Cashless Economy – Is India Ready for Transformation?

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

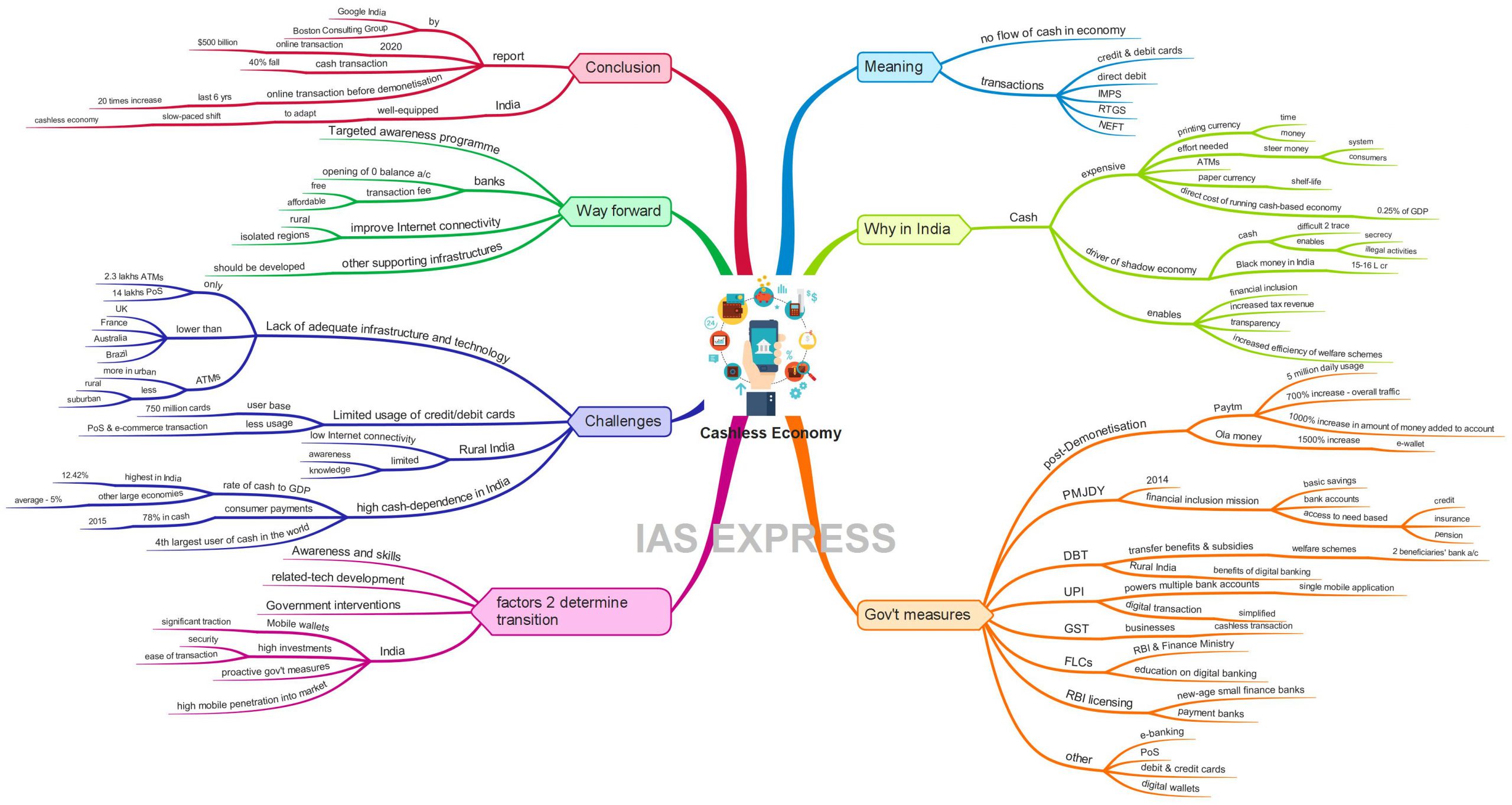

To make India a cashless economy, during the Union Budget 2019-20, the Finance Minister had stated that 2% tax deducted at source will be levied on cash withdrawals that exceed Rs.1 crore in a year from the bank account to discourage the practice of making business payments through cash transactions. The government had also said that the businesses with an annual turnover of over Rs.50 crore can offer low-cost digital modes of payments and no charges or Merchant Discount Rate will be imposed on them or their customers. This is a noteworthy move by the government of India to incentivize people to adapt to the emerging cashless economy. Transforming the cash-dependent India into a cashless economy is proving to a great challenge for the Indian government given the size of the informal sector within the Indian economy. It is estimated that nearly 90% of all transactions in the Indian economy is dependent on cash. This is due to the large informal sector that employs 90% of the workforce. India cannot become cashless unless this mammoth sector adapts to the digital payments. Incentivizing the people alone is not sufficient. The government needs to develop the supporting infrastructures and technologies for India to become a cashless economy while also providing awareness to its people.

What is a cashless economy?

- Cashless economy is the term that is used to describe the situation wherein the flow of cash doesn’t exist within the economy and that all the transactions are undertaken through electronic channels.

- This can include cash transfer through credit and debit cards, direct debit, and electronic clearing and payment systems such as Immediate Payment Services (IMPS), National Electronic Funds Transfer (NEFT) and Real-Time Gross Settlement (RTGS) in India.

Why should India transform into a cashless economy?

India should shift to a cashless economy. The reasons for this statement are as follows:

- Cash is expensive: A significant amount of time and money is needed to print the currency. RBI has spent Rs.32.1 billion on printing the currency. The effort is also needed to steer the money through the system and to the consumers. Also, there is the cost for the setting up of and maintaining of the ATMs. Furthermore, the paper currencies have shelf-life after which it needs to be replaced. It is estimated that the direct cost of running a cash-based economy is about 0.25% of India’s GDP.

