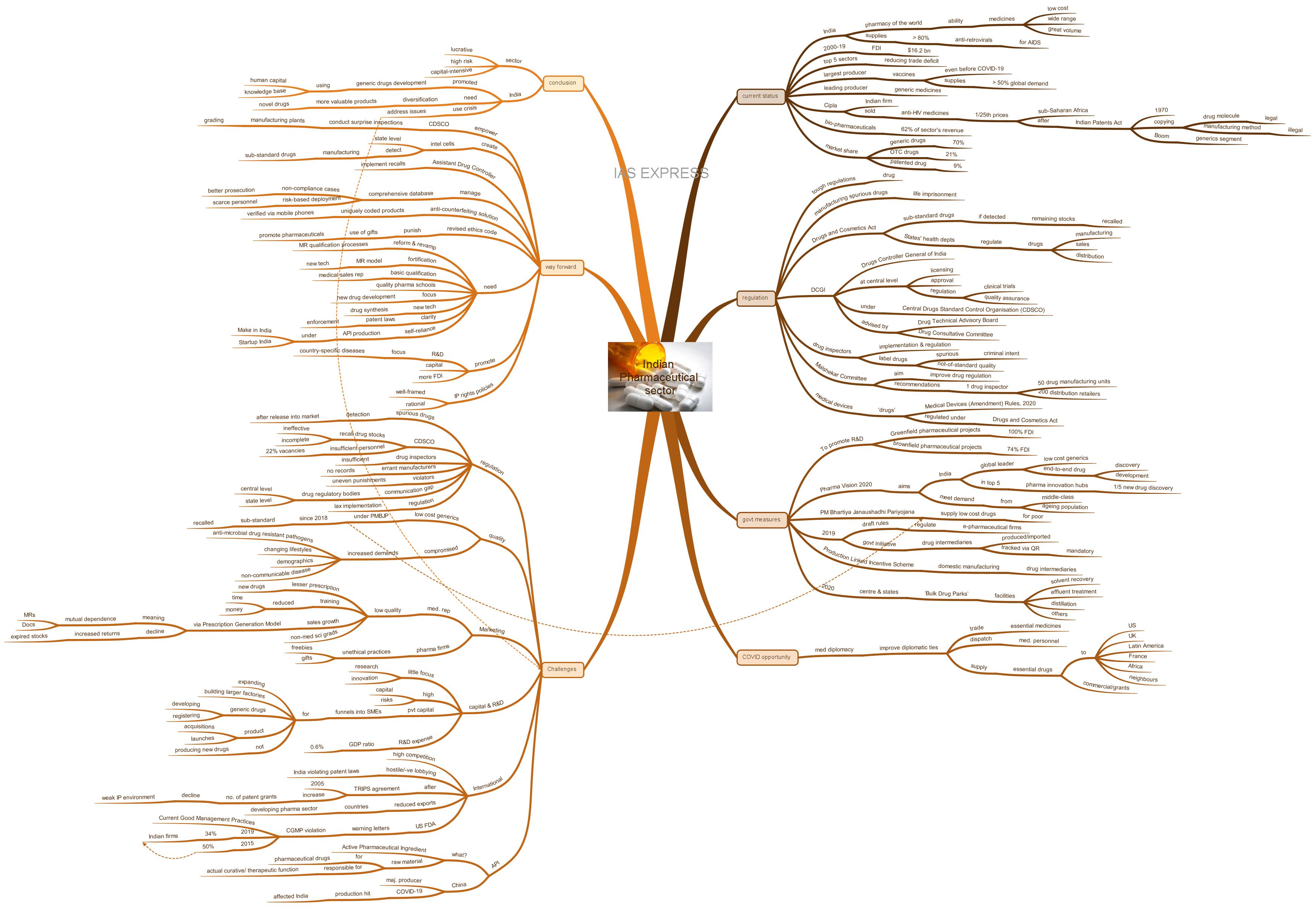

Pharmaceutical Sector in India – Opportunities and Challenges

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

India’s pharmaceutical sector is expected to be one of the very few industries that will record growth in this fiscal year amid strains from the COVID-19 pandemic and the Great Lockdown. Investors are looking at pharma companies as safer bets and the sudden surge in global demand for cheap and reliable drugs has presented a rare opportunity for the Indian pharmaceutical sector to transition from ‘Pharmacy of the World’ to ‘a Global Research Hub’. However, there are also issues in the way of India reaching this goal.

What is the current status of the Indian pharmaceutical sector?

- India is considered as the ‘pharmacy of the world’ due to its ability to produce a wide range and great volume of medicines, that too at low costs.

- Between 2000 and 2019, FDI of $16.2 billion was realized.

