Coronavirus (COVID-19) Recession & Impacts – Explained in Layman’s Terms

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

For the first time since the Great Depression, both advanced economies and developing economies are facing recession due to COVID-19 pandemic. India is not exempted from this crisis. While tackling the pandemic, it is necessary to ensure that the global economy does not suffer as it can lead to numerous job losses, poverty and hunger.

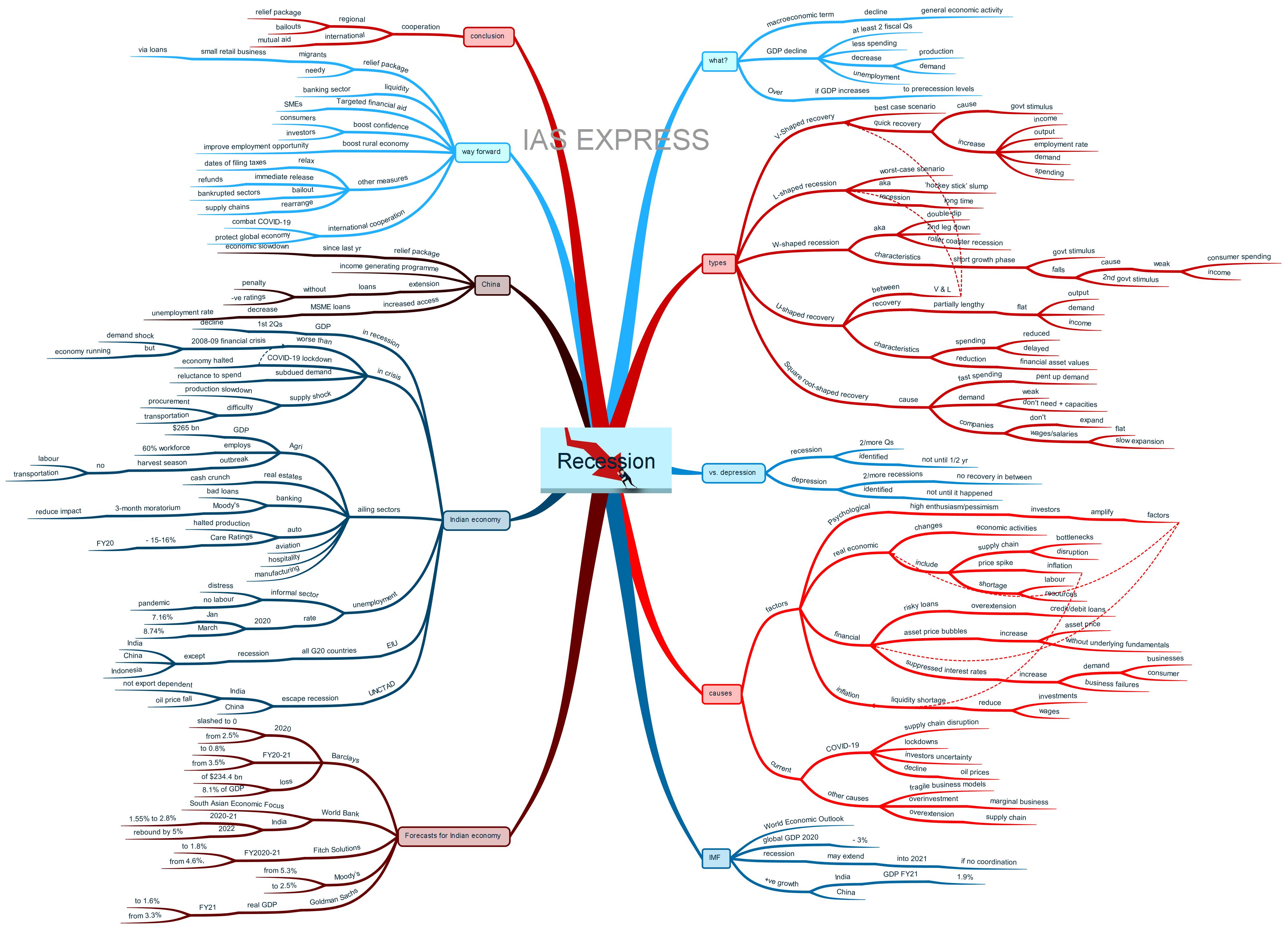

What is a recession?

