Goods and Services Tax (GST): All You Need to Know

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

Goods and Services Tax (GST) for UPSC IAS Preparation.

The recent report of the Union comptroller and auditor general (CAG) on the goods and services tax (GST) does praise its rollout as a landmark achievement. Notably, the revenue obtained from the GST in July 2019 stood at Rs.1.02 lakh crore. This is a 5.8% hike when compared to the GST revenue collected during the same month last year. However, the CAG also points out several deficiencies in its implementation.

What is tax?

- Tax is a mandatory charge levied by the government on the individual/organization.

- It helps the government fund the developmental projects and welfare activities of the country.

- It is classified into two: direct and indirect tax.

- This classification is based on who pays the tax.

- Direct tax is the one that is directly paid by the individual and is based on the ability of the individual to pay it. Eg: Income tax.

- The indirect taxes are levied on the production or consumption of goods or services or transactions including imports and exports. Eg: Excise tax, VAT, and Service tax

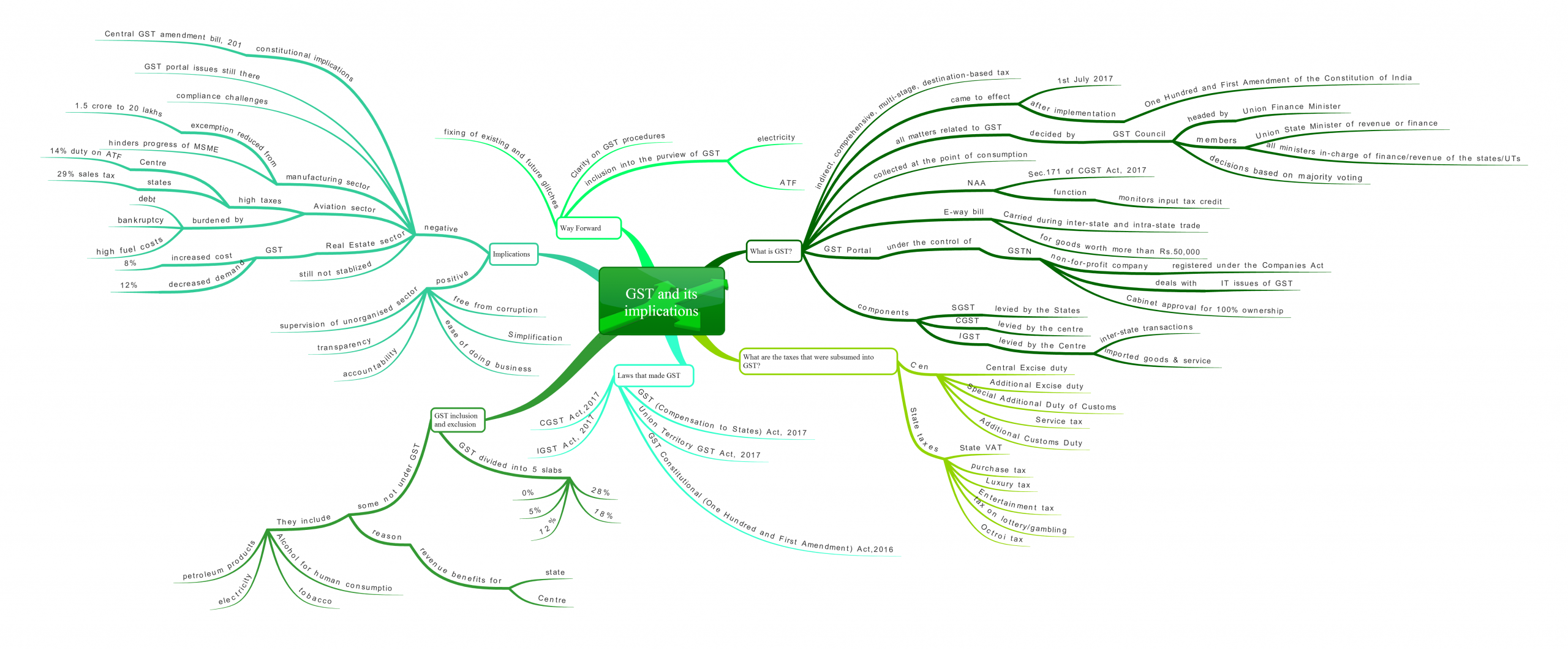

What is GST?

- Goods and Services Tax is an indirect, comprehensive, multi-stage, destination-based tax levied on each value addition of the goods and services.

- It came into effect on 1st July 2017 after the implementation of the One Hundred and First Amendment of the Constitution of India.

- It is a comprehensive tax that replaces many indirect taxes levied by the Central and the State government in India.

- It is a tax that is imposed at every step of the production and is refunded to everyone involved except the final consumer.

- GST is collected at the point of consumption rather than the point of origin, unlike the previous taxes.

- Three taxes are applicable within GST. They are:

- CGST/Central GST

- SGST/State GST

- IGST/Integrated GST

Who levies what in the GST?

- the Centre levies the Central GST;

- the State levies the State GST;

- The Centre levies Integrated GST on transactions that take place between states and imported goods and services.

- The Parliament will compensate for any loss faced by the State.

What were the taxes that were replaced by GST?

State taxes:

- State VAT

- Luxury tax

- Entertainment tax

- Octroi tax and entry tax

- Purchase tax

- Tax on lottery/gambling

Central taxes:

- Central excise duty

- Additional excise duty

- Special additional duty of customs

- Service tax

- Additional customs duty

What are the laws that enabled the implementation of GST?

- Central GST Act, 2017

- Integrated GST Act,2017

- GST (Compensation to States) Act, 2017

- Union Territory GST Act, 2017

- GST Constitutional (One Hundred and First Amendment) Act,2016

What are the measures/authorities for implementing GST?

