The digital tax challenges – Two-pillar approach and associated concerns

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

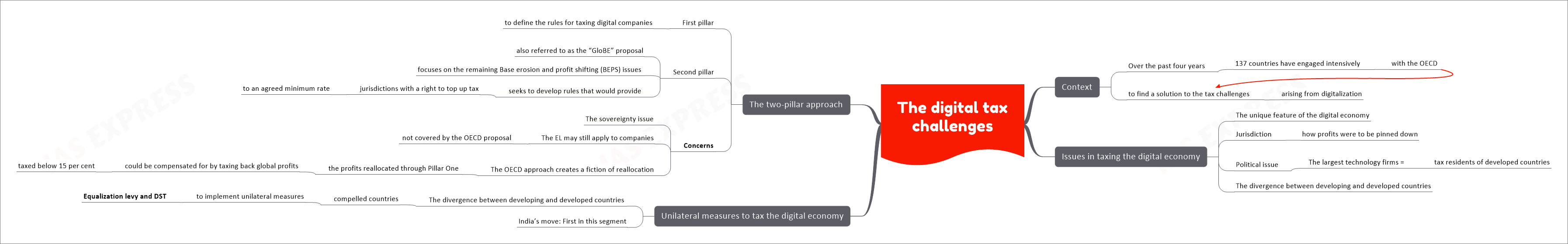

Context: Over the past four years, 137 countries have engaged intensively with the OECD to find a solution to the tax challenges arising from digitalisation. Like any international agreement, finding a middle ground has been difficult and a series of compromises have been made.

Taxing the digital economy: Related issues

Unique feature:

- The unique feature of the digital economy is that firms can operate seamlessly across borders and users and their data contribute to their profits. However, this made it harder to tax such an economy.

Jurisdiction:

- It was not clear how profits were to be pinned down to any jurisdiction.

Political issue:

- This became a political issue because the largest technology firms are tax residents of developed countries and redefining digital presence as the basis of taxation would potentially allow large markets like India more right to tax.

The divergence between developing and developed countries

- Developing countries wanted the profits from digital operations should be fractionally apportioned to markets while developed countries believe that a fraction of residual profit, mainly arising from marketing functions, should be taxed in markets.

Unilateral measures to tax the digital economy

- The divergence between developing and developed countries compelled countries to implement unilateral measures.

India’s move: First in this segment

- India was the first country to implement a gross equalisation levy on turnover. This is not covered by tax treaties.

- So, while the income tax act does not apply to the levy, credit is available for the tax paid by the company in its home country.

Digital services tax (DST):

- Similar to India’s move, several other countries have announced or implemented a digital services tax (DST).

The scope of the equalisation levy.:

- In 2021, India expanded the scope of the equalisation levy. This pressured the US and OECD to respond.

- The US initiated the US Trade Representative investigations which found DST to be discriminatory and then announced retaliatory tariffs.

The two-pillar approach

- While the tariffs were to be levied on less significant items of the US-India trade, the DSTs encouraged the US to actively participate in finding a consensus-based solution.

- As talks progressed, the OECD announced that the issue of allocation of taxing rights would be actively considered and adopted a two-pillar approach.

The first pillar and the sovereignty issue:

- The first pillar was to define the rules for taxing digital companies.

- After a change in the administration, the US agreed to back the proposal.

- However, Pillar One was to go beyond digital companies and apply to large companies with annual revenue of over € 20 billion.

- To ensure certainty to taxpayers, the solution will require excessive global coordination. For this, an entirely different process of dispute resolution panels is being created.

- For this, an entirely different process of dispute resolution panels is being created. Whether this will undermine sovereignty, remains to be seen.

- Therefore, it is important to consider if the consensus approach is worth pursuing.

The second pillar:

- The Pillar Two proposals are also referred to as the “GloBE” proposal.

- In essence, the GloBE proposal focuses on the remaining base erosion and profit shifting (BEPS) issues and seeks to develop rules that would provide jurisdictions with a right to top up tax to an agreed minimum rate where other jurisdictions have not exercised their primary taxing rights or the payment is otherwise subject to low levels of effective taxation.

- The actual rate to be applied under GloBE is yet to be determined.

Other issues associated with the two-pillar approach:

Companies that are not covered by the OECD proposal:

- The EL may apply to companies that are not covered by the OECD proposal, leaving one to wonder whether it will truly address the tax challenges from digitalisation.

A fiction of reallocation:

- The OECD approach creates a fiction of reallocation, where the profits reallocated through Pillar One could in fact be compensated for by taxing back global profits taxed below 15 per cent.

- Corporations that argue in favour of simplicity must also consider the potential benefits from an EL like a tax that sets aside the complications of attributing profits to complex functions.

Conclusion

- As per Pillar One proposal, DSTs will be removed once the OECD approach is ratified in 2023. It is imperative therefore that countries assess the price of compromise.

- For India, it must calibrate its response to the OECD formula, and assess the compromises it will have to make.

Practice Question for Mains

- Examine the recent developments overtaxing the digital economy. Give a way forward. (250 Words, 15 Marks).

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.