Loan Restructuring Schemes- New RBI Scheme vs. Previous Schemes

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

The RBI has cleared a new loan restructuring scheme to help out borrowers in these COVID-19 stricken times. Earlier, the RBI had allowed the banks to provide a 6 month moratorium on term loans to its customers. However the banks were unhappy with the idea and called for a restructuring scheme. In this financially stressing period, the effectiveness of these loan recasting schemes is to be understood.

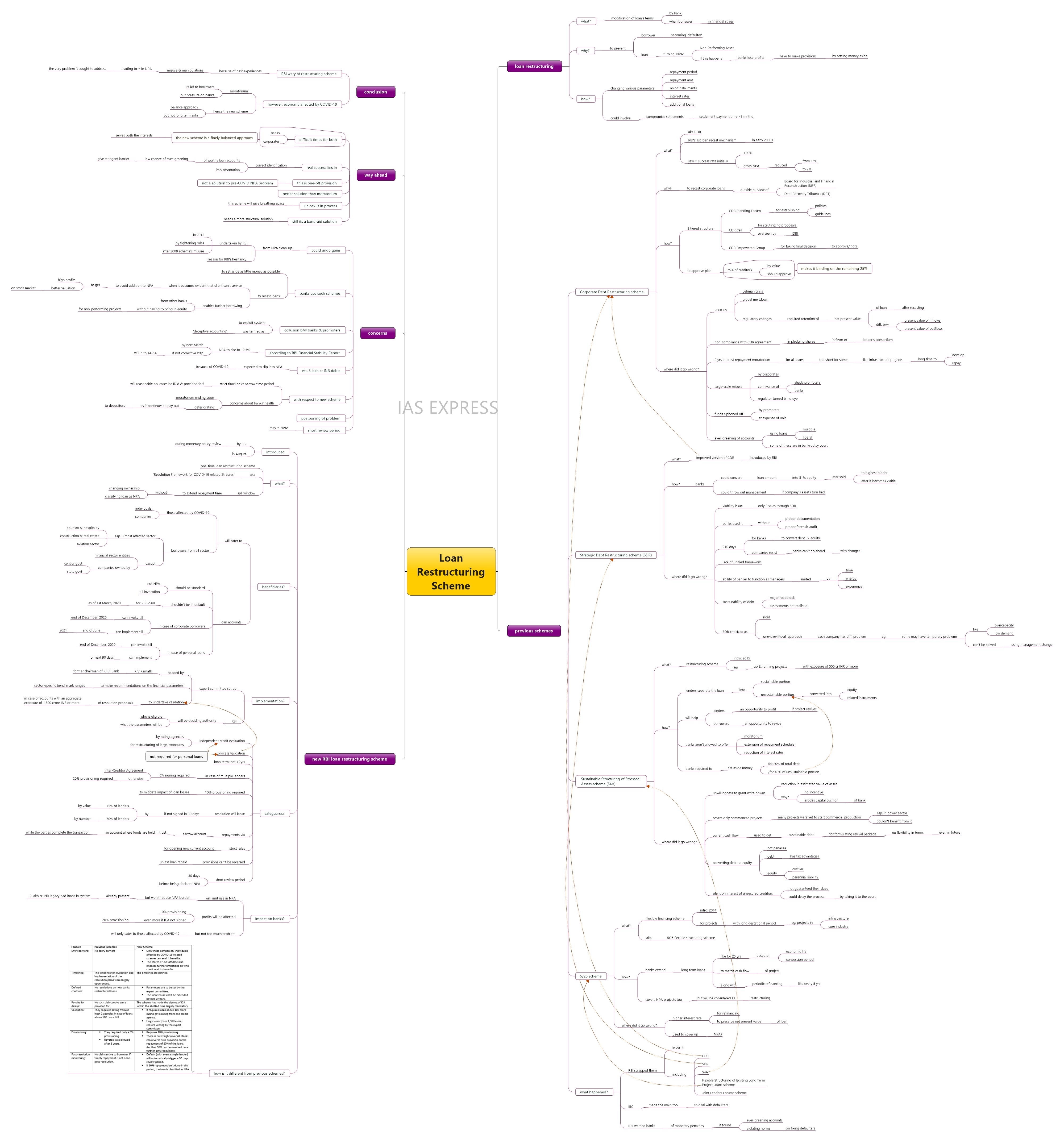

What is loan restructuring and why is it used?

