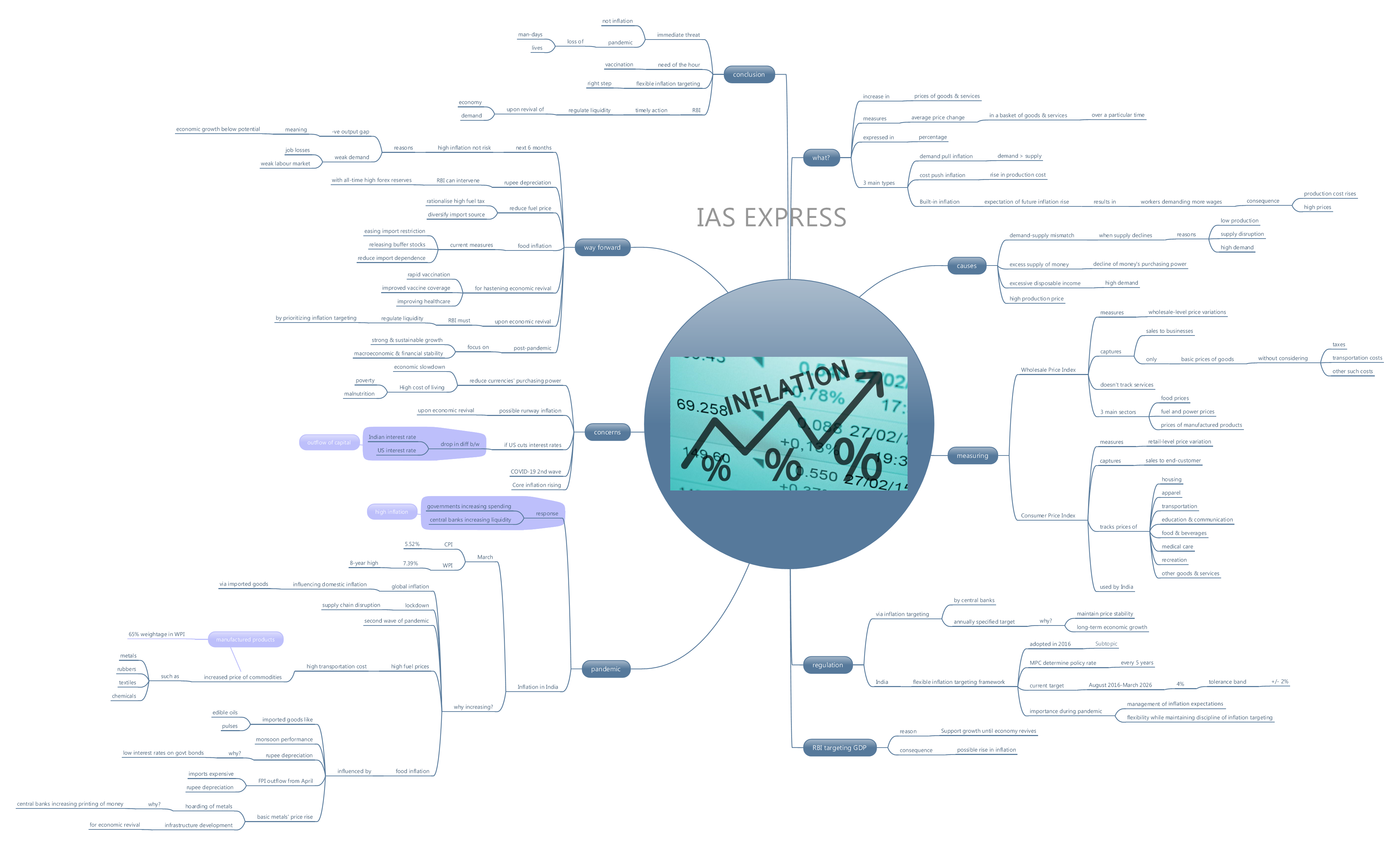

Inflation – Meaning, Pandemic’s Role and Way Forward

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

In the pandemic era, when a lot of attention is being paid to the GDP growth of countries, inflation has been turning into a looming threat. India’s inflation rate has consistently remained above the ideal 4% with its WPI reaching a reaching an 8 year high in March. The implications of the rising prices on a population that is suffering job losses and loss of social security and on an economy that is struggling to keep its head above water has raised concerns.

What is inflation?

- Inflation is the rise in prices of goods and services.

- It measures the average price change in a basket of goods and services over a time period and is expressed as a percentage.

- There are 3 main types of inflation:

- Demand pull inflation is caused when the demand for goods and services exceeds the supply of the same.

- Cost push inflation happens when the cost of production of goods and services increases.

- Built-in inflation is caused when there is expectation of the inflation rates to rise in the future. Such an expectation leads to workers demanding more wages to maintain their living standards. This translates to increased cost of production and hence higher prices of goods and services. This forms a continuing wage-price spiral.

