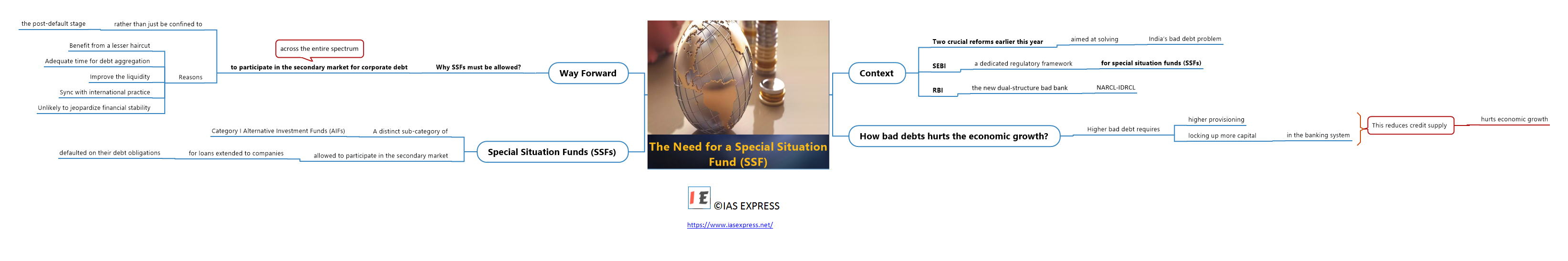

The Need for a Special Situation Fund (SSF)

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

Context

Two crucial reforms earlier this year

- Indian financial markets witnessed two crucial reforms earlier this year.

- Both these reforms are aimed at solving India’s bad debt problem.

SEBI

- SEBI came out with a dedicated regulatory framework for special situation funds (SSFs).

RBI

- The RBI approved the new dual-structure bad bank, NARCL-IDRCL.

While the bad bank is an upgraded version of the existing asset restructuring companies (ARCs) model, the SSF is a relatively novel concept.

How bad debts hurt economic growth?

- India suffers from a chronic bad debt problem.

- Higher bad debt requires higher provisioning, locking up more capital in the banking system.

- This reduces the credit supply and hurts economic growth.

A way to solve this problem

- To overcome this problem, banks and financial institutions were initially allowed to sell their stressed loans only to ARCs.

- Now they can sell to SSFs too.

- Transfer of stressed loans to ARCs and SSFs would release capital locked-up in the banking system and help improve credit supply.

Special Situation Funds (SSFs): A major reform in the right direction

- SEBI has introduced SSFs as a distinct sub-category of Category I Alternative Investment Funds (AIFs).

- AIFs manage privately pooled funds raised from sophisticated investors with deep pockets.

- While AIFs have traditionally played a prominent role in equity markets, their participation in distressed debt markets has been limited.

- Regulations did not permit AIFs to participate in the secondary market for corporate loans extended by banks and NBFCs.

- The new regulations now create a special sub-category of AIFs, namely SSFs, which are allowed to participate in the secondary market for loans extended to companies that have defaulted on their debt obligations.

- This is a major reform in the right direction.

Why SSFs must be allowed to participate in the secondary market for corporate debt?

Benefit from a lesser haircut

- A haircut is the lower-than-market-value placed on an asset when it is being used as collateral for a loan.

- The size of the haircut is largely based on the risk of the underlying asset.

- Riskier assets receive larger haircuts.

- A haircut also refers to the sliver or haircut-like spreads market makers can create or have access to.

- Default is a lagging indicator of financial stress.

- If lenders and bond investors could offload potentially stressed assets to SSFs before defaulting in the secondary market, they would benefit from a lesser haircut.

Adequate time for debt aggregation

- SSFs would also get adequate time for debt aggregation before default, reducing the collective action problems that may arise after default during insolvency or restructuring.

Improve the liquidity

- Allowing SSFs to purchase investment-grade loans would also improve the liquidity in the secondary market for corporate loans.

- Traditionally, banks originated loans and held them till maturity.

- Over time, lending moved from involving a single lender to multiple lenders via syndicated lending.

- As volumes in the primary syndication market increased, demand for secondary trading also developed to allow liquidity, risk and portfolio management.

Sync with international practice

- Secondary trading of loans is now institutionalised in international financial markets.

- These markets are liquid precisely because they are open to a wide variety of non-bank participants including insurance companies, pension funds, hedge funds and private equity funds.

- Allowing SSFs entry into the secondary market would therefore be in sync with international practice.

- The RBI task force on secondary markets for corporate loans, chaired by T N Manoharan, made this suggestion in 2019.

Unlikely to jeopardize financial stability

- SFs cannot borrow funds or engage in any leverage except for temporary funding requirements.

- Consequently, risks associated with liquidity, credit or maturity transformation and asset-liability mismatches are unlikely to arise.

- Given their structure, SSFs are likely to acquire sufficient debt in a distressed company to acquire control or to influence its subsequent insolvency or restructuring process to maximise its value through business turnaround or sale.

Way Forward

- Overall, the introduction of SSFs promises to usher in a modern era of distressed debt investing in India.

- To realise their true potential, SSFs must be allowed full participation across the entire spectrum of the secondary market for corporate debt and not just be confined to the post-default stage.

Practice Question for Mains

- Discuss how the introduction of Special Situation Funds (SSFs) in India promises to usher in a modern era of distressed debt investing. (250 Words,15 Marks)

Referred Sources

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.