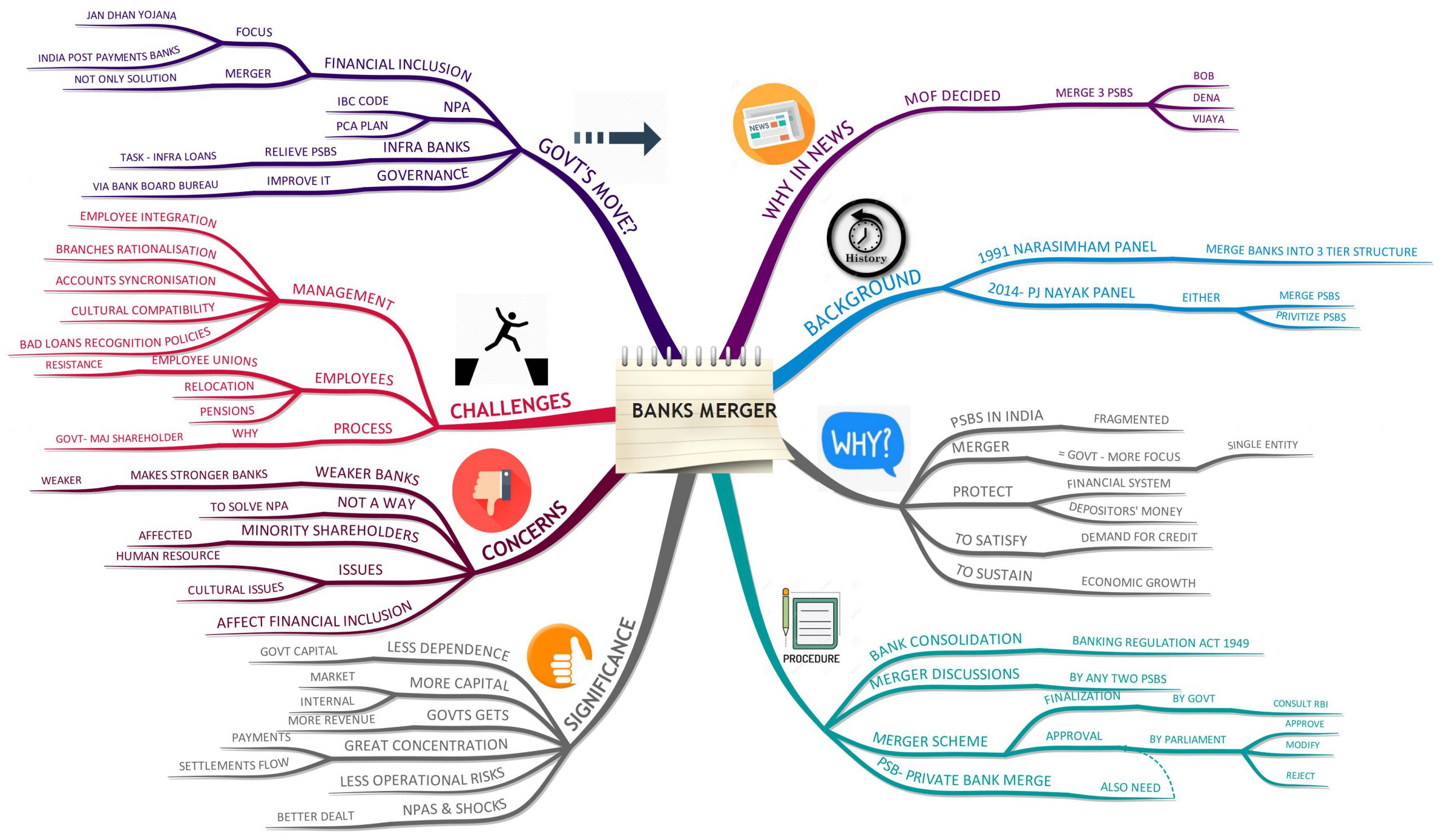

Recently, the Union Ministry of Finance decided to merge three public sector banks namely Bank of Baroda, Dena Bank and Vijaya Bank. However, the decision to merge at the time of weakening trend of banks has raised serious concerns.

Background

- The idea of bank consolidation was around since 1991, when former RBI governor M. Narasimham had suggested the government to merge banks into a 3-tiered structure, with 3 large banks with a global presence at the top, 8 to 10 national banks at tier 2 and a large number of regional and local banks at the bottom.

- In 2014, PJ Nayak Panel had also recommended that the government should either merge or privatize Public Sector Banks (PSBs).

Why Banks Merger/Consolidation?

- Public Sector Banks (PSBs) in India is highly fragmented compared to other key economies.

- The merger will facilitate the government to pay closer attention to the enlarged institution.

- It will protect the financial system and depositors’ money since the enlarged institution will be more profitable and better deal with any stressed loans.

- To develop the capacity to satisfy the demand for credit (loan) and sustain economic growth.