- Currently, the sector is one of the top 5 sectors that are bringing down India’s trade deficit with other countries.

- India is the largest producer of vaccines in the world – a title held by it even before the advent of COVID-19 and the demand stimulated by it. Its supplies meet more than 50% of the global demand for different vaccines

- It is one of the leading producers of generic medicines.

- A noted landmark in the growth history of the Indian pharmaceutical sector was when Cipla (an Indian firm) marketed anti-HIV medicines at 1/25th the market cost in sub-Saharan Africa. This followed when the Indian Patents Act was passed in 1970, legalising the copying of a drug molecule for production while copying the actual manufacturing process was considered illegal. This triggered the boom of India’s generics segment.

- 62% of the revenue contribution to this sector is from bio-pharmaceuticals.

- More than 80% of the antiretrovirals used for treating AIDS around the world is supplied by India.

- Of the Indian pharmaceutical sector, generic drugs constitute the largest segment with a market share of 70%. OTC drugs constitute the next biggest segment with 21% of the market segment. Patented drugs account for 9% of the market share.

- It has a presence even in countries like the USA, Japan, Australia and countries in Western Europe, which are noted for their stringent pharmaceutical standards.

- Apart from this, India has been showing substantial progress in its ‘Ease of Doing Business’ ratings and the ‘Global Competitiveness Index’ rankings. This is an indication of the business environment improvement- and would attract more foreign players.

How is the sector regulated in India?

- India has some of the toughest legislation in the world for drug regulation. It even provides for life imprisonment as a penalty for manufacturing spurious drugs.

- According to the Drugs and Cosmetics Act, in case any sub-standard drugs are detected, the remaining stocks are to be recalled.

- Under the provisions of the Drugs and Cosmetics Act of 1940, manufacturing, sale and distribution of drugs are regulated mainly by the state authorities under the states’ health departments.

- Other aspects like licensing, approval, regulation of clinical trials and the quality assurance are handled by the Drugs Controller General of India at the central level.

- The office of DCGI functions under the Central Drugs Standard Control Organisation (CDSCO). He/ she is advised by the Drug Technical Advisory Board and the Drug Consultative Committee.

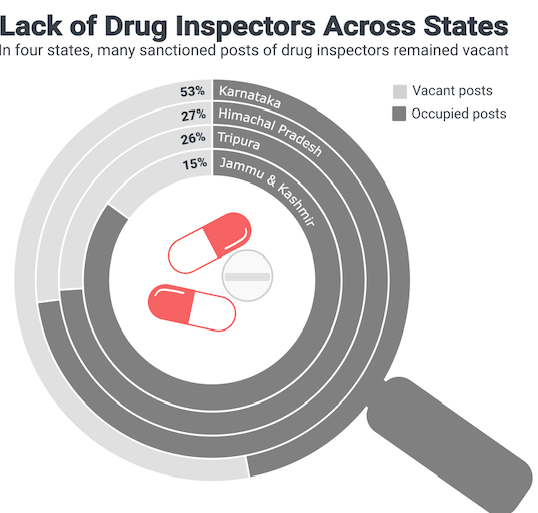

- The ultimate implementation and regulation of the drug manufacturers are carried out by drug inspectors, who are the foot-soldiers of the regulatory framework.

- According to the Malshekar Committee (for improving drug regulation) recommendations, there should be one drug inspector for every 50 drug manufacturing units. Also, there should be one inspector for every 200 distribution retailers.

- The drug inspectors can label the drugs as ‘spurious’ (involving criminal intent) or simply ‘not-of-standard quality’. Based on this, the state authority can decide on the prosecution, license cancellation or simply recall.

- The centre notified medical devices as ‘drugs’ according to the Medical Devices (Amendment) Rules, 2020. This means that these devices will be regulated under the Drugs and Cosmetics Act, 1940. This decision followed the ‘Implant Files Investigations’ of the International Consortium of Investigative Journalists that revealed the poor regulation in the medical devices industry and the resulting adverse effects to the patients. Eg: faulty hip implants from Johnson & Johnson.

What are the government efforts for this sector?

- The government has allowed 100% FDI in Greenfield pharmaceutical projects and 74% FDI in brownfield pharmaceutical projects. This move encourages investment for R&D work- especially for finding solutions for endemic health problems.

- The government had launched the Pharma Vision 2020 with the following objectives:

- Transform India into a global leader in low-cost generics and end-to-end drug discovery and development.

- Make India one of the top 5 pharma innovation hubs in the world- this would entail India launching one out of every five new drugs globally.

- Meet the rising demand from the growing middle-class and quickly ageing population, which would exert significant pressure on the country’s healthcare system.