- When a borrower is facing financial stress, the banks can modify the terms of the loan by a practice called restructuring/ recasting.

- This is done to prevent the borrower being declared a defaulter and the loan being classified as an NPA (non-performing asset).

- If the loan is classified as NPA, the banks stand to lose their profits as they have to make provisions towards it by setting aside money.

How is it done?

- Loans can be restructured by changing various parameters like:

- Repayment period

- Repayable amount

- Number of instalments

- Interest rate

- Additional loans

- It could also involve ‘compromise settlements’e. the settlement payment time is more than 3 months.

How have the previous such schemes fared?

- The RBI had made use of one-time loan restructuring in the aftermath of the 2008-09 Global Financial Crisis. These concessions were misused by corporate borrowers and banks. This forced the central bank to make the rules more stringent in 2015.

- Over the years, several such schemes have been introduced to help address the NPA issue:

Corporate Debt Restructuring (CDR):

- The CDR system is the RBI’s first loan recast mechanism.

- It was framed in the early 2000s to recast corporate debts outside the purview of the Board for Industrial and Financial Reconstruction (BIFR) and the Debt Recovery Tribunals (DRT).

- It has a 3 tiered structure consisting of:

- CDR Standing Forum– which is responsible for establishing policies and guidelines related to debt restructuring.

- CDR Cell– for scrutinizing the recasting proposals from borrowers and banks. This was overseen by the erstwhile IDBI.

- CDR Empowered Group– which takes the final decision on whether or not to approve the restructuring proposal.

- To approve the resolution plan, a minimum of 75% of the creditors (by value) should approve it and this makes it binding on the remaining 25% of the creditors.

- Initially, the CDR saw high success rate (over 90%). The gross NPA came down from 15% to a mere 2%.

Where did it go wrong?

Some of the reasons for CDR’s failure are:

- The Lehman crisis and the global meltdown in 2008-09 built up too much stress in the system.

- This coincided with regulatory changes– requirement of retention of the net present value of the loan after recasting. Net present value is the difference between present value of inflows and the present value of outflows. This led to increase in debts.

- Inability to infuse equity capital on the promoters’ part. Equity capital is the capital raised in exchange for ownership share in the company.

- Non-compliance with the CDR agreement in pledging shares in favour of consortium of lenders.

- Prescription of 2 years interest payment moratorium for all types of loans. This is too short a time period for loans to infrastructure projects– which take a long time to develop, let alone repay.

- Large scale misuse by the corporates with shady promoters conniving with banks to manipulate the system. The regulator turning a blind eye to these manipulations were no help either.

- Promoters of big corporates siphoned off funds at the expense of their struggling units.

- Promoters managed to keep their accounts evergreen by getting multiple and liberal loan recasts. Some of these are in bankruptcy courts.

Strategic Debt Restructuring Scheme (SDR):

- This is an improved version of the CDR introduced by the RBI.

- Under this scheme, the banks could convert the loan amount into 51% of equity. Once the firm becomes viable, this equity could then be sold to the highest bidder.

- When a companies’ assets turn bad, the banks had the power to throw out its management.

Where did it go wrong?

- Only 2 sales have taken place through SDR because of viability issue. Hence, it hasn’t helped the banks in resolving their bad loan problem.

- The banks triggered the SDR mechanism in a hurry without proper forensic audits or documentations.

- To convert debts to equity, the banks get 210 days. In many cases, the companies resist the conversion and the banks cannot go ahead with the changes if the companies don’t agree to the new terms.

- Lack of a unified framework had led to confusions. Eg: the SDR process can be stopped if a company is admitted into the BIFR.

- The ability of bankers to function as managers of many companies is limited. Banks do not possess the experience, time and energy required to revive a stressed company.