- In 1991 itself, Narasimham Committee recommended that India should have fewer but stronger PSBs.

What is the procedure for Banks Merger?

- Bank consolidation procedures are provided under the Banking Regulation Act, 1949.

- Any two PSBs can initiate merger discussions, however, the merger scheme should be finalized by the government in consultation with RBI and it must be placed in Parliament for approval.

- Parliament has the right to modify or reject the merger scheme.

- Parliamentary approval is also necessary for the merger between a public sector bank and a private bank.

What is the significance of PSBs mergers? (pros)

- It will reduce their dependence on the government for capital since it will increase the role of internal and market resources.

- It will open up more capital generation opportunities, both internally and from the market, for the merged entity.

- For the government, it will enable more dividends which forms part of their non-tax revenue.

- It will lead to greater concentration of payment and settlement flows since there will be lesser competitors in the financial sector.

- Operational risks would decrease after the merger because when the size of the operations grows, the distance between management and operational personnel is greater, thus creating a geographical gap leading to a less efficient system. The merger of banks could avoid it.

- It will help to better deal with their credit portfolio including stress or Non-performing assets (NPAs). Because consolidation will prevent more resources being spent in the same area and strengthen banks to deal with shocks.

What are the concerns regarding the merger? (cons)

- Weaker banks would make an unhealthy impact on the operations of the stronger one after the merger.

- For instance, after the announcement of the merger, shares of Bank of Baroda and Vijaya Bank fell substantially. However, Dena bank gained sharply.

- Notably, Dena bank is the bank in the worst financial situation among the 3 entities. It is currently under RBI Prompt Corrective Action Framework (PCA). Note – Learn about PCA at the bottom.

- The strategy to ask healthy banks to take over weak banks is less likely to solve the bad loan crisis in the banking system.

- Minority shareholders will be affected by the decision of dominant shareholder i.e., the government, as the former left with no say in the matter.

- Human resource and cultural issues can also impede the success of mergers.

- It will impede the government’s goal of financial inclusion to reach the unbanked poor. It has to be noted that, during the post-liberalisation period after 1991, the merger of state banks with its associates resulted in the closure of about 5,000 branches in rural and remote areas.

What are the challenges with the merger?

Management: With the merger, the management will bear critical challenges with respect to staff integration, rationalisation of branches, synchronizing accounting, cultural compatibility, policies for recognition of bad loans etc.

Employees: The whole process face resistance from employee unions, who are fearful of losing their jobs. Their promotion prospects may be affected due to a reduction of seniority in the merged entity. Further, the rationalisation of branches will lead to their relocation.

Pensions: Pension would be affected due to different employee benefit structures.

Process: A merger in the private sector will include changing the shareholders. But this is difficult with PSBs since the government is the dominant shareholder.

What should be the government’s move?

On Financial inclusion: Government should not look at the merger as the only way for financial inclusion.

- Financial inclusion can be better served with other means like Jan Dhan Yojana and

- Establishment of India Post Payments Bank that took banking services to the doorsteps of the unbanked poor.

- The government should give some time for these programmes to yield meaningful results.

On NPA: Government should not see the banks consolidation as the only means to solve the NPA crisis.

- There are legal and regulatory measures to address the NPA issues through a market-based resolution plan in the form of insolvency and bankruptcy (IBC) code.

- Efforts were also taken to put 11 banks under surveillance via prompt corrective action (PCA) plan to de-stress the banking sector.

Infrastructure banks: Government can establish infrastructure development banks to fund infrastructure projects and relieve PSBs of this task. Infrastructure is one of the key components of stressed loans due to its long-term nature.

Governance: Government should focus on improving governance in PSBs through Bank Board Bureau and not interfere in the loan sanctions.

Way ahead

Undeniably, there are too many public sector banks in India and hence consolidation is a good idea in theory. However, mergers should be done between strong banks. It is crucial to ensure that such mergers do not end up creating an entity that is weaker than the original pre-merger strong bank. Certainly, mergers are just one way of managing the crisis and thus cannot be ignored totally. But the trick lies in ensuring that the merger process is managed prudently. Identifying synergies and exploiting scale efficiencies will be important here.

About Prompt Corrective Action (PCA) framework

- It is meant to take necessary corrective action on weak and troubled banks.

- Under this, RBI has created some trigger points to assess, monitor and control banks.

- The trigger points are based on CRAR (a metric to measure balance sheet strength), NPA and ROA (Return on Assets).

- Based on each trigger point, the banks have to follow a mandatory action plan.

- Once the bank triggered the point, it will be barred from undertaking fresh business activities like opening branches, recruiting personnel or lending to risky firms.

- Apart from these actions, RBI could also take discretionary action plans.

Practice Questions

- Examine various implications of proposed merger of three public sector banks- Bank of Baroda, Vijaya Bank and Dena Bank.

- India requires a mix of efficiently run PSBs and aggressive private banks to attain growth & development along with social justice. Do you think recent merger of PSBs was a right move? Critically comment.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.