Fintech Sector in India

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

The Indian fintech sector has been witnessing a boom in the recent past and the pandemic conditions have further accelerated the adoption of fintech- especially the cashless transaction solutions. The government, the central bank and the private sector have been introducing a slew of measures and initiatives for this sector. Most recently, the RBI‘s Monetary Policy Committee proposed the use of UPI for cash withdrawal at ATMs.

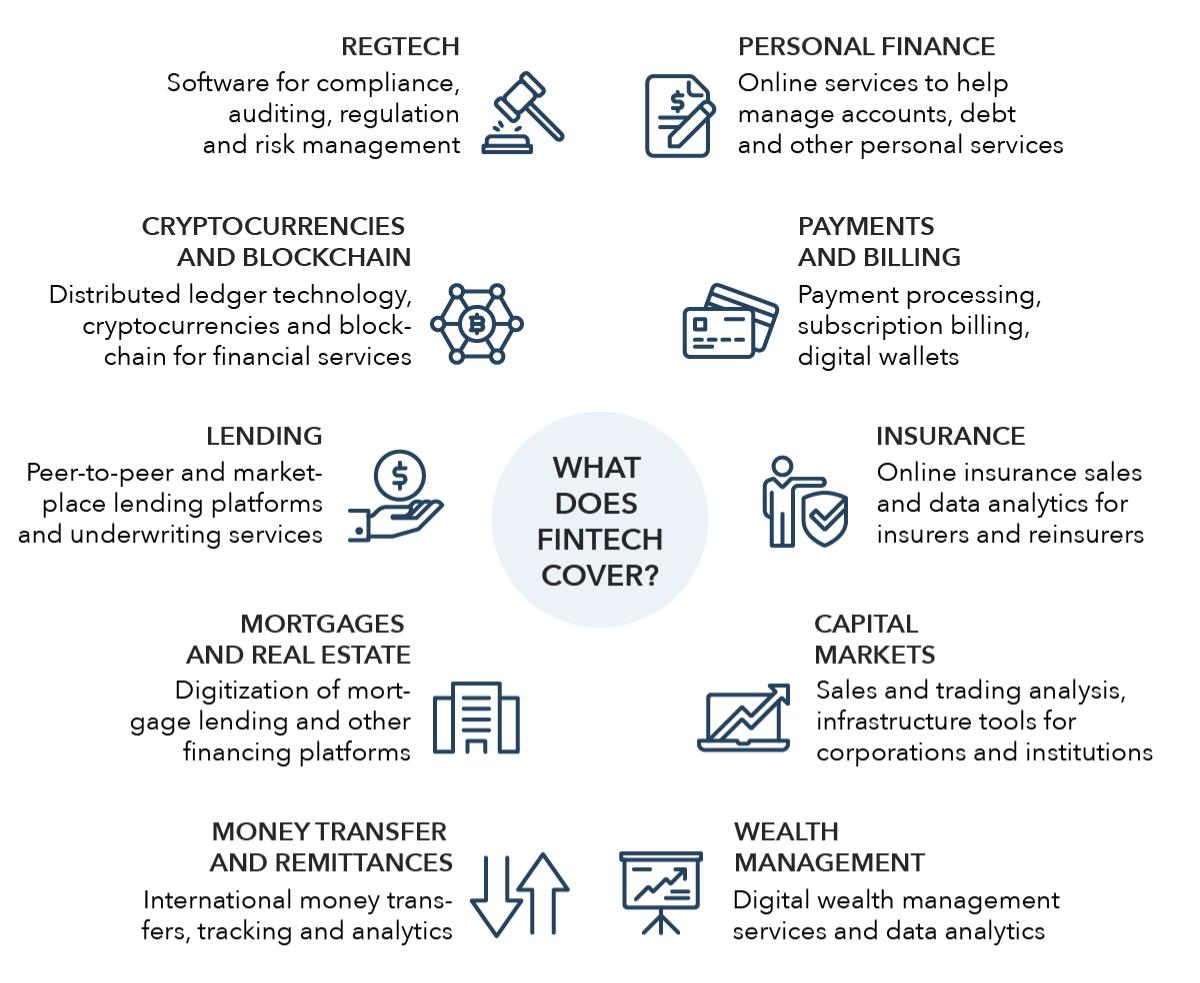

What is fintech?

