Integration of Credit Card to Unified Payments Interface (UPI) – Need, Benefits and Challenges

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

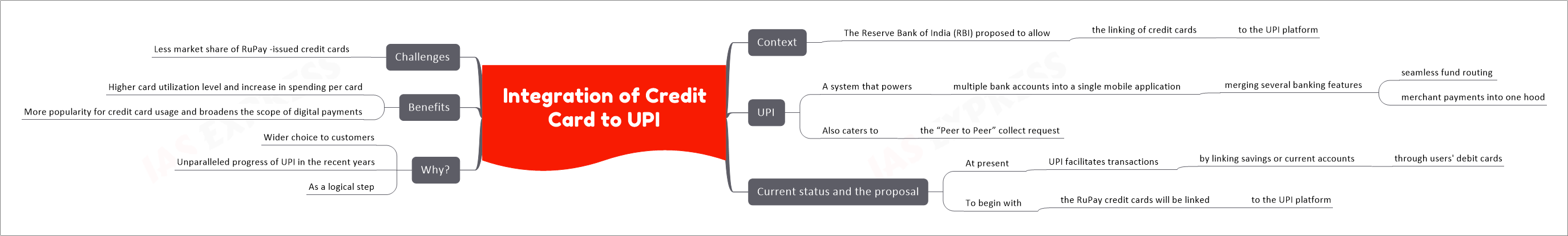

Context: The Reserve Bank of India (RBI) has proposed to allow the linking of credit cards to the UPI platform.

Unified Payments Interface (UPI)

- Unified Payments Interface (UPI) is a system that powers multiple bank accounts into a single mobile application (of any participating bank), merging several banking features, seamless fund routing & merchant payments into one hood.

- It also caters to the “Peer to Peer” collect request which can be scheduled and paid as per requirement and convenience.

Current status and the proposal

- At present, UPI facilitates transactions by linking savings or current accounts through users’ debit cards.

- To begin with, the Rupay credit cards will be linked to the UPI platform, which will provide additional convenience to the users and enhance the scope of digital payments.

Why such a move?

The wider choice for customers:

- The basic objective of linking credit cards to UPI is to provide customers with a wider choice of payments.

- Currently, UPI is linked through debit cards and bank accounts. Now, you can link your credit cards, too, which improves the journey.

Unparalleled progress of UPI in the recent years:

- The progress of UPI in recent years has been unparalleled. UPI has become the most inclusive mode of payment in India with over 26 crore unique users and five crore merchants on the platform. In May 2022 alone, around 594 crores amounting to Rs 10.4 lakh crore was processed through UPI.

- Many other countries are engaged with us in adopting similar methods in their countries.

As a logical step:

- Credit cards serve two primary purposes: convenient payments and short-term liquidity, hence this is a logical step.

Benefits of such a move

Higher card utilization level and increase in spending per card:

- Permitting UPI-based payments to credit cards could lead to some of the upfront spendings from savings/current accounts shifting to credit cards, which in turn could drive higher card utilization levels and an increase in spending per card for banks that operate a higher share of RuPay cards.

More popularity for credit card usage and broadens the scope of digital payments:

- With the added layer of a credit card linked to UPI, we believe that customers who didn’t have access to a credit card previously but want the experience of a 30-day interest-free credit will now get to do it, thereby broadening the scope of digital payments.

Challenges associated with this move

Less market share of RuPay-issued credit cards:

- As RuPay-issued credit cards are still gaining market share, this is unlikely to grow materially in the near term unless the enhancement in UPI linking is extended to other card platform operators as well.

Practice Question for Mains

- UPI has already proven its utility by its widespread adoption and bringing the same convenience to access credit can be a watershed moment for credit penetration in India. Discuss. (15 Marks, 250 Words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.