- Sustainability of debt is a major roadblock. Oftentimes, the banks convert debt into equity without realistic assessment of the debt’s sustainability.

- The SDR has been criticised as ‘rigid’ and ‘a one-size-fits-all’ This does not help as each company faces a different problem. Eg: some companies face problems due to temporary issues like overcapacity or low demand. In such cases changing the management would not help.

Sustainable Structuring of Stressed Assets (S4A) scheme:

- This is a restructuring scheme introduced, in 2015, for projects that are already up and running and has an exposure of 500 crore INR or more.

- The lenders are required to separate the unsustainable loan from the sustainable loan and convert it into equity or other related instruments.

- This reduces the borrower’s debt burden while also reducing the promoter’s equity stake.

- This gives the borrowers a chance to revive and the banks have an opportunity to profit if the company regains stability.

- Unlike in case of CDR, the banks aren’t allowed to offer any moratoria or extensions on repayment schedule or to reduce the interest rate.

- The banks were required to set aside money for 20% of the total debt or 40% of unsustainable portion of the debt.

Where did it go wrong?

- The lenders were hesitant to grant write down (reduction in estimated value of asset) of debts due to lack of incentives. Also, such write downs would erode the capital cushions of the banks.

- The scheme covers only those projects that have already commenced. Many projects, especially in the power sector, were yet to start commercial production due to lack of regulatory clearances and hence couldn’t benefit from it.

- Current cash flows of the project were used to determine the sustainable debt for formulating the revival package. They did not have any flexibility to alter the terms and conditions- even in the future.

- Converting debt into equity is not a panacea for all issues. Debt has tax Equity is costlier and also a perennial liability.

- The scheme was silent on the interests of unsecured creditors. As a result, the unsecured creditors were not guaranteed their dues and hence could delay the process by taking the matter to the court.

5/25 Scheme:

- This is a flexible financing scheme that was introduced in 2014 to extend long-term loans to match the project’s cash flow with periodic refinancing.

- This scheme was introduced by RBI to provide for financing of infrastructure and other core industry projects which have long gestational period.

- Also known as 5:25 flexible structuring scheme, it enables the bank to fix longer amortization period (time taken to pay off a loan) (eg: 25 years), based on concession period or economic life of the project. It also provides for periodic refinancing. Eg: every 5 years.

- This scheme was available even for projects that were already classified as ‘stressed’ or ‘bad debt’. Though these projects will remain labelled NPA, the process will be considered as ‘restructuring’.

Where did it go wrong?

- The refinancing was at a higher interest rate. This was done to preserve the loan amount’s net present value.

- This was used as a tool by the banks to cover up their NPAs.

What happened to these loan restructuring schemes?

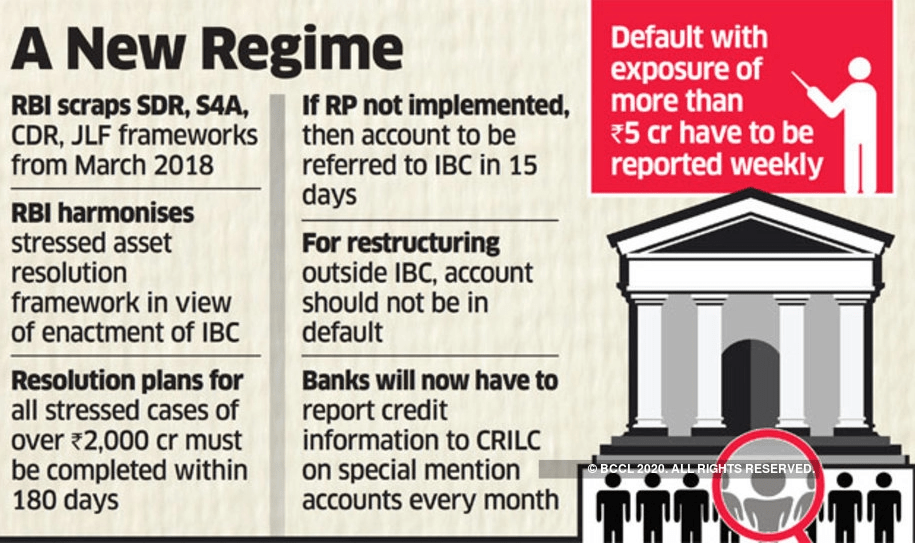

- In 2018, the RBI scrapped numerous loan recasting schemes like CDR, S4A, SDR, Flexible Structuring of Existing Long Term Project Loans scheme and the Joint Lenders Forums scheme.

