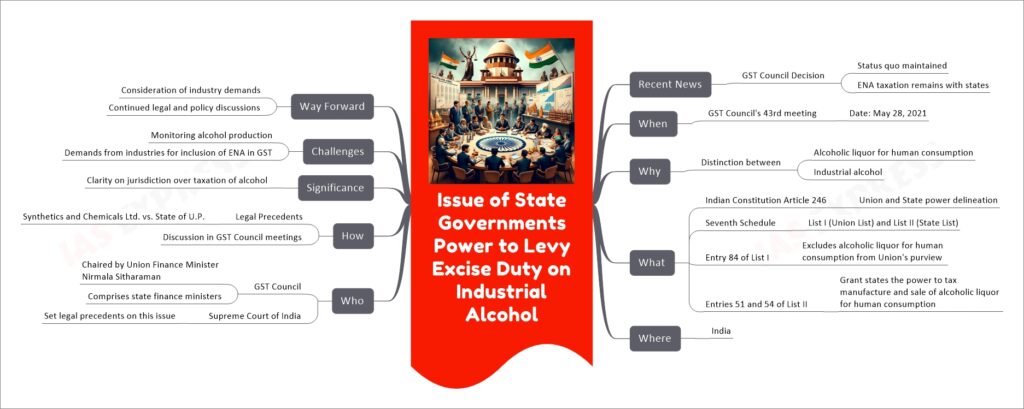

Issue of State Governments Power to Levy Excise Duty on Industrial Alcohol

The issue surrounding state governments’ ability to levy excise duty on industrial alcohol primarily involves the taxation of extra-neutral alcohol (ENA), a highly distilled, food-grade alcohol used in manufacturing alcoholic beverages and for various industrial applications. The core of the debate centers on the constitutional provisions that delineate the powers of the Union and State governments in taxing alcoholic substances. According to the Indian Constitution, states have the exclusive right to tax alcoholic liquor intended for human consumption, while the Union’s jurisdiction excludes this, allowing it to tax other types of goods. A landmark decision by the GST Council, led by Union Finance Minister Nirmala Sitharaman, upheld the status quo, allowing states to continue taxing ENA. This decision reflects ongoing deliberations over the tax jurisdiction of ENA, balancing between industry demands for GST inclusion (to avail input tax credits) and state interests in maintaining revenue from alcohol taxation. Legal precedents further complicate the landscape, emphasizing the nuanced distinction between alcohol for human consumption and industrial use in determining tax authority.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.