Hindenburg Research report on Adani Group

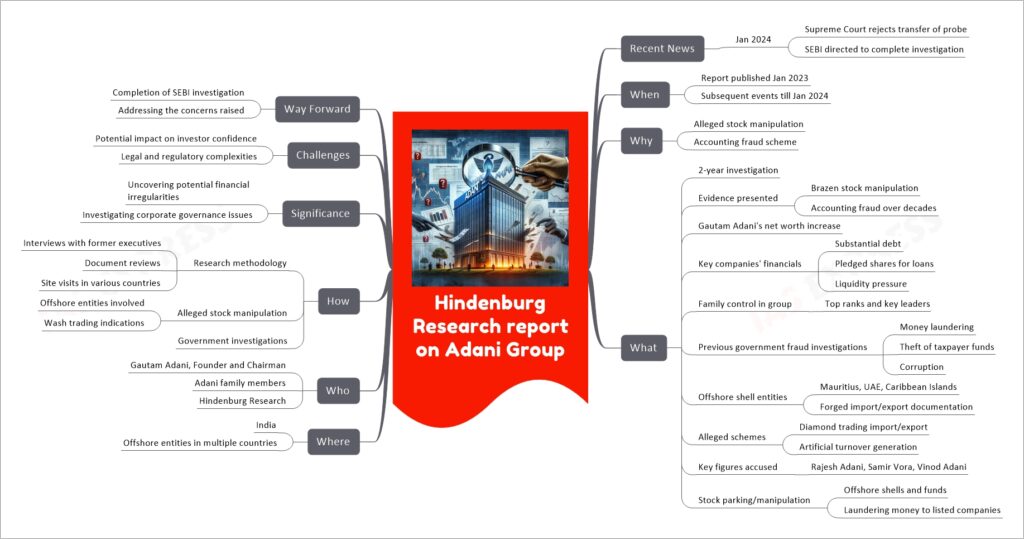

The Hindenburg Research report on Adani Group, published in January 2023, alleges a decades-long scheme of stock manipulation and accounting fraud involving the Adani Group. The report claims that Gautam Adani, the founder and chairman, amassed significant wealth largely through the appreciation of his group’s stock prices. The investigation by Hindenburg Research, which spanned two years, involved interviews, document reviews, and site visits across several countries. It suggests the involvement of various Adani family members in fraudulent activities and raises concerns about the group’s financial stability and transparency.

The report’s aftermath saw legal developments, including the Supreme Court of India’s directive for the Securities and Exchange Board of India (SEBI) to complete its investigation. The Adani Group’s response was to dismiss the allegations as baseless and a calculated attack on India’s integrity and growth story. They questioned Hindenburg Research’s motives and transparency, particularly regarding the details of its short positions and the profit it has made.

The case brings to the forefront issues related to corporate governance, market manipulation, and the impact of such allegations on investor confidence. It highlights the challenges and complexities in addressing legal and regulatory concerns in such high-profile cases. The way forward includes the completion of the SEBI investigation and addressing the concerns raised by the report to restore confidence in the financial markets.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.