- Cash is the driver of the shadow economy: Cash is difficult to trace. Its transaction provides secrecy enabling the people to carry out illegal activities like tax evasion, black money, etc. In 2007, currency in circulation was almost on par with the bank deposits. However, in the last three years, the currency with Indians was more than the bank deposits by 50%. According to the government data, the amount of black money (unaccounted money) in India is 15-16 lakh crores. The unaccounted money is used to finance the shadow economy that is running parallel to the government as it finances illegal activities terrorist activities, purchasing votes, smuggling, betting, trafficking, etc.

- Enables financial inclusion and increased tax revenues: A cashless economy mandates all citizens to have bank accounts. This will ensure a higher financial inclusion rate. It will also guarantee transparency in the transaction of money within the economy – minimizing the possibility of tax evasion exponentially. Even the beneficiaries of various government schemes can easily be identified and taken care of by the government.

What are the measures taken by the Indian government?

- Demonetisation: Demonetisation drive has not curbed the black money. However, it had nudged India towards being a cashless economy. It has become a radical ‘reform’ to transform India into a cashless economy. Paytm had witnessed 5 million daily usage post demonetisation as opposed to their average transaction of three million. It also saw a 700% increase in the overall traffic and a 1000% increase in the amount of money added to its account in the first two days of post-demonetisation. Ola Money too saw a 1500% increase in its e-wallet.

- Apart from demonetisation, the government has undertaken various other measures to reduce people’s dependence on cash in recent years.

- Some of them are as follows:

- Pradhan Mantri Jan Dhan Yojana, one of the biggest financial inclusion initiatives in the world, was launched in 2014. It is a national mission on financial inclusion which has an integrated approach to bring about comprehensive financial inclusion and provide banking services to all households within the country. This scheme ensures access to a range of financial services like availability of basic savings, bank accounts, access to need-based credit, insurance and pension. It has played a significant role in the opening of bank accounts for the poor.

- Direct Benefit Transfer (DBT): It is a scheme that was launched by the Government of India to transfer the benefits and subsidies of various social welfare schemes like LPG subsidy, Old Age Pension, Scholarship, MGREGA, etc. directly to the bank account of the beneficiaries. This allowed for the penetration of digital banking into rural India.

- Unified Payment Interface (UPI): It is a system that powers multiple bank accounts into a single mobile application (of any participating banks), merging several banking features, seamless fund routing, and merchant payments into one hood. This makes digital transactions a simplified process. Transaction via UPI had increased the monthly transaction from nil to 754 million in less than 3 years.

