MSME Sector in India, Atmanirbhar Bharat Package & Credit Guarantees – Explained

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

Updates *

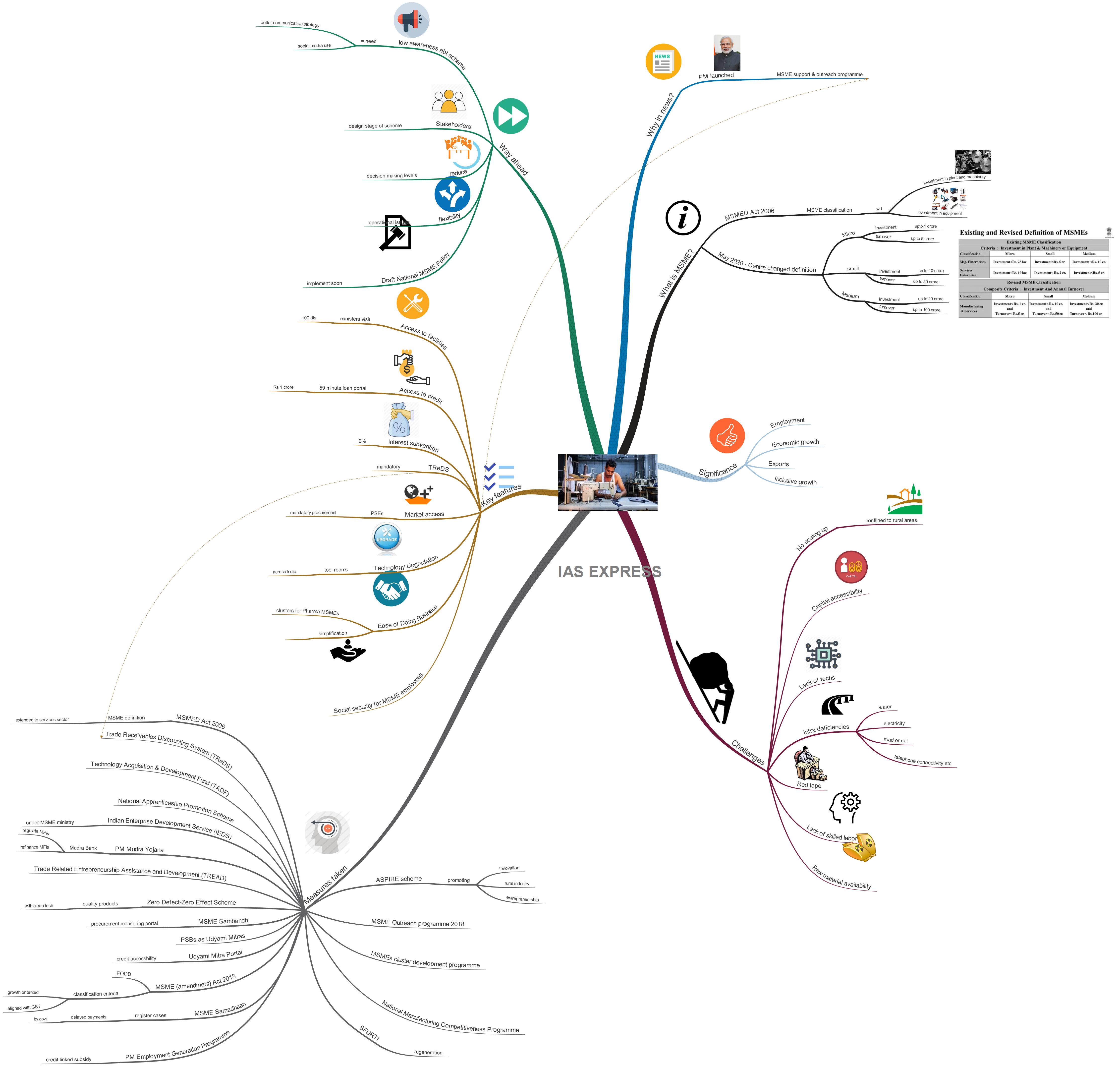

What is MSME?