- A recession is a macroeconomic term that refers to a significant decline in general economic activity in a designated region.

- It happens when the GDP declines for at least two fiscal quarters in a row.

- The decline in real GDP can lead to consumers spending less as they lose confidence in economic growth. Less spending means that there is a decrease in demand, which, in turn, leads to a fall in production.

- Such events can lead to lay-offs, job loss and a spike in unemployment.

- It is normally visible in real GDP, real income, employment, industrial production and wholesale-retail sales.

- A recession is over when the GDP climbs back to prerecession levels.

What are the types of recessions?

The following curves are the routes the economy may take during a recession.

V-Shaped recovery

- This is the best-case scenario.

- It happens when the economy rockets back quickly as it had fallen, aided by a government stimulus that pushes demand.

- In this case, there will be an increase in income, output, demand and spending, leading to a rise in employment and jobs.

L-shaped recession

- This is the worst-case scenario.

- It is sometimes described as ‘hockey stick’ slump.

- It happens when the growth nosedives and stays down for a very long time.

W-shaped recession/recovery

- It is also known as “double-dip”, “second leg down” and “roller coaster recession”.

- It occurs when the economic growth is bumpy, characterised by frequent upturns and downturns, resembling the letter ‘W’.

- In this current context, this scenario arises when the economy bursts into a short growth phase prompted by a government stimulus, but falls off the cliff due to weak consumer spending and household income because of reasons like COVID-19 pandemic.

- This may prompt the government to offer a second round of stimulus, making the economy repeat the down and up the track.

U-shaped recovery

- This is somewhere between V and L route.

- It occurs when the recovery is partially a lengthy process when output, demand and income remain flat for a long period.

- If the lockdown persists for a longer duration and companies are forced to limit operations, unemployment could rise, companies’ profits could decline and financial markets would fall further.

- This curve is characterised by consumers reducing spending, delaying planned purchases and reduction in financial asset values. This results in long delays in economic recovery, despite the fiscal and monetary aids.

Square root-shaped recovery

- Some economic slides and recovery follow a peculiar pattern that involves a quick rise for few quarters from a sharp recession, before hitting a plateau and flattening for a long period that could extend for years.

- This scenario happens when consumers’ spending rapidly gathers pace shortly after restrictions move away because of pent up demand.

- This sudden spending does not continue beyond a few quarters.

- In this scenario, the demand is not strong enough to push companies to add more capacity lines.

- Thus, as companies do not expand, wages and salary remains flat or expands at a very slow pace, leading to stagnant growth of the economy.

- Thus, the economic growth curve resembles the shape of a mathematical square root.

What is the difference between depression and recession?

- A recession becomes a depression if it lasts for a long duration of time.

- In the recession, the economy declines for two or more quarters.

- A depression will last for several years and very rare.

- It can be considered as two or more recessions linked together with no economic recovery in between.

- The recession cannot be defined until at least half a year has passed, and depression can seldom be identified until after it has happened.

What causes a recession?

Financial Factors:

- Overextension of credit and debt on risky loans and marginal borrowers can result in the enormous build-up of risk in the financial sector.

- Increase in the supply of money and credit in the economy by the Central banks and the banking sector can drive this process to the extremes, kindling a risky asset price bubbles.

- An asset bubble occurs when the price of an asset, such as stocks, bonds, real estate or commodities, increases at a rapid pace without any underlying fundamentals like equally fast-increasing demand to justify the price hike.

- Artificially suppressed interest rates during the boom times can increase businesses and consumer demands. This can lead to an increase in failures of risky businesses, which in turn results in recession.

Psychological Factors:

- Excessive enthusiasm of investors during boom years that bring the economy to its peak and the reciprocal pessimism that occurs after a market crash can amplify the effects of real economic and financial factors.

- The subjective expectations of investors, businesses and consumers always have a critical role in the beginning and spread of economic decline.

Real Economic Factors:

- Real changes in the economic activities, beyond the financial accounts and investors’ psychology, also play a crucial role in contributing to recession.

- These include disruption in supply chains and damages caused to related businesses.

- The other real economic factors that can cause recession include labour shortage, supply chain bottlenecks, a spike in commodity prices (which can lead to inflation), lack of resources to support overstimulated business investment plans etc.

