Economic Survey 2023-24: Summary & Mindmap

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

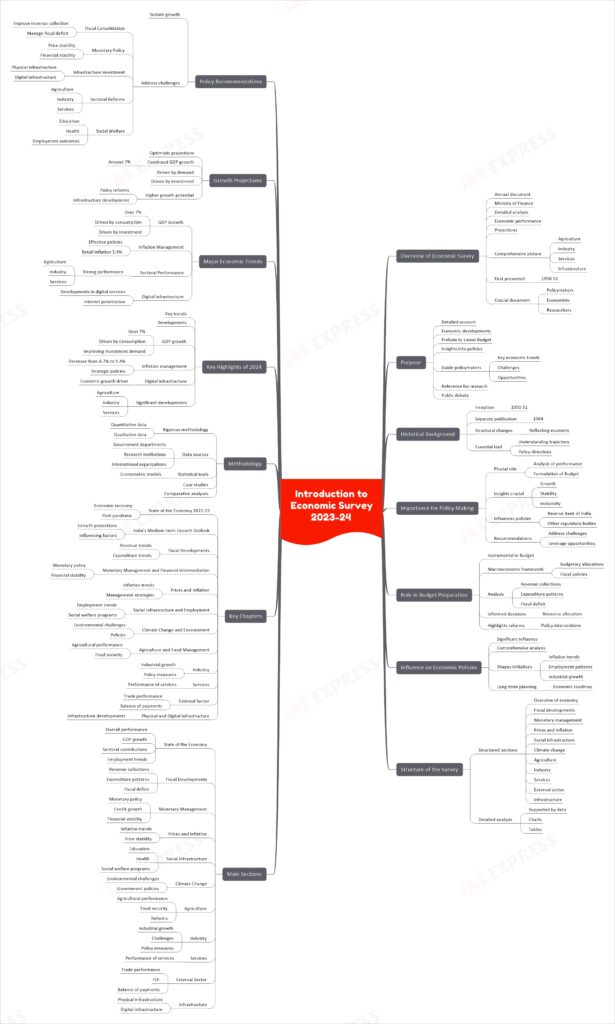

I. Introduction to the Economic Survey 2023-24

Overview of Economic Survey

The Economic Survey is an annual document published by the Ministry of Finance of India. It provides a detailed analysis of the country’s economic performance over the past year and offers projections for the upcoming financial year. The survey aims to present a comprehensive picture of the economy, encompassing various sectors such as agriculture, industry, services, and infrastructure. The first Economic Survey was presented in 1950-51 and has since evolved to become a crucial document for policymakers, economists, and researchers.

Purpose

The primary purpose of the Economic Survey is to provide a detailed account of the economic developments in the country. It serves as a prelude to the Union Budget and offers insights into the government’s economic policies and their impact. The survey aims to inform and guide policymakers by highlighting key economic trends, challenges, and opportunities. It also serves as a reference for academic research and public debate on economic issues.

Historical Background

The Economic Survey has a rich historical background, dating back to its inception in 1950-51. Initially presented along with the Union Budget, it has been published separately since 1964. Over the years, the survey has undergone several changes in its structure and content to reflect the evolving economic landscape of the country. It has become an essential tool for understanding the economic trajectory and policy directions of the Indian government.

Importance for Policy Making

The Economic Survey plays a pivotal role in policy making. It provides a detailed analysis of the economy’s performance, which helps in the formulation of the Union Budget. The survey’s insights are crucial for designing policies that promote economic growth, stability, and inclusivity. It also influences monetary policy decisions by the Reserve Bank of India (RBI) and other regulatory bodies. The survey’s recommendations are often considered by policymakers to address economic challenges and leverage opportunities for sustainable development.

Role in Budget Preparation

The Economic Survey is instrumental in the preparation of the Union Budget. It provides a macroeconomic framework that guides the budgetary allocations and fiscal policies. The survey’s analysis of revenue collections, expenditure patterns, and fiscal deficit helps in making informed decisions about resource allocation. It also highlights the need for reforms and policy interventions to achieve the government’s economic objectives.

Influence on Economic Policies

The Economic Survey significantly influences economic policies in India. Its comprehensive analysis of various sectors and policy recommendations often shape government initiatives and reforms. For instance, the survey’s insights into inflation trends, employment patterns, and industrial growth have led to targeted policy measures to address these issues. The survey also provides a roadmap for long-term economic planning and development.

Structure of the Survey

The Economic Survey is structured into several sections, each focusing on different aspects of the economy. The main sections include an overview of the economy, fiscal developments, monetary management, prices and inflation, social infrastructure, climate change, agriculture, industry, services, external sector, and infrastructure. Each section provides a detailed analysis of the respective area, supported by data, charts, and tables.

Main Sections

The main sections of the Economic Survey are:

- State of the Economy: Analyzes the overall economic performance, including GDP growth, sectoral contributions, and employment trends.

- Fiscal Developments: Examines revenue collections, expenditure patterns, and fiscal deficit.

- Monetary Management: Discusses monetary policy, credit growth, and financial stability.

- Prices and Inflation: Analyzes inflation trends and price stability measures.

- Social Infrastructure: Covers education, health, and social welfare programs.

- Climate Change: Discusses environmental challenges and government policies.

- Agriculture: Analyzes agricultural performance, food security, and reforms.

- Industry: Examines industrial growth, challenges, and policy measures.

- Services: Analyzes the performance of the services sector.

- External Sector: Discusses trade performance, FDI, and balance of payments.

- Infrastructure: Covers physical and digital infrastructure developments.

Key Chapters

The key chapters of the Economic Survey include:

- State of the Economy 2022-23: Provides an overview of the economic recovery post-pandemic.

- India’s Medium-term Growth Outlook: Discusses growth projections and influencing factors.

- Fiscal Developments: Analyzes revenue and expenditure trends.

- Monetary Management and Financial Intermediation: Examines monetary policy and financial stability.

- Prices and Inflation: Analyzes inflation trends and management strategies.

- Social Infrastructure and Employment: Discusses employment trends and social welfare programs.

- Climate Change and Environment: Examines environmental challenges and policies.

- Agriculture and Food Management: Analyzes agricultural performance and food security.

- Industry: Examines industrial growth and policy measures.

- Services: Analyzes the performance of the services sector.

- External Sector: Discusses trade performance and balance of payments.

- Physical and Digital Infrastructure: Covers infrastructure developments.

Methodology

The Economic Survey employs a rigorous methodology to analyze the economy. It uses a combination of quantitative and qualitative data, sourced from various government departments, research institutions, and international organizations. The survey employs statistical tools and econometric models to analyze trends and make projections. It also includes case studies and comparative analyses to provide a comprehensive understanding of the economic landscape.

Key Highlights of 2024

The Economic Survey 2024 highlights several key trends and developments in the Indian economy. The survey notes a robust GDP growth of over 7% for the third consecutive year, driven by stable consumption and improving investment demand. It highlights the effective management of inflation, which decreased from 6.7% in FY23 to 5.4% in FY24, due to strategic administrative and monetary policies. The survey also emphasizes the importance of digital infrastructure in driving economic growth and highlights significant developments in sectors such as agriculture, industry, and services.

Major Economic Trends

The major economic trends highlighted in the Economic Survey 2024 include:

- GDP Growth: Sustained growth of over 7% driven by consumption and investment.

- Inflation Management: Effective policies leading to a decrease in retail inflation to 5.4%.

- Sectoral Performance: Strong performance in agriculture, industry, and services.

- Digital Infrastructure: Significant developments in digital services and internet penetration.

Growth Projections

The Economic Survey 2024 provides optimistic growth projections for the Indian economy. It forecasts a continued GDP growth of around 7% in the medium term, driven by robust domestic demand and investment. The survey also highlights the potential for higher growth rates with sustained policy reforms and infrastructure development.

Policy Recommendations

The Economic Survey 2024 offers several policy recommendations to sustain economic growth and address challenges. These include:

- Fiscal Consolidation: Measures to improve revenue collection and manage fiscal deficit.

- Monetary Policy: Continued focus on price stability and financial stability.

- Infrastructure Investment: Increased investment in physical and digital infrastructure.

- Sectoral Reforms: Targeted reforms in agriculture, industry, and services to boost productivity and growth.

- Social Welfare: Enhanced social welfare programs to improve education, health, and employment outcomes.

II. State of the Economy: Steady as She Goes

Introduction

India’s calibrated response to the pandemic on the economic front included three salient components:

- Public Spending on Infrastructure: This approach created a strong demand for jobs and industrial output, triggering a vigorous private investment response. The strengthened balance sheets of the financial and non-financial private sector were aided by a decade of supportive initiatives by the Government and the Reserve Bank of India (RBI).

- Digitalisation of Service Delivery: The adversities faced by business enterprises and public administration led to a significant push towards digitalisation. This shift was supported by public policy focus and nurturing of digital technology processes and frameworks.

- Atmanirbhar Bharat Abhiyan: This initiative provided targeted relief to different sectors of the economy and sections of the population. Structural reforms under this program helped achieve a firm recovery and increased the medium-term growth potential.

Economic Performance

The Indian economy recovered and expanded in an orderly fashion over the past three years. The real GDP in FY24 was 20% higher than its level in FY20. This growth was inclusive, marked by a reduction in unemployment and multi-dimensional poverty and an increase in labor force participation. The Indian economy looks forward to FY25 optimistically, anticipating broad-based and inclusive growth.

Global Economic Scenario

In 2023, the global economy achieved greater stability despite uncertainties. According to the World Economic Outlook (WEO) by the International Monetary Fund (IMF) in April 2024, the global economy registered a growth of 3.2% in 2023, though slightly lower than in 2022. The global economic growth was robust despite elevated uncertainty from geopolitical developments.

Domestic Economic Indicators

GDP and Growth:

- India’s real GDP grew by 8.2% in FY24, posting growth of over 7% for a third consecutive year. This growth was driven by stable consumption demand and steadily improving investment demand. On the supply side, Gross Value Added (GVA) at 2011-12 prices grew by 7.2% in FY24.

Investment and Consumption:

- Private consumption remained a crucial driver of GDP growth. Private final consumption expenditure (PFCE) grew by 4.0% in real terms in FY24. Urban demand was reflected in indicators like domestic passenger vehicle sales and air passenger traffic. Rural consumption growth also picked up pace in early 2024.

Sectoral Performance:

- The manufacturing sector recovered, growing by 9.9% in FY24. The construction sector also showed increased momentum with a 9.9% growth due to infrastructure development and real estate demand.

- The services sector exhibited growth with robust performance in trade, transport, real estate, and ancillary services. The proliferation of global capability centers (GCCs) boosted resilience in services exports.

