Convertible Bonds – Types & Advantages

From Indian Economy Mindmap Notes » Financial Market

What is a Convertible Bond?

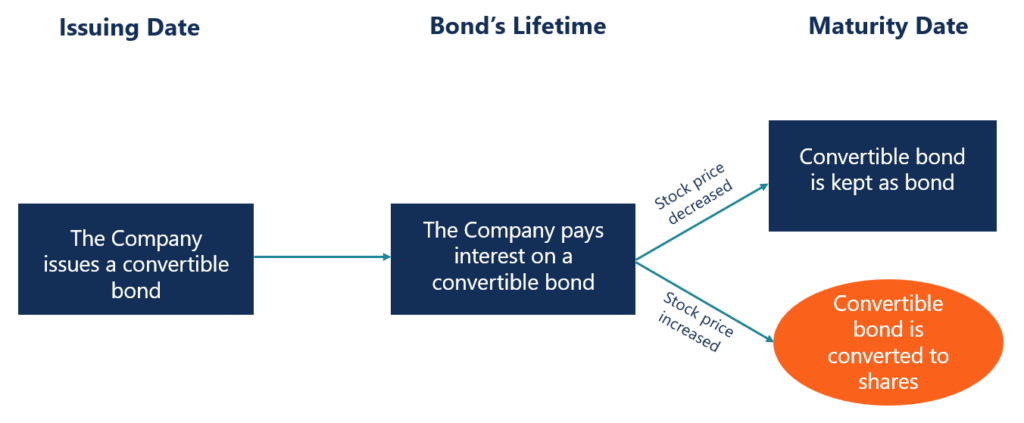

A convertible bond is a type of debt security that provides an investor with a right or an obligation to exchange the bond for a predetermined number of shares in the issuing company at certain times of a bond’s lifetime. It is a hybrid security that possesses features of both debt and equity.

Similar to regular bonds, a convertible bond comes with a maturity date and pays interest to investors. In addition, if an investor decides not to convert their bonds to equity, they will receive the bond’s face value at maturity. However, if an investor converts the bonds to the company’s shares, the bond will lose all its debt features and then possess only equity features.

Companies with a low credit rating and high growth potential often issue convertible bonds. For financing purposes, the bonds offer more flexibility than regular bonds. They may be more attractive to investors since convertible bonds provide growth potential through future capital appreciation of the stock price.

Types of Convertible Bonds

There is no formal classification of convertible bonds in the financial markets. However, underwriters often refer to the following types:

1. Vanilla convertible bonds

These are the most common type of convertible bonds. Investors are granted the right to convert their bonds to a certain number of shares at a predetermined conversion price and rate at the maturity date. Vanilla bonds may pay coupon payments during the life of the bond, and come with a fixed maturity date at which the investors are entitled to the nominal value of the bond.

2. Mandatory convertibles

Mandatory convertibles provide investors with an obligation to convert their bonds to shares at maturity. The bonds usually come with two conversion prices. The first price would delimit the price at which an investor will receive the equivalent of its par value in shares. The second price sets a limit to the price that the investor can receive above the par value.

3. Reverse convertibles

Reverse convertible bonds give the issuer an option to either buy back the bond in cash or convert the bond to equity at a predetermined conversion price and the rate at the maturity date.

Advantages of Convertible Bonds

Convertible bonds are a flexible option for financing that offers some advantages over regular debt or equity financing. Some of the benefits include:

1. Lower interest payments

Generally, investors are willing to accept lower interest payments on convertible bonds than on regular bonds. Thus, issuing companies can save money on their interest payments.

2. Tax advantages

Since interest payments are tax-deductible, convertible bonds allow the issuing company to benefit from interest tax savings that are not possible in equity financing.

3. Deferral of stock dilution

If a company is not willing to dilute its stock shares in the short or medium term but is comfortable doing so in the long term, convertible bond financing is more appropriate than equity financing. The current company’s shareholders retain their voting power and they may benefit from the capital appreciation of its stock price in the future.

Good information, but cover all points like ias question.