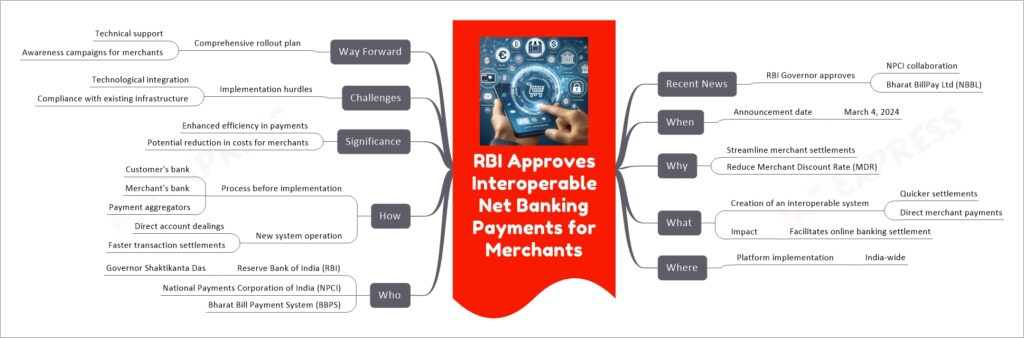

RBI Approves Interoperable Net Banking Payments for Merchants

The RBI has sanctioned the development of an interoperable net banking payment system by the NPCI in collaboration with Bharat BillPay Ltd (NBBL). This system aims to facilitate quicker settlements and direct payments for merchants, potentially reducing the Merchant Discount Rate (MDR). By allowing for direct dealings between accounts through a new platform, it seeks to streamline the payment process, thereby enhancing efficiency and reducing costs for merchants.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.