Indian Economy Slowdown – Causes and Consequences

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

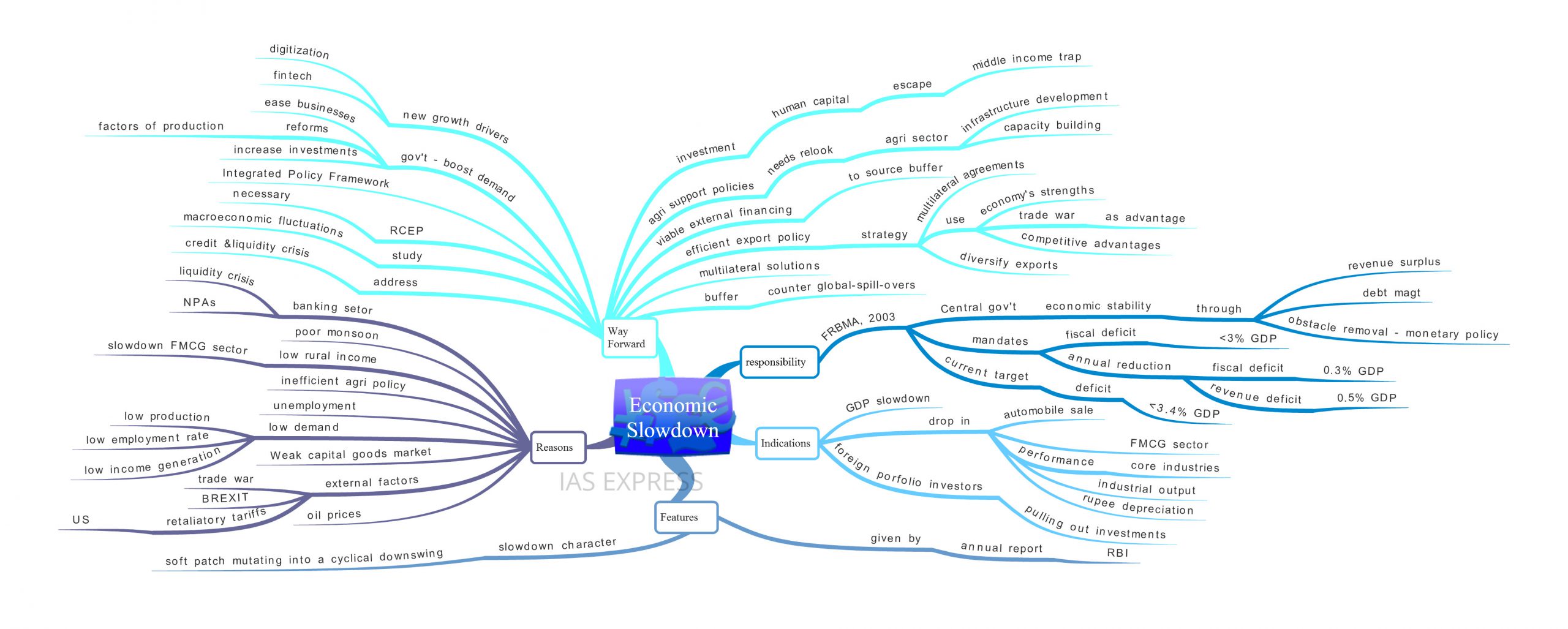

After its brief stint as the world’s fastest-growing economy, India’s economic growth has been slowing to all-time lows. Crisil had forecasted India’s GDP growth to be 6.3% for the fiscal year 2020. Earlier it forecasted it to be 6.9%. This comes after the GDP growth rate was at its slowest in almost 6 years. Earlier, Moody too had forecasted economic slowdown by 6.2%. From these current data, it is obvious that the Indian economy is currently facing crisis due to a combination of factors such as increased unemployment rate, rural distress, liquidity crunch, etc.

Who does the onus of maintaining macroeconomic stability lie with?

- Since India has a multiparty polity, its expenditure policies are susceptible to electoral Hence, legislation is needed to keep the economy stable. This is the FRBMA, 2003 i.e., Fiscal Responsibility and Budget Management Act, 2003.

