Payments Infrastructure Development Fund (PIDF) Scheme

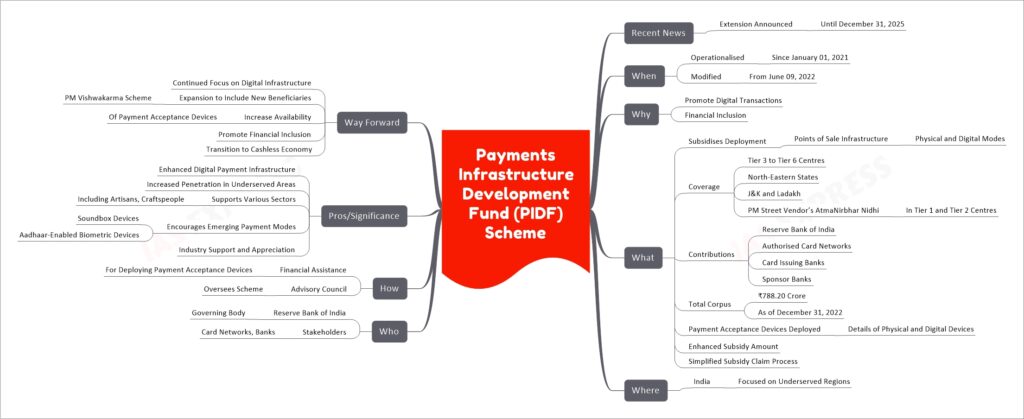

The Payments Infrastructure Development Fund (PIDF) Scheme, operational since January 2021 and extended until December 31, 2025, aims to subsidize the deployment of Points of Sale (PoS) infrastructure across India, particularly in underserved areas like tier-3 to tier-6 centres and the northeastern states. It has been expanded to include beneficiaries of the PM Street Vendor’s AtmaNirbhar Nidhi in tier-1 and tier-2 centres, with the Reserve Bank of India, card networks, and banks contributing to its corpus. The scheme’s modification in 2022 to enhance subsidy amounts and simplify the subsidy claim process reflects its commitment to boosting digital transaction facilities and financial inclusion, especially at the grassroots level.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.