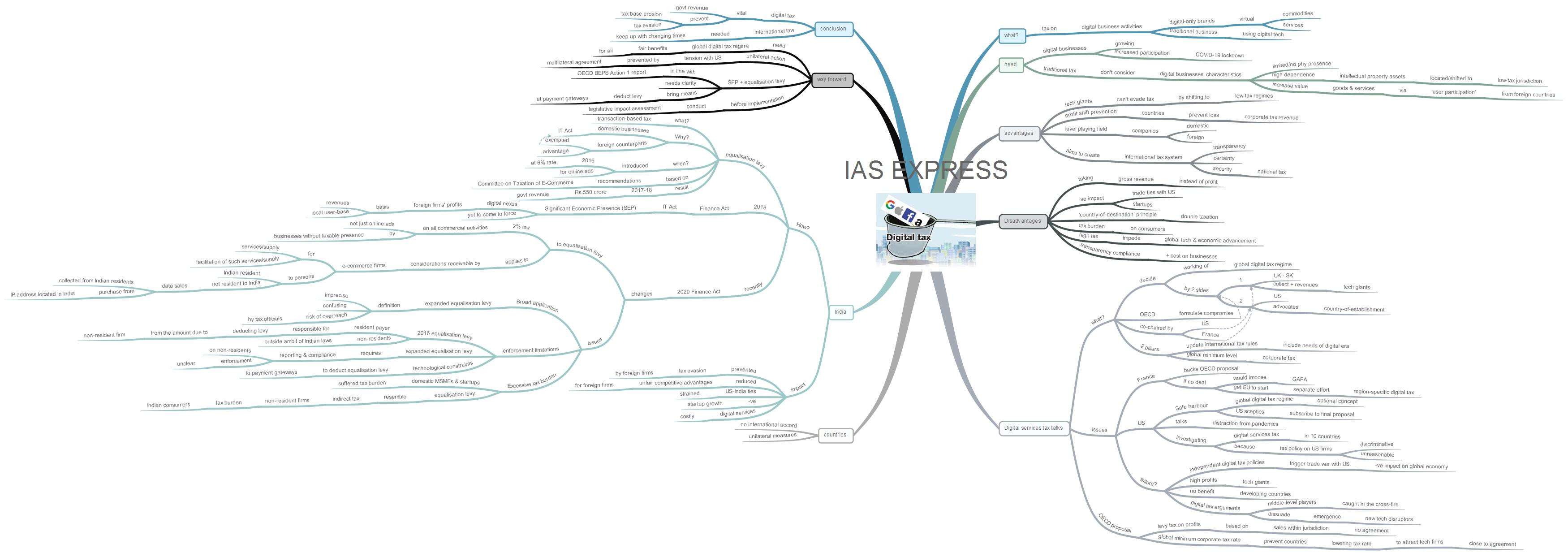

Digital Tax – Need, Challenges, Way Ahead

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

The digital tax issue has been a source of contention between the USA and France for a while now. Meanwhile, India has gone ahead to set up a taxation framework on a transaction basis. Recently, it expanded the tax regime to include a wider range of digital activities, seeking to improve revenue inflow. This comes in times of the economic slowdown draining the coffers of the government.

What is digital tax?

- Digital tax is a tax that is levied on digital business activities.

- The digital businesses include both the digital-only brands that focus on virtual commodities and services and the services traditional market players use for transforming their businesses with digital technologies.

- Virtual commodities include downloaded software, website applications and digital assets like ebooks, image files, audio clips/audio files, movies or digital files.

- Digital services include those provided by social media companies, collaborative platforms etc.

Why is there a need for digital tax?

- The growth of the digital economy over the last few decades has made sure that there is a limited need for the physical presence of the businesses in a country to make a profit there.

- Presently, there is a significant increase in participation in the digital economy due to the COVID-19 lockdown and digital tax is one of the many ways to boost the governments’ stressed revenue.

- The current tax regime is built around the traditional brick and mortar businesses and digital entities are not taken into account because of loopholes in the taxation system.

- This is because digital businesses have three unique characteristics:

- They offer services by having limited or no physical presence. Example: Facebook, Twitter etc.