- FRBMA puts the onus of maintaining long term macroeconomic stability on the central government by means of revenue surplus, effective debt management, removing obstacles to monetary policies, etc.

- The act mandates that the central government must strive to keep the fiscal deficit within 3% of GDP. It is also to eliminate revenue deficit by 2009. To achieve this, an annual reduction in fiscal deficit by 0.3% of GDP and revenue deficit by 0.5% is required.

- However, due to the use of expenditure intensive programs, the limits have been made flexible. The current target is to keep the deficit within 3.4%.

What are the indications of the slowdown?

- The slowing growth of GDP is a major indicator of economic slowdown. GDP/ Gross Domestic Product is the sum of private consumption expenditure, investment, government expenditure, and net exports.

- “GDP can be thought of as a measure not so much of size… It measures the movement of money through and around the economy; it measures activity.” –John Lanchester

- Drop in automobile sales: The production in the top 5 firms in India has dropped by about 30% compared to last year.

- Drop in Fast Moving Consumer Goods sector: Compared to 2018, the sector’s growth fell by about 9.7% in the rural area. This is a sector that has demand even during the poor economic performance as these constitute basic necessities like toiletries, OTC medicines, etc.

- Performance drop of the core industrial segments like coal, steel, cement, etc.

- Industrial output drop: The sector had recorded a mere 2% growth in output.

- Rupee depreciation: Rupee value is at a 9-month low. It is estimated that it may plummet to 73.5 by the end of September 2019. This has weighed on India’s key exports like rice.

- Foreign Portfolio Investors pulling out of investments in India. These investors have been on a selling spree especially after the budget presentation that called for taxing foreign investors that operate using ‘trust’ structure. The investors had pulled out 2,881 crore INR during just 2 sessions of August.

What are the features of the slowdown?

- The annual report from RBI characterised the ongoing economic slowdown as ‘a soft patch mutating into a cyclical downswing’ rather than the speculated ‘deep structural slowdown’.

- Soft patch is a slowdown that lasts for 2 to 3 quarters, usually due to high commodity prices. Soft patches are not necessarily indicative of further economic slowing. They are usually temporary and can be easily sailed through.

- A cyclical downswing is the downward turn of an economic/ business cycle. It can be caused by a number of factors like high-interest rate, inflation, etc. It is usually managed using counter-cyclical action.

- A structural slowdown requires deep-seated reforms to get the economy back on its legs, as it arises from issues with the core structure itself. The RBI report said that the current slowdown is cyclical rather than structural.

What are the contributors to the slowdown?

- Poor monsoon performance has led to a lower area under cultivation. This, in turn, has led to lower output and consequently, lower rural income generation. This is a consequence of high dependence on monsoons by Indian agriculture.

- Lowered rural income has affected the consumption and demand in rural India. This is reflected in the slump in the FMCG sector. The sector relies on the rural economy for raw material sourcing also. Hence, a drop in rural income will constitute a double-pronged attack on the FMCG sector.

- Inefficient agricultural policy has led to excess surplus production of certain agricultural commodities. A case in point is India’s sugar production. As the sugarcane yields 60% more returns than its comparable crops, many farmers adopt its cultivation leading to a surplus. This, in turn, contributes to low farmer incomes.

- High levels of unemployment arising due to many factors like poor employability of graduates, low job creation, etc. contribute to the economic slowdown. This is because low employment brings in lesser income and hence lower demand. Consumption is the bedrock of demand, a vital market force needed to fuel the economy.

- The demand drop led to a lower requirement of industry produced goods. This led to lower output from the industries which fell to below 4% in 2012-19. This affected the employment and income generation in both urban and rural scenario. A case in point is the automobile sector. The low demand led to production cuts. The number of working days of the factories was cut back for weeks. Simultaneously the employees’ income also fell. Also, the dependent service sector was hit, with several showrooms closing down.

- A weak capital goods market is a major contributor. Capital goods productivity is also a major indicator of the succeeding season’s productivity. The RBI’s annual review of the conditions reported that the industrial players were utilising the current capacities to the maximum and are showing reluctance to invest in addition to their capital goods stock.

- The liquidity crisis and the issues revolving around the banking sector are major contributors. Due to low liquidity, the banks are reluctant to lend credit to the businesses. This much-needed credit could infuse life into the decelerating economy.