- GST: The implementation of GST has encouraged businesses to opt for cashless transactions.

- Financial Literacy Centres: The RBI and Finance Ministry have established the Financial Literacy Centres (FLCs), a keystone of the PMJDY. This initiative has provided financial education programmes to spread awareness of banking products and benefits.

- The RBI has also provided licences to open new-age small finance banks and payment banks which are expected to give a push to financial inclusion and bring in innovative banking solutions.

- Other promotions like e-banking, debit and credit cards, card-swipe or PoS machines and digital wallets have made the transition to cashless economy easier.

What are the factors that determine the transition to the cashless economy?

Several factors determine the transition to the cashless economy. They are as follows:

- Awareness and skills related to banking and e-transactions

- Technological developments to support the cashless economy

- Government interventions to promote the transition.

Indications in India of transition to the cashless economy are as follows:

- Mobile wallets have significant market traction in India in recent times.

- Banks and related service providers have invested highly to improve security and ease of cash transactions.

- As previously mentioned, the Government of India is undertaking various measures to incentivize the population to shift to the cashless economy while also discouraging the cash payments.

- In India, as per the 2011 census, more households had mobile phones than toilets. 58% of households had mobile phones while 47% had toilets within the houses in 2011. 5 years later, the gap between the two has widened as the march of telecom connectivity has outpaced the march of water connectivity in the country. According to fresh data from a nationally representative household survey, the proportion of households with toilets has increased while the proportion of those with mobile phones has grown even more sharply. This shows the increased potential of the Indian economy to transform into a cashless economy if the government intervenes.

- India’s current economic situation has created a crucial turning point. If this situation is handled correctly, there is a high probability of India becoming a cashless economy.

What are the challenges that India might face while transferring to the cashless economy?

- Lack of adequate infrastructure and technology within the Indian society: India, a country with a vast area, currently has only 2.3 lakhs ATMs and 14 lakhs Point of Sale (POS). This is much too low when compared to other countries like the UK, France, Australia, and Brazil as they have three or four times that of India. Moreover, the ATMs are concentrated in urban areas and they are scarce in suburban and rural areas.

- Limited usage of credit/debit cards: India has a user base of 750 million cards. Ideally, its usage on PoS should be at least 375 million transactions per month, on the assumption that the customers, on average use the card at least once in two months on the POS terminal. But according to the RBI data, the volume of POS and e-commerce transactions together for all banks is about 130 million against the 765 million on the ATM channel as of 2016.

- The penetration of mobile internet is very low in rural India: Making India a cashless economy is highly difficult in the current scenario as rural India has poor internet connectivity. Also, the awareness and knowledge related to digital transactions are limited in rural areas.

- Indian economy is cash-dependent: India is much dependent on cash, so much so, that the MNCs like Amazon had to include “cash on delivery” to penetrate the Indian market. The rate of cash to GDP is the highest in India (12.42%). In other large economies, the average cash to GDP ratio is 5%. In fact, the year 2015 saw 78% of all consumer payments in cash in India. On the other hand, during the same period, it was 20% and 25% in the US and the UK. India is also the 4th largest user of cash in the world. This shows India is not fast enough to adapt to the current era, the one that is dominated by technological innovations and developments. Rural India’s adaptation to new technologies is slow. This is a major concern for India’s aspiration to become a cashless economy.

What can be the way forward?

- Targeted financial education drive can be undertaken by the government to improve the knowledge of e-transactions to the public, even the illiterate.

- The banks must make sure that the transaction fee is either free or affordable to all.

- The banks must encourage the opening of zero balance accounts to encourage the poor to make use of the bank accounts.

- The government must improve internet connectivity in rural India and other isolated regions.

- Supporting infrastructures must be assured like the availability of ATMs in the rural and suburban areas as the availability of bank accounts alone cannot address the problem of India being overly dependent on cash.

Conclusion:

According to a report by Google India and Boston Consulting Group, by 2020, $500 billion worth of transactions would take place online. This means that the increase will be 10 folds. Furthermore, cash-based transactions would fall by 40% in the coming years. The online transactions have increased 20 times in the last 6 years. This data is before the demonetisation. While observing the recent situation, it is evident that India is well-equipped to adapt to the slow-paced shift towards the cashless economy.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.