Finfluencers- Reasons for Popularity & the Need for Regulation

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

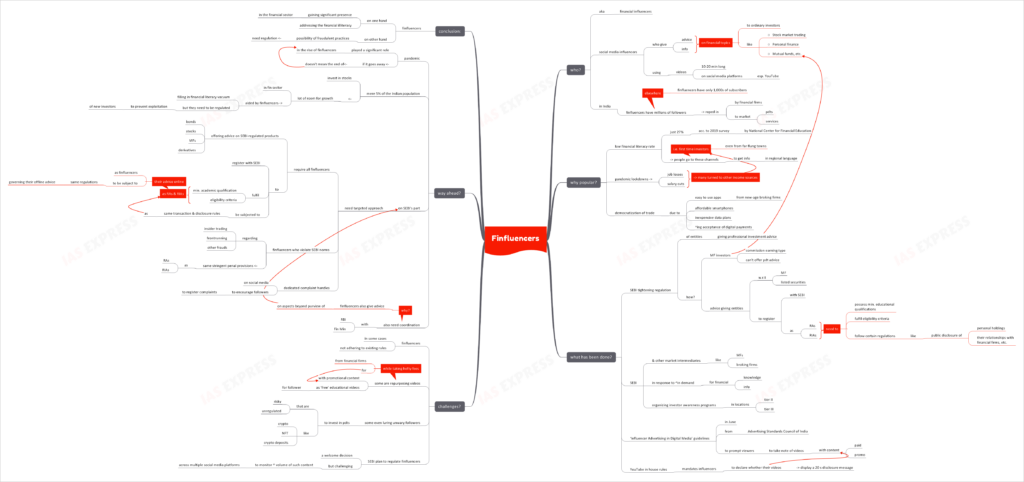

During the lockdowns, many turned to social media platforms to inform their entry into the investment market. As a result, the finfluencer segment has taken firm roots and is now flourishing. AT the same time, the situation presents risk of large scale frauds. Recently, SEBI announced plans to formulate regulations for the emerging finfluencer segment.

Who are finfluencers?

- Finfluencers or financial influencers are those social media influencers who give out information and advice on a range of financial topics to the ordinary investors.

- They cover topics like:

- Stock market trading

- Personal finance

- Mutual funds, etc.

- They make use of social media, especially YouTube, to reach out to their viewers, often using 10-20 minute long videos.

- While finfluencers abroad have thousands of subscribers to their channels, Indian finfluencers have following that goes into millions.

- Given their growing clout, financial firms are now roping in finfluencers to market their products and services.

Why are they gaining popularity?

- The growing popularity could be explained by the low financial literacy rate in India. According to a 2019 survey by the National Centre for Financial Education, a mere 27% of Indians are financially literate.

- In such a scenario, these channels providing informative content, often in regional languages, attract first time investors from even the far flung towns.

- The pandemic has been a strong catalyst for their rising influence. The lockdown and the resulting salary cuts and job losses pushed many to seek alternative income sources.

- In these recent years, new-age broking firms have been launching easy-use-use mobile applications. This combined with affordable smartphones, inexpensive data plans and the increasing acceptance of digital payments has helped democratize trade.

What has been done?

- Recently, Securities Exchange Board of India/ SEBI has been tightening the regulation of entities offering professional investment advice. For instance,

- Mutual fund distributors, who earn commission, are prohibited from offering product advice.

- Entities offering advice on listed securities or mutual funds are required to be registered, as Research Analysts or Registered Investment Advisers, with the SEBI.

- These RAs and RIAs are to possess minimum academic qualifications and fulfil the eligibility criteria.

- The SEBI subjects registered advisers to regulations like public disclosure of personal holdings, their relationships with financial firms, etc.

- In response to the rise in demand for financial knowledge and information, SEBI and other market intermediaries like mutual funds and broking firms have been organizing investor awareness programs in Tier-II and Tier-III places.

- In June this year, the Advertising Standards Council of India released the ‘Influencer Advertising in Digital Media’ guidelines to prompt viewers to take note of videos with paid or promotional content.

- YouTube itself has certain in-house rules. It mandates influencers to declare whether their videos contain paid promotion. Such videos display a 20 second disclosure message.

What are the challenges?

- In some cases, finfluencers are giving out financial advice without adhering to any of the general rules that are already in place.

- Finfluencers tend to re-purpose videos with promotional content as ‘free’ educational videos for their follower base, for which they take hefty fees from the financial firms.

- In some cases, finfluencers have even lured their unwary followers into investing in unregulated risky products like cryptos, NFTs and crypto deposits.

- Though the SEBI plan to regulate financial advisors on social media is a welcome decisions, monitoring the enormous volume of such content across multiple social media platform will be a challenging task.

What is the way ahead?

- While the pandemic may have played a significant role in the rise of finfluencers, its subsidence isn’t expected to expected to take the financial influencers’ segment down with it.

- Currently, a mere 5% of the Indian population invest in stocks. This means there is significant room for growth in the financial sector, and the finfluencers are filling the country’s financial literacy vacuum.

- However, finfluencers need to be regulated to prevent exploitation of the new retail investors.

- SEBI would do well to adopt a targeted approach:

- It could require all finfluencers, offering advice on SEBI-regulated products like bonds, stocks, mutual funds and derivatives, to register with the Board.

- It could apply the same qualification criteria to these influencers as RIAs.

- Finfluencers violating SEBI regulations regarding insider trading, frontrunning and other fraudulent practices must be subject to the same stringent penal provisions as mainstream players.

- Transaction and disclosure rules that apply to RAs’ and RIAs’ offline advice should also apply to their advice provided on social media platforms.

- The Board could launch dedicated complaint handles on social media platforms to encourage followers to report violations.

- Finfluencers also provide content that are beyond SEBI’s purview. Hence, their regulation requires the involvement of others like RBI and the Finance Ministry.

Conclusion:

Finfluencers are gaining significant presence in the financial sector and they are addressing the financial illiteracy in India. On the other hand, the situation is also a recipe for fraudulent practices like frontrunning. Hence, regulation is key.

Practice Question for Mains:

Comment on the rise of finfluencers in India. How can they be regulated? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.