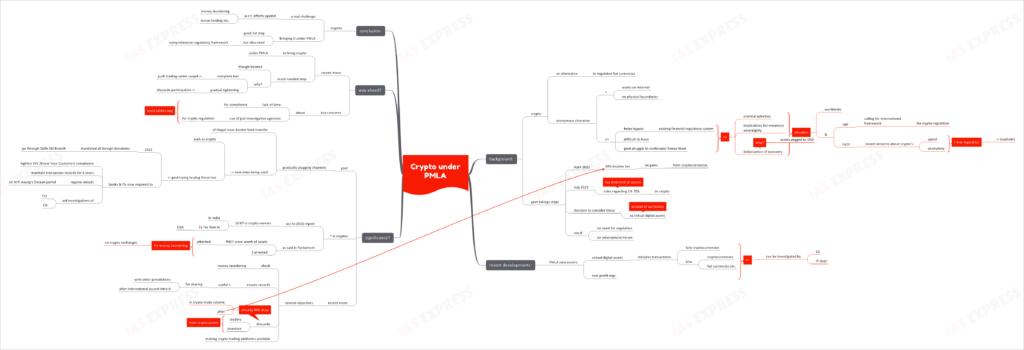

Crypto under PMLA- Background, Recent Developments & Significance

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

Recently, the government made a significant move with relations to crypto-regulations, especially with regards to the use of crypto-assets for money laundering and other criminal activities.

Background:

- Cryptocurrencies seek to provide an alternative to regulated fiat currencies and bypass the existing financial regulatory system.

- Their anonymous character has meant that these assets are difficult to trace and the governments struggle to confiscate/ freeze them. An added difficulty is presented by the fact that these assets work over the internet and are not bound by physical boundaries.

- These features also enable the use of crypto assets for a range of criminal activities.

- Even more concerningly, it raises the question of monetary sovereignty. Apart from their lack of a central regulating entity, these assets are frequently pegged to the US Dollar, meaning- the increased use of cryptocurrencies would lead to dollarization of the Indian economy and the Indian monetary authority (RBI) and the fiscal authority (the government) would lose control over the economy.

- This isn’t a concern unique to the Indian situation alone. Across the world, regulators and policymakers are looking for ways to regulate crypto assets. The IMF has been calling for an international framework for crypto regulation. The FATF has been continuously highlighting the implications of speed and anonymity provided by cryptoassets for crime. The fact that majority of the countries haven’t taken any regulatory actions has created a system of loop-holes that are being abused by criminals and terrorists.

- Recently, the government has been taking efforts to regulate crypto assets that are taking the world by storm.

- In April 2022, 30% income tax was imposed on gains from cryptocurrencies.

- In July 2022, the government introduced rules regarding 1% TDS (tax deducted at source) on crypto.

- The government’s decision to consider these as ‘virtual digital assets’, rather than ‘currencies’ is noteworthy.

Recent Developments:

- Recently, the central government made a move to increase the scrutiny of virtual digital assets (aka cryptocurrencies) and non-profit organizations under the Prevention of Money Laundering Act.

- This means that the Enforcement Directorate and also other agencies like the IT Department, would now be able to investigate all services involving such virtual digital assets. These services include trading between cryptocurrencies, between cryptocurrencies and fiat currencies, etc.

Why is this significant?

- The central government has gradually plugged most of the conventional routes of illegal cross-border fund movement. Hence, these funds are moving to newer channels.

- In the recent years, the centre has been attempting to plug these channels as well, to curb money laundering and illegal use of non-profit organizations (eg: ‘donating’ to charitable institutions to convert black money into legal money).

- In 2021, the government mandated that all foreign donations be routed through the Delhi branch of the State Bank of India.

- Banks and financial institutions are now to tighten KYC (Know Your Customer) compliance, maintain transaction records for 5 years, register details on NITI Aayog’s Darpan portal and also aid the FIU (Financial Intelligence Unit) and the ED (Enforcement Directorate) in their investigations.

- Meanwhile, the uptake of cryptoassets is increasing. According to a 2021 report, India is estimated to have 10.07 crore crypto owners- highest in the world. This is 3-fold more than the number in the USA.

- It was recently disclosed in the Parliament that, ₹907 crore worth of assets were attached and 3 persons were arrested for money laundering via crypto-exchanges.

- India has been vocal about the need for international coordination in regulating crypto-assets.

- The recent move is expected to achieve several objectives:

- Check money laundering via crypto-exchanges and ensure record-keeping of such transactions. Once an international accord is signed into being, these records can be shared with other jurisdictions

- Dissuade traders and investors away from crypto-assets- already there has been a 90% drop in crypto trading volume since the punitive taxes were imposed

- Make crypto-trading platforms unviable

What is the way ahead?

- The recent move to bring virtual digital asset transactions under PMLA is a much-needed, though belated, step in curbing money laundering.

- While a complete ban could push crypto-trade under the carpet, the gradual tightening of monitoring and regulations are expected to help dissuade the sector’s unsustainable boom. This is especially significant given how there has been a surge in advertisements encouraging investments in virtual assets and even reports of increase in investments.

- However, the industry players have raised concerns about the insufficient time given for compliance with the new norms.

- Also, leaving the task of regulating crypto-assets solely to the investigative agencies is unlikely to create an effective regulatory environment.

Conclusion:

Crypto-assets present a real challenge to India’s efforts against money laundering, terror funding and other criminal activities. Bringing crypto-trade under PMLA is a good first step. A more comprehensive regulatory framework is needed, going forward.

Practice Question for Mains:

How is India’s move to bring crypto-trade under PMLA significant? What is the way ahead? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.