- The term fintech (financial technology) refers to emerging digital technology for improving and automating financial services, in terms of delivery and usage.

- This variety of functions is enabled by specialized softwares, algorithms and more recently, the development and use of cryptocurrencies like Bitcoins.

- Originally, the term was coined to refer to technologies used in established financial organizations’ back-end system. Now, it has a wider scope and spans across a wide range of sectors like education, retail banking, investment management, non-profit fundraising, etc.

What is the status of fintech sector in India?

- India is one of the fastest growing fintech markets in the world. In FY20, it was valued at 50-60 billion USD and is expected to touch 150 billion USD by 2025. The sector has seen a cumulative funding of 27.6 billion USD.

- There are over 2,100 fintechs in India and more than 67% of these have been set up in just the last 5 years.

- There are 1,860 startups in this sector. More than 17 of these fintech companies had acquired ‘unicorn status’ by December 2021.

- The fintech ecosystem in India has a range of sub-segments, like:

- Payments

- Lending

- WealthTech (wealth technology)

- Personal finance management

- InsurTech (insurance technology)

- RegTech (regulation technology), etc.

- Initially, over 90% of the sector’s investment inflow went into payments and alternative finance segment. However, there is now a trend of more equitable distribution of investment into other segments of the sector- such as InsurTech and RegTech.

- There has been a significant growth in the digital payments segment with the monthly volume going beyond 5.7 billion transactions worth some 2 trillion USD in September 2021.

- India, recording the highest number of real time online transactions (25.5 billion payment transactions in real time) in 2020, is ahead of the USA, UK and China combined.

- Fintech services like mobile banking, mobile wallets, paperless lending, secure payment gateways, etc. are already witnessing wide adoption.

What are the government initiatives for the sector?

- Some of the factors that have contributed to the growth of fintech ecosystem in India are:

- Growing availability of smartphones

- Increase in internet access

- Availability of high-speed connectivity, etc.

- Some government initiatives that have been enabling the growth of this sector:

Jan Dhan Yojana

- Jan Dhan Yojana is an initiative that enabled new bank enrollment of over 435 million people.

- It is the largest financial inclusion initiative in the world.

- It has aided direct benefit transfer and enabled the access to a number of financial service applications such as credit, remittances, insurance and pensions.

- This has encouraged the fintech players to develop tech products for the enormous customer base in the country.

Payment mechanisms and interfaces

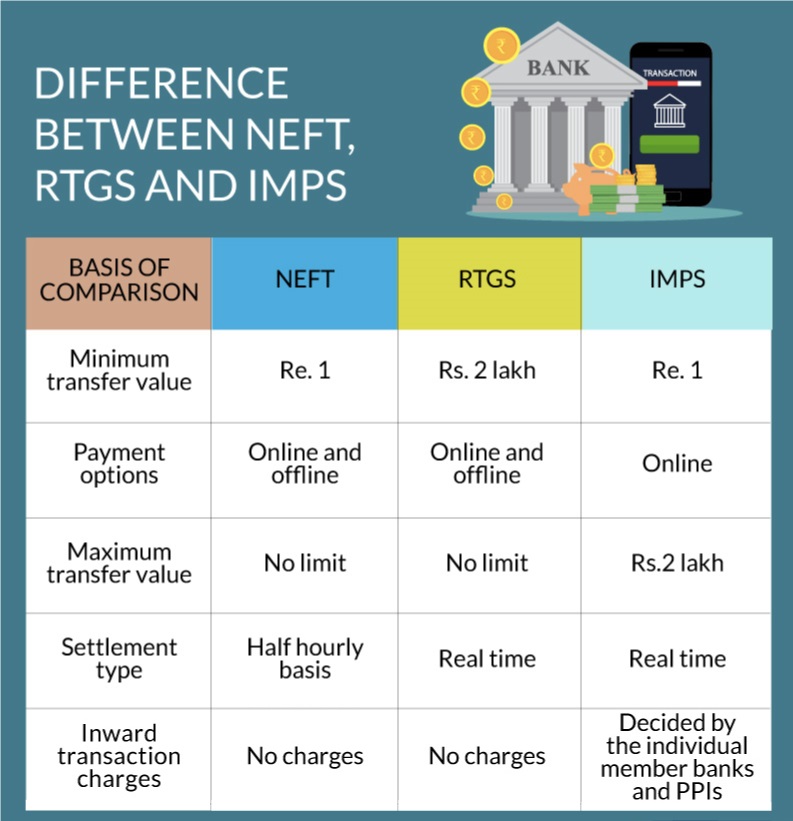

- RTGS or Real Time Gross Settlement is a fund transfer system implemented in 2004. It is operated by the RBI and it enables inter-bank electronic cash remittance. It is used for high value transactions.

