Demonetisation – A Success or a Failure?

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

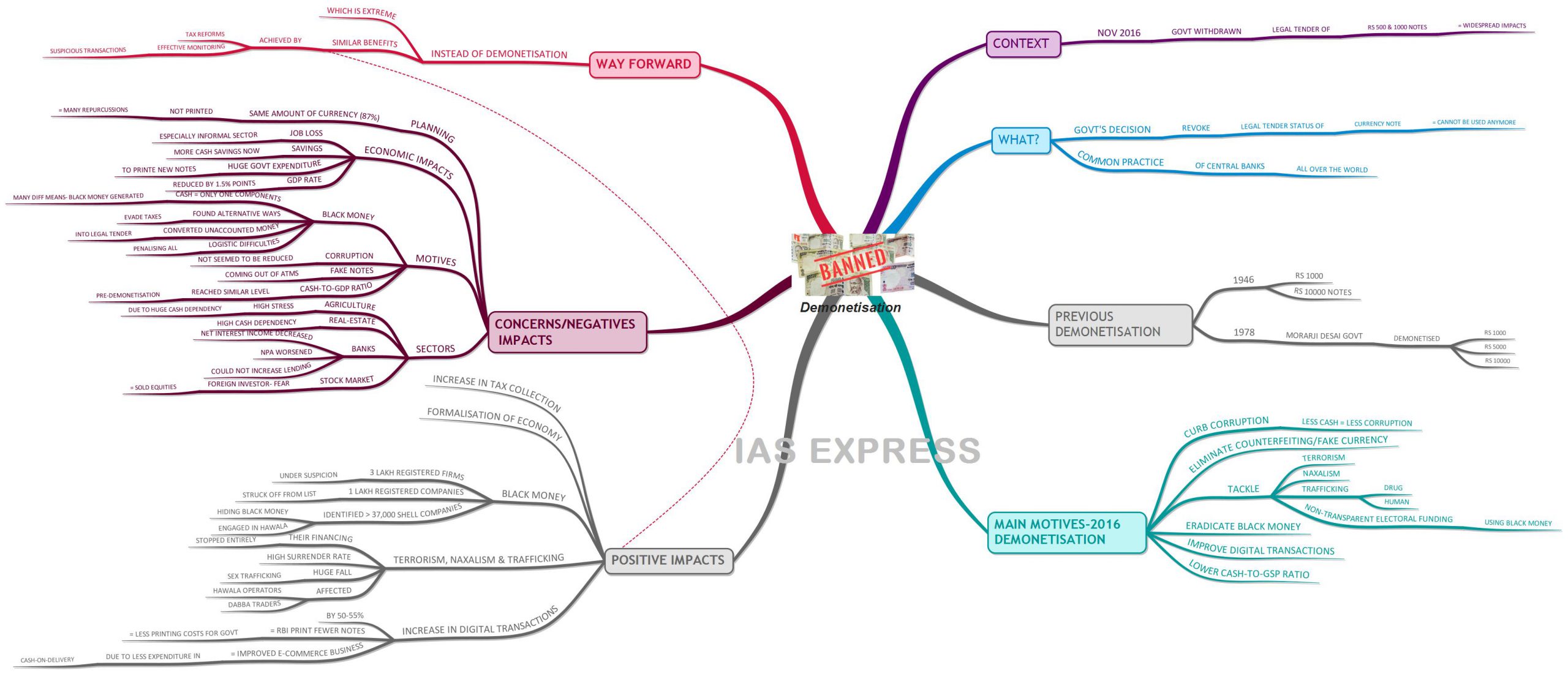

The government under the prime ministership of Narendra Modi on November 8, 2016, had announced that the largest denomination of Rs 500 and Rs 1000 were demonetised with immediate effect ceasing to be a legal tender. Even though people suffered during demonetisation to get cash and exchange the banned notes, it gave a big boost to digital currency.

What is Demonetisation?

- Demonetization refers to the decision of the government to revoke the legal tender status of a currency note. (Note- All the currencies issued by RBI are used as a legal tender because the value they bear is assured by the RBI).

- Once the currency note is demonetised, it cannot be used anymore.

