Why ‘de-dollarization’ is imminent?

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

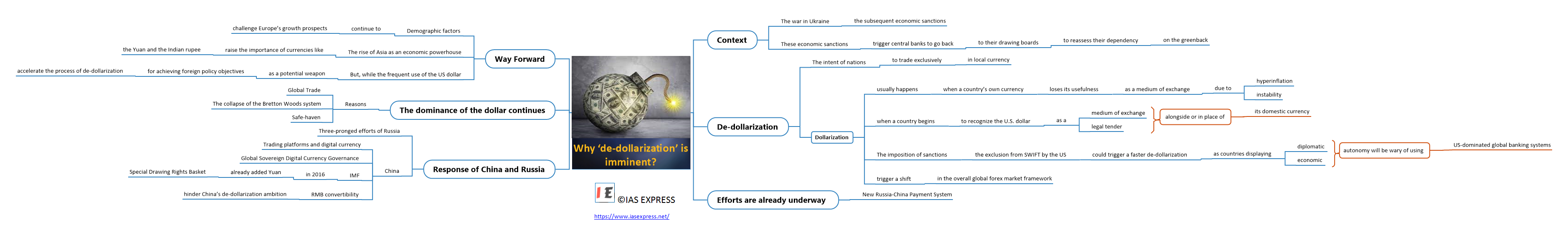

Context

- The war in Ukraine and the subsequent economic sanctions.

What the editorial is about?

- How do these economic sanctions trigger central banks to go back to their drawing boards to reassess their dependency on the greenback?

De-dollarization

- Dollarization usually happens when a country’s own currency loses its usefulness as a medium of exchange, due to hyperinflation or instability.

- Dollarization is when a country begins to recognize the U.S. dollar as a medium of exchange or legal tender alongside or in place of its domestic currency.

- De-dollarization is the intent of nations to trade exclusively in local currency.

- Most recently, some countries such as Iran and Russia announced their intention to do so, positioning themselves to be less affected by U.S. financial sanctions.

- The imposition of sanctions and the exclusion from SWIFT by the US could trigger a faster de-dollarization as countries displaying diplomatic and economic autonomy will be wary of using US-dominated global banking systems.

New Russia-China Payment System

- Efforts are already underway for the possible introduction of a new Russia-China payment system, bypassing SWIFT and combining the Russian SPFS (System for Transfer of Financial Messages) with the Chinese CIPS (Cross-Border Interbank Payment System).

Global forex market

- This can also trigger a shift in the overall global forex market framework.

- The US dollar, which is the world’s reserve currency, can see a steady fall in the current context as leading central banks may look to diversify their reserves away from it to other assets or currencies like the Euro, Renminbi or gold.

Response of China and Russia

Three-pronged efforts of Russia

- Russia had started its three-pronged efforts towards de-dollarization in 2014 when sanctions were imposed on it for the annexation of Crimea.

- However, these steps haven’t sufficed to effectively shield “fortress Russia”.

Trading platforms and digital currency

- China, on the other hand, aims to use trading platforms and its digital currency to promote de-dollarization.

- China has established RMB trading centres in Hong Kong, Singapore and Europe.

Global Sovereign Digital Currency Governance

- In 2021, the People’s Bank of China submitted a “Global Sovereign Digital Currency Governance” proposal at the Bank for International Settlements to influence global financial rules via its digital currency, the e-Yuan.

Special Drawing Rights

- The IMF has already added Yuan to its SDR (Special Drawing Rights) basket in 2016.

- In 2017, the European Central Bank exchanged EUR 500 million worth of its forex reserves into Yuan-denominated securities.

RMB convertibility

- However, the lack of full RMB convertibility will hinder China’s de-dollarization ambition.

Despite these efforts, the US dollar continues to reign

Global Trade

- Currently, about 60 per cent of foreign exchange reserves of central banks and about 70 per cent of global trade is conducted using USD.

The collapse of the Bretton Woods system

- The status of the dollar was enhanced by the collapse of the Bretton Woods system, which essentially eliminated other developed market currencies from competing with the USD.

Safe-haven

- The association of the USD as a “safe-haven” asset also has a psychological angle to it and like old habits, people continue to view the currency as a relatively risk-free asset.

How the dominance of the dollar helps the US government?

- This status of the reserve currency allows the US government to refinance its debt at a low cost in addition to providing foreign policy leverage.

- Additionally, sudden dumping of dollar assets by adversarial central banks will also pose balance sheet risks to them as it will erode the value of their overall dollar-denominated holdings.

Way Forward

- Demographic factors will continue to challenge Europe’s growth prospects.

- The rise of Asia as an economic powerhouse will raise the importance of currencies like the Yuan and the Indian rupee.

- But, while the frequent use of the US dollar as a potential weapon for achieving foreign policy objectives will no doubt accelerate the process of de-dollarization, there is still a long road ahead.

Practice Question for Mains

- Diversification away from USD is meant to insulate economies from geopolitical risks. Critically comment. (250 Words, 15 Marks)

Referred Sources

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.