Cereal Inflation- Causes & Concerns

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

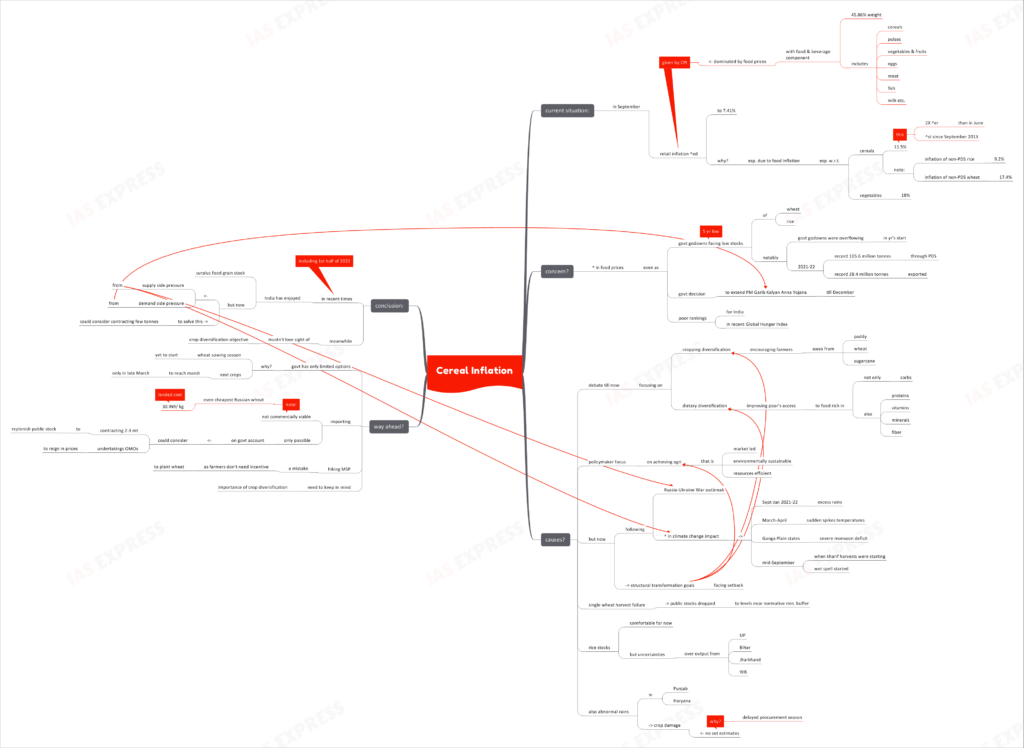

What is the current situation?

- In September, the retail inflation spiked to 7.41%. Retail inflation rate is given by the Consumer Price Index.

- It is to be noted that food prices dominate the CPI, with food and beverage component accounting for 45.86% weight of CPI. Some of the food items, whose prices are considered for CPI, include cereals, pulses, fruits and vegetables, milk, eggs, meat, fish, etc.

- This spike has resulted from the increase in food inflation– especially with respect to vegetable and cereal prices:

- In September, the cereals and products subcategory showed an inflation of 11.5%– over twice what it was in June and the highest since September 2013.

- The inflation of non-PDS rice stood at 9.2%.

- The inflation of non-PDS wheat was pegged at 17.4%.

- The vegetables subcategory showed an inflation print of 18%.

- In September, the cereals and products subcategory showed an inflation of 11.5%– over twice what it was in June and the highest since September 2013.

Why is this concerning?

- This spike in food prices comes even as government godowns are witnessing a 5-year low in total wheat and rice stocks.

- The current situation is especially striking given how the same godowns were overflowing with grain stocks in the beginning of the year.

- In 2021-22, a record 105.6 million tonnes of wheat and rice was channel through the PDS and a record 28.4 million tonnes were exported.

- The government had recently decided to extend the PM Garib Kalyan Anna Yojana till December- which would increase the pressure on public stocks.

- The recent Global Hunger Index highlighted a drop in India’s performance.

What caused this situation?

- Till now, the debate focused on achieving cropping and dietary diversification i.e. encouraging farmers away from cultivating paddy, wheat and sugarcane and also improving the poor’s access to food rich in protein, vitamins, fiber and minerals, alongside carbohydrates.

- The focus of policymakers has been on achieving a market-led, environmentally sustainable and resource-efficient agricultural sector.

- However, now, these structural transformation goals have faced a setback because of the Russia-Ukraine War and the subsequent global economic disruptions.

- The growing impact of climate change is adding to the mix

- September to January 2021-22 witnessed excess rains.

- March to April period saw sudden spikes in temperature.

- The Gangetic Plain states suffered severe monsoon deficits.

- In mid-September, right when the kharif crops were about to be harvested, the wet spell began.

- A single wheat harvest failure has caused the public stocks to decline to levels near normative minimum buffer.

- The rice stocks are a comfortable level, but there is uncertainty over the output from UP, Bihar, Jharkhand and West Bengal.

- The abnormal rains have damaged crops in Haryana and Punjab. The extent of loss would become apparent only as the procurement season progresses.

What is the way ahead?

- The government is left with only limited options as the wheat sowing season is yet to start and the next crop would not be reaching the mandis before March.

- Importing isn’t a commercially viable option, for even the cheapest Russian wheat costs 30 INR/ kg. Given how importing is possible only on government account, the government may consider contracting 2-3 million tonnes of import to replenish public stocks and undertake OMOs (open market operations) to reign the prices in.

- Hiking MSP, in the current situation, would be a mistake. Also Indian farmers don’t need special incentives to sow wheat.

- Meanwhile, it should be kept in mind that the cereal inflation situation doesn’t weaken the case for crop diversification.

Conclusion:

In the recent years and even in the first half of 2022, India has enjoyed surplus foodgrain stocks. However, the global supply chain disruption and the increasing impacts of climate change has triggered supply-side inflationary pressure while the decision to extend the free grain scheme could increase the demand-side pressure. For now, the government could consider contracting a few tonnes to keep prices within check. Meanwhile, the objective of crop diversification mustn’t be forgotten.

Practice Question for Mains:

Discuss the significance of cereal inflation in India. Examine the reasons and possible solutions. (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.