- They are highly dependent on intellectual property assets that are typically located in or can be shifted to a low-tax jurisdiction

- They can increase the value to their goods and services through highly engaged ‘user participation’ from other countries.

- The current tax regime does not consider these aspects.

- Thus, many countries are developing a new framework to regulate and get a “fair” share of taxes from the revenues generated from virtual goods and services by focusing on these aspects.

What are the advantages and disadvantages of digital taxes?

Advantages:

- Tech giants like Google, Facebook, Amazon etc., which have a huge consumer base in developing countries like India will not be able to avoid taxation by shifting their offices to low-tax regimes.

- If the law prevents profit shifts, the countries from which the cross-border digital companies profit will be able to stop losing corporate tax revenue.

- Digital tax will ensure a level playing field for both domestic and foreign players. In the absence of such a law, the goods and services provided by firms based in a foreign country would get taxed less and hence have a significant competitive advantage over the domestic firms.

- It seeks to create a clear international tax system with improved transparency and certainty for businesses and security for national tax revenues.

Disadvantages:

- Taxing the gross revenues instead of the firm’s profits is problematic.

- The move to bring in digital tax would hurt trade ties with the US.

- It may harm start-ups– especially during their initial expansion stages.

- There is a risk of ‘double taxation’ when shifting from a ‘country-of-establishment’ principle to a ‘country-of-destination’ principle.

- These platforms and broker service providers would pass on the burden of tax to the end consumers or the sellers. This will affect their affordability and popularity.

- The government had opted for low taxation on digital businesses to promote innovation. Increasing taxes may impede global economic and technological advancement.

- Compliance with the transparency guidelines would bring in additional cost burdens on the businesses.

Digital services tax talks:

What are the talks all about?

- Governments across the world, from the UK to South Korea, have been eager to collect additional revenues from the tech giants that are presently paying meagre amounts of taxes in their countries.

- While some parties believe that the firms must pay more to the state coffers, other opine that these firms must be taxed where they are based (which is the USA in most cases).

- The OECD has been involved in formulating a compromise between these two sides. In this negotiation process, over 130 countries are involved.

- These talks are co-chaired by France and the USA- countries that represent diametrically opposing stands on the issue. The talks are to decide on how this global tax regime is to work.

- The talks involve 2 pillars:

- Discussions to update the international tax rules to match the needs of the digital era.

- Discussions to set a global minimum level for corporate tax.

What are the issues faced during the talks?

- The negotiations aren’t easy as the stakes involved are very high – the right to levy taxes on some of the largest and most valuable firms in the world.

- Though France backs the OECD proposal, it had announced that it would go ahead and impose its temporarily suspended GAFA tax if a global deal isn’t finalized quickly.

- Another route that France is mulling (if the talks don’t conclude soon) is to get the EU to start a separate effort to establish a region-specific digital tax.

- The USA holds an opposing view to France. It has accused France of unfairly targeting American firms. It even slapped tariffs on certain French imports to the USA- such as wine and cheese.

- The USA had called for a ‘safe harbour’, which is being interpreted as an attempt to make the global digital tax regime an optional concept. This has not been taken well by other negotiators.

- On the other hand, the ‘safe harbour’ concept is also considered as an attempt to persuade the domestic sceptics in the USA to subscribe to any final proposal arrived at by the talks.

- The USA has also raised concerns about the need to rush negotiations in the time of a global pandemic. It has argued that such talks are a distraction from more important matters like the economic implications of the Great Lockdown.

- The US Trade Representative Office, in June, announced an investigation into the digital service taxation in 10 jurisdictions including Italy, UK and Spain. It is to investigate (retroactively) for discriminations and unreasonable tax policy against the American firms. India is one of the countries being probed.

- If the talks fail to reach a consensus soon, many jurisdictions would go the French way and implement their own digital tax policy. Knowing the USA, this would probably trigger tax disputes and further trade tensions.

- Any form of a trade war at this point would be undoubtedly devastating to the global economy. This is especially so as millions are expected to go into poverty and the many years’ worth of progress in social indicators achieved by developing countries are already regressing. The USA itself is facing historical levels of job losses and other social insecurities.