Fiscal and Monetary Management

Fiscal Balance:

- Despite expansionary public investment, fiscal balances of the general government (central and state governments) improved progressively. Gains in tax compliance, expenditure restraint, and digitisation contributed to this balance.

Inflation and Monetary Policy:

- Inflationary pressures were managed through administrative and monetary policy responses. The RBI’s vigilant regulatory actions ensured the banking and financial system’s stability.

Investment Trends:

- Gross Fixed Capital Formation (GFCF) continued to be an important growth driver. Private non-financial corporations’ investment increased by 19.8% in FY23. Early signs in FY24 indicated sustained momentum in private capital formation.

External Sector and Trade

Trade and Exports:

- While subdued global demand for goods pressured the external balance, strong services exports largely counterbalanced this. Global output showed resilience, with shrinking inflationary pressures and recovering trade.

Foreign Direct Investment (FDI):

- FDI flows showed moderation due to global uncertainties and higher borrowing costs. However, the domestic environment continued to attract significant investment, maintaining stability in the external sector.

Future Outlook

Economic Growth Prospects:

- The Indian economy is anticipated to achieve robust growth in FY25 and beyond, driven by inclusive policies and strong sectoral performance. The focus on macroeconomic stability will be crucial in navigating external uncertainties.

Global Economic Impact:

- The global economy’s performance will influence India’s growth trajectory. Potential geopolitical conflicts and policy changes in major economies could impact trade and investment flows.

Policy Continuity:

- The government’s continued commitment to structural reforms and fiscal prudence is expected to support sustained economic growth and stability.

In conclusion, the Indian economy’s steady growth trajectory amidst global uncertainties underscores its resilience and strategic policy responses. The focus on infrastructure, digitalisation, and self-reliance has positioned India for continued economic expansion and inclusive growth in the coming years.

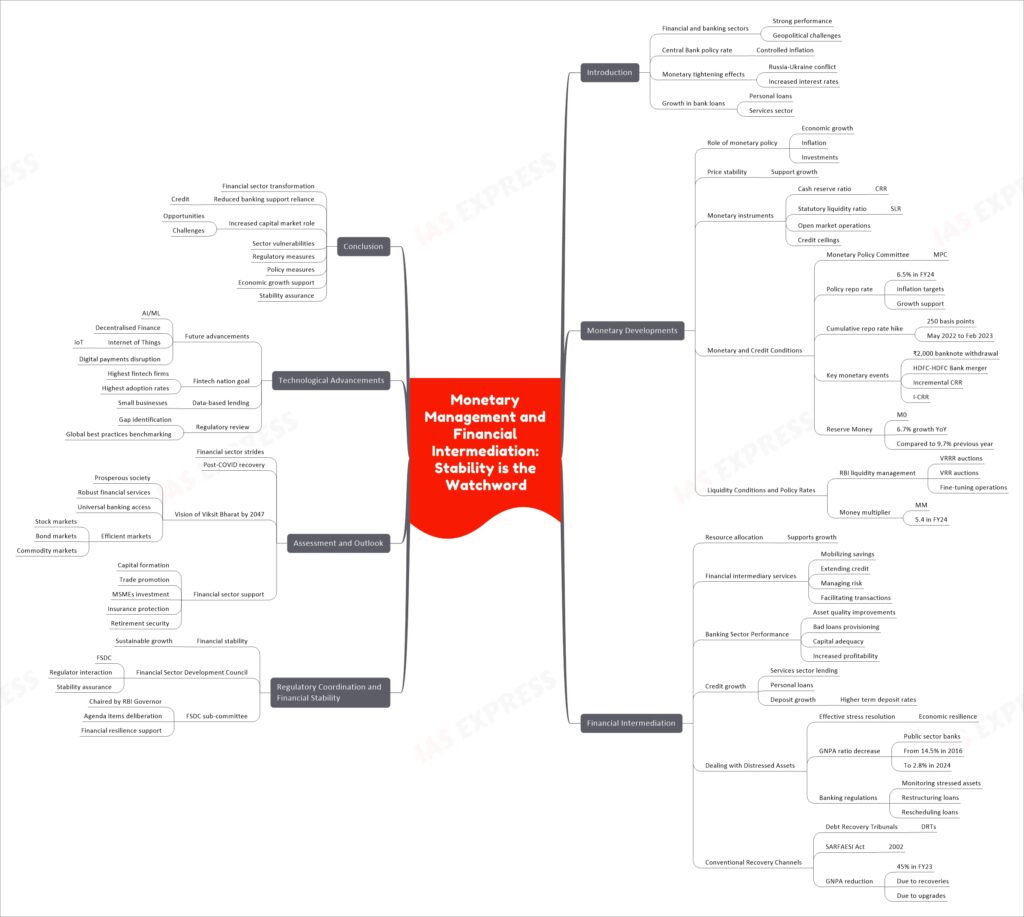

III. Monetary Management and Financial Intermediation: Stability is the Watchword

Introduction

India’s financial and banking sectors have exhibited strong performance despite ongoing geopolitical challenges. The Central Bank maintained a steady policy rate throughout the year, ensuring controlled inflation. The effects of monetary tightening, following the Russia-Ukraine conflict, are evident in the increased lending and deposit interest rates among banks. Significant and widespread growth in bank loans, particularly personal loans and services, highlight this trend.

Monetary Developments

Monetary policy plays a crucial role in influencing macroeconomic indicators such as economic growth, inflation, and investments. The primary objective is to maintain price stability while supporting growth. Various instruments like the cash reserve ratio (CRR), statutory liquidity ratio (SLR), open market operations, and credit ceilings are employed to achieve this goal.

Monetary and Credit Conditions:

- The Monetary Policy Committee (MPC) maintained the policy repo rate at 6.5% in FY24, focusing on withdrawing accommodation to align inflation with targets while supporting growth.

- A cumulative policy repo rate hike of 250 basis points (bps) between May 2022 and February 2023 was maintained.

- Key events impacting monetary and credit conditions in FY24 include the withdrawal of ₹2,000 banknotes in May 2023, the merger of HDFC with HDFC Bank in July 2023, and the temporary imposition of incremental CRR (I-CRR) in August 2023.

- Reserve Money (M0) grew by 6.7% year-on-year (YoY) as of March 29, 2024, compared to 9.7% in the previous year.

Liquidity Conditions and Policy Rates:

- The RBI managed liquidity through Variable Rate Reverse Repo (VRRR) and Variable Rate Repo (VRR) auctions, along with fine-tuning operations.

- During FY24, the money multiplier (MM) was 5.4, indicating higher liquidity in the market.

Financial Intermediation

Financial intermediation facilitates the efficient allocation of resources and supports economic growth. Services provided by financial intermediaries, such as mobilizing savings, extending credit, managing risk, and facilitating transactions, are essential for technological innovation and economic development.

Performance of the Banking Sector:

- The banking sector’s soundness is underscored by improvements in asset quality, enhanced provisioning for bad loans, sustained capital adequacy, and increased profitability.

- Credit growth is driven by lending to services and personal loans, while deposit growth has accelerated due to higher term deposit rates.

Dealing with Distressed Assets:

- Effective stress resolution is a measure of economic resilience. The GNPA ratio of public sector banks decreased from 14.5% in March 2016 to 2.8% in March 2024.

- Banking regulations provide measures for monitoring and addressing stressed assets, including restructuring and rescheduling loans.

Conventional Recovery Channels:

- Debt Recovery Tribunals (DRTs) and the Securitisation and Reconstruction of Financial Assets and Enforcement of Security Interest (SARFAESI) Act, 2002, form the primary recovery mechanisms. In FY23, around 45% of GNPA reduction in SCBs was due to recoveries and upgrades.

Regulatory Coordination and Financial Stability

Financial stability is crucial for sustainable economic growth. The Financial Sector Development Council (FSDC) facilitates interaction among financial sector regulators to ensure stability. The FSDC sub-committee, chaired by the RBI Governor, deliberates on agenda items proposed by members and supports actions required for financial resilience.

Assessment and Outlook

India’s financial sector has made significant strides, contributing to a resilient post-COVID economic recovery. The vision of “Viksit Bharat” by 2047 aims for a prosperous society with a robust financial services sector, universal access to banking, and efficient stock, bond, and commodity markets. The financial sector must support capital formation, promote trade and investment in MSMEs, and provide insurance protection and retirement security to all citizens.

Technological Advancements

Future advancements will likely involve Artificial Intelligence/Machine Learning (AI/ML), Decentralised Finance, and the Internet of Things (IoT), potentially disrupting the digital payments ecosystem. The goal is for India to evolve as a ‘fintech nation’ with the highest number of fintech firms and adoption rates. Efforts should be made to move towards data-based lending for small businesses and continuous regulatory review to identify gaps and benchmark against global best practices.

Conclusion

India’s financial sector is undergoing a significant transformation, reducing reliance on banking support for credit and increasing the role of capital markets. This shift presents both opportunities and challenges. The sector must prepare for vulnerabilities and be equipped with regulatory and policy measures to intervene when necessary, ensuring stability and supporting economic growth.

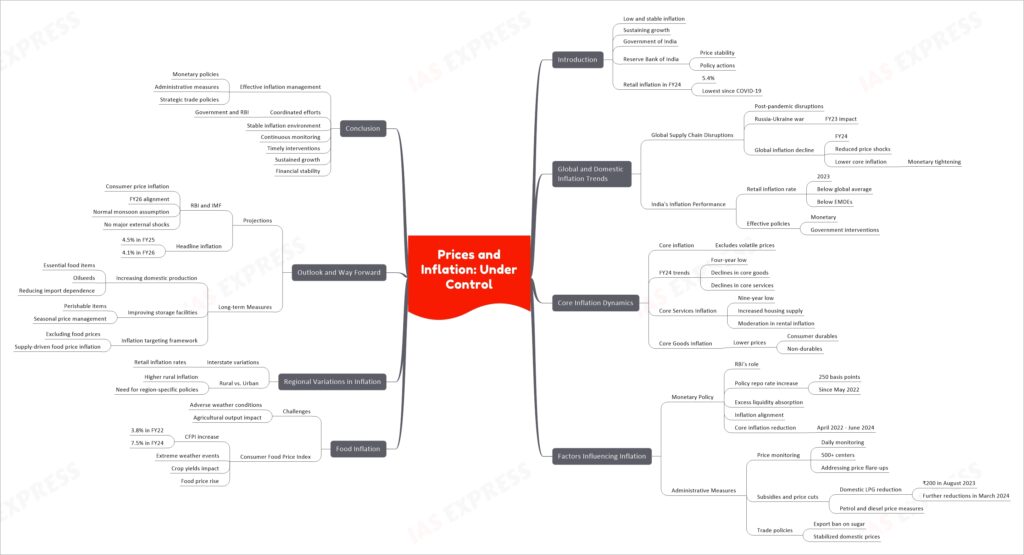

IV. Prices and Inflation: Under Control

Introduction

Low and stable inflation is essential for sustaining economic growth. Both the Government of India and the Reserve Bank of India (RBI) play pivotal roles in maintaining inflation at manageable levels to ensure financial stability. The RBI’s commitment to price stability, combined with various policy actions by the central government, has resulted in retail inflation being kept at 5.4% in FY24, the lowest since the COVID-19 pandemic period.