- NEFT or National Electronic Funds Transfer is a system introduced in 2005 for smaller value transactions. It is maintained by the RBI for electronic fund transfers between bank accounts.

- NPCI or National Payments Corporation of India was incorporated in 2008 as a not for profit organization under the Payment and Settlement Systems Act, 2007. It is a joint initiative of RBI and Indian Banks’ Association. It is an umbrella organization for retail payments and settlement systems.

- IMPS or Immediate Payments Service is an electronic fund transfer system launched in 2010 and managed by NPCI. It was started to provide 24×7 fund transfer facility.

- UPI or Unified Payments Interface is considered as a revolutionary fintech product from NPCI. It is built on IMPS infrastructure and it can be availed through multiple UPI apps. It has seen the participation of 261 banks and recorded 4.21 billion monthly transactions (worth more than 100 billion USD) as of October 2021.

- AePS (Aadhaar Enabled Payment System) was launched in 2010 to deliver the 4As for financial inclusion in rural areas:

- Authentication of customer

- Availability of services

- Accessibility

- Affordability (services are free of cost)

- Aadhaar Payment Bridge System has made recurring bulk payments of government subsidies and benefits easier.

- CTS (Cheque Truncation System) was launched in 2011 to enable faster clearance of cheques.

- NACH (National Automated Clearing House) was launched in 2012. It is a web-based platform for inter-bank electronic transactions that are repetitive and of high volumes.

- RuPay is a global card payment network launched by the NPCI in 2012.

