Independent Payments Regulatory Board – Do India need it?

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 80+ questions reflected

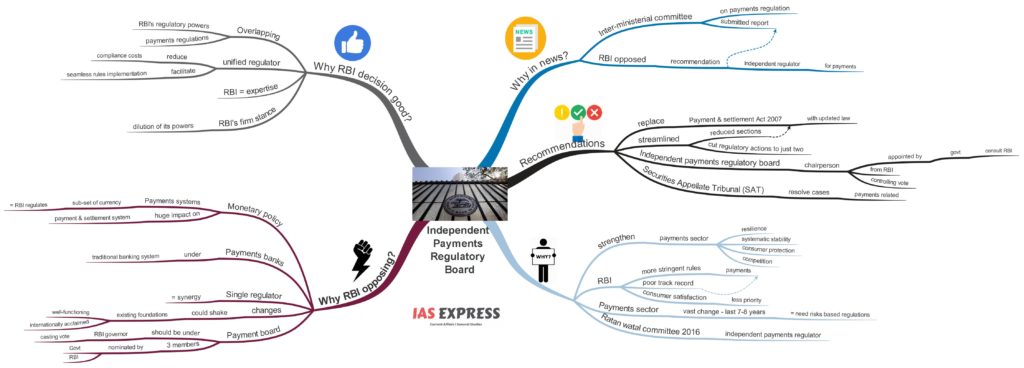

Recently, an inter-ministerial committee on the regulation of the payments system in India has submitted its report to the finance ministry. However, the RBI has opposed its proposal to establish a separate and independent regulator for the payments sector in India.

What are the recommendations of the committee?

- The aim is to replace the Payment and Settlement Act, 2007 with an updated law named as the Payment and Settlement Services Bill.

- The committee has substantially streamlined the current law by reducing the number of sections from 100 to 38 and cutting the number of possible actions by a regulator to just two.

- The committee recommended to set up an Independent Payments Regulatory Board.

- It also proposed a government-appointed chairperson to head the board.

- The government has to consult RBI for the appointment process.

- It has suggested that the head comes from within the central bank itself and have a controlling vote.

- It also recommended that the Securities Appellate Tribunal (SAT) should resolve the cases with respect to the payments.

What is the need for an independent payments regulator?

- It will strengthen competition and consumer protection, systemic stability and resilience in the payments industry.

- RBI has imposed more stringent rules for payments like two-factor authentication even for micro-payments which are not the global norm. Notably, RBI’s track record in the payments sector does not inspire a great deal of confidence. This is because consumer satisfaction is not among its priorities.

- The Payment Council of India (PCI) also held that the payments sector in India has undergone a vast change in the last 7 to 8 years. Hence, there are several types of risks involved, and a risk-based regulation is the need of the hour.

- Ratan Watal Committee 2016 also recommended for the creation of an independent payments regulator within the framework of the RBI or give independent status for the RBI’s Board for Regulation and Supervision of Payment and Settlement Systems (BPSS) to be called the Payment Regulatory Board (PRB).

Why RBI opposed the recommendations?

RBI argues that payments systems are a sub-set of currency, which is regulated by the RBI.

- There is a huge impact of monetary policy on payment and settlement systems and vice-versa.

- Hence the regulation of payment systems should remain with the monetary authority, that is, the RBI.

Besides, the activities of the payments banks come under the purview of the traditional banking system. Thus there is no reason for having a separate regulator for payment systems outside the RBI.

Also, the regulation of the banking systems and payment system by the same regulator provides synergy.

The changes should not end up shaking the existing foundations which are considered to be well-functioning and internationally acclaimed structure.

RBI also held that it would prefer the Payments Regulatory Board to function under the purview of the RBI governor.

- However, it may consist of 3 members nominated by the government and the RBI.

- It should come with a casting vote for the governor to make sure of smooth operations of the board.

RBI also rejected the recommendation on Securities Appellate Tribunal (SAT).

- The exchanges and securities markets are not under the purview of the Payment Systems Bill.

- Hence there is no valid reason for bringing SAT for resolving payment system related cases.

Why is RBI’s decision welcome?

- It is apparent that there is overlapping of the regulatory powers of the RBI and the proposed regulations for the payments industry. A unified regulator can thus help reduce the compliance costs as well as facilitate the seamless implementation of rules.

- Moreover, there is also a risk that a brand new regulator may not be able to match the expertise of the RBI in carrying out regulatory duties. This is important considering the fact that the payments industry is rapidly growing and it cannot ill-afford any regulatory errors at this point.

- Further, the decision comes as an expression of RBI’s firm stance against any dilution of its existing powers over the financial sector.

What is the way forward?

The move comes as an instance of RBI and the central government being at loggerheads over the legitimate extent of their powers. RBI’s opposition against the government’s plans has potentially set the stage for a regulatory turf war. However, at this time of increasing risks to the stability of the domestic financial system, both the government and RBI should work together for efficient as well as the sustainable payments system in the country.

Also read: MSP for MFP Scheme – Critical Analysis

Practice Question

The Proposal for establishing Independent payments regulator in India aims at fostering competition and protect consumers in the country, however, RBI opposes this idea. Discuss the reasons.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.