- As the economy is a coexistence of many sectors, any single damage can have ripple effects on investments, employment, consumption and stock market.

- These real economic factors are also linked with financial markets as interest rates represents the cost of financial liquidity for businesses.

Inflation:

- Inflation is the general increase in prices of goods and services of a certain period.

- It can lead to a liquidity shortage or a decrease in the amount of money available to purchase these goods.

- This will also reduce the money available to invest and provide wages.

Causes of the Current Recession:

- Though officially not declared, the world is heading towards a global recession.

- The major cause is the huge economic shock due to the disruption of global and domestic supply chains and direct damage to businesses across the globe due to the COVID-19 pandemic and public health response such as lockdowns.

- The fear and uncertainty among investors also contribute to the likelihood of a recession.

- Other factors that are causing the recession include the overextension of supply chains, overinvestment in marginal business, and fragile business models that have become the norm over the decade.

- The stock markets are also plunging, warning of the impending recession.

- Due to COVID-19 related restrictions, there is also the fall in the oil prices, showing a cease in economic activities and lack of demand for oil because of it.

What did the IMF say about the recession?

- According to the IMF’s latest World Economic Outlook report, the global GDP will drop by 3% this year in the assumption that the pandemic fades in the second half of this year, the worst since the 1930s Great Depression.

- It had also warned that the recession could extend into 2021 if policymakers fail to coordinate global response to combat the virus.

- India’s GDP is expected to drop to 1.9% in FY21 as against 5.8% estimated in January due to lockdown.

- The report also said that India and China are the only countries that will register positive growth rate in 2020.

What are the forecasts for the Indian economy for the near future?

Indian economy may record the worst economic growth since 1991 liberalisation. Along with the IMF, Barclays, World Bank, Moody’s, Goldman Sachs and Fitch have slashed India’s growth forecast due to COVID-19 lockdown.

Barclays:

- Barclays has cut India’s growth projection to zero from 2.5% earlier.

- It has also slashed India’s growth projection to 0.8% for FY20-21 from the earlier estimation of 3.5%.

- Furthermore, it predicted a loss of $234.4 billion (8.1% of GDP), assuming a partial lockdown until May.

- It stated that lockdown is expected to by end by early June, which will be followed by modest recovery and investments in certain sectors.

World Bank:

- The World Bank, in its South Asian Economic Focus report, stated that India is likely to grow at 1.55% to 2.8% in 2020-21.

- It stated that disruptions in demand and supply due to lockdown would result in a sharp growth deceleration in FY21 (April 2020 to March 2021).

- It also forecasted growth to rebound 5% in fiscal 2022 as the impact of COVID-19 would dissolve.

Fitch Solutions:

- Fitch Solutions has cut India’s economic growth forecast for FY2020-21 to 1.8% from the previous 4.6%, stating that private consumption is likely to decline due to the pandemic.

Moody’s:

- The Moody’s has cut India’s GDP growth rate forecast from 5.3% to 2.5% due to nationwide lockdown.

- It expects the Indian economy to rebound to 5.8% in FY2021.

Goldman Sachs

- According to the Goldman Sachs forecast, India’s real GDP could fall to 1.6% in FY21. This is a slash from the earlier prediction of 3.3%.

- Before the local spread of COVID-19 accelerated, the Goldman Sachs had pegged growth at 5.8% in FY21.

It should be noted that these figures could further deteriorate if the lockdown is extended again to combat COVID-19.

What is the crisis faced by the Indian economy?

- India has already gone into a recession as the GDP in the first two quarters of the current fiscal is showing a declining trend.

- The country’s current economic crisis is far worse than that of 2008-09 financial crisis.

- This is because, during the 2008-09 financial crisis, there was a massive demand shock, which was overcome as businesses kept running.

- In contrast, the coronavirus-led lockdown has put all businesses to a halt.

- The reluctance of the consumers and businesses to spend has led to subdued demand.

- Furthermore, the businesses in India are dealing with supply shock, leading to the slowdown of production. This is because the raw materials procurement and transportation are facing difficulty due to lockdown

- The sectors that are impacted by lockdown include:

- Agricultural sector: It contributes about $265 billion to the GDP and employs 60% of the country’s workforce. This sector is among the worst affected because the outbreak has happened at the harvest season. The absence of labour and transportation facilities will have serious implications for the rural economy in the near future.