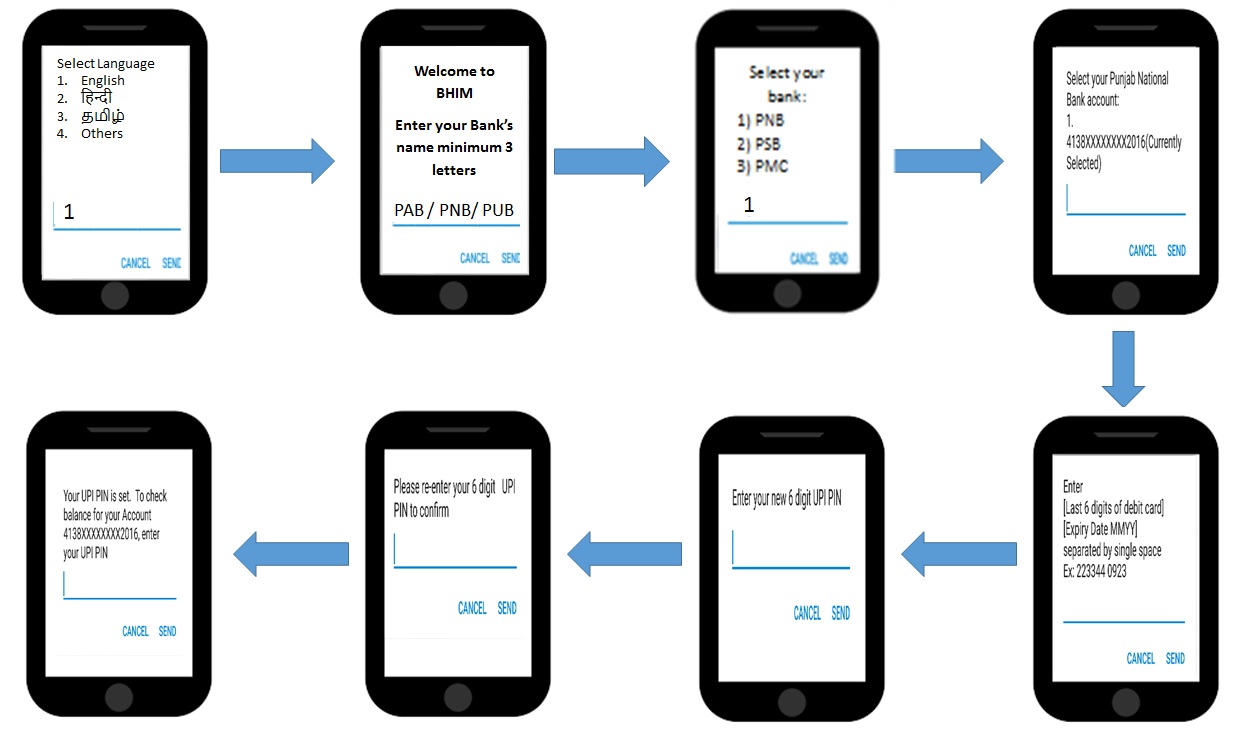

- NUUP (National Unified USSD Platform) or *99# service is a mobile-based banking service that works on USSD channel. It was launched in 2014. It works on feature phones.

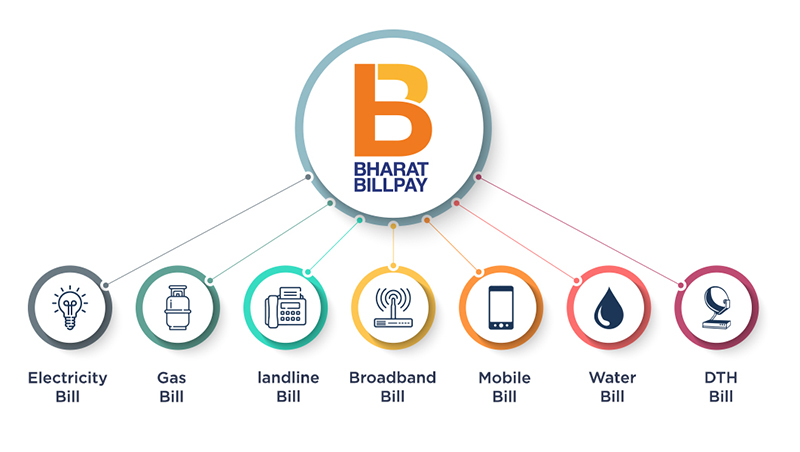

- BBPS (Bharat Bill Payment System) started in 2014.

- BHIM or Bharat Interface for Money is a mobile wallet app developed by NPCI based on the UPI. It was launched in 2016. It is now available in 20 languages.

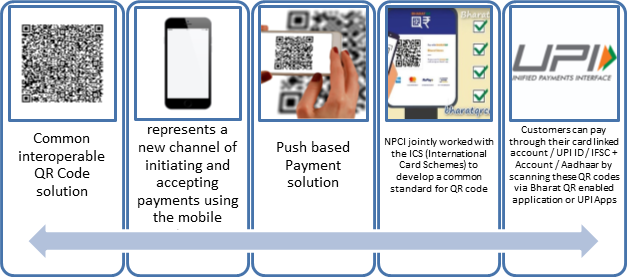

- BharatQR Code is an integrated payment system launched in 2016. It is a QR Code-based digital payment mechanism developed by NPCI, VISA, MasterCard and American Express. Its interoperability feature has meant that merchants need to display only one QR code for customers to make payments (as opposed to separate QR codes specific to different payment networks).