Global and Domestic Inflation Trends

Global Supply Chain Disruptions

Post-pandemic, the global economy experienced significant supply chain disruptions, notably exacerbated by the Russia-Ukraine war in the first half of FY23. These disruptions led to increased inflationary pressures worldwide. However, in the latter half of FY23 and FY24, global inflation began to decline due to the diminishing impact of price shocks, particularly in energy prices, and lower core inflation driven by monetary tightening across major economies.

India’s Inflation Performance

Despite global inflationary trends, India’s retail inflation rate in 2023 remained below the global average and that of many emerging market and developing economies (EMDEs). This achievement was primarily due to effective monetary policies and strategic interventions by the RBI and the government.

Core Inflation Dynamics

Core inflation excludes volatile food and energy prices to provide a clearer view of underlying inflation trends. In FY24, core inflation in India hit a four-year low, driven by declines in both core goods and core services inflation.

- Core Services Inflation: Core services inflation, which includes housing rents and other service costs, reached a nine-year low in FY24 due to increased housing supply and moderation in rental inflation.

- Core Goods Inflation: Core goods inflation also declined, significantly influenced by lower prices for consumer durables and non-durables.

Factors Influencing Inflation

Monetary Policy

The RBI has played a crucial role in managing inflation through its monetary policy. Since May 2022, the RBI increased the policy repo rate by 250 basis points to absorb excess liquidity and align inflation with target levels. This gradual tightening helped reduce core inflation significantly between April 2022 and June 2024.

Administrative Measures

The government implemented several administrative measures to control inflation:

- Price Monitoring: Daily monitoring of prices at over 500 centers helped the government swiftly address price flare-ups in specific items.

- Subsidies and Price Cuts: For example, in August 2023, the price of domestic LPG cylinders was reduced by ₹200, and further reductions followed in March 2024. Similar measures were taken for petrol and diesel prices.

- Trade Policies: Adjustments in trade policies, such as the export ban on sugar, helped stabilize domestic prices.

Food Inflation

Food inflation has been particularly challenging due to adverse weather conditions impacting agricultural output. The Consumer Food Price Index (CFPI) saw an increase from 3.8% in FY22 to 7.5% in FY24. This rise was primarily due to extreme weather events affecting crop yields and pushing up food prices.

Regional Variations in Inflation

There were notable interstate variations in retail inflation rates across India in FY24. Rural areas experienced higher inflation rates compared to urban areas. This disparity highlights the need for region-specific policy measures to address inflation effectively.

Outlook and Way Forward

Projections

The RBI and the International Monetary Fund (IMF) project that India’s consumer price inflation will align progressively with the target in FY26, assuming normal monsoon conditions and no major external shocks. The RBI expects headline inflation to be 4.5% in FY25 and 4.1% in FY26.

Long-term Measures

For long-term price stability, the following measures are suggested:

- Increasing Domestic Production: Focused efforts to increase the production of essential food items, particularly oilseeds, to reduce import dependence.

- Improving Storage Facilities: Enhancing storage and processing facilities for perishable items like vegetables to manage seasonal price surges.

- Revisiting Inflation Targeting Framework: Considering an inflation targeting framework that excludes food prices, as food price inflation is often supply-driven rather than demand-driven.

Conclusion

India’s success in managing inflation through effective monetary policies, administrative measures, and strategic trade policies demonstrates the importance of coordinated efforts between the government and the central bank. As the country moves towards a more stable inflation environment, continuous monitoring and timely interventions will remain crucial to sustain economic growth and financial stability.

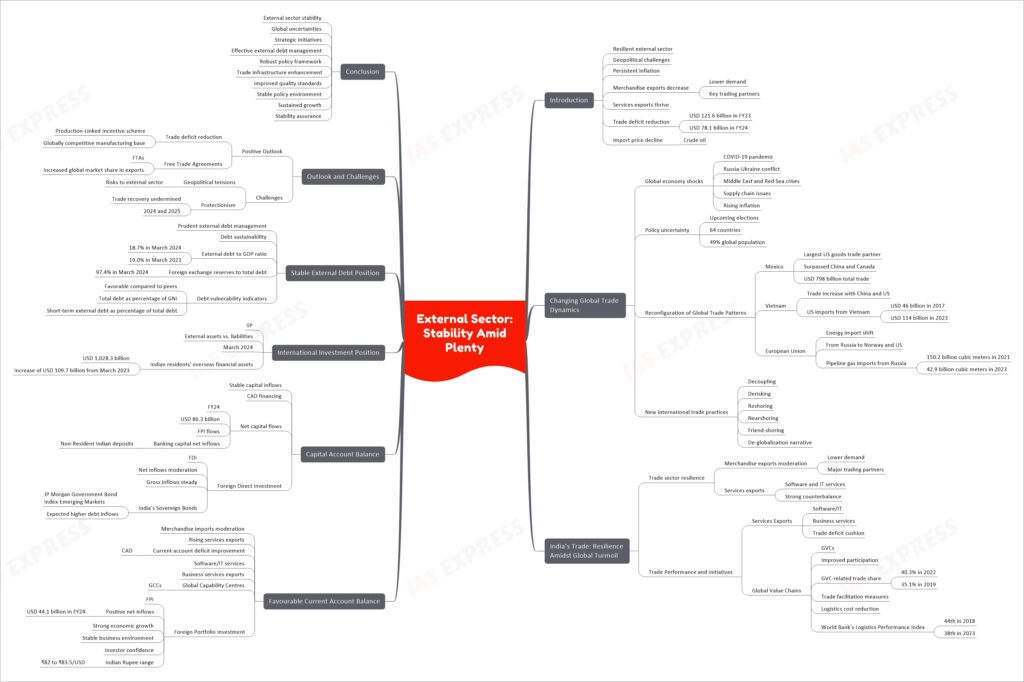

V. External Sector: Stability Amid Plenty

Introduction

India’s external sector remained resilient despite ongoing geopolitical challenges and persistent inflation. Although merchandise exports decreased due to lower demand from key trading partners, services exports continued to thrive, reducing the overall trade deficit from USD 121.6 billion in FY23 to USD 78.1 billion in FY24. The decline in import prices, particularly crude oil, contributed significantly to this improvement.

Changing Global Trade Dynamics

The global economy has faced several shocks since the COVID-19 pandemic, including the Russia-Ukraine conflict and crises in the Middle East and Red Sea. These disruptions have led to significant supply chain issues and rising inflation in many countries. Additionally, the upcoming elections in 64 countries, representing about 49% of the global population, add to the policy uncertainty affecting international trade and immigration policies.

Reconfiguration of Global Trade Patterns

- Mexico became the largest goods trade partner of the United States in 2023, surpassing China and Canada with a total trade of USD 798 billion.

- Vietnam saw an increase in trade with both China and the US, with US imports from Vietnam more than doubling from USD 46 billion in 2017 to USD 114 billion in 2023.

- European Union countries shifted their energy imports from Russia to Norway and the US, with EU pipeline gas imports from Russia declining from 150.2 billion cubic meters in 2021 to 42.9 billion cubic meters in 2023.

These shifts reflect new international trade practices such as decoupling, derisking, reshoring, nearshoring, and friend-shoring, along with a growing narrative of de-globalization.

India’s Trade: Resilience Amidst Global Turmoil

Despite the challenges, India’s trade sector demonstrated resilience. Merchandise exports were moderated by lower demand from major trading partners, but services exports, particularly in software and IT services, provided a strong counterbalance.

Trade Performance and Initiatives

- Services Exports: The rise in services exports, driven by software/IT and business services, helped cushion the trade deficit.

- Global Value Chains (GVCs): India’s participation in GVCs improved, with the share of GVC-related trade in gross trade rising to 40.3% in 2022 from 35.1% in 2019. This improvement was aided by government measures on trade facilitation and logistics cost reduction, reflected in India’s rise in the World Bank’s Logistics Performance Index from 44th in 2018 to 38th in 2023.

Favourable Current Account Balance

The moderation in merchandise imports, coupled with rising services exports, improved India’s current account deficit (CAD). Software/IT services and business services exports drove this increase, supported by India emerging as a hub for Global Capability Centres (GCCs).

- Foreign Portfolio Investment (FPI): India saw positive net FPI inflows of USD 44.1 billion in FY24, supported by strong economic growth, a stable business environment, and increased investor confidence. This helped keep the Indian Rupee within a manageable range of ₹82 to ₹83.5/USD.

Capital Account Balance

Stable capital inflows continued to finance the CAD. Net capital flows during FY24 stood at USD 86.3 billion, primarily driven by FPI flows and net inflows of banking capital, including Non-Resident Indian (NRI) deposits.

- Foreign Direct Investment (FDI): Although there was a moderation in net FDI inflows, gross FDI inflows remained steady. The inclusion of India’s Sovereign Bonds in the JP Morgan Government Bond Index-Emerging Markets is expected to contribute to higher debt inflows.

International Investment Position (IIP)

India’s IIP, which measures the difference between the country’s external assets and liabilities, improved significantly. As of March 2024, Indian residents’ overseas financial assets were USD 1,028.3 billion, an increase of USD 109.7 billion from March 2023.

Stable External Debt Position

India has managed its external debt prudently, maintaining sustainability over the years. The external debt to GDP ratio declined to 18.7% at the end of March 2024 from 19.0% in March 2023. The ratio of foreign exchange reserves to total debt stood at 97.4% as of March 2024.

- Debt Vulnerability Indicators: India’s debt vulnerability indicators are favorable compared to peer countries, with relatively low levels of total debt as a percentage of Gross National Income (GNI) and short-term external debt as a percentage of total external debt.

Outlook and Challenges

Positive Outlook

- Trade Deficit Reduction: India’s trade deficit is expected to decline further with the expansion of the Production-Linked Incentive (PLI) scheme and the establishment of a globally competitive manufacturing base.

- Free Trade Agreements (FTAs): Recently signed FTAs are anticipated to increase India’s global market share in exports.

Challenges

- Geopolitical Tensions: Ongoing geopolitical tensions pose risks to India’s external sector performance.

- Protectionism: Rising protectionism could undermine trade recovery in 2024 and 2025.