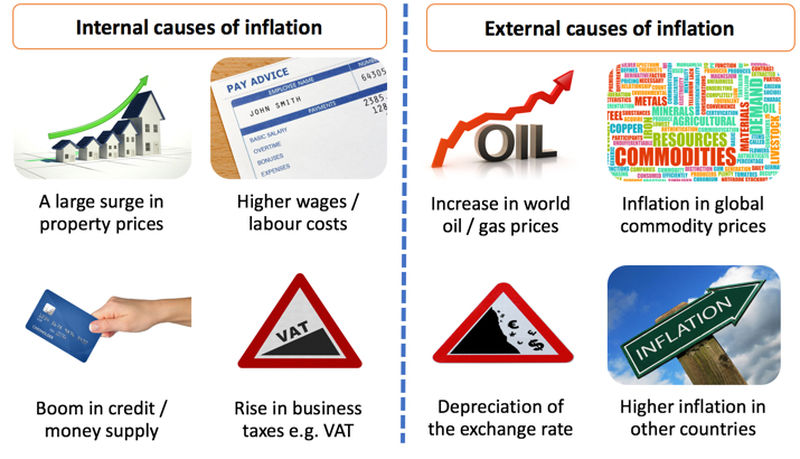

What are the causes of inflation?

Some of the main reasons for inflation are:

- A demand-supply mismatch in which the supply of multiple commodities becomes low due to reasons like low production or disruption of supply chain combined with high demand from the market.

- Excess circulation of money leads to decline in the purchasing power of money. This also causes inflation.

- When people have more disposable income, the tendency to spend increases. This increases demand and leads to inflation.

- A spike in production prices of commodities translates into increased price of the final products.

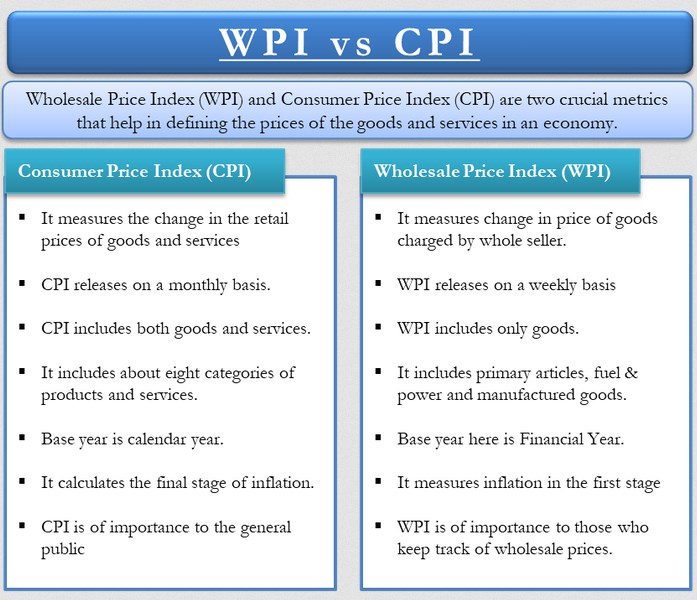

How is it measured?

- It is measured using 2 main indices: WPI and CPI.

- While the WPI or Wholesale Price Index measures price variations at the wholesale-level, the CPI or Consumer Price Index measures retail level price variations.

- While sale of goods and services by businesses to smaller businesses for further sale is captured by WPI, the sale of goods and services to consumers for end use is captured by CPI.

- The WPI tracks only the basic prices of goods without factoring in other costs like taxes, transportation costs, etc. Also, WPI does not track services.

- The three main sectors focused upon by WPI are food prices, fuel and power prices and prices of manufactured products.

- The CPI tracks the prices of 8 major groups: housing, apparel, transportation, education and communication, food and beverages, medical care, recreation and other goods and services.

- India has now moved to CPI measurement.

- The RBI is mandated by law to target the inflation rate in India.

How is inflation regulated in India?

- Inflation targeting is a tool used by central banks to maintain price stability i.e., keep inflation rates close to an annually specified target to enable long term economic growth.

- India uses a flexible inflation targeting framework that was adopted in 2016 through an amendment to the RBI Act, 1934.

- Under this framework, the Monetary Policy Committee determines the policy rate every 5 years. It has members from the RBI and members appointed by the government. Its function is to maintain price stability by setting repo rate.

Why retain the framework when the pandemic is raging?

- In light of the pandemic situation and the resultant need to support the economy, there have been calls for revising the inflation target to give more leeway for the RBI to cut interest rates. There have also been suggestions of revising the framework itself (the Economic Survey suggested shifting the inflation metric to core inflation instead of headline inflation to exclude the transitory food and fuel prices and supply side factors that can’t be influenced by monetary policy) and some even suggest totally abandoning it.