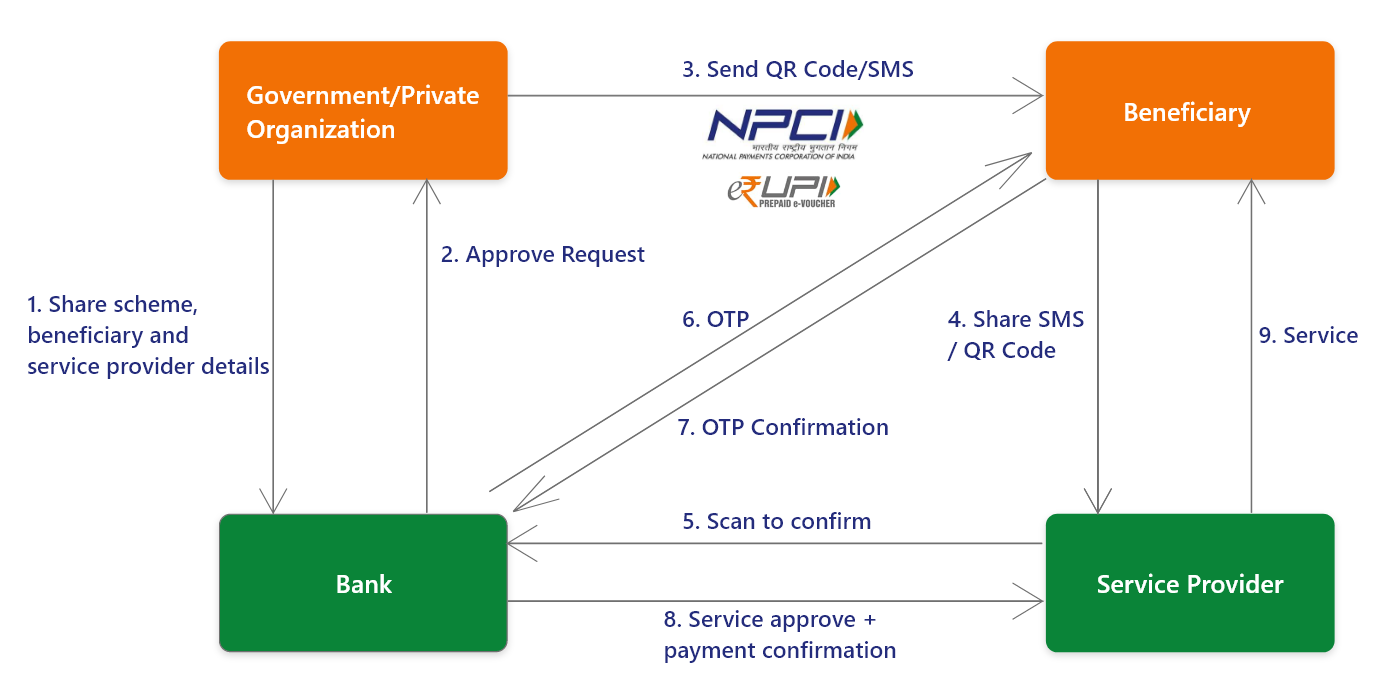

- e-RUPI is a digital payments instrument that provides cashless and contactless payment solutions. It is a person- and purpose-specific solution. It was launched in 2021.

- NETC (National Electronic Toll Collection) is a toll payment solution that enables the FASTag system.

Infrastructure-wise

- India Stack:

- It is a set of APIs that enables the utilization of a unique digital infrastructure to solve the challenges faced in realizing a service delivery system that is presence-less, paper-less and cash-less.

- It is used by governments, businesses and various other developers.

- It is an important driving force behind the growing fintech sector in India as it provides public digital infrastructure, based on open APIs, to encourage many digital initiatives- both public and private.

- Payments Infrastructure Development Fund or PIDF scheme of RBI subsidizes deployment of payment acceptance infrastructure in tier-3 to tier-6 regions.

Regulation-wise

- RBI’s Regulatory Sandbox is an important tool in ensuring responsible innovation in fintech sector.

- RBI’s recognition of peer-to-peer lenders as NBFCs has enabled the creation of a regulatory around P2P lending.

- Launch of Regulatory Compliance Portal in 2021 is one of the government initiatives to reduce the compliance burden.

Financial Literacy

- In order to improve financial literacy of the various sections of the population, a number of initiatives have been undertaken- such as:

- Setting up of the National Centre for Financial Education

- Centre for Financial Literacy project by the RBI, etc.

IMSC

- A steering committee was established by the Finance Ministry in 2018 to consider the issues in the development of the country’s fintech space and make the regulations related to the sector more flexible. It gave its report in 2019.

- The IMSC or Inter-Ministerial Steering Committee on Fintech was set up under the Department of Economic Affairs to implement the report’s recommendations, such as exploring potential applications in financial processes and application of the government- like accounting, asset management, taxation, welfare services and handling citizens’ grievances.

