Investment Facilitation Agreement- Background, Significance & Concern

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

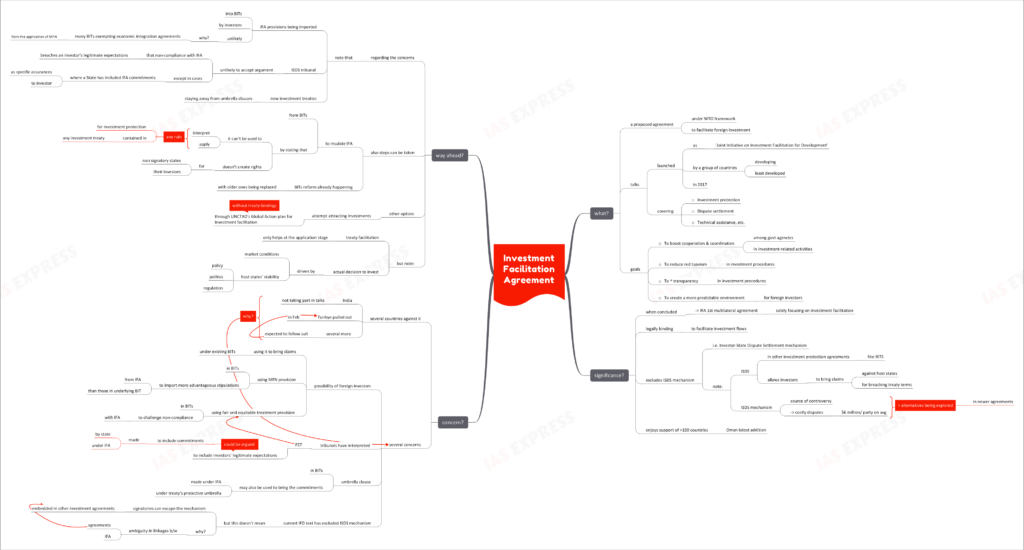

WTO has been in a moribund phase, especially with its dispute settlement system in shambles. However, there have been much activity at the forum around the proposed IFD/IFA. India has chosen to stay out of the negotiations on this landmark deal.

What is IFA?

- The IFA/ Investment Facilitation Agreement is a proposed agreement under the WTO framework to facilitate foreign investment.

- It was originally launched, as the ‘Joint Initiative on Investment Facilitation for Development’, in 2017, by a group of developing and least developing countries.

- Its goals are:

- To boost cooperation and coordination among the government agencies in investment-related activities

- To reduce red tapeism in investment procedures

- To increase transparency in investment procedures

- To create a more predictable environment for foreign investors

- It covers a range of issues like:

- Investment protection

- Dispute settlement

- Technical assistance, etc.

Why is it significant?

- When concluded, the IFA would become the 1st multilateral agreement focusing solely on investment facilitation.

- It would create a legally binding provisions to facilitate investment flows.

- The ISDS or Investor-State Dispute Settlement mechanism has been excluded from the scope of the IFA text.

- In other investment protection agreements, such as BITs (Bilateral Investment Treaties), foreign investors can bring claims against host states for alleged breach of treaty terms through the ISDS mechanism.

- ISDS provisions in many international agreements have been a source of controversy over the years.

- Disputes under this mechanism is often costly- estimated to incur $6 million on average per party.

- Hence, the newer investment agreements are looking at alternative options for dispute resolution.

- It currently enjoys the support of over 100 countries. Oman is one of the newest additions.

What are the concerns?

- While many WTO members are taking part in the IFA talks, India isn’t one of them. Also Turkiye pulled out the IFD discussions in February. More are expected to follow suit due to several concerns:

- India is not participating in the IFA negotiations possibly due to concerns that foreign investors could use it to bring claims under existing bilateral investment treaties (BITs).

- Foreign investors may use the most favoured nation provision in BITs to import more advantageous stipulations from the IFA than those in the underlying BIT.

- Foreign investors may also use the fair and equitable treatment provision in BITs to challenge non-compliance with the IFA.

- Tribunals have interpreted FET to include investors’ legitimate expectations, which could be argued to include the commitments made by a state under the IFA.

- The ‘umbrella clause’ in BITs may also be used to bring the commitments made under the IFA under the treaty’s protective umbrella.

- Also, just because the current IFD text has excluded ISDS mechanism doesn’t mean that its signatories can escape the mechanism embedded in other investment agreements that they have signed. This is especially because of the ambiguity in the linkages between such agreements and IFD.

What is the way ahead?

- IFA provisions being imported into BITs by foreign investors is unlikely due to many BITs exempting economic integration agreements from the application of MFN.

- An ISDS tribunal is unlikely to accept the argument that non-compliance with IFA breaches an investor’s legitimate expectations, except in cases where a State has included IFA commitments as specific assurances to the foreign investor, and then fails to uphold them without a proportionate public policy justification.

- Most new investment treaties are staying away from umbrella clauses, limiting the possibility of investors suing states for non-compliance with IFA as a breach of a BIT.

- The IFA can be insulated from BITs by unequivocally stating that

- It cannot be used to interpret or apply any rule for investment protection contained in any investment treaty

- It doesn’t create rights for non-signatory states and their investors.

- The BIT reform process is already underway, with older treaties being replaced with newer ones that contain more balanced provisions.

- The possibility of an ISDS tribunal interpreting provisions broadly cannot be ruled out, but it should not be the reason to oppose international lawmaking.

- On the other hand, India can simply choose to avoid all the trouble and attempt attracting investments through the UNCTAD’s Global Action plan for investment facilitation, sans treaty bindings.

- At the same time, it must be remembered that facilitation only helps at the application stage, while the actual decision to invest is driven by market conditions and the host states’ stability- political, policy and regulatory.

Conclusion:

Currently, India is staying out of the IFD talks, due to concerns over policy space and the possibility of importing ISDS mechanism’s ills in exchange for investment facilitation. In the event of the parties not bringing in better clarity with regards to the IFD-ISDS linkages, countries could simply opt for the Global Action plan for investment facilitation and focus on improving their regulatory and policy environment for investors.

Practice Question for Mains:

What is the Investment Facilitation Agreement that is being discussed at the WTO? What are the pros and cons? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.