- Central banks all over the world follow a practice where older currency notes are revoked and new currency notes with better features are issued.

Was this the first time the government is demonetising?

- India opted for demonetization two times before the 2016 monetisation.

- The first instance of demonetisation by the government was implemented in 1946 when the RBI demonetised Rs 1,000 and Rs 10,000 notes.

- Later, higher denomination bank notes (Rs 1000, Rs 5000 and Rs 10000) were re-introduced in 1954.

- However, the Morarji Desai government demonetised these notes in 1978.

- According to data provided by RBI Rs 10,000 note was printed in 1938 and 1954 and was subsequently demonetised in 1946 and 1978 respectively.

- Demonetisation has been implemented in India primarily because of economic and political issues like hyperinflation, hostilities, political turmoil, or other sensitive states of affairs like corruption, etc.

What were the main motives behind 2016 demonetisation?

Government and RBI had many intentions behind this. The major objectives of the demonetisation drive are as follows:

- Curb Corruption: Cash and corruption are correlated. By reducing the cash circulation one can control the corruption as well.

- Eliminate Counterfeiting/Fake currency: The Annual Report of RBI shows that during the year 2016-’17, Rs 41.5 crores worth of fake currency notes in the form of old Rs 500 and Rs 1,000 notes were detected in the banking system. The estimate of the total fake currency in the system was Rs 400 crores.

- Tackle Terrorism: High denomination notes like Rs. 500 and Rs. 1000 are often used in terrorist/naxalist activities, drug, and human trafficking. In addition, these notes constitute a huge percentage of money spent during general elections by political parties and candidates in India.

- Eradicate Black Money: The accumulation of black money generated by the income that has not been declared to tax authorities (tax evasion). Demonetisation would bring back those black money in the form of high-value notes into the banks which otherwise would not have any value.

- Improve digital transactions.

- Lower Cash-to-GDP ratio.

What are the positive impacts of demonetisation?

Increase in tax collection:

- Due to the demonetisation drive, there is a considerable increase in the number of Income Tax Returns (ITRs) filed.

- The number of Returns filed as on August 2017 registered an increase of 24.7% compared to a growth rate of 9.9% in the previous year.

Tackling Black Money:

- Transactions of more than 3 lakh registered firms are under the radar of suspicion while one lakh companies were struck off the list.

- The government has identified more than 37000 shell companies which were engaged in hiding black money and hawala transactions.

- About 163 companies which were listed on the exchange platforms were suspended from trading due to the pending submission of proof documents.

Impacts on terrorism, Naxalism, and trafficking:

- Due to demonetisation, terrorist and Naxalite financing has stopped almost entirely. The surrender rate has reached its highest since the demonetisation is announced.

- According to the Nobel laureate Kailash Satyarthi and several others working to fight human trafficking, the note ban had led to a huge fall in sex trafficking.

- Since demonetisation, no high-quality fake currency notes were found/seized by intelligence operations, including at the Indo-Bangladesh border.

- Furthermore, it also affected the hawala operators and dabba trading venues.

Increase in digital transactions:

- In 2015-16, the value of transactions for debit and credit cards was ₹1.6 lakh crore and ₹2.4 lakh crore, respectively; in 2016-17, it was ₹3.3 lakh crore for each.

- Thus digital transactions have increased by around 50-55% points since demonetisation.

- Increase in digital transactions = RBI has to print fewer notes = save printing costs of the government.

- In addition to demonetisation, digital transactions have also been boosted by the launch of BHIM and UPI App.

- Increase in digital transactions could also improve the e-commerce business due to a decline in Cash On Delivery (COD) demand which could cut down their costs.

What are the concerns/negative impacts of demonetisation?

Poor Planning:

- At the time of demonetisation, the high-value notes constitute 87.5% of the currency value which is certainly a huge percentage of currency in the economy.

- Therefore, the same amount of currency should have been printed and made ready for the circulation in the economy once the demonetisation drive started.

- However, India went for demonetisation without having done this which led to many repercussions.

Economic impacts:

- Jobs: As people ran out of money, they could not be able to pay = economic activity slowed down & supply-chain affected particularly in the informal sector = A lot of people have lost their jobs. In a recent report by Azim Premji University, around 50 lakh people lost their jobs since demonetization was launched in November 2016.

