Foreign Contribution (Regulation) Amendment Bill, 2020

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

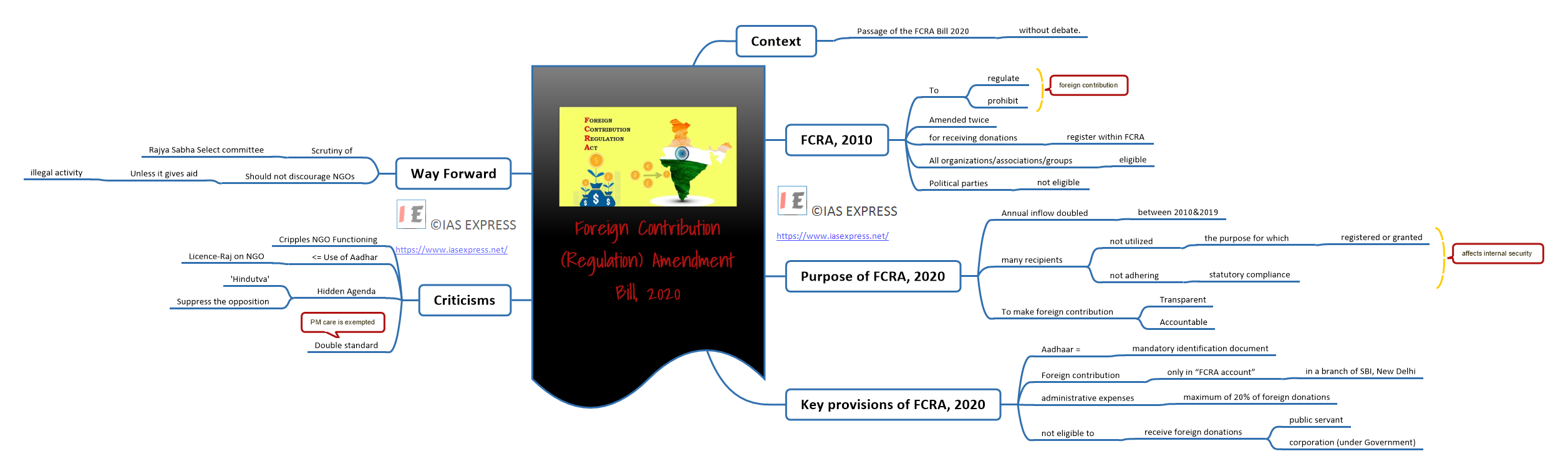

Recently, the Parliament has passed the Foreign Contribution (Regulation) Amendment Bill 2020 (FCRA) in its monsoon session, which would greatly tighten and restrict the existing Foreign Contribution Regulation Act (FCRA). Though The bill is receiving backslash from the NGOs and the Opposition with regards to the encroachment of NGOs financial administration, it has been passed (without any debate) with a view of increasing transparency in the working of an organization receiving foreign funds. In this context, Let make a detailed analysis of the recently passed Foreign Contribution (Regulation) Amendment Bill 2020

What was the initial Act?

- The decision of amendment comes with the Foreign Contribution (Regulation) Act (FCRA) of 2010, which has been amended twice.

- The Initial FCRA was enacted to regulate and prohibit the acceptance and utilization of foreign contribution such as transfer of any currency, security, or article for any activities detrimental to “national interest.”

- The Act applies to all associations, organizations, group which intend to obtain foreign donations.

- It also mandates the respective organization to register within FCRA for receiving donations on cultural, educational, economic, and religious goals.

- Political parties are not eligible for the same.

- Individuals are permitted to accept foreign contributions without permission of MHA. However, the monetary limit for acceptance of such foreign contributions shall be less than Rs. 25,000.

- It was implemented by the Ministry of Home Affairs.

What is the purpose of the Amendment?

- The annual inflow of foreign contribution has almost doubled between the years 2010 and 2019, but many recipients of foreign contribution have not utilised the same for the purpose for which they were registered or granted prior permission under the FCRA 2010.

- Recently, the Union Home Ministry has suspended licenses of the six (NGOs) who were alleged to have used foreign contributions for religious conversion.

- Many persons were not adhering to statutory compliances such as submission of annual returns and maintenance of proper accounts. Such a situation could have adversely affected the internal security of the country.

- The new Bill aims to enhance transparency and accountability in the receipt and utilisation of foreign contributions and facilitating the genuine non-governmental organisations or associations who are working for the welfare of society.

What are the key provisions of the FCRA Bill, 2020?

- The highlighting feature of the amendment is the reduction in utilization of foreign funds in the administration of the organization from 50 per cent to 20 per cent. The Government described the move as a step to ensure compliance and transparency with proper utilization of foreign funds.

- The Act prohibits the transfer of foreign contributions to any individual, association, or a registered company, causing an uproar from NGOs and Opposition

- Another key variation is the compulsory Aadhaar registration of all its office bearers, directors, or crucial functionaries for identification purposes, thus increase the existing burden of registrations.

- Every person who has been given a certificate of registration must renew the certification within six months of expiration.

- The Government may conduct an inquiry before renewal to ensure that

- The person making the application is not fictitious or benami

- The person making the application has not been prosecuted or convicted for creating communal tension or indulging in activities aimed at religious conversion

- The person making the application has not been found guilty of diversion or misuse of funds, among other conditions.

- The Act empowers the Government to ask an organization to not use the funds by holding a “summary inquiry.”

- Earlier it was supposed to be done only after the person or association has been “found guilty” of violation of the Act.

- FCRA account has to be made with State Bank of India, New Delhi, whereby the Government can monitor the flow of money.

- It also extends the period of suspension of registration of a person by the Government from the present limit of 180 days by up to an additional 180 days.

What are the criticisms of the FCRA Bill, 2020?

- The Act allows the Government to capture and scrutinize small details like change in a bank account or address.

- The reduction in use of foreign contribution for administrative purposes from 50 per cent to 20 per cent is unfavourable concerning the NGOs working for research and health.

- In times like COVID-19, the sector needs more relaxation than restrictions. The largescale NGOs are arguing onto the fact that they transfer funds to the smallscale based organization which doesn’t have any parent support of donations.

- Grassroots organizations with the help of Large NGOs funds facilitated the fight of social, economic, educational, environmental issues.

- The Opposition is looking onto the Act as a way for “” It is no mystery that the majority of foreign funds are received by Christian NGOs, a minority in India.

- The Opposition also calls out to Government on “PM fund cares” which is exempted from the Act, meaning, no question on the amount of the foreign funds received into the same.

- In 2019, Central Bureau Investigation raided the Amnesty International’s offices on account of FCRA violation. Notably, Amnesty was vocal against human rights violations in Jammu and Kashmir after the Government revoked special status under Article 370.

What can be the way forward?

- NGOs are a necessary component of civil society and this bill needs greater public debate and scrutiny as they help implement government schemes at the grassroots. They fill the gaps, where the government fails to do their jobs.

- The government should send the bill to a select committee of the Rajya Sabha.

- Unless there is reason to believe the funds are being used to aid illegal activities, the functioning of a global community which are mainly intended to share ideas and resources across national boundaries should not be discouraged.

Conclusion

- The NGO sector is already heavily regulated and international donors find it difficult to make grants in India. Going forward, this will become more cumbersome because of the amendments.

- In the current times when foreign funds are most needed for COVID 19 related relief activities, these changes could prove to be counter-productive.

Practice Question for Mains

- Critically evaluate the implications of the Foreign Contribution (Regulation) Amendment Bill 2020 (FCRA) to the performance of NGOs of the country.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.