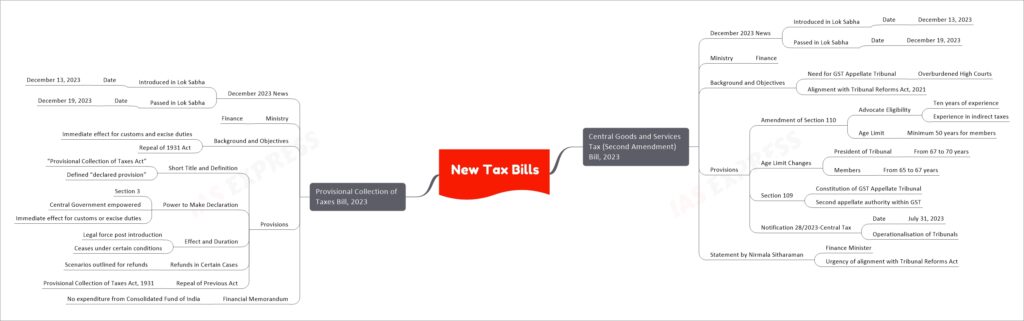

New Tax Bills

The Central Goods and Services Tax (Second Amendment) Bill, 2023, and the Provisional Collection of Taxes Bill, 2023, are significant legislative developments introduced in December 2023. The former amends the Central Goods and Services Tax Act, 2017, primarily to establish a Goods and Services Tax Appellate Tribunal, aligning the Act with the Tribunal Reforms Act of 2021. This tribunal aims to relieve the burden on High Courts and provide a second appellate authority within the GST framework. Key changes include modifications in the qualifications for tribunal members and adjustments to age limits. The latter bill repeals the Provisional Collection of Taxes Act, 1931, and focuses on providing immediate effect to certain customs and excise duty provisions. It ensures fiscal responsibility by not involving expenditure from the Consolidated Fund of India. Both bills reflect the Indian government’s efforts to streamline tax legislation and administration.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.