- International issues are also affecting the slowdown. The US-China trade war and Brexit are the political components of these global spillovers. The US is also engaging in retaliatory tariff actions against India, especially when the domestic economy was looking to the global demand potential to compensate for the dropping domestic demands.

- Oil is a major driver of the economy. A country’s oil demand and consumption give a clear insight into its growth rate. Given the tensions in the Gulf of Hormuz and also US’s CATSA policy, India’s cheaper oil imports from Iran have been disturbed.

Way Forward:

- Credit and liquidity issues need to be addressed first and foremost. Lack of capital would bring the economy to a grinding halt as the markets cannot depend solely on demand to be a driver.

- RBI report says that the current efforts to repair the banks’ balance sheets and setting up capital buffers has stimulated a stabilising effect on the volume of stressed assets. It has also reported that these measures have instilled confidence in the economy leading to restart of credit inflows.

- Our experiences with the high magnitude shifts and fluctuations in global macroeconomic conditions indicate the need to study these developments to identify emerging policies that drive the economy. Currently, there is a tendency towards protectionism, unilateral trade decision and a tendency to reverse the globalisation measures. The events have also indicated that both emerging and developed nations are susceptible to these global shocks.

- In the Indian context, our stand on globalisation will come into question with the upcoming decision on RCEP. While many domestic players are urging the government to exclude their respective sector from the international deal, the state cannot afford to stay out of it given the expansive market it will open up.

- The slowdown shows that the country needs to develop strong buffers to hold up against such wide-reaching global spill-overs. It is to be understood that neither global collective actions like WTO norms nor global financial safety nets are guaranteed.

- India should strive for multilateral solutions as opposed to unilateral ones such as those that had landed the US and China is economic hot waters.

- RBI recommends the Integrated Policy Framework (IPF) of IMF’s global policy agenda as a way forward by jointly considering monetary, exchange rate, macroprudential and capital flow management policies and their interactions. The effectiveness of this strategy will depend on cooperation from all stakeholders.

- India needs to focus on engineering an export policy that suits the times. Global demand is the key determinant of export performance. The increase in unilateral trade actions calls for an opportunistic export strategy that does the following:

- Makes the best use of the supply-demand mismatch created by the outflowing presence of large players in light of the trade war.

- Improve the diversity of exports offered by the country.

- Leverages innate strengths and competitive advantages.

- Simultaneously, India needs to work towards getting countries to move towards cooperative multilateral agreements. This could be done under the existing international instruments itself and needs to keep national self-interest in mind.

- Foreign investment cannot be depended upon to a very large extent. It has a tendency to flow out during economic adversities and has high sensitivity to global spill-overs. This is prominent especially in light of the ‘passive investment’ strategies used by these investors. This is evident from the experience with the risk-averse portfolio outflows during the period of high crude oil prices forcing India to depend on reserves for meeting the requirements. This calls for the consideration of ‘viable external financing’ to source a precautionary buffer as suggested by RBI.

- Since the core issue ailing the economy’s animal spirit is domestic demand, the major focus of the policies must be on

- improving ease of doing business,

- reforms in factors of production,

- utilizing the opportunities thrown up by trade tensions,

- Expedited implementation of state’s capital expenditure, etc.

- There is also a need to relook at the policies used by the state to support agriculture. A key point is that in agriculture, 44% of the labour is employed in generating a mere 17% of GVA. It shows an annual growth rate of about 3.1%. The sector is saturated by labour and the labour force is facing under-employment.

- There is a need to balance the measures to ensure low food inflation without compromising on farmers’ income. This calls for allowing farmers’ direct role in the market, where large scale direct procurement of farm produce can take place. The focus should be on capacity building of Indian farming sector rather than simply ensuring a minimum support price. Use of food processing and improved storage capacity will aid growth.

- Need to invest in education, health and other contributors that enable human capital formation. Research and development are vital for innovations, which in turn is vital for India to escape the middle-income trap.

- FinTech and digitalisation have been identified by RBI as the new growth drivers. Their potential is to be used while keeping the necessity of risk minimisation to prevent technology’s misuse.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.