- Savings: Households are now holding far more of their savings in cash than in the year prior to demonetisation = setback to the attempt at financialising household savings.

- Govt expenditure: by RBI cost the government around Rs 8000 crore during the period between July 2016-June 2017.

- GDP: During the Demonetisation, many industries were not able to continue their production activities due to the decrease in consumption demand. This is the reason why the country’s growth rate, which was 7.5% in September 2016 declined to 5.7% in June 2017. It means the demonetisation caused a reduction of 1.5% in the Indian GDP.

Tax Evasion/Black Money: One of the main motives behind demonetisation was to get people to pay taxes and eradicate black money.

- But cash is only one component of black wealth (about 1% of it). Black money is produced by different means which are not affected by the one-shot squeezing out of cash as it can quickly regenerate.

- Also, People very quickly found ways around the system to evade taxes.

- Many converted the unaccounted money into legal tender. Thus demonetisation itself became a tool for turning the black money into white.

- Moreover, there were logistical difficulties in penalising all of them = whole purpose gets defeated.

Corruption: It was claimed that the drive would reduce corruption by bringing to light the corrupt rich and by reducing the cash flow. But it is apparent that the corruption has not yet suppressed since demonetisation.

Fake notes: The number of fake notes in the banking system jumped by 20.4 % during 2016-17 compared to the previous year. Apart from this, we have heard the news of the fake notes coming out of ATM across the country.

Cash-GDP ratio:

- The cash-GDP ratio has reached levels similar to the period before demonetisation.

- Hence the government’s expectation of bringing behavioural changes among the people in terms of holding cash was not realised.

Agriculture:

- Reports of stress in agriculture have begun to appear because of demonetization.

- It is because, cash is the dominant mode of transaction in the agriculture sector from Sale, transport, marketing, and distribution of ready produce to wholesale centres or mandis.

Other impacts:

- Real-estate – It was badly affected as it is highly cash-dependent and has long been a favourite asset for holding black wealth.

- Banks –Banks are not in a position to considerably increase lending; their net interest income has decreased, thus, worsening their capital situation and their NPA situation got worse.

- Stock market – Demonetisation hasn’t really affected the overall stock market much and investors believe the impact is temporary, with lower interest rates and more government spending offsetting any adverse effects.

- Foreign investors –Foreign investors were major sellers of equities because they feared an economic slump, resulting in the slump in the stock market.

Conclusion

To summarize, the main benefit that the demonetisation brought about was the considerable increase in the number of income tax returns filed and the resultant tax collections. It also led to a formalisation of the economy.

However, these could have been achieved by other policy initiatives as well and not necessarily by demonetisation.

Tax reforms and effective monitoring of suspicious transactions could be a viable alternative for resolving the issues that the policy-makers sought to fix through demonetisation.

Another benefit is that digital transactions have become more common. But financial savings in the form of currency notes have also increased, which means that people still value cash.

To conclude in the words of the ex-RBI governor, Raghuram Rajan, “the demonetisation is not a well-planned or well-thought-out, useful exercise”.

Demonetisation and COVID-19 pandemic

The sufferings during demonetisation and adoption of digital payments made people better prepared to survive the prolonged lockdown period during the first wave of Covid-19 pandemic. The extensive use of technology during the pandemic also provided further boost to the digitisation process.

Updates

- Oct 2022: The Supreme Court recently said that it will have to examine the 2016 demonetisation decision.

- The petitions are challenging the government’s demonetisation of Rs 500 and 1000 currency notes.

- Government’s stand: The Centre has taken the position that, given subsequent developments and the passage of time, it has now become an academic issue.

- Court’s opinion:

- The court wants to look into the 2016 demonetisation decision to see if it has devolved into a “academic” exercise.

- The court has directed the Centre and the Reserve Bank of India to respond to the petitions.

- Judicial review: The Supreme Court acknowledged the “Lakshman Rekha” (limitations) on judicial review of government policy decisions. However, the manner in which it is done and the procedure can be scrutinised.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.

Thank you for the holistic explanation.