- The government had launched the Pradhan Mantri Bhartiya Janaushadhi Pariyojana to supply low-cost pharma drugs to the economically weaker sections.

- The government, in 2019, released draft rules for regulating the e-pharmaceutical companies. A regulatory platform is to be set up by the centre.

- Drug intermediaries produced or imported into the country are to be tracked using QR codes according to a 2019 government initiative. This is soon to be made mandatory and will ensure quality and transparency in the sector.

- In March this year, the Union Cabinet approved the establishment of mega ‘Bulk Drug Parks’ in association with state governments. These parks will have common facilities like solvent recovery, effluent treatment, distillation, etc.

- The Cabinet also approved the ‘Production Linked Incentive Scheme’ for encouraging domestic manufacturing of drug intermediaries.

How is India making use of the opportunity presented by COVID-19 crisis?

- India has been making use of ‘medical diplomacy’ to increase its influence in the international sphere.

- Medical diplomacy is the state’s use of essential medicines’ trade and medical personnel’s dispatch to affected countries to improve its international relations.

- India has been supplying essential drugs like hydroxychloroquine and paracetamol to different categories of countries ranging from USA, Russia, France and UK to African and Latin American countries like Zambia, Uganda, Niger, Kenya, Colombia and Uruguay.

- In the neighbourhood, the drugs are being supplied to Afghanistan, Bangladesh, Bhutan, Nepal, Maldives, Mauritius, Myanmar and Sri Lanka.

- While some of these countries received the drugs on a commercial basis, others received it as grants from India.

- Apart from this, India is also dispatching its medicinal personnel to neighbours like Nepal.

What are the issues and challenges?

On the regulatory side:

- The detection of spurious drugs often takes place much later than it is released into the market, which may be even months. Hence the CDSCO’s power to recall the drug stocks remains ineffective.

- A 2019 report highlighted the insufficient capacity and number of drug inspectors, lack of records on errant manufacturers, etc. The issue of uneven punishments for violators and incomplete enforcement of recalls were also highlighted.

- The report also emphasised the communication gap between the drug regulatory bodies at the central and state levels.

- The states have an inadequate number of drug inspectors – sometimes even as high as 53% vacancies like in Karnataka. The CDSCO itself suffers from insufficient personnel with 22% vacancies.

- The lax implementation of regulations in India is evident from India’s handling of the NDMA (a carcinogen) contamination in ranitidine (a medication for treating heartburn). While other countries’ regulators were recalling the product and studying its safety profile, the DCGI simply asked the drug manufacturers to ‘verify and take appropriate measures to ensure patient safety’.

On the quality side:

- Assessment by Bureau of Pharma Public Sector Undertakings of India found that a significant portion of low-cost generics supplied under the PMBJP since 2018 was sub-standard. This led to batches being recalled.

- Increased demands from the emergence of anti-microbial drug-resistant pathogens, changing lifestyles, demographics, the spread of non-communicable disease and other aspects have triggered several profit-driven firms to cut corners.

On the marketing side:

- A significant slowing in the flow of prescriptions due to a drop in quality of medical representatives (MRs). The job is being done even by non-science graduates and undergraduates.

- The pharma firms have been reducing the time and money spent on training MRs- in some cases, completely doing away with any training and directly putting the MRs on the field.

- Compared to this, in countries like Russia, only medical graduates can be pharma sales representatives. In the EU, personnel are required to pass stringent examinations to qualify as MRs. They are also required to periodically renew their certification.

- Pharma sales growth through the ‘Prescription Generation Model’ (mutual dependence between the doctors and the MRs for prescription generation) has been declining. Consequently, there has been an increase in return of expired stocks from stockists – sometimes as high as 4 to 5% (accepted level is 1%).

- Use of freebies and gifts from the pharma firms to doctors to unethically promote the prescription of their drugs.

On capital and R&D aspects:

- Indian pharmaceutical sector lags in the R&D aspect for developing new medicines- far behind other WTO countries. There has only been limited focus on research and innovation.

- Developing novel drugs is a completely different game given its high capital and risk requirements. According to a 2016 assessment, it takes 2.87 billion USD to develop and get a drug approved.

- The private capital is generally funnelled into SMEs- for expanding, building larger factories, developing and registering generic drugs, acquisitions and product launches in different markets- not in producing novel pharmaceuticals.

- R&D expense to GDP ratio of India is low- a mere 0.6%- compared to other countries. Eg: 2.1% in China. This is unfortunate as India has the required human capital and academic strengths to develop such novel drugs.

International aspects:

- There is stiff competition from firms in countries like China, Israel and Japan.

- Hostile and negative lobbying by the big players who frequently accuse Indian firms of violating patent laws.