Conclusion

India’s external sector has shown remarkable stability amidst global uncertainties. Strategic initiatives, effective management of external debt, and a robust policy framework have contributed to this resilience. Moving forward, continuous efforts to enhance trade infrastructure, improve quality standards, and maintain a stable policy environment will be crucial for sustaining this growth and stability.

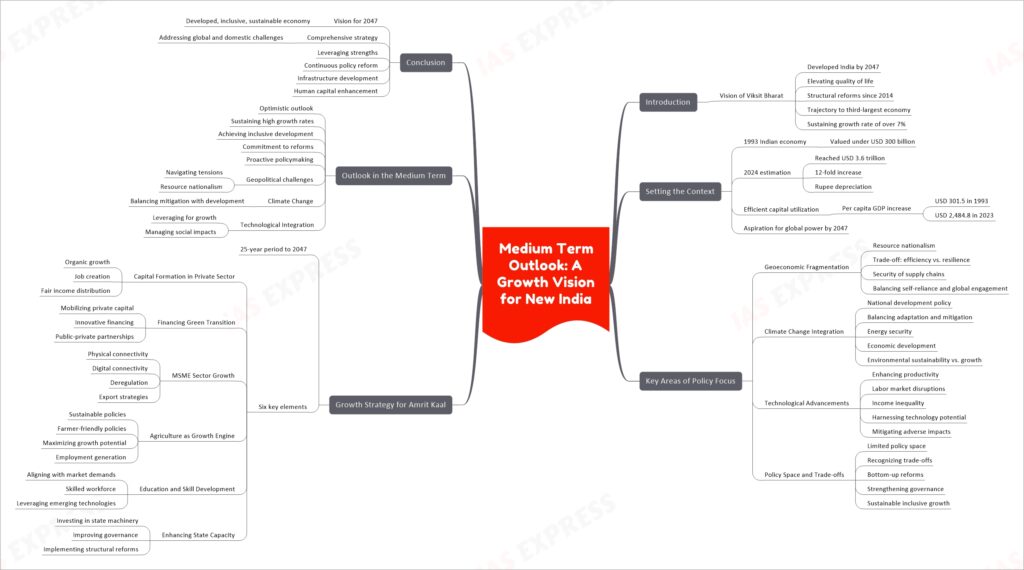

VI. Medium Term Outlook: A Growth Vision for New India

Introduction

The vision of a ‘Viksit Bharat’ or Developed India by 2047 is aimed at elevating the dignity and quality of life of every Indian citizen. This vision is backed by a decade of structural reforms initiated by the Government of India since 2014, which have set the Indian economy on a trajectory to become the third-largest in the world. The medium-term goal is to sustain a growth rate of over 7% by building on these reforms.

Setting the Context

In 1993, the Indian economy was valued at less than USD 300 billion. By 2024, it is estimated to have reached USD 3.6 trillion, marking a 12-fold increase despite the depreciation of the Indian rupee. This growth has been achieved with efficient capital utilization, reflected in the substantial increase in per capita GDP from USD 301.5 in 1993 to USD 2,484.8 in 2023. India, with its rich historical and cultural heritage, aspires to become a major global economic power by 2047, the centenary of its independence.

Key Areas of Policy Focus in the Short to Medium Term

Geoeconomic Fragmentation and Resource Nationalism

The increasing fragmentation of global economies and the rise of resource nationalism have created a trade-off between efficiency and resilience. Ensuring the security of supply chains through building buffers and slack has become more important than operating at the frontiers of efficiency. Policies need to address these challenges by balancing inward-looking self-reliance with outward-looking global engagement.

Climate Change Integration

Integrating climate change strategies into national development policy is essential. This involves balancing adaptation and mitigation efforts with energy security and economic development. Policymakers must navigate the trade-offs between environmental sustainability and economic growth to ensure socio-economic stability and public health.

Technological Advancements

Technology is emerging as a crucial determinant of economic prosperity. While it enhances productivity, it also poses challenges such as labor market disruptions and income inequality. The focus should be on harnessing technology’s potential while mitigating its adverse social impacts.

Policy Space and Trade-offs

Countries now have limited policy space due to multiple global crises. Recognizing and accepting trade-offs has become necessary for effective policymaking. The focus should be on bottom-up reforms to strengthen governance and ensure sustainable, inclusive growth.

Growth Strategy for Amrit Kaal: Strong, Sustainable, and Inclusive

The growth strategy for Amrit Kaal, the 25-year period leading up to 2047, involves six key elements:

- Capital Formation in the Private Sector: Ensuring organic growth in private sector capital formation to drive job creation and fair income distribution.

- Financing Green Transition: Mobilizing private capital for green transition through innovative financing instruments and public-private partnerships.

- MSME Sector Growth: Enhancing physical and digital connectivity, deregulation, and export strategies to support the growth of Micro, Small, and Medium Enterprises (MSMEs).

- Agriculture as a Growth Engine: Implementing environmentally sustainable and farmer-friendly policies to maximize agriculture’s potential for growth and employment.

- Education and Skill Development: Aligning education and skill policies with market demands to ensure a skilled workforce capable of leveraging emerging technologies.

- Enhancing State Capacity: Investing in state machinery to improve governance and implementation of structural reforms.

Outlook in the Medium Term

The medium-term outlook for the Indian economy is optimistic, with a focus on sustaining high growth rates and achieving inclusive development. The government’s commitment to structural reforms, combined with proactive policymaking, is expected to drive economic growth and improve the standard of living for all citizens.

- Geopolitical Challenges: Navigating geopolitical tensions and resource nationalism will be crucial.

- Climate Change: Balancing climate change mitigation with economic development will be a key focus.

- Technological Integration: Leveraging technology for growth while managing its social impacts.

Conclusion

India’s growth vision for 2047 aims to create a developed, inclusive, and sustainable economy. This vision is anchored in a comprehensive strategy that addresses the current global and domestic challenges while leveraging the country’s strengths. Continuous efforts in policy reform, infrastructure development, and human capital enhancement will be essential to achieve this ambitious goal.

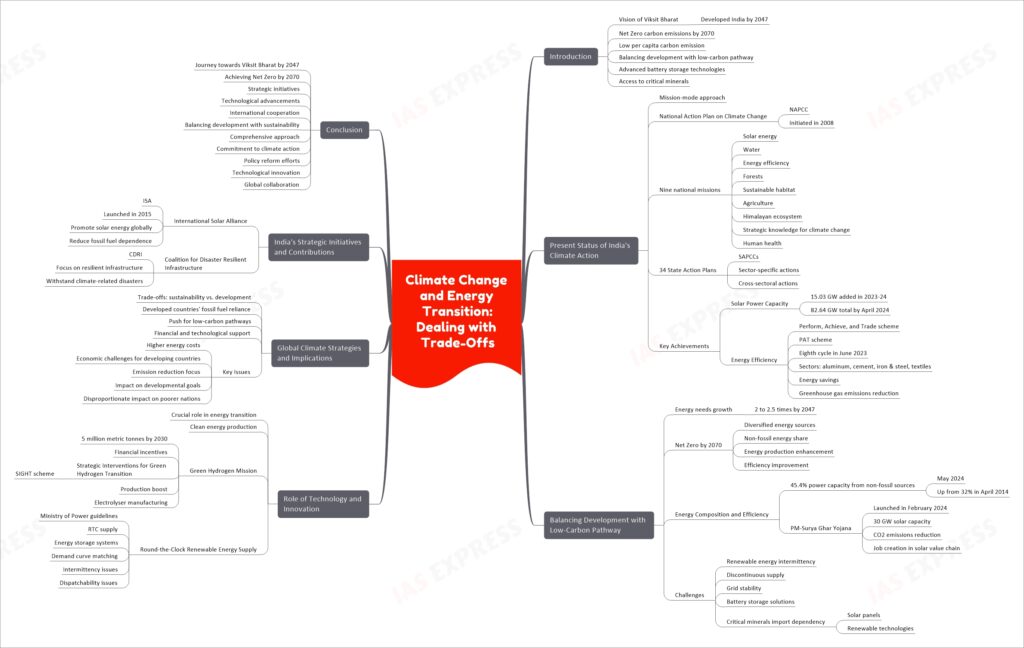

VII. Climate Change and Energy Transition: Dealing with Trade-Offs

Introduction

India’s vision of achieving a ‘Viksit Bharat’ (Developed India) by 2047 includes an ambitious goal of reaching Net Zero carbon emissions by 2070. Despite being one of the fastest-growing economies, India’s per capita carbon emission is significantly lower than the global average. The challenge lies in balancing the country’s development needs with a low-carbon pathway, especially when cleaner energy sources require advanced battery storage technologies and access to critical minerals.

Present Status of India’s Climate Action

India has adopted a mission-mode approach to address climate change. The National Action Plan on Climate Change (NAPCC), initiated in 2008, outlines the strategy to enhance the sustainability of the country’s development path. The NAPCC includes nine national missions covering various aspects like solar energy, water, energy efficiency, forests, sustainable habitat, agriculture, the Himalayan ecosystem, strategic knowledge for climate change, and human health. As of now, 34 State Action Plans on Climate Change (SAPCCs) are operational, laying out sector-specific and cross-sectoral actions.

Key Achievements:

- Solar Power Capacity: India added 15.03 GW of solar power capacity in 2023-24, reaching a cumulative 82.64 GW by April 2024.

- Energy Efficiency: The eighth cycle of the Perform, Achieve, and Trade (PAT) scheme was notified in June 2023, covering sectors like aluminum, cement, iron & steel, and textiles, aiming for significant energy savings and reduction in greenhouse gas emissions.

Balancing Development with Low-Carbon Pathway

India’s energy needs are expected to grow 2 to 2.5 times by 2047 to meet the developmental priorities of a growing economy. Achieving Net Zero by 2070 requires an orderly transition to a diversified mix of energy sources, with a significant share of non-fossils and enhancement in energy production and efficiency.

Energy Composition and Efficiency:

- As of May 2024, 45.4% of India’s power capacity is from non-fossil sources, up from 32% in April 2014.

- Initiatives like the PM-Surya Ghar Yojana launched in February 2024 aim to add 30 GW of solar capacity, reduce CO2 emissions, and create jobs across the solar value chain.

Challenges:

- Renewable energy faces issues of intermittency and discontinuous supply, impacting grid stability without viable battery storage solutions.

- The high dependency on imports for critical minerals for solar panels and other renewable technologies poses a systemic risk.

The Role of Technology and Innovation

Technology plays a crucial role in India’s energy transition. The focus is on harnessing technology for clean energy production while addressing the challenges of energy demand and storage.

Green Hydrogen Mission:

- India aims to produce 5 million metric tonnes (MMT) of green hydrogen by 2030. Financial incentives under the Strategic Interventions for Green Hydrogen Transition (SIGHT) scheme are in place to boost production and manufacturing of electrolysers.