- Recently, the MPC decided to retain the inflation target at 4% with a tolerance band of +/- 2% for period between August 2016 and March 2026.

- In the present scenario, this retention of inflation target is a welcome decision because changing the target now could make management of inflation expectations This is because the inflation expectations have been higher than the actual inflation.

- Retaining the target gives stability and helps the MPC focus its attention on anchoring inflation expectations while keeping in sight the objective of aiding growth.

- According to the RBI Report on Currency and Finance, this target band gives flexibility without undermining the discipline of inflation target.

- In case the upper tolerance limit is set above 6% (4+2%), the policy could be counterproductive and would hamper growth. In case the lower limit is less than 2% (4-2%), the policy would disincentivize production.

- Critics have argued for the dismantling of the framework based on the understanding that there is a trade-off between inflation and growth. This is not true in the medium-to-long term.

- Unlike what critics argue, the RBI has focused on economic growth since the start of the pandemic by cutting interest rates, adopting an accommodative stance, etc. This is despite the increase in inflation due to supply side factors.

- Many countries are reviewing their frameworks to introduce flexibility to enable better management of uncertainty in the economy. Eg: the US Federal Reserve has announced a shift to average inflation targeting. A similar strategy has been introduced by Japan. The Thai Central Bank has shifted from a point target to range target to enhance flexibility.

Why is RBI targeting GDP growth instead of inflation rate?

- Since 2019, the RBI has been focusing on incentivizing economic activities. With the onset of the pandemic, the RBI has been signaling that it would be supporting growth and would allow the inflation rate to go beyond the mandated range.

- This implies that the RBI has been according primacy to GDP growth rather than its legal requirement of maintaining the inflation rate within the mandated range.

- The reasoning is that once the economy revives, the RBI would shift its attention from GDP growth to inflation rate.

- However, the 2nd wave has disrupted the economic revival post the 1st In March, the wholesale inflation rose to over 7%. The RBI has once again decided to focus on GDP growth for as long as required.

- As a result, there is a chance that the inflation rate could spike.

How has the pandemic impacted inflation rate?

- The pandemic has brought in an unprecedented economic crisis worldwide. The governments are responding by increasing fiscal spending and the central banks are increasing liquidity in their economies.

- A case in point is the 6 trillion USD fiscal expansion and a loose monetary policy in the USA.

- There is widespread concern that these measures could lead to a sharp increase in inflation especially as the vaccination drives are getting economies back on track in developed countries.

- If the inflation rates in countries like the USA remains outside the comfort zone, their central banks could take measures that could have repercussions for emerging economies.

- The reverse flow of funds from the emerging economies to the developed economies is one of these possible repercussions.

What are the reasons for inflation in India?

- According to the latest Monetary Policy Report from the RBI, only Turkey has performed worse than India in containing the inflation rate.

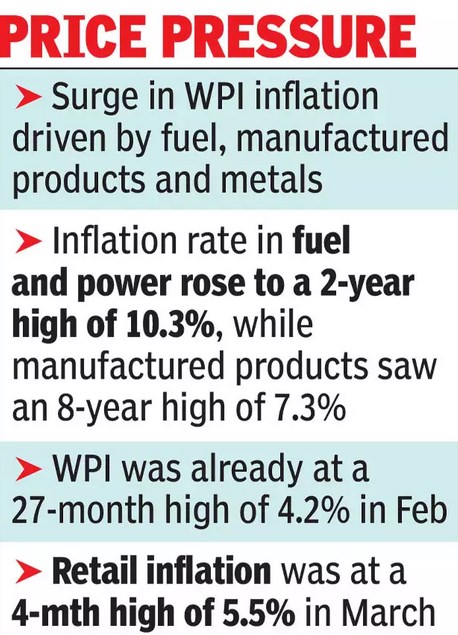

- The CPI of India increased from 4.06% in January to 5.03% in February and then to 5.52% in March.

- The WPI of India has risen to an 8 year high of 7.39% in March.

- The high global inflation could drive prices high in India. An increase in global inflation feeds into domestic inflation rate via imported goods.

- With the 2nd wave of the coronavirus pandemic is wreaking havoc, the state governments are imposing local lockdowns. Supply chain disruptions, similar to those observed during the 2020 lockdowns could drive up the prices.

- Though the governments and businesses are better prepared than last year for such disruptions, the unexpected magnitude of the 2nd wave could make preparations insufficient.

- The governments at the center and states have been piling up taxes on petroleum products to shore up their revenues in light of an uncertain economy. This is resulting in high retail prices of petrol and diesel i.e. fuel inflation.

- In addition to this, the drop in oil prices that served as a respite in the aftermath of the 1st wave, might not be available for the 2nd Major economies like the USA are getting back to normal with a large part of their population getting vaccinated. This is bound to increase oil prices.