- Real estate sector: It was already struggling before lockdown due to funding crunch.

- The banking sector would suffer due to building up of bad loans. According to Moody’s, the RBI’s guidelines permitting banks and NBFCs to grant a 3-month moratorium on loan payments will soften the negative credit impact that is caused due to COVID-19.

- Automobile sector: The production in the automobile sector is currently on hold as a part of lockdown. According to Care Ratings, the automobiles could see a decline in volume by 15-16% in FY20.

- The slowdown in the automobile and real estate sectors will directly impact the steel manufacturing industry.

- The other sectors that will face the brunt of COVID-19 lockdown include aviation sector, hospitality, manufacturing

- The other signs of recession are apparent, including joblessness in all the sectors.

- The informal sector, comprising of thousands of micro-enterprises, is in distress as numerous migrant workers have returned to their villages amid the pandemic.

- If these sectors are pressured due to the current situation and are unable to recover, then the migrant workers would not have any jobs to return to.

- Thus, there is a high likelihood of an increase in job losses. The unemployment rates were already at a 45-year high before the outbreak of COVID-19 and the outbreak has further increased the overall unemployment rate of 7.16% in January 2020 to 8.74% in March 2020.

- Despite this bleak situation, the Economic Intelligence Unit has predicted that India will be among the three fastest-growing economies when compared with the G20 countries. The other two include China and Indonesia.

- The rest of the G20 countries are likely to face a recession.

- Also, a study by the UN Conference on Trade and Development (UNCTAD) has forecasted that India and China will escape the recession

- Furthermore, India is less likely to face the full impact of the global recession.

- This is because, unlike China, it does not have a high dependence on exports.

- Additionally, the price of the oil has come down, bringing favourable condition for India’s balance of payment.

- Thus, India may not be hit as hard when compared to the rest of the countries.

What can India learn from China?

- China has been giving out a relief package ever since its economic slowdown began a year ago. This may be the reason behind UNCTAD’s prediction that China will be able to avoid recession.

- China also began many income-generating programmes and banks have been asked to extend loans and rollover debt without penalty or negative ratings.

- The country has also increased the MSMEs’ access to loans, which led to a decrease in the unemployment rate.

- It is highly likely that China may escape the recession or may experience it in a mild form.

- However, India, on the other hand, is likely to face more impact when compared with China.

- Thus, it is necessary to ensure that the required steps are taken to soften the adverse economic blow on the people.

What are the other measures that India must take to survive this recession?

- The Central Government’s relief package could help migrants to set up a small retail business through loans. However, this might lead to a piling up of NPAs, but nothing compared to the big loans that the mega businesses defaulted.

- Ample liquidity must be provided by the Central Banks to the NBFCs and banks.

- Targeted financial aid should be provided to the already weakened small and micro-enterprises.

- According to the latest CMIE report, rural unemployment is at 31%, which is higher than in urban areas that may face a 20% unemployment rate.

- Thus, the government must provide necessary relief for the most vulnerable in the country.

- Due to the uncertainty surrounding the pandemic, it is highly likely that there will be reluctance in spending. Therefore, governments must ensure that there are coordinated measures to boost the economy by improving consumers’ and investors’ confidence.

- Instead of further improving the MSMEs in the urban areas, the government can mobilise resources to improve the rural economy so that the urban areas are decongested.

- In this context, the government can ensure a continuous supply of power, water, good living space, and improved infrastructure like roads to increase employment opportunities in these areas.

- Other measures that can be taken by the government include:

- Relaxing dates of filing taxes

- Immediate release of refunds

- Bailout packages for bankrupted sectors

- Rearranging supply chains

- Apart from these measures, the Centre must ensure that there is an international collaboration to prevent the spreading of infection and to protect the global economy by safeguarding the supply chains.

Conclusion:

Ensuring cooperation at regional and international levels to bring the economies back on track post lockdown is a need of the hour. At the regional level, providing necessary relief packages and bailing out stressed sectors can boost the investors’ confidence and consumers’ spending. Enabling mutual aid across the global economy can exponentially improve performance.

Practice question for mains:

Critically examine the economic impact of COVID-19 pandemic. What are the measures that can be taken by the Indian government to alleviate the impact? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.