Round-the-Clock Renewable Energy Supply:

- The Ministry of Power’s guidelines for Round-the-Clock (RTC) supply of renewable energy with energy storage systems ensure that renewable energy matches the buyer’s demand curve, addressing issues related to intermittency and dispatchability.

Global Climate Strategies and Their Implications

The global approach to climate change often ignores the trade-offs between environmental sustainability and economic development. Developed countries, having relied on fossil fuels for growth, now push developing nations to adopt low-carbon pathways without providing adequate financial and technological support.

Key Issues:

- Developed nations’ policies often result in higher energy costs and economic challenges for developing countries.

- The focus on reducing emissions sometimes undermines broader developmental goals, leading to a disproportionate impact on poorer nations.

India’s Strategic Initiatives and International Contributions

India’s approach to climate action includes significant international contributions and strategic initiatives aimed at sustainable development.

International Solar Alliance (ISA): Launched in 2015, the ISA aims to promote solar energy and reduce dependence on fossil fuels globally.

Coalition for Disaster Resilient Infrastructure (CDRI): This initiative focuses on building resilient infrastructure to withstand climate-related disasters.

Conclusion

India’s journey towards a Viksit Bharat by 2047 and achieving Net Zero by 2070 is marked by strategic initiatives, technological advancements, and international cooperation. Balancing economic development with environmental sustainability remains a complex challenge, but India’s comprehensive approach and commitment to climate action demonstrate a robust path forward. Continuous efforts in policy reform, technological innovation, and global collaboration will be crucial to achieving these ambitious goals.

VIII. Social Sector: Benefits That Empower

Introduction

India’s rapid economic growth in recent years has been accompanied by substantial social and institutional progress. The transformational implementation of government programs has played a significant role in improving health, education, sanitation, digital empowerment, and the quality of life in rural areas. This holistic approach has ensured the ease of living for all, with particular emphasis on women-led development, rural governance, and community participation.

Health and Sanitation

Healthcare Initiatives

Ayushman Bharat: Launched in 2018, this scheme aims to provide health coverage to over 100 million poor and vulnerable families, offering insurance coverage of ₹5 lakh per family per year for secondary and tertiary care hospitalization.

- Impact: Over 50 crore beneficiaries have been registered under the scheme, leading to significant improvements in health outcomes and financial protection.

Mission Indradhanush: This immunization program, launched in 2014, aims to cover all those children who are either unvaccinated or partially vaccinated against vaccine-preventable diseases.

- Achievements: The percentage of fully immunized children aged 12-23 months increased from 62% in 2014 to 90% in 2023.

Sanitation and Cleanliness

Swachh Bharat Mission (SBM): Launched in 2014, SBM aims to achieve an open defecation-free (ODF) India and improve solid waste management.

- Outcomes: As of 2023, 100 million household toilets have been constructed, significantly reducing the incidence of waterborne diseases and improving public health.

Jal Jeevan Mission: Initiated in 2019, this mission aims to provide safe and adequate drinking water through individual household tap connections by 2024.

- Progress: Over 8 crore households have been provided with tap water connections, improving health and reducing the burden on women who traditionally fetch water.

Education and Digital Empowerment

Educational Reforms

National Education Policy (NEP) 2020: This policy aims to overhaul the Indian educational system, promoting a more holistic, flexible, multidisciplinary approach.

- Key Features: Introduction of early childhood care and education (ECCE), reduction of curriculum content, and emphasis on critical thinking and creativity.

Pradhan Mantri Poshan Shakti Nirman (PM POSHAN): This scheme provides one hot cooked meal to school children to enhance their nutritional status.

- Impact: Benefits over 11 crore children in government and government-aided schools, reducing malnutrition and improving school attendance.

Digital Initiatives

Digital India: Launched in 2015, this initiative aims to transform India into a digitally empowered society and knowledge economy.

- Components: BharatNet for rural broadband connectivity, PMGDISHA for digital literacy, and e-Governance initiatives for seamless delivery of government services.

DIKSHA Platform: This platform offers teachers, students, and parents engaging learning material relevant to the prescribed school curriculum.

- Achievements: Over 3 crore users, with resources available in multiple Indian languages, ensuring inclusive and equitable education.

Women-Led Development

Empowerment Initiatives

Deendayal Antyodaya Yojana – National Rural Livelihoods Mission (DAY-NRLM): Launched in 2011, this mission aims to alleviate rural poverty through building sustainable community institutions of the poor.

- Impact: Mobilized over 8 crore rural women into Self Help Groups (SHGs), enhancing their income and socio-economic status.

Stand-Up India Scheme: Launched in 2016, this scheme facilitates bank loans between ₹10 lakh and ₹1 crore to at least one Scheduled Caste (SC) or Scheduled Tribe (ST) borrower and at least one woman borrower per bank branch for setting up a greenfield enterprise.

- Outcome: Empowered over 70,000 women entrepreneurs, fostering gender equality and economic independence.

Financial Inclusion

Pradhan Mantri Jan Dhan Yojana (PMJDY): This national mission aims to ensure access to financial services, including banking, savings and deposit accounts, remittance, credit, insurance, and pension.

- Achievements: Opened over 44 crore bank accounts, with a significant proportion held by women, thereby improving financial literacy and inclusion.

Rural Development and Governance

Rural Employment

Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA): Enacted in 2005, this act guarantees 100 days of wage employment per year to rural households.

- Results: Generated over 300 crore person-days of employment in 2023-24, significantly reducing rural distress and improving livelihoods.

Governance Reforms

Direct Benefit Transfer (DBT): This system transfers subsidies directly to the people through their bank accounts, reducing leakages and ensuring targeted delivery of benefits.

- Success: Over ₹38 lakh crore transferred via DBT since its inception in 2013, ensuring transparency and efficiency in welfare programs.

One Nation One Ration Card (ONORC): Launched in 2019, this initiative enables migrant workers and their families to access PDS benefits from any fair price shop across India.

- Impact: Facilitated over 24 crore portability transactions, ensuring food security for migrant populations.

Conclusion

India’s social sector progress, driven by comprehensive and inclusive government programs, has significantly improved the quality of life for its citizens. As the nation aims to achieve developed status by 2047, continuous efforts in health, education, sanitation, digital empowerment, and rural development are crucial. Empowering women, ensuring financial inclusion, and enhancing governance will play pivotal roles in this transformative journey towards a more equitable and prosperous society.

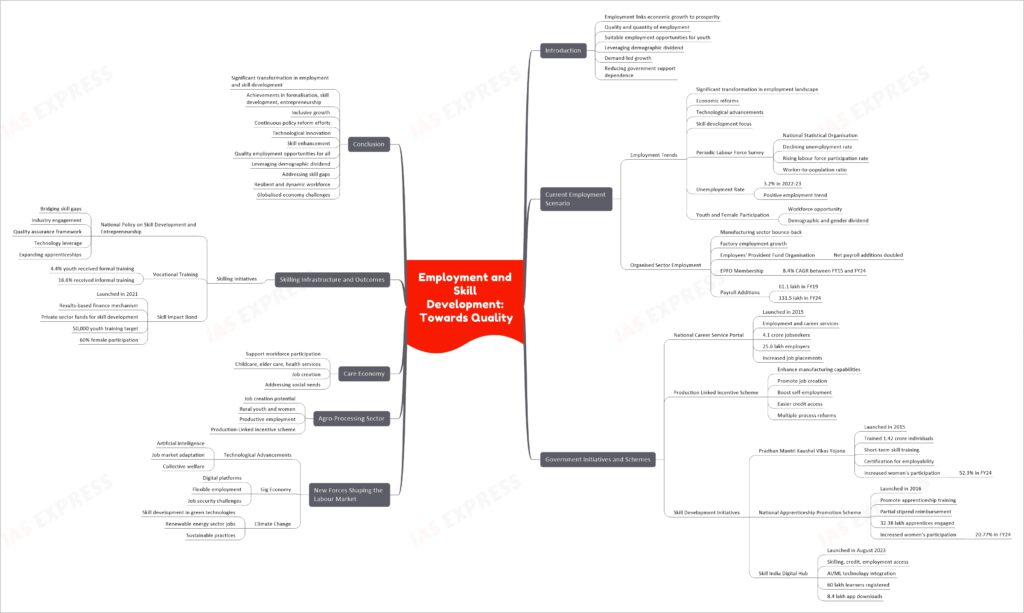

IX. Employment and Skill Development: Towards Quality

Introduction

Employment serves as the crucial link between economic growth and the overall prosperity of a population. The quality and quantity of employment determine how effectively economic output translates into better living standards. Generating suitable employment opportunities for India’s youth is essential to leverage the country’s demographic dividend and foster demand-led growth, reducing dependence on government support for dignified survival and sustenance.

Current Employment Scenario

Employment Trends

Over the past decade, India has witnessed a significant transformation in its employment landscape. This evolution is driven by economic reforms, technological advancements, and a focus on skill development. According to the Periodic Labour Force Survey (PLFS) by the National Statistical Organisation (NSO), the all-India annual unemployment rate for persons aged 15 years and above has been declining since the COVID-19 pandemic, accompanied by a rise in the labour force participation rate (LFPR) and worker-to-population ratio (WPR).

- Unemployment Rate (UR): The annual unemployment rate for 2022-23 was 3.2%, indicating a positive trend in employment.

- Youth and Female Participation: Rising youth and female participation in the workforce presents an opportunity to tap into the demographic and gender dividend.

Organised Sector Employment

The organised manufacturing sector exhibited a bounce-back in factory employment in FY22, with continued growth in employment and upscaling of factories. The net payroll additions under the Employees’ Provident Fund Organisation (EPFO) have more than doubled in the past five years, indicating healthy growth in formal employment.

- EPFO Membership: The EPFO membership numbers grew at an 8.4% Compound Annual Growth Rate (CAGR) between FY15 and FY24.

- Payroll Additions: The yearly net payroll additions to the EPFO increased from 61.1 lakh in FY19 to 131.5 lakh in FY24.

Government Initiatives and Schemes

National Career Service (NCS) Portal

Launched in 2015, the NCS Portal offers employment and career services. By March 2024, it had attracted 4.1 crore jobseekers and 25.6 lakh employers, with a significant increase in job placements.

Production Linked Incentive (PLI) Scheme

The PLI scheme aims to enhance India’s manufacturing capabilities and promote job creation. It has boosted self-employment by easing access to credit and implementing multiple process reforms.

Skill Development Initiatives

Pradhan Mantri Kaushal Vikas Yojana (PMKVY): Since its inception in 2015, PMKVY has trained over 1.42 crore individuals, focusing on short-term skill training and certification to enhance employability.