Joint Working Groups on Fintech

- Joint Working Groups have been set up bilaterally with several countries to

- Improve regulatory connect

- Adopt best practices and other learnings from each other

- Collaborate to develop and promote fintech solutions, interoperability standards and payment linkages

- The UK-India Fintech JWG has agreed to facilitating faster and cheaper flow of remittances between the 2 countries. The countries are also exploring options to improve connectivity between India’s UPI system and UK’s payment system and also working towards greater acceptance of Rupay in the UK.

- The Singapore-India Fintech JWG have been focusing on collaboration in the areas of API development, regulatory sandbox, integration of RuPay-NETS (Network Electronic Transfers), security in payments and digital cash flow, AADHAR Stack, UPI-FAST payment link and e-KYC.

IFSCA

- The International Financial Services Centre Authority or IFSCA is a unified authority established in 2020 under the IFSCA Act, 2019.

- It is authority responsible for development and regulation of financial products, services and financial institutions in the IFSCs in India.

- The government is working on developing a world-class fintech hub at GIFT-IFSC.

Other measures

- The adoption of fintech has also been accelerated by the Make in India program and the Digital India initiative.

- Several government actions, such as the demonetization, while creating chaos among the general public, have created significant growth opportunity for the fintech sector.

- More recently, the pandemic and the subsequent measures by the government to tackle the situation have further hastened the adoption of contactless payment solutions.

What are the challenges?

- India’s financial landscape faces several hurdles- a huge section of the population still remain either unbanked or underserved. There is also the issue of constantly changing regulatory environment.

- There is also the lack of financial literacy. A mere 24% of the Indian population are financially literate. This is despite the country having a literacy rate of 80%.

- While the digital lending through mobile apps caught on during the pandemic, many issues accompanied the explosion. Many apps employed mafia-like tactics, capitalizing on the widespread lack of financial literacy by charging interests as high as 500%. This heavy handedness has been connected to several suicides by borrowers. The RBI found that over half of these digital loan providers were operating illegally.

- Cyber-security is another key concern. Many continue to register complaints with the RBI regarding fake/ illegal apps. Such apps are enabling cyber-criminals to steal people’s data and money.

What is the way ahead?

- With the entry of fintech into the equation, India’s financial and banking service sectors are witnessing transformation.

- India is expected to witness a fintech revolution given the combination of factors- a young population, increased smartphone and internet penetration levels, a highly favourable market and government led attempts to promote the sector.

- This revolution is being accelerated by the growing partnerships between fintech companies and the traditional banking, retail and insurance sectors.

- All these factors mean that Indian fintech sector is well-positioned to achieve a valuation of 150 to 160 billion USD by 2025, according to a report by Boston Consulting Group and FICCI.

- However, to achieve this goal, the sector would need investments– in the range of 20 to 25 billion USD in the next few years.

- Meanwhile, the global fintech sector is rapidly evolving with the advances in the fields of AI, machine learning and predictive behaviour analytics. Some of the active areas of fintech innovation include open banking (which provides financial data from banks and NBFCs to 3rd party financial service providers), robo-advisors (for providing investment advice), cryptocurrency, smart contracts, etc.

- For Indian fintech to grow sustainably, the regulatory practices of the world’s best fintech ecosystems must be studied and adopted according to the Indian context. Regulatory support will go a long way in aiding the sector’s growth.

- Care must be taken to regularly monitor the risks and impacts of developments in the fintech sector.

- The RBI has been working on digital lending guidelines. These are expected to be framed along the lines of the recommendations of the Working Group on Digital Lending. The recommendations focus on 3 key fronts:

-

- Legal and regulatory

- Technology

- Consumer protection

- Startups are expected to play a vital role in the fintech revolution. Hence, early cultivation of entrepreneurship at educational institutions and other public institutions can help.

Conclusion

The Indian fintech sector is booming and recent trends show that the sector is attracting a significant amount of investments. Fintech solutions are finding takers even in remoter rural locations. This is incentivizing development of newer fintech solutions and services. While this presents tremendous opportunities for the economy, the accompanying regulatory challenges must be kept in mind.

Practice Question for Mains

The Indian fintech sector is witnessing a boom. Outline the factors and government initiatives that have aided this growth. What are the challenges going forward? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.