GST Council

- All matters related to GST like the rules, regulations, issues, etc., are decided by GST Council.

- It is a constitutional body that is headed by Union Finance Minister and its members include the Union State Minister of revenue or finance and Ministers in-charge of the finance or taxation of all States, Delhi and Puducherry.

- The decisions within the GST Council are based on the majority voting.

National Anti-Profiteering Authority (NAA)

- National Anti-Profiteering Authority (NAA) is established under Section 171 of the Central GST Act, 2017 deals with matters related to the reduction of tax rates and the benefit obtained from input tax credit are passed on to the intended beneficiaries.

- Note- Input Tax Credit under GST. Input Tax Credit or ITC is the tax that a business pays on a purchase and that it can use to reduce its tax liability when it makes a sale. In other words, businesses can reduce their tax liability by claiming credit to the extent of GST paid on purchases.

E-Way bill

- Under GST, the individual must carry an E-Way bill for goods worth more than Rs.50, 000 that are being transported for inter-state and intra-state trade.

- This is generated through the E-way bill portal.

Goods and Services Tax Network (GSTN)

- GSTN is a not-for-profit company registered under the Companies Act. It is involved in administering and advising the government on issues related to information technologies that are essential for the GST.

- The Center holds 24.5% stake, the states hold 24.5%, and the remaining 51% is divided between ICICI Bank, HDFC, HDFC Bank, LIC Housing Finance, and NSE Strategic Investment Corporation Ltd.

- Recently Cabinet has approved to make GSTN a government-owned company. That is, now the government will hold 100% ownership of the same.

- A contract is signed between Infosys Ltd and GSTN to manufacture hardware and software that are necessary for the implementation of GST.

What are the items that are not included in the GST?

- There is a difference between those commodities that are exempted from GST (0%) and those that are not under the GST.

- GST is divided into 5 different tax slabs: 0%, 5%, 12%, 18% and 28%.

- All products under the 0% slab exempted from GST. These include medical services and many other essential goods and services.

- Some products are not covered under the GST. They are alcohol for human consumption, tobacco, electricity, and petroleum products like crude oil, Aviation Turbine Fuel (ATF), High-Speed Diesel (HSD), etc.

Why they are not included within the GST?

- Those products that are not under the purview of the GST contribute significantly to the States’ and Centre’s revenues.

- Some States earn nearly 25% of revenue from the value tax levied on alcoholic beverages.

What are the implications of the GST?

Positive implications:

- Simplification: Previously, there were numerous taxes that ought to be paid by citizens like luxury tax, central excise, etc. The GST incorporates all these taxes into a simpler structure to ensure a better understanding of the tax mechanism of the county.

- Ease of doing business: GST is a simplified and transparent tax regime that enables an easier understanding of tax compliance to the government. Previously, many companies faced problems related to numerous registration processes like vat, customs excises, etc.

- Supervision of unorganized sector: It is mandatory for all the companies whether organized or unorganized to be registered under the GST. This allows the government to have a wider coverage of tax collection.

- Transparency and accountability: Due to the simplified and integrated tax collection through the GST, the consumers are free from the exploitation either by the government or the private companies.

- Free from corruption: The GST online portal allows for direct registration, filing returns, and paying taxes without the need for direct contact with the tax authorities. This allows the transparent monitoring of the taxes and inclusion of unorganized sector into the mainstream economy.

Negative implications:

- Aviation sector: Currently, the Central government charges 14% excise duty on ATF, and State governments charge nearly 29% of the sales tax on the same. India is one of the fastest-growing aviation markets in the world but the aviation companies are burdened by increasing debt and bankruptcy due to high fuel cost and depreciation of the rupee. The bulk of aviation companies’ budget is spent on fuel. This must come to an end to prevent a crisis in the aviation sector as it may create negative implications for the Indian economy.

- Real Estate sector: Many experts believe that the implementation of the GST has increased the cost of real estate in India. There has been an 8% increase in the cost of real estate and a fall in the demand for the same by 12%.

- Still not stabilized: The GST structure is still new and is facing many structural changes in response to the administrative glitches. Due to the frequent problems and constant changes, there are many negative impacts within the economy.

- Constitutional implication: According to the constitution, the power to levy taxes rests in the hands of the Parliament and the State legislatures. However, as per the Central GST Bill 2017, the Central government can decide the rate of CGST below 20% without approval from the parliament.

- Compliance challenges: Currently, there many complaints with regards to the complexity of the procedures, multiple registrations, invoice matching, etc.

- Impact on manufacturing sector: The tax exemption has been reduced from Rs.1.5 crore to Rs.20 lakh. The burden of paying the tax falls on small businesses, thus hindering their growth and development. This will be a great blow to the ambitious “Make in India” initiative.

- Issues with the GST portal: The GST Network (GSTN) still faces technical glitches. This is problematic as it is required by the businesses to register, filing GST returns, etc., through this portal. The GST was hastily implemented without the consideration of solving and clarifying such issues. This, as a result, increased the cost and the inefficiency of the filing GST

Way Forward

- It is high time that the government takes measures to bring in the electricity and the Aviation Tribunal fuel under the GST to ensure effective growth and development of the economy.

- It is essential to provide clarity on the procedures to be followed while filing GST and also to repair the existing problems and prevent future ones from arising for an efficient tax regime.

- Though presently the GST may face certain glitches and drawbacks, it is flexible in nature as the decisions and implementations are based on transparent discussion within GST Council. This allows for flexible response and resolution of the problems related to GST.

- Thus, in the long run, it will prove to be a proficient tax regime.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.