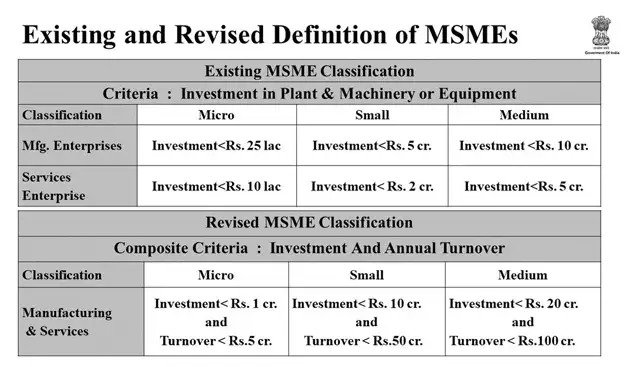

- MSME Development (MSMED) Act, 2006 classifies MSMEs based on the

- Investment in plant and machinery for manufacturing units

- Investment in equipment for service enterprises.

- On May 13, 2020, the Centre has revised the definition of MSMEs by revising the investment limit as well as introducing additional criteria of “turnover” as follows: *

- Micro: Any firm with investment up to Rs 1 crore and turnover under Rs 5 crore.

- Small: A company with investment up to Rs 10 crore and turnover up to Rs 50 crore.

- Medium: A firm with investment up to Rs 20 crore and turnover under Rs 100 crore.

- The centre also removed the distinction between the manufacturing and services sector in MSME definition.

- Here’s a table with the current definition of MSMEs and the revised definition announced by the government:

What is the importance of MSMEs for Indian Economy?

Employment creator:

- MSME is 2nd largest employment provider after agriculture sector.

- It provides 80% of jobs in the industry with just 20% of the investment.

- They also check rural-urban migration by providing people living in isolated areas with a sustainable source of employment.

Economic growth and exports:

- It contributes about 31% to the nation’s GDP, 45% share in the overall exports and 34% share in the manufacturing output as per the 2017 report.

- Non-traditional products like sports goods, readymade garments etc. account for more than 95% of the MSME exports. As these products are mostly handcrafted and hence eco-friendly, there exists an enormous potential to expand MSME led exports.

- Moreover, MSMEs act as ancillary industries for large-scale industries since they provide the latter with raw materials, important components etc.

Inclusive growth:

- MSMEs drive inclusive growth since it develops the lives of the most vulnerable and marginalized sections in India who are the majority of MSME owners.

- Thus MSME sector empowers people by breaking the cycle of poverty and deprivation.

- It is also because the MSME sector in India mostly depends on people’s skills rather than their wealth or capital.

What are the challenges faced by the MSME sector?

- Lack of scaling up and expansion or confined to the rural area – due to the following challenges.

- Access to capital: Around 40% of the small enterprises depends on the informal sources of credit or loan.

- Lack of latest techs = Less productivity + Less competitive compared to imported products and services.

- Deficiencies in basic infrastructural facilities: such as water, electricity, road or rail and telephone connectivity etc.

- Bureaucratic red tape: difficulties in getting multiple statutory clearances with respect to electricity, environment, labour etc.

- Lack of skilled labour

- Raw material availability

What are the measures taken by the government?

- MSMED Act of 2006 included services sector in the definition of MSME, apart from extending the scope to Medium Enterprises.

- Trade Receivable Discounting System (TReDS): an exchange driven trading mechanism aims at ending the endless delays faced by MSMEs in receiving payments for their supplies to bigger industries.

- Technology Acquisition and Development Fund (TADF)

- To facilitate the acquisition of clean, green and energy efficient technologies by MSMEs.

- Launched under National Manufacturing Policy

- Implemented by the Department of Industrial Policy & Promotion (DIPP)

- The National Apprenticeship Promotion Scheme: encourages third-party agencies to provide basic training when in-house training infrastructure not available.

- Indian Enterprise Development Service (IEDS):

- A special cadre established under MSME ministry

- To reform the prevalent regulatory regime that hindered the MSME growth

- Trade-Related Entrepreneurship Assistance and Development (TREAD): launched by MSME ministry to promote women entrepreneurs by providing loan/credit.