- At the same time, the lockdown has turned the topic of digital tax into a niche issue. Meanwhile, the digital businesses, especially the tech giants, are raking in profits given the social distancing norms prevalent across the world pushing businesses and customer bases to the virtual platform. All these profits continue to flow offshore with little benefit to the source countries.

- While the countries argue over their share of the revenue from the tech giants, a lot of the middle-level players would be caught in the cross-fire. This would dissuade the emergence of new tech disruptors out of the current crisis.

What is the proposal made by OECD to address these issues?

- One of the compromises suggested by the OECD is that the countries be given the right to tax profits incurred based on sales in their jurisdiction. This would give the USA limited rights to tax European luxury goods companies in addition to covering the US-based tech giants for the other countries. This is to address the concerns regarding the first pillar of the talks.

- Regarding the second pillar of talks, a global minimum corporate tax rate would prevent countries from lowering their tax rates to attract these tech firms to set base in their jurisdiction. This leg of the talks is closer to agreement than the first leg.

How are countries imposing digital tax?

- As there isn’t any international accord for taxation of digital businesses, many countries have adopted unilateral measures to address the issue.

- The French GAFA tax is a prominent example. GAFA (Google, Apple, Facebook and Amazon) tax is a 3% digital service tax (DST) on revenues generated by the likes of the 4 tech giants in the French territory. The implementation has been suspended until the end of the year to aid the OECD talks.

- Italy introduced a 3% DST on tech companies generating a minimum revenue of 5,500,000 Euros from the Italian market.

- Other countries like Australia, Malaysia and Uganda are following this route too.

India:

How does India tax digital businesses?

- India has been making use of an ‘equalisation levy’ to level the playing field for the domestic and the foreign players on the virtual platform.

- While the domestic businesses are subject to the Income Tax Act, their foreign counterparts are exempted from its provisions. Hence they enjoy an advantage over the domestic firms. This is what the levy seeks to equalize.

- Equalisation levy was first introduced in 2016 at the rate of 6%. However, this was only limited to advertisements online.

- It is noted that this is a transaction-based tax, as opposed to a tax on earnings. This is to ensure that India doesn’t violate its international obligations.

- It was introduced based on the recommendations of the Committee on Taxation of E-Commerce.

- This move has brought in over Rs.550 crore for the government coffers in 2017-18.

- In 2018, the Finance Act introduced the Significant Economic Presence concept to IT Act of 1961. It incorporates a digital nexus to tax the profits of foreign businesses, based on its revenues and local user-base. This is yet to come into force.

- Currently, India too is involved in the talks to bring in a revamped framework for taxing digital businesses as the international taxation principles being used in the present are outdated (formulated in the 1920s).

What are the recent changes made in India’s tax regime to tax digital assets?

- The 2020 Finance Act brought in changes to the equalisation levy.

- The amendments impose a 2% tax on all online commercial activity (an expansion from the previous limitation to only online advertisements) by businesses that don’t have a taxable presence in India.

- This applies to considerations receivable by e-commerce firms for services/supply/facilitation of such services/supply to persons who are

- Resident in India

- Not resident in India- under certain circumstances like sale of data collected from residents of India or if the purchase is through an IP address located in India.

Issues in the new regime

Broad application

- The expanded equalization levy’s wide scope has been flagged as a cause of concern.

- The definitions provided have been termed ‘imprecise’ and is bound to cause several confusions. Eg: The levy can apply to:

- Transactions between 2 residents facilitated by an e-commerce operator.

- Transactions between 2 non-residents (like a foreign tourist in India paying his/her home cable bill) using an Indian IP address.

- This raises the risk of overreach by tax officials.

- The Committee on taxation of e-Commerce had noted the importance of taxable nexus – the connection between the taxing state and the foreign business. These include services that are received, utilized, provided or performed in the India jurisdiction. It had recommended the application of the levy on 13 specific payment categories like web hosting services and online advertising. This clarity is absent in the new regime.

- This wide applicability is in contrast to the DSTs of the UK and France where only specific digital activities are taxed.