- Participation: Women’s participation in PMKVY increased from 42.7% in FY16 to 52.3% in FY24.

National Apprenticeship Promotion Scheme (NAPS): Launched in 2016, NAPS promotes apprenticeship training by reimbursing a partial stipend and supporting the cost of basic training. Over 32.38 lakh apprentices were engaged between FY17 and FY24.

- Women’s Participation: The participation of women in NAPS increased from 7.74% in 2016-17 to 20.77% in 2023-24.

Skill India Digital Hub: Launched in August 2023, this platform facilitates access to skilling, credit, and employment through AI/ML technology, integrating various skilling schemes and online courses.

- Registration: As of March 2024, 60 lakh learners were registered on the platform, with 8.4 lakh app downloads.

New Forces Shaping the Labour Market

Technological Advancements

Artificial Intelligence (AI): The integration of AI in various economic activities necessitates adapting the job market to steer technological choices towards collective welfare.

Gig Economy: The rise of gig work, driven by digital platforms, is reshaping traditional employment structures, offering flexibility but also posing challenges related to job security and benefits.

Climate Change

Adapting to climate change impacts requires skill development in green technologies and sustainable practices, creating new job opportunities in the renewable energy sector and environmentally sustainable industries.

Agro-Processing Sector

The agro-processing sector is identified as a fertile ground for job creation, particularly for rural youth and women. Promoting agro-processing can generate productive, intermediate, and large-scale employment, leveraging schemes like the Production-Linked Incentive (PLI) scheme.

Care Economy

Developing a well-structured care economy is essential to support workforce participation by women and cater to an ageing population. Investment in childcare, elder care, and health services can create numerous jobs while addressing social needs.

Skilling Infrastructure and Outcomes

Skilling Initiatives

National Policy on Skill Development and Entrepreneurship (NPSDE): This policy focuses on bridging skill gaps, improving industry engagement, establishing a quality assurance framework, leveraging technology, and expanding apprenticeship opportunities.

- Vocational Training: According to the PLFS report 2022-23, 4.4% of youth aged 15-29 years received formal vocational/technical training, while another 16.6% received informal training.

Skill Impact Bond

Launched in 2021, the Skill Impact Bond uses a results-based finance mechanism to attract private sector funds for skill development. It targets training 50,000 youth, with a focus on ensuring 60% female participation.

Conclusion

India’s employment and skill development landscape has undergone significant transformation over the past decade, with notable achievements in formalisation, skill development, entrepreneurship, and inclusive growth. Continuous efforts in policy reform, technological innovation, and skill enhancement are crucial to sustain this progress and ensure quality employment opportunities for all. By leveraging its demographic dividend and addressing skill gaps, India can build a resilient and dynamic workforce ready to meet the challenges of a globalised economy.

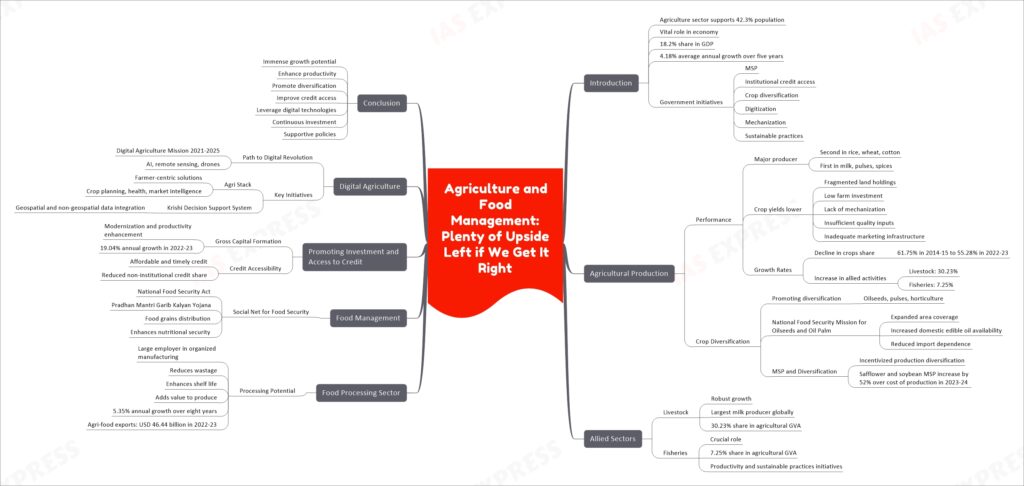

X. Agriculture and Food Management: Plenty of Upside Left if We Get It Right

Introduction

The Indian agriculture sector, supporting about 42.3% of the population, plays a vital role in the country’s economy with an 18.2% share in GDP. Over the last five years, the sector has grown at an average annual rate of 4.18%. Government initiatives such as assured remunerative prices through Minimum Support Price (MSP), improved access to institutional credit, crop diversification, digitization, mechanization, and sustainable practices have positively impacted the sector.

Agricultural Production: Performance and Promoting Crop Diversification

Performance

India is a major agricultural producer, ranking second in rice, wheat, and cotton production, and first in milk, pulses, and spices. However, crop yields are lower compared to other major producers due to factors such as fragmented land holdings, low farm investment, lack of mechanization, insufficient access to quality inputs, and inadequate marketing infrastructure.

Growth Rates:

- Crops: The share of crops in agricultural Gross Value Added (GVA) at current prices declined from 61.75% in 2014-15 to 55.28% in 2022-23.

- Allied Activities: Livestock and fisheries have performed better than traditional crops, with their shares in agricultural GVA increasing to 30.23% and 7.25%, respectively, in 2022-23.

Crop Diversification

Promoting crop diversification towards oilseeds, pulses, and horticulture is crucial for sustainable agricultural growth. Government measures such as the National Food Security Mission (NFSM) for Oilseeds and Oil Palm have significantly expanded the area coverage and increased domestic availability of edible oils, reducing import dependence.

MSP and Diversification:

- The increase in MSP for pulses and oilseeds has incentivized farmers to diversify production.

- Safflower and soybean saw MSP increases of 52% over the cost of production in 2023-24.

Allied Sectors: Animal Husbandry, Dairying, and Fisheries

Livestock

The livestock sector has shown robust growth, contributing significantly to farmers’ incomes. India is the largest milk producer globally, and the sector’s share in agricultural GVA increased to 30.23% in 2022-23.

Fisheries

Fisheries also play a crucial role in the agricultural economy, with a share of 7.25% in agricultural GVA. Initiatives to enhance productivity and sustainable practices in fisheries have contributed to this growth.

Food Processing Sector (FPI): Processing Potential

India’s food processing industry, one of the largest employers in organized manufacturing, has shown significant growth. The sector helps reduce wastage, enhance shelf life, and add value to agricultural produce.

Growth and Employment:

- The food processing industry grew at an average annual rate of 5.35% over the last eight years.

- The value of agri-food exports, including processed food, reached USD 46.44 billion in 2022-23.

Food Management: Social Net for Food Security

India’s food management system ensures food security through programs like the National Food Security Act (NFSA) and the Pradhan Mantri Garib Kalyan Yojana (PMGKAY). These programs distribute food grains to a significant portion of the population, enhancing nutritional security.

Promoting Investment and Access to Credit in Agriculture and Allied Sectors

Gross Capital Formation (GCF):

- Investment in agriculture is crucial for modernizing the sector and enhancing productivity.

- GCF in agriculture grew at an annual rate of 19.04% in 2022-23, indicating increased investment.

Credit Accessibility:

- Affordable and timely credit is essential for farmers. The share of non-institutional credit has reduced significantly, enhancing investment in the sector.

Digital Agriculture: Path to Digital Revolution

The integration of digital technologies in agriculture aims to modernize the sector. The Digital Agriculture Mission 2021-2025 focuses on using AI, remote sensing, drones, and other technologies to improve agricultural practices.

Key Initiatives:

- Agri Stack: A digital platform providing farmer-centric solutions for crop planning, health, and market intelligence.

- Krishi Decision Support System (Krishi-DSS): Integrates geospatial and non-geospatial data for better decision-making.

Conclusion

India’s agriculture sector holds immense potential for growth if managed correctly. Enhancing productivity, promoting diversification, improving access to credit, and leveraging digital technologies are critical steps towards achieving sustainable agricultural development. Continuous investment in infrastructure, technology, and supportive policies will ensure that the agriculture sector remains a cornerstone of India’s economy.

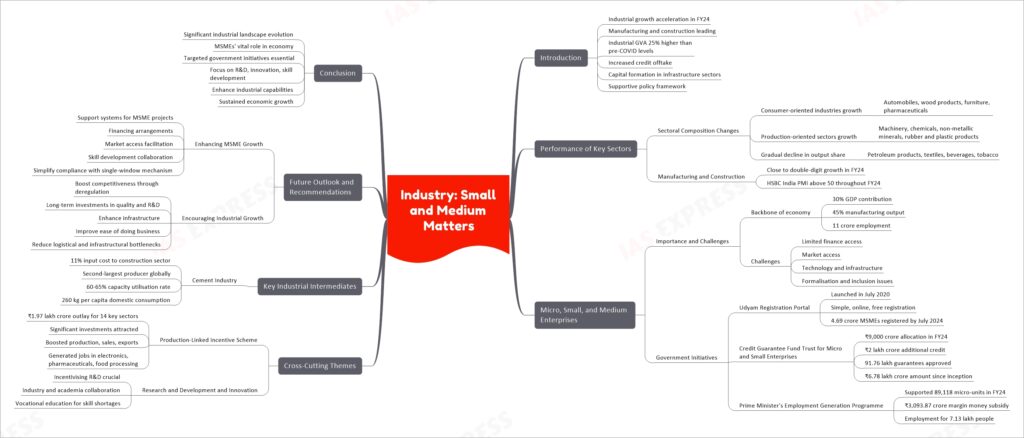

XI. Industry: Small and Medium Matters

Introduction

Industrial growth in India accelerated in FY24, with manufacturing and construction leading the way. Industrial Gross Value Added (GVA) at constant prices in FY24 was 25% higher than pre-COVID levels, reflecting a broad-based recovery. This recovery was supported by increased credit offtake, a focus on capital formation in infrastructure-oriented sectors, and a supportive policy framework.

Performance of Key Sectors and Related Issues

Sectoral Composition Changes

Over the past decade, there have been significant changes in India’s manufacturing landscape. Consumer-oriented industries like automobiles, wood products, furniture, and pharmaceuticals have seen substantial gains in output share. Production-oriented sectors such as machinery, chemicals, non-metallic minerals, and rubber and plastic products have also increased their share, balancing the growth dynamics. Meanwhile, sectors like petroleum products, textiles, beverages, and tobacco have experienced a gradual decline in output share.