- Zero Defect-Zero Effect (ZED) Scheme: to rate and handhold all MSMEs for producing top quality products utilising clean technology.

- Mudra Bank

- MUDRA Bank = Micro Units Development and Refinance Agency Bank.

- The Rs 20,000 crore MUDRA Bank seeks to provide refinancing to small and medium enterprises, especially those from SC & ST.

- The idea is to refinance micro-finance institutions (MFIs) through Pradhan Mantri Mudra Yojana.

- This bank would be responsible for regulating and refinancing all MFIs which are in the business of lending to MSME.

- MSME Sambandh- A portal that will help in monitoring the implementation of the Public Procurement from MSMEs by Central Public Sector Enterprises (CPSEs).

- PSBs as Udyami Mitras – Public Sector Banks (PSBs) to enable faster registration, discounting and financing for MSMEs and revive stressed MSMEs.

- Udyami Mitra Portal – launched by SIDBI to improve credit accessibility and handholding services to MSMEs

- 2018 Amendment to MSME Act 2006: already explained about it in “What is MSME?” heading. It will encourage ease of doing business, make the classification criteria growth-oriented and align them with the new GST regime.

- MSME Samadhaan – empower MSMEs to directly register their cases related to delayed payments by Central Ministries/Departments/CPSEs/State governments.

- PM Employment Generation Programme – Credit linked subsidy programme under MSME ministry.

- Revamped Scheme of Fund for Regeneration of Traditional Industries (SFURTI) – organizes traditional industries and artisans into clusters and make them competitive by improving their marketability & equipping them with improved skills.

- A Scheme for Promoting Innovation, Rural Industry & Entrepreneurship (ASPIRE) –

- Creates new jobs & reduce unemployment,

- Promotes entrepreneurship culture

- Facilitates innovative business solution etc.

- National Manufacturing Competitiveness Programme (NMCP) – to develop global competitiveness among Indian MSMEs.

- MSMEs Cluster Development Programme – cluster development approach to enhance productivity, competitiveness and capacity building of MSMEs.

- MSME Outreach Programme in 2018

What are the key features of MSME Outreach Programme 2018?

The aim is to boost MSME sector by means of facilitating their growth and expansion.

Access to Facilities

- It will run for 100 days covering 100 Districts throughout the country.

- Various central ministers will visit these districts to assess various facilities being extended to the MSME sector by the government.

- Under it, entrepreneurs will be encouraged to come forward and make the best use of these facilities including access to credit and market etc.

Access to Credit

- The government will launch a 59-minute loan portal to enable easy access to credit for MSMEs.

- Loans up to Rs. 1 crore will be granted approval through this portal, in just 59 minutes.

Interest Subvention

- The government will provide 2% interest subvention for all GST registered MSMEs on fresh or incremental loans.

TReDS

- MSMEs with turnover more than Rs. 500 crore will now be mandatorily brought under Trade Receivables e-Discounting System (TReDS).

- This will facilitate entrepreneurs to access credit from banks, based on their upcoming receivables.

- This will help address their problem of cash delays.

Market access

- For access to markets for entrepreneurs, the government made it mandatory for public sector enterprises to procure 25% of their purchases from MSMEs.

- Out of 25% procurement, 3% should be from women entrepreneurs.

Technology Upgradation

- The government will establish tool rooms across the country as a vital part of product design.

Ease of Doing Business

- Clusters will be formed for pharma MSMEs. 70% of the cost for establishing these clusters will be borne by the government.

- Simplification of government procedures in terms of filing returns, clearances etc.

Social Security for MSME sector employees

- A mission will be launched to ensure that the MSME employees have Jan Dhan Accounts, provident fund, and insurance.

Way ahead

- There is a growing number of schemes, portals, programmes etc. for the MSME sector. But there is low awareness about these initiatives amongst the targeted beneficiaries. Hence, there is a need to develop a better communication strategy and the use of new age media tools like social media.

- To make the schemes more demand-driven, it is imperative to involve the stakeholders at the design stage itself.