- It made IBC the main tool to deal with defaulters.

- The RBI warned the banks that if they were found ever-greening accounts or violating its norms on fixing defaulters, monetary penalties would be imposed.

What is the new RBI loan restructuring scheme?

- In early August, the RBI gave the green signal to a one-time loan restructuring scheme during its monetary policy review meeting.

- This ‘Resolution Framework for COVID-19 related Stresses’ is a special window to extend repayment time without having to classify the loans as NPA or changing ownership.

Who are the beneficiaries?

- This scheme will cater to both companies and individuals– who were affected by the COVID-19 pandemic’s economic fallout.

- This scheme is available to borrowers from all sectors. The 3 most affected sectors- tourism and hospitality, construction and real estate and aviation sector– will mainly benefit from it.

- Financial sector entities and companies run by central/ state governments will not be eligible.

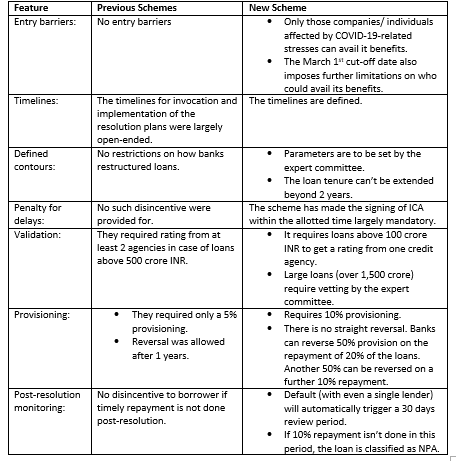

- These loan accounts should continue to be standard (i.e. not classified as NPA) till the invocation date.

- Loan accounts (of individuals and companies) that are in default for 30 days or less as on 1st March, 2020 are covered by this scheme.

- In case of corporate borrowers, the banks can invoke a resolution plan till the end of December, 2020 and implement it till the end of June next year.

- In case of personal loans, the banks can invoke the resolution plan till the end of December, 2020 and implement it within the next 90 days.

How will the scheme be implemented?

- To make recommendations on the financial parameters, the RBI has set up an expert committee, headed by former chairman of ICICI Bank, K V Kamath.

- The RBI has already given broad contours for these parameters. The 5 member panel will recommend sector-specific benchmark ranges for these factors to be provided for in each resolution plan for borrowers with an aggregate exposure of 1,500 crore INR or more.

- In case of accounts above a specific threshold, the committee will undertake a validation process of its resolution plans. This will be notified by the RBI along with modifications.

- This implies that the RBI will be the deciding authority on who is eligible and what the parameters will be.

Does the scheme have safeguards against misuse?

To prevent the ever-greening of bad loans, the RBI has added safeguards in the resolution framework:

- Independent credit evaluation by rating agencies is required for restructuring of large exposures.

- In case of restructuring loans above a certain threshold, a process validation by the expert committee is also required.

- These credit evaluation by rating agency and process validation by the expert committee are not required for personal loans.

- The term of loans under resolution can’t be more than 2 years.

- If multiple lenders are lending to a single borrower, an ICA (Inter-Creditor Agreement) needs to be signed.

- The banks need to make a 10% provision for accounts under resolution to mitigate the impact of loan losses.

- If the banks don’t sign the ICA, a 20% provision needs to be made.

- The resolution will lapse if 75% of the lenders (by values) and 60% of the lenders (by numbers) don’t sign on within 30 days.

- All repayments are to be routed via an escrow account (an account where funds are held in trust while the parties complete the transaction).

- Strict rules for opening new current account.