Manufacturing and Construction

Manufacturing and construction achieved close to double-digit growth in FY24. The HSBC India Purchasing Managers’ Index (PMI) for manufacturing remained well above the threshold value of 50 throughout FY24, indicating sustained expansion and stability.

Micro, Small, and Medium Enterprises (MSMEs)

Importance and Challenges

MSMEs are the backbone of the Indian economy, contributing approximately 30% to the GDP, 45% to manufacturing output, and providing employment to 11 crore people. Despite their importance, MSMEs face challenges such as limited access to finance, markets, technology, and infrastructure, as well as issues with formalisation and inclusion.

Government Initiatives

To address these challenges, the government has implemented several initiatives:

- Udyam Registration Portal: Launched in July 2020, this portal has helped formalise MSMEs by providing a simple, online, and free registration process. As of July 2024, 4.69 crore MSMEs were registered on the portal.

- Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE): In FY24, the government allocated ₹9,000 crore to the CGTMSE, enabling additional credit of ₹2 lakh crore. The scheme has approved 91.76 lakh guarantees amounting to ₹6.78 lakh crore since inception.

- Prime Minister’s Employment Generation Programme (PMEGP): In FY24, this program supported 89,118 micro-units with a margin money subsidy of ₹3,093.87 crore, creating employment opportunities for around 7.13 lakh people.

Cross-Cutting Themes

Production-Linked Incentive (PLI) Scheme

The PLI scheme, with an outlay of ₹1.97 lakh crore for 14 key sectors, aims to enhance India’s manufacturing capabilities and exports. By May 2024, the scheme had attracted significant investments, boosted production, sales, and exports, and generated jobs, particularly in sectors like electronics, pharmaceuticals, and food processing.

Research and Development (R&D) and Innovation

Incentivising R&D and innovation is crucial for industrial growth. Commitment to R&D must be ingrained in the industry, with active collaboration between industry and academia and an emphasis on vocational education to address skill shortages.

Key Industrial Intermediates

Cement Industry

The cement industry, contributing approximately 11% of the input cost to the construction sector, has seen significant progress since de-licensing in 1991. India is now the second-largest cement producer in the world. The industry’s capacity utilisation rate has been around 60-65%, with domestic consumption at 260 kg per capita, indicating potential for growth.

Future Outlook and Recommendations

Enhancing MSME Growth

To foster the growth of MSMEs, several steps are recommended:

- Support Systems: Develop MSME projects and ensure adequate financing arrangements.

- Market Access: Provide grassroots-level facilitation to ensure market access for MSME products.

- Skill Development: Collaborate with industry and academia to upskill the workforce.

- Ease of Compliance: Simplify compliance requirements with a single-window mechanism for clearances and digitisation of processes.

Encouraging Industrial Growth

Public policy should focus on boosting competitiveness through deregulation, long-term investments in quality and R&D by the private sector, and enhancing infrastructure. The government’s initiatives to improve the ease of doing business and reduce logistical and infrastructural bottlenecks are crucial for further industrialisation.

Conclusion

The industrial landscape in India has evolved significantly over the past decade, with notable gains in various sectors. MSMEs continue to play a vital role in the economy, and targeted government initiatives are essential to address their challenges and support their growth. By focusing on R&D, innovation, and skill development, India can further enhance its industrial capabilities and achieve sustained economic growth.

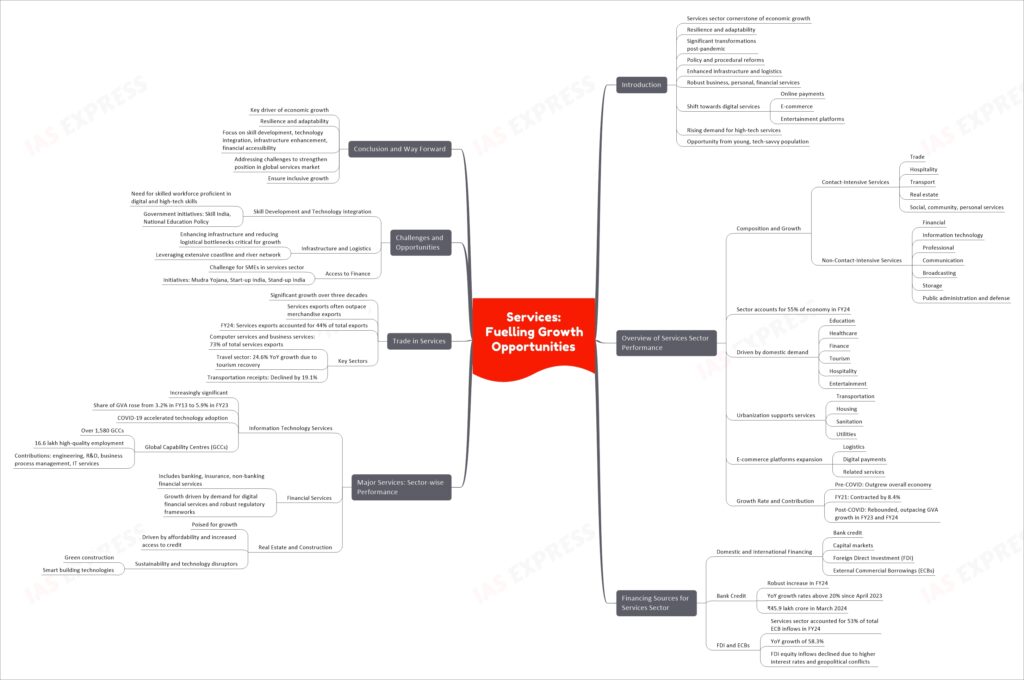

XII. Services: Fuelling Growth Opportunities

Introduction

The services sector has been the cornerstone of India’s economic growth over the past three decades, showing remarkable resilience and adaptability. The post-pandemic period, particularly FY24, has highlighted significant transformations within domestic service delivery systems. Emphasis on policy and procedural reforms, enhanced physical infrastructure, and logistics has led to the robust performance of business, personal, financial, and infrastructure-based services. A notable shift towards digital services, including online payments, e-commerce, and entertainment platforms, has emerged. The demand for high-tech services as inputs in other productive activities is also rising. India’s young and tech-savvy population provides an opportunity to further enhance the vocational and educational ecosystem, equipping the labor force with necessary digital and high-tech skills to fully leverage these opportunities.

Overview of the Services Sector Performance

Composition and Growth

India’s services sector encompasses a wide array of economic activities, broadly classified into contact-intensive and non-contact-intensive services:

- Contact-Intensive Services: Trade, hospitality, transport, real estate, social, community, and personal services.

- Non-Contact-Intensive Services: Financial, information technology, professional, communication, broadcasting, and storage services, including public administration and defense services.

The sector accounts for approximately 55% of the economy’s total size in FY24, driven by significant domestic demand for education, healthcare, finance, tourism, hospitality, and entertainment services. Rapid urbanization supports the transportation, housing, sanitation, and utility services sectors. The expansion of e-commerce platforms has heightened the need for logistics, digital payments, and related services.

Growth Rate and Contribution:

- For a decade before COVID-19, the services sector consistently outgrew the overall economy.

- In FY21, the sector contracted by 8.4%, while overall GVA declined by 4.1%.

- Post-COVID-19, the sector rebounded, outpacing overall GVA growth in FY23 and FY24.

Financing Sources for Services Sector Activity

Domestic and International Financing

The services sector meets its financing needs through various domestic and international sources, including bank credit, capital markets, Foreign Direct Investment (FDI), and External Commercial Borrowings (ECBs).

- Bank Credit: FY24 saw a robust increase in credit inflows to the services sector, with year-on-year (YoY) growth rates consistently above 20% since April 2023. Outstanding services sector credit reached ₹45.9 lakh crore in March 2024.

- FDI and ECBs: The services sector accounted for 53% of total ECB inflows in FY24, with a YoY growth of 58.3%. However, FDI equity inflows to the services sector declined due to higher interest rates, geopolitical conflicts, and global uncertainties.

Major Services: Sector-wise Performance

Information Technology Services

The IT and IT-enabled services sector has become increasingly significant, with its share of total GVA rising from 3.2% in FY13 to 5.9% in FY23. The COVID-19 pandemic accelerated the adoption of technology-driven solutions, further fuelling the sector’s growth.

- Global Capability Centres (GCCs): India hosts over 1,580 GCCs, providing high-quality employment to more than 16.6 lakh people. GCCs contribute significantly to economic growth through engineering, research and development, business process management, and IT services.

Financial Services

India’s financial services sector includes banking, insurance, and other non-banking financial services. The sector has shown resilience and growth, driven by increased demand for digital financial services and robust regulatory frameworks.

Real Estate and Construction

The real estate sector is poised for growth, driven by affordability and increased access to credit. Sustainability and technology are key disruptors, influencing green construction practices and smart building technologies.

Trade in Services

India’s export of services has grown significantly over the past three decades, often outpacing merchandise exports. Services exports accounted for 44% of India’s total exports in FY24.

- Key Sectors: Computer services and business services exports constitute about 73% of total services exports. The travel sector saw a YoY growth of 24.6% due to the recovery in tourism, while transportation receipts declined by 19.1%.

Challenges and Opportunities

Skill Development and Technology Integration

The rapid digitization of the services sector necessitates a skilled workforce proficient in digital and high-tech skills. Government initiatives like Skill India and the National Education Policy aim to bridge this gap.

Infrastructure and Logistics

Enhancing infrastructure and reducing logistical bottlenecks are critical for the growth of the services sector. Leveraging India’s extensive coastline and river network can improve transportation efficiency and reduce costs.

Access to Finance

Access to finance remains a challenge for small and medium enterprises (SMEs) in the services sector. Initiatives like Mudra Yojana, Start-up India, and Stand-up India aim to ease credit accessibility and support SME growth.

Conclusion and Way Forward

India’s services sector is a key driver of economic growth, showing resilience and adaptability in the face of global challenges. Continued focus on skill development, technology integration, infrastructure enhancement, and financial accessibility will be crucial for sustaining growth and leveraging new opportunities. By addressing these challenges, India can further strengthen its position in the global services market and ensure inclusive growth.