- Furthermore, the number of different decision-making levels in the government needs to be reduced and enable flexibility on operational issues.

- Draft National MSME Policy should be implemented soon which proposes National MSME Authority headed by the Prime Minister and also empowers the centre to change investment limits instead of being forced to go the Parliament every time.

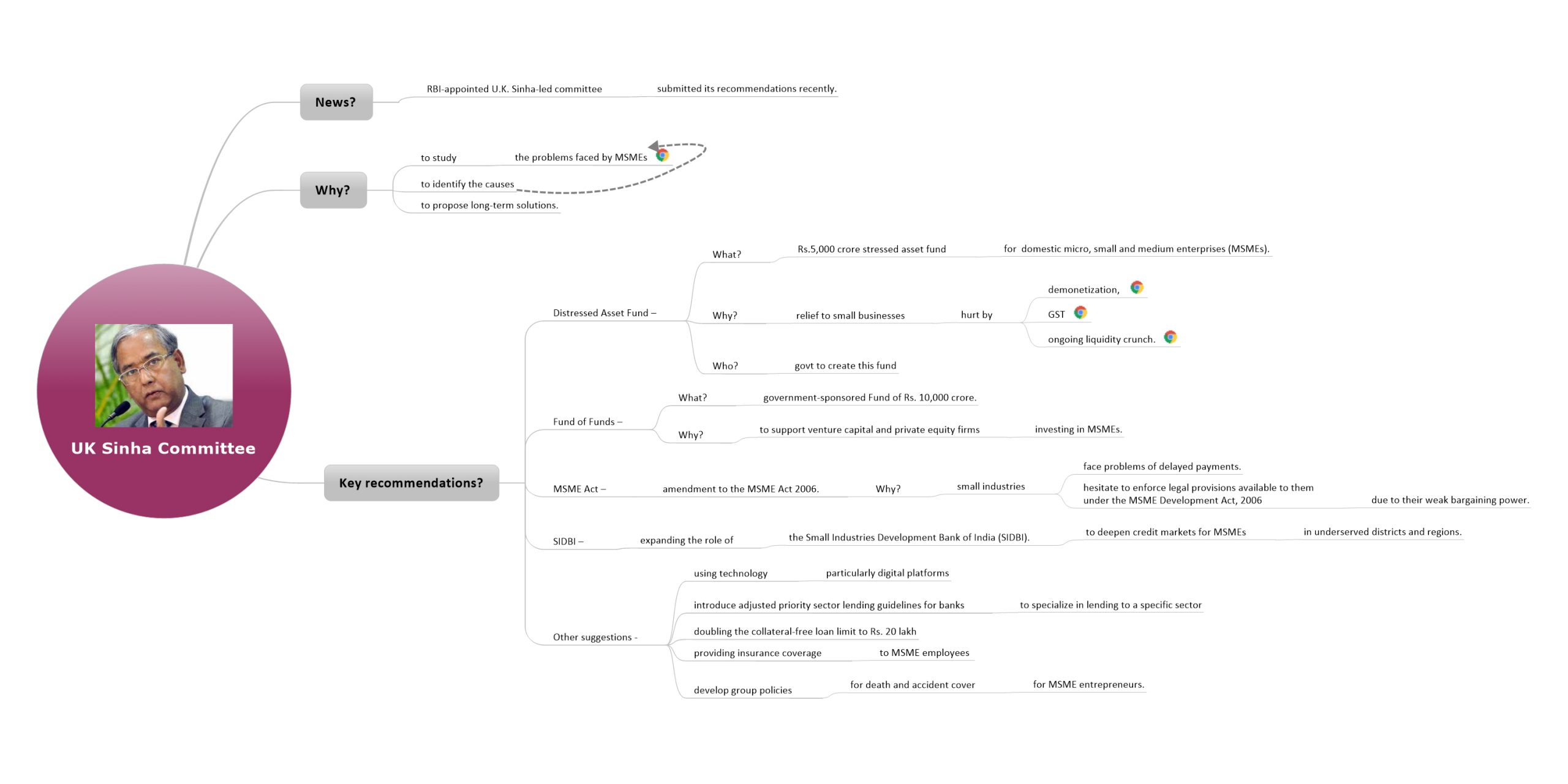

U.K. Sinha Committee

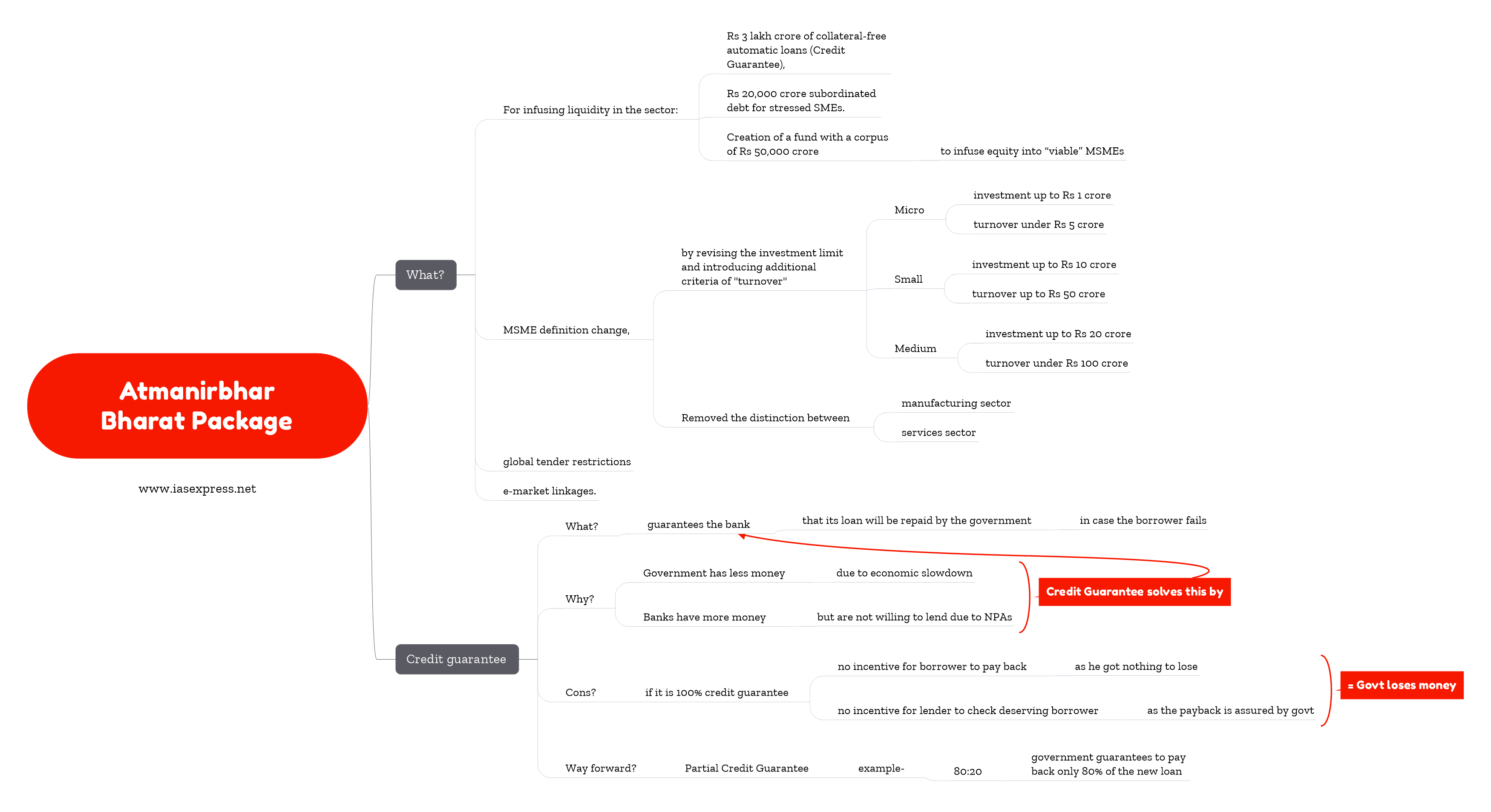

Atmanirbhar Bharat Package *

As part of the Atmanirbhar Bharat package, Finance Minister Nirmala Sitharaman on May 13 announced measures to help support and revive the micro, small and medium enterprises (MSMEs) affected by the COVID-19 outbreak.