- Fuel inflation translates to higher cost of goods transportation. As a consequence, prices of commodities like metals, rubber, textiles and chemicals are also increasing. Notably manufactured products have a 65% weightage in the WPI.

- The food inflation has also been increasing especially in those items that are largely imported such as 25% in edible oils and 13.25% in pulses.

- The monsoon performance is another factor that could affect inflation rate via food price inflation. The past two monsoons have been normal and experts are doubting a 3rd normal monsoon. According to a Crisil report, in the last 20 years, the Indian economy has enjoyed 3 good monsoon years in a row only once.

- In addition to this, the rupee is weakening. This depreciation has resulted from RBI’s efforts to maintain low interest rates on government bonds. The recent announcement of the G-SAP led to a more than 1.5% drop in the rupee.

- Though the Foreign Portfolio Investors added 1.94 lakh crore INR to the Indian economy between October and February as the economy recovered, the resurgence of the pandemic’s second wave has triggered an FPI outflow starting April. This has put a pressure on the rupee and has made imports more expensive.

- Globally, there has been an increase in prices of basic metals like copper, iron, zinc, lead, etc. This is because investors have been buying them up to protect themselves against the increase in money printing by central banks across the world. These metals are used in manufacturing several products and hence could contribute to inflation.

- This is added to by the increased focus on infrastructural development to aid economic revival in many countries. Such construction activities drive up the prices of iron, steel, etc.

What are the concerns?

- Inflation reduces the purchasing power of a country’s currency as goods and services become dearer.

- As a consequence, the cost of living increases in the country. This ultimately results in a slowdown of the economy.

- The inflation rate has an implication for hunger and malnutrition situation in India. There is a real risk of it combining with the pandemic to create a humanitarian crisis.

- Currently, the inflation situation is partly aided by the low demand. However, when the economy revives, the demand with increase. With the demand, the inflation rates could soar. There have even been fears of runaway inflation.

- Currently, the USA has announced no plans to reduce its interest rates. If it decides to cut the interest rates, the differential with the Indian interest rates would drop and would trigger an outflow of capital. This would weaken the rupee.

- The 2nd wave is set to put the Indian economy out of synch with other advanced economies. Many of the western nations have vaccinated a huge portion of their populations and are set to reopen their economies. At the same time, India has made only little progress on the vaccination front and is facing a surge in cases day by day.

- It is noteworthy that the core inflation (inflation measured while excluding transitory price volatility as in case of prices of food items, energy products, etc.) has been edging up too. This trend has been occurring from before the onset of pandemic.

What is the way ahead?

- Currently, there is a negative output gap i.e., the economy is growing below its potential. In such a situation, high inflation is not the biggest risk in the immediate future.

- In addition to this, the job losses and weak labor market means that workers’ bargaining power for higher wages is low. Hence, the demand is to remain weak and the inflation would not be a great risk in the next 6 months.

- If the rupee value declines to uncomfortable levels, the RBI has ample space to intervene given the all-time high in forex reserves. However, such interventions in the currency market should be well thought out and cautious.

- High taxes on fuel should be rationalized using coordinated policy actions by the central and state governments.

- The central government has been looking to reduce dependence on West Asian oil following tensions with Saudi Arabia regarding restrictions in oil production. The inflation situation could be improved by procuring oil from other sources enabling cheaper imports.

- With regards to imported food inflation, the government has already been undertaking measures to improve pulses’ supply like easing restrictions on imports, releasing buffer stocks, etc. While these measures have helped reduce inflation rate of pulses, it is still in double digits. Encouraging pulses’ cultivation would help soothe the situation especially given that India’s acreage under cultivation of pulses is still below target.

- The best measure for reviving the economy is to speed up the vaccination process and improve the vaccination coverage.

- Focus should be on improving hospital and ancillary capacity and effective use of pandemic protocols.

- However, when the vaccination drive successfully aids the recovery of the economy, the RBI must be quick to regulate the liquidity by prioritizing inflation targeting.

- In the post-pandemic future, the focus should be on enabling strong but sustainable growth while ensuring macroeconomic and financial stability.

Conclusion

In the near future, a rising inflation is not as great a threat as a stalled economy. The pandemic claiming lives and man-days is no less a threat. Vaccination (at least targeted coverage) is clearly the best step forward. The MPC decision to stick to flexible inflation targeting is widely considered a welcome step. A lot rides on RBI taking timely action to regulate liquidity when the economy and with it the demand revives.

Practice question for mains

Discuss the implications of a rising inflation rate during a pandemic. How justified is the RBI in prioritizing GDP growth over inflation targeting in such a scenario? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.

Good comprehensive coverage. Thank you for your dedicated efforts and keep it up.