- Provisions cannot be reversed unless the loan is paid back.

- In case of normal loans, if the borrower defaults, a 90 days review period is given before being declared NPA. Under this scheme however, the review period is a mere 30 days.

How will it impact banks?

- The banks will be able to limit the rise in NPAs– something that is bound to happen due to the pandemic and the lockdown.

- However, it will not reduce the NPA burden from the present levels. Nearly 9 lakh crore INR worth of legacy bad loans will continue to plague the system.

- The banks are required to maintain an additional provision of 10% against the post-resolution debt. This will affect their profits.

- Banks that don’t sign the Inter-Creditor Agreement (ICA) within 30 days of invoking the resolution plan will have to maintain 20% provision- an even bigger burden.

- But banks won’t be facing much of a problem as they have to tackle only those borrowers who were stressed after the incidence of the pandemic.

How is it different from the previous schemes?

What are the concerns?

- It was only in 2015 that the RBI had to tighten rules to prevent the borrowers and banks from misusing the 2008 restructuring scheme. This is the reason why it had been hesitating as resorting to the same solution could undo the gains from its NPA clean-up drive.

- The RBI had been sceptical of restructuring process in general because the banks often use these schemes to set aside as little money as possible for their bad assets. They recast the terms of the loans when it becomes evident that the client would not be able to service the loan and hence, avoid addition to their NPAs.

- This would enable the promoters to borrow from other banks without having to bring in equity in their non-performing projects.

- In the bank’s case, having to make lesser provisions for NPAs imply higher profits and better valuation on the stock market.

- This has led to banks and promoters colluding to exploit the system. Former RBI Governor Raghuram Rajan had called it ‘deceptive accounting’.

- On the other hand, the RBI Financial Stability Report expects the NPA to rise to 5% by March next year. If corrective steps aren’t taken, it could bulge to 14.7%.

- An estimated 3 lakh crore INR worth of debts are expected to slip into NPA because of COVID-19.

- With respect to the new scheme, a major concern is the strict timeline. Experts have voiced concern about whether a reasonable number of cases could be identified and provided for within this narrow time period.

- The moratorium period is to end soon and it is feared that the banks’ health would deteriorate as it continues to pay out interests to depositors.

- Rating agencies have warned that this is simply ‘kicking the can down the road’ e. postponing the problem.

- Some have raised concern about the short time period in which a firm could be classified as NPA. This could lead to increase in NPAs.

What is the way ahead?

- It is to be understood that the COVID-19 has presented a difficult situation for both corporates and the banks. The new scheme is a finely balanced approach to serving the interests of both.

- The real success lies in correct identification of the worthy loan accounts and implementation. Given the stringent entry barriers, the likelihood of successful ever-greening attempts is slim. At the same time, care should be taken to see that the eligible loans don’t get left out due to too stringent conditions.

- This new scheme can be seen as a better solution than moratorium. Moratorium benefited only the borrowers but stressed the banks which continued to pay interests to its depositors.

- Given that unlock is in process, the companies are bound to restart their businesses and generate capital to pay off their debts. Restructuring will give them breathing space in the meantime.

- It is to be noted that this new scheme is a one-off provision for addressing the stress on loans due to COVID-19 situation. This is not a solution for the pre-COVID NPA problem.

- But this is still a band-aid solution. A more structural solution is needed. This is a major lesson from the consequences of the 2015’s attempt to cover up bad loans.

Conclusion

The RBI has been wary of restructuring schemes after its past experiences which resulted in large-scale misuse and manipulation leading to a spike in NPAs- the very problem it sought to address using such schemes. However, in the COVID-19 afflicted economy, the moratorium route has failed to bring relief to banks though it helped out borrowers. The new recast scheme is largely perceived as a careful balanced approach but is not a long term solution. This attempt is comparable to plugging a leak in a fast flooding boat before actually repairing it.

Practice question for mains

Despite RBI’s multiple failed experiments of using loan restructuring to reduce the NPA burden, the central bank again introduced a new loan restructuring scheme in August. Comment. How is this scheme different from the previous schemes? (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.