The measures taken by the Finance Ministry include

- For infusing liquidity in the sector:

- Rs 3 lakh crore of collateral-free automatic loans (Credit Guarantee),

-

- it is for MSMEs that have an already outstanding loan of Rs 25 crore or those with a turnover less than Rs 100 crore.

- The loans will have a tenure of 4 years and they will have a moratorium of 12 months (that is, the payback starts only after 12 months).

- The loan should be taken before October 31, 2020.

-

- Rs 20,000 crore subordinated debt for stressed SMEs. This will allow loans to MSMEs that were already categorised as “stressed”, or struggling to pay back. In this case, the government’s guarantee is not full, but partial.

- Creation of a fund with a corpus of Rs 50,000 crore to infuse equity into “viable” MSMEs to help them expand and grow.

- Rs 3 lakh crore of collateral-free automatic loans (Credit Guarantee),

- MSME definition change, (read it under “What is MSME” heading)

- global tender restrictions

- e-market linkages.

How far will these measures help?

- The Rs 3 lakh crore credit guarantee:

- is the most beneficial announcement as it will most likely have a meaningful impact in helping MSMEs pay salaries and stay in the business even as the economy slows down.

- According to the Finance Minister, this measure will help as many as 45 lakh MSMEs. While this is a minuscule proportion of the overall number of MSMEs, these are likely to be the medium and small enterprises, which employ almost 40% of all employees — although these enterprises themselves are very few in number (just about 0.5% of all MSMEs).

- The change in the definition of MSMEs: will also help because “turnover” is the more efficient way to identify an MSME and it also allows a lot of firms, particularly in the services sector like mid-sized hospitals, hotels and diagnostic centres to be eligible for benefits as an MSME.

- The other steps: are unlikely to make a huge dent in the overall scheme of things.

What are credit guarantees?

- Loans to MSMEs are mostly given against property (as collateral) because often there isn’t an effective cash flow analysis available.

- But in times of crisis, like the one currently playing out, property prices fall and this affects the ability of MSMEs to seek loans. It also means that banks are less willing to provide loans.

- A credit guarantee by the government helps as it guarantees the bank that its loan will be repaid by the government in case the MSME fails.

- For example, if the government extends say a 100% credit guarantee up to an amount of Rs 1 crore to a company, it means that a bank can lend Rs 1 crore to that firm. In case the firm fails to pay back, the government will pay all of Rs 1 crore. If this guarantee was for the first 20% of the loan, then the government would guarantee to pay back only Rs 20 lakh.

Why credit guarantees?

- Government has less money: Even before the Covid-19 crisis, Indian government finances were in poor health. This pandemic has meant that government revenues will come under further pressure. Experts are already talking about a GDP contraction of 5% to 10% in the current financial year. That will result in a revenue loss of anywhere between Rs 5 to 7 lakh crore. And yet, this is also the year when employees and firms want the government to help them out financially.

- Banks have more money but are not willing to lend: Efforts to pump liquidity via the banks have been a non-starter because banks simply do not want to lend any new money. Banks, quite justifiably, suspect that any new loans will only add to their growing mountain of non-performing assets (NPAs).

- So a credit guarantee by the government helps in this regard as it guarantees the bank that its loan will be repaid by the government in case the borrower falters to repay the loan.

What are the disadvantages of credit guarantees?

- There are downsides particularly if it is a 100% credit guarantee. It is because such a guarantee leaves no incentive for either borrower to pay back (he has nothing to lose) or for the lender (the banker is assured of payback from the government so why should he bother to check if the borrower is deserving or not).

- As a result, it is quite likely that the government will have to start shelling out money in the next financial year when MSME NPAs rise once the moratorium is over.

Way forward

- A more prudent option would have been a split (say an 80%-20%) wherein the government guarantees to pay back only 80% of the new loan. This circumvents the problem of a moral hazard.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.