- Immediately following the 2005 implementation of the TRIPS agreement, the sector saw a surge in the number of patents grants. However, with the weakening of the Intellectual Property environment, there was significant waning.

- Many countries have started working on policies to develop their own domestic pharmaceutical sector. This will reduce the demand for India’s generic drugs’ exports in the long run.

- Warning letters about CGMP (Current Good Management Practices) violations from the US FDA to India has been historically high. In 2019, 34% of the FDA warnings were issued to Indian firms. In 2015, India firms had 50% share in such FDA warnings.

The API issue:

- API or Active Pharmaceutical Ingredient is the raw material used for the production of pharmaceutical drugs. These are the components of the drug that are responsible for the actual curative/ therapeutic function.

- China is one of the major producers of the APIs- especially in Hubei (of which Wuhan is the capital), Zhejiang and Jiangsu (neighbouring regions). The API production took a hit due to the COVID-19 outbreak and the subsequent lockdown in China.

- This came to affect a significant part of world’s API supply.

- India, for its part, depends heavily (nearly 90%) on Chinese-manufactured API. Indian firms like Granules India and AurobindoPharma are heavily dependent on Chinese raw materials for manufacturing antibiotics and antiretrovirals.

- Concerns have been raised about the depleting API inventories in India.

- This foreign-dependence and declining supply of API is expected to affect India’s ability to supply cheap drugs to the world.

What is the way forward?

- The CDSCO must be empowered to conduct surprise inspections of manufacturing plants. The plants can be graded accordingly to help consumers understand the differences in the quality of the drugs.

- In 2018, the creation of intelligence cells at the state level was recommended for detecting cases of sub-standard drug manufacturing. A dedicated post of Assistant Drug Controller for implementing recalls was also proposed.

- It is vital to manage a comprehensive database on cases of non-compliance. This will enable better prosecution of offenders and risk-based deployment of the scarce personnel.

- Reduce the chances for counterfeit drug production by getting top brands to use an anti-counterfeiting solution. Eg: uniquely coded products that can be verified using mobile phones.

- Need for a revised ethics code to punish the use of gifts to promote pharmaceuticals.

- There is a need for reforming and revamping the MR qualification processes.

- Fortification of the MR model with new technologies like apps and devices.

- Basic educational qualification for working as medical sales representatives must be made mandatory.

- Establishing quality pharma schools is essential for a well-trained human resource in the field.

- Though the Indian pharmaceutical sector has been moving ahead mostly using its generics segment, this isn’t reliable in the long term given the increasing tendency of many countries to develop their own pharmaceutical sectors for the same. A sure-fire way of maintaining pharmaceutical market presence is focusing on novel drug development.

- Apart from high calibre academic institutions, there is a need for promoting R&D work and even more essentially, capital funding for developing these drugs.

- Use of emerging technologies to aid in drug synthesis. Eg: in 2018, scientists in the UK have developed a ‘Chemputer’ program to ‘democratize the pharma industry’.

- One possible route in developing these new drugs, the R&D work can be prioritised towards developing solutions for country-specific diseases.

- Developing clarity on India’s patent laws and their enforcement will secure the sector’s viability. It will also promote innovation.

- The policies governing IP rights must also be well-framed and rational.

- In line with India’s Self-Reliance Mission, there is a pressing need to develop self-reliance in API production. India has far more FDA-approved API production centres than anywhere else in the world. This reflects the unexplored potential presented by the API segment. SMEs could be incentivized to manufacture API domestically under various initiatives like Make in India and StartUp India.

- The time is especially ripe for attracting more FDI into India given the prevalence of anti-China sentiments in the global market. Developing the API production capabilities is low-hanging fruit for developing the Indian pharma sector. The works towards this goal can start with identifying API ingredients that are most in demand for production in India.

- Over the last few years, the government has been improving the health infrastructure and healthcare accessibility via various schemes like Ayushman Bharat and Janaushadhi Pariyojana. This presents a vast potential to the pharma sector for expansion and reaching deep into the domestic market. It simply has to ensure quality and affordability.

Conclusion

The pharmaceutical sector is a lucrative but high risk and capital-intensive sector. India has made use of its human capital and knowledge base to catch the generic drugs’ wave. However, for the sector to stay afloat, it must diversify into more valuable products like novel drugs instead of only copying off-patent drugs. Developing a new drug and getting it approved for a market introduction may take decades. The current disruptive situation has presented another opportunity for addressing the various issues dragging the sector down. The question is how effectively and how quickly it is made use of.

Practice question for mains

COVID-19 crisis presents various opportunities and challenges to India’s pharmaceutical sector. Examine.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.

Great article