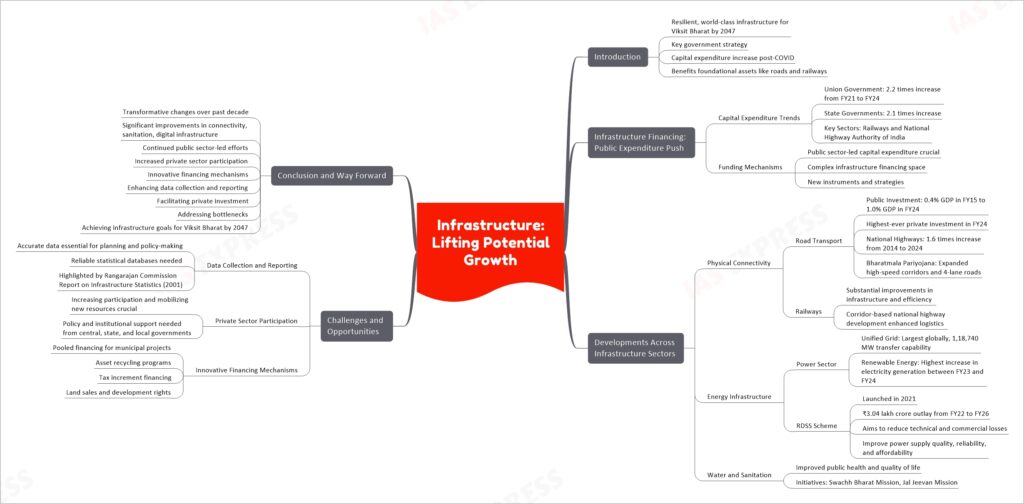

XIII. Infrastructure: Lifting Potential Growth

Introduction

The creation of resilient, world-class infrastructure is a key component of India’s strategy to become a Viksit Bharat (Developed India) by 2047. Infrastructure development, encompassing physical, social, financial, and digital infrastructure, has been at the forefront of government initiatives, especially following the economic slowdown caused by the COVID-19 pandemic. Capital expenditure by the government has seen a significant increase, particularly benefiting foundational assets like roads and railways.

Infrastructure Financing: The Public Expenditure Push

Capital Expenditure Trends

- Union Government: Capital expenditure increased by 2.2 times from FY21 to FY24.

- State Governments: Capital expenditure increased by 2.1 times during the same period.

- Key Sectors: Gross budgetary support for railways and the National Highway Authority of India increased from 36.4% to 42.9% of total capital expenditure between FY21 and FY24.

Funding Mechanisms

Despite innovations in infrastructure financing, public sector-led capital expenditure remains crucial for large-scale projects. The complexity of the infrastructure financing space, with various new instruments and strategies, makes it challenging to aggregate the total flow of funds.

Developments Across Infrastructure Sectors

Physical Connectivity

Road Transport

- Public Investment: Capital investment rose from 0.4% of GDP in FY15 to about 1.0% of GDP in FY24.

- Private Investment: The sector attracted its highest-ever private investment in FY24.

- National Highways: The length of national highways increased by 1.6 times from 2014 to 2024. The Bharatmala Pariyojana expanded high-speed corridors by 12 times and 4-lane roads by 2.6 times during the same period.

Railways

The railways sector has seen substantial improvements in infrastructure and efficiency, supported by increased public and private investments. The systematic push through corridor-based national highway development has enhanced logistics efficiency.

Energy Infrastructure

Power Sector

- Unified Grid: India operates one of the largest unified electricity grids globally, with an inter-regional transfer capability of 1,18,740 MW.

- Renewable Energy: Renewable energy resources have seen the highest increase in electricity generation between FY23 and FY24.

RDSS Scheme

- Revamped Distribution Sector Scheme (RDSS): Launched in 2021 with an outlay of around ₹3.04 lakh crore from FY22 to FY26, aiming to reduce technical and commercial losses and improve the quality, reliability, and affordability of power supply.

Water and Sanitation

Infrastructure development in water and sanitation has improved public health and quality of life, particularly through initiatives like the Swachh Bharat Mission and the Jal Jeevan Mission.

Challenges and Opportunities

Data Collection and Reporting

Accurate data on infrastructure investment and utilization is essential for effective planning and policy-making. The need for reliable statistical databases, as highlighted by the Rangarajan Commission Report on Infrastructure Statistics (2001), remains critical.

Private Sector Participation

Increasing private sector participation and mobilizing resources from new sources are essential for sustained infrastructure development. Policy and institutional support from central, state, and local governments are crucial for this.

Innovative Financing Mechanisms

Innovative approaches like pooled financing for municipal projects, asset recycling programs, tax increment financing, and land sales and development rights can facilitate resource mobilization for infrastructure development.

Conclusion and Way Forward

India’s infrastructure landscape has seen transformative changes over the past decade, with significant improvements in road, rail, air connectivity, sanitation, and digital infrastructure. Continued public sector-led efforts, combined with increased private sector participation and innovative financing mechanisms, are essential for sustaining this growth. Enhancing data collection and reporting, facilitating private investment, and addressing bottlenecks will be crucial in achieving India’s infrastructure goals and supporting its vision of becoming a Viksit Bharat by 2047.

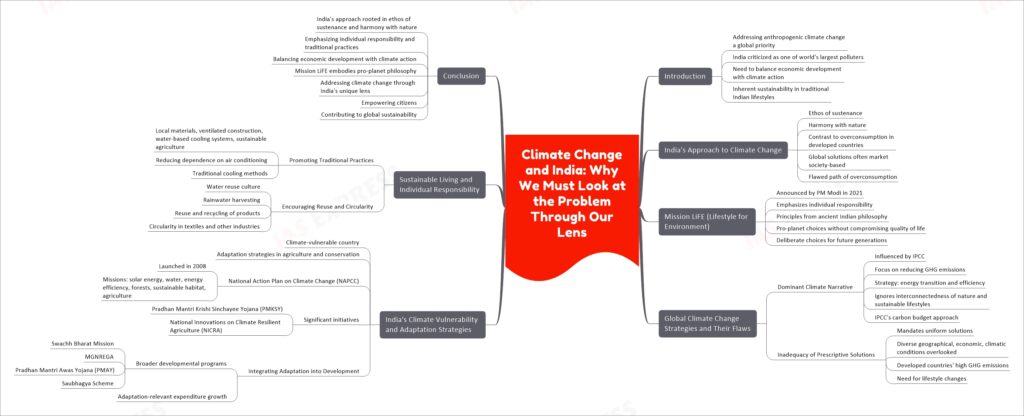

XIV. Climate Change and India: Why We Must Look at the Problem Through Our Lens

Introduction

Addressing anthropogenic climate change has emerged as a global priority, with multilateral bodies, experts, and the media urging nations worldwide to mitigate a potential climate catastrophe. Despite India’s significant strides in the last decade, it continues to be labeled one of the world’s largest polluters, often criticized for not doing enough. This criticism overlooks two crucial points: the need for India to balance economic development with meaningful climate action and the inherent sustainability in traditional Indian lifestyles.

India’s Approach to Climate Change

India’s ethos, rooted in the principles of sustenance, emphasizes a harmonious relationship with nature. This is in stark contrast to the overconsumption seen in developed countries. The global solutions to climate change are often based on a market society approach, substituting means to achieve overconsumption rather than addressing overconsumption itself. This approach has led to policies with unintended consequences, resulting in minimal reduction in carbon emissions. India, with its large population, cannot afford to follow this flawed path and must look at the problem through its lens to balance economic development and climate action.

Mission LiFE (Lifestyle for Environment)

In 2021, Prime Minister Narendra Modi announced Mission LiFE at the UN Climate Change Conference. This initiative seeks to bring individual responsibility to the forefront of climate action, drawing principles from ancient Indian philosophy. Mission LiFE advocates for making pro-planet choices without compromising on quality of life, emphasizing deliberate choices that consider future generations. The mission encourages addressing the “wants” of people in ways that do not harm nature.

Global Climate Change Strategies and Their Flaws

The Dominant Climate Narrative

The global approach to climate change, heavily influenced by the Intergovernmental Panel on Climate Change (IPCC), emphasizes reducing greenhouse gas (GHG) emissions, particularly carbon dioxide (CO2). However, the strategy adopted worldwide, focusing on energy transition and efficiency, often ignores the inherent interconnectedness of nature and the need for sustainable lifestyles. The IPCC’s carbon budget quantifies the remaining carbon space available to limit global warming, yet this approach fails to address the fundamental issue of overconsumption prevalent in developed countries.

The Inadequacy of Prescriptive Solutions

Global climate strategies tend to be prescriptive, mandating uniform solutions for diverse geographical, economic, and climatic conditions. This one-size-fits-all approach fails to account for natural ideas relevant to sustainable development, such as local consumption patterns and plant-based diets. Developed countries, with their high GHG emissions from sectors like power, transport, and agriculture, often overlook the need for lifestyle changes that reduce consumption and environmental impact.

India’s Climate Vulnerability and Adaptation Strategies

India is one of the most climate-vulnerable countries, necessitating adaptive strategies in agriculture and conservation to mitigate climate change’s detrimental effects. The Government of India’s National Action Plan on Climate Change (NAPCC), launched in 2008, includes missions focused on solar energy, water, energy efficiency, forests, sustainable habitat, and agriculture. The promotion of micro-irrigation under the Pradhan Mantri Krishi Sinchayee Yojana (PMKSY) and the introduction of the National Innovations on Climate Resilient Agriculture (NICRA) are significant initiatives to enhance agricultural resilience.

Integrating Adaptation into Development

India’s adaptation efforts are integrated into broader developmental programs such as the Swachh Bharat Mission, Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA), Pradhan Mantri Awas Yojana (PMAY), and the Saubhagya Scheme. The Initial Adaptation Communication estimates that adaptation-relevant expenditure grew from 3.7% of GDP in 2015-16 to 5.60% in 2021-22, reflecting the government’s focus on climate resilience.

Sustainable Living and Individual Responsibility

Promoting Traditional Practices

India’s traditional practices, such as using local materials, ventilated construction, water-based cooling systems, and sustainable agriculture, offer valuable lessons in sustainability. For instance, reducing dependence on air conditioning and promoting traditional cooling methods can significantly lower energy consumption and urban heat islands.

Encouraging Reuse and Circularity

Building a culture of water reuse through individual behavior change and design specifications like rainwater harvesting is essential. Similarly, promoting the reuse and recycling of products, such as textile waste, can significantly reduce environmental impact. Policies supporting circularity in textiles and other industries can enhance sustainability.

Conclusion

India’s approach to climate change must be rooted in its ethos of sustenance and harmony with nature. By emphasizing individual responsibility and traditional practices, India can balance economic development with meaningful climate action. Mission LiFE embodies this philosophy, advocating for deliberate, pro-planet choices that consider future generations. Addressing climate change through India’s unique lens will enable the nation to empower its citizens while contributing to global sustainability.

Practice Questions

- Analyze the impact of recent fiscal policies on India’s economic growth and fiscal deficit. Discuss the effectiveness of these policies in achieving sustainable economic development. (250 words)

- Evaluate the role of digital infrastructure in transforming India’s service sector. How has it contributed to economic growth and what challenges remain? (250 words)

- Critically assess the effectiveness of government initiatives in addressing climate change and promoting sustainable development in India. What further measures are needed? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.