Excessive tax burden

- The domestic start-ups and MSMEs suffered an undue tax burden because of the 2016 equalization levy, as it closely resembled an indirect tax.

- Direct taxes are imposed on an individual’s income. Indirect taxes are imposed on transacted taxable value. It is passed on to the consumer at the end of the chain. Eg: the GST.

- The resemblance of the equalisation levy concept to an indirect tax has made it easier for the non-resident firms to pass on the tax burden to Indian consumers.

- This problem is expected to persist under the expanded equalisation levy regime too – leading to tax burdens on the domestic consumers and firms, an effect in contrast to what was originally intended.

Need for reporting and compliance

- The resident payer bears the responsibility for deducting the levy from the amount due to the non-resident firm under the 2016 equalisation levy on online advertising.

- This is because of enforcement limitations. The fact that these non-residents don’t come under the ambit of Indian laws and procedures enable them to evade such charges without liability.

- The expanded levy, however, imposes obligations of reporting and compliance on these non-residents. How this will be done is still unclear.

- The Committee had recommended the deduction of the equalisation levy at payment gateways like PayPal and Billdesk.

- This implementation is being held back by technological constraints.

How has the new digital tax regime affected India’s economic growth?

- Companies that don’t have a physical presence weren’t included in the tax framework earlier. These new amendments bring them under the Indian tax laws’ ambit.

- The changes are expected to deter firms from earning revenue from India while evading taxation by basing themselves in tax havens.

- It levels the playing field for domestic and international firms and reduces unfair competitive advantages.

- On the other hand, these taxes would strain India’s relations with countries like the USA.

- It would also adversely impact the growth phase of start-ups.

- The end users may have to shell out more for the same services they have been availing at lower costs till now.

What can be the way forward?

- The e-commerce market is set to expand to $200 billion by 2026. This is a largely untapped revenue source for not only the Indian government but also many of the world’s economies.

- The digital tax could help address some of the revenue shortages that the governments are bound to face in light of the economic crisis following the pandemic and the Great Lockdown. In this perspective, the talks on digital tax is not really a niche issue but one of the low hanging fruits.

- With the social distancing norms in effect, more consumers are expected to take to virtual shopping and more businesses will look to sell their wares and services online. While the government revenues from other sources may drop, the revenue from the digital forum is only bound to increase in the near future.

- With all these considerations, it is high time to bring in a global digital tax regime to enable fair benefits to all countries from the major pandemic-driven move to the digital platform.

- Even before the pandemic struck, policymakers around the world were aware of the ‘free-rider problem’ but were struggling with formulating an effective and consistent taxation framework.

- Unilateral action by any country is bound to invite tariffs, retaliatory measures and further aggravation of trade ties from the likes of the USA- not at all welcome in times of the COVID-19-driven economic crisis. Hence a multilateral agreement is necessary. The OECD talks need to proceed smoothly for finalising a global digital taxation regime.

- In India’s case, the coupling of the Significant Economic Presence (SEP) test with the equalisation levy is a coordinated effort to tax digital businesses in India and is in line with the OECD BEPS Action 1 report.

- However, there is a need for clarity in certain aspects like applicability of the levy. Addressing the various ambiguities in the new amendments would help address uncertainties among the digital operators.

- It also needs to take steps to bring in means to deduct the levy at payment gateways. Else, the tax burden would again fall on the end consumer and domestic firms.

- One way to prevent any shock, which may prove dangerous in the current situation, to the up and coming local businesses – especially the start-ups – is to conduct legislative impact assessment before the full-on implementation of the newly framed policies.

Conclusion:

The tech giants and other digital non-residents are a major source of government revenue that needs to be tapped – one to improve tax revenue receipts of the government and two, to prevent tax base erosion and tax evasion. It is noted that India is a major market for these tech giants i.e. a significant portion of their profits flows from here. Hence, it is only fair that they are taxed appropriately. The digital tax question is an illustration of the need for legislation across the world to step up the pace to keep up with the changing times.

Practice question for mains:

It has been opined that the talks on global digital tax regime should be put on the backburner in times of a global pandemic and historic economic crisis. Do you agree? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.