RBI Digital Payments Index

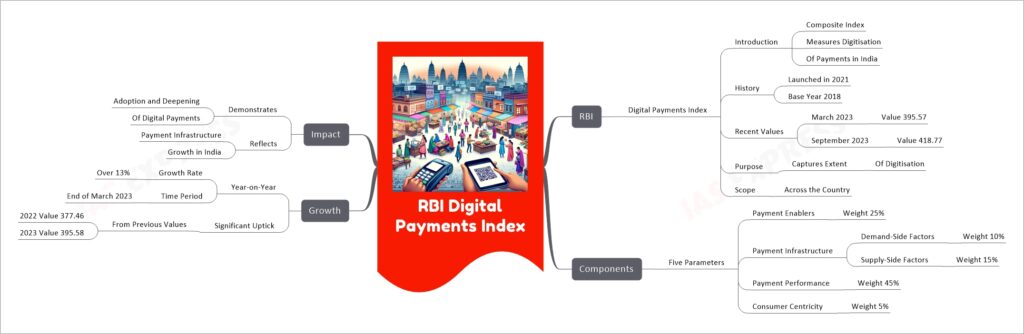

The RBI Digital Payments Index (DPI) is a comprehensive measure developed by the Reserve Bank of India to assess the extent of digitalization in the payments sector across India. This index, introduced in 2021, uses March 2018 as its base year. As of September 2023, the DPI stood at 418.77, indicating a significant growth from its value of 395.57 in March 2023. The index comprises five key parameters: Payment Enablers (25% weight), Payment Infrastructure with both demand-side (10%) and supply-side factors (15%), Payment Performance (45%), and Consumer Centricity (5%). The year-on-year growth rate of over 13% by the end of March 2023 highlights the increasing adoption and deepening of digital payments in India, reflecting a significant enhancement in the country’s payment infrastructure.

In simple terms, the RBI Digital Payments Index is a tool used by the Reserve Bank of India to track and measure the growth and spread of digital payment systems in India. It shows how much people are using digital methods to make payments, and how this is growing over time. The index uses different factors like how easy it is to make digital payments, the availability of the necessary technology, how well the payment systems are working, and how customer-friendly they are. The rise in the index’s value over the years indicates that more and more people in India are switching to digital modes of payment.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.