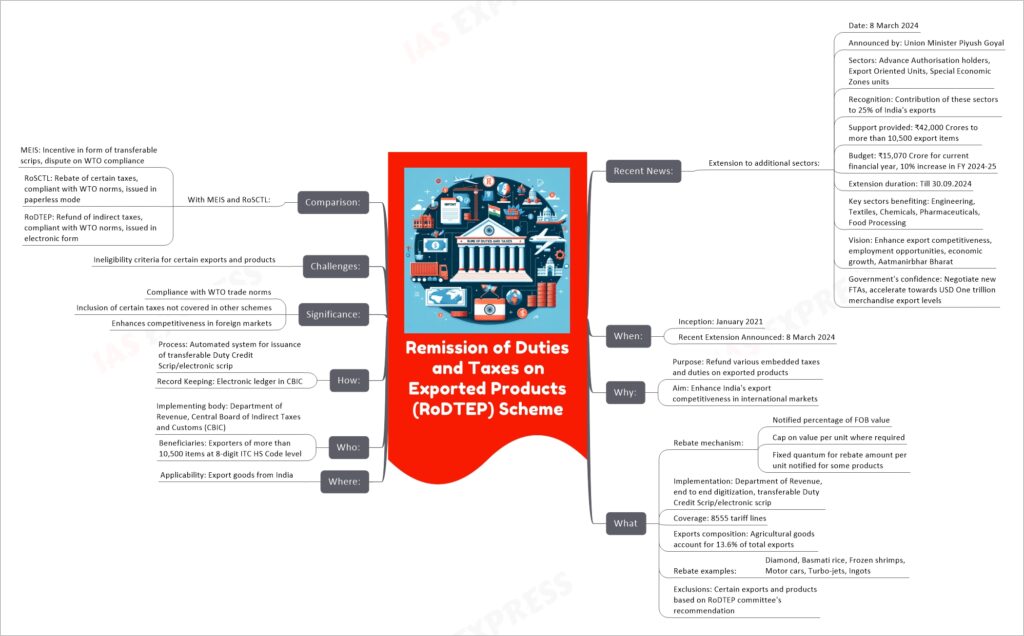

Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme

The Remission of Duties and Taxes on Exported Products (RoDTEP) Scheme, introduced by the Government of India in January 2021, aims to enhance India’s export competitiveness by refunding various embedded taxes and duties on exported products. Recently, it was extended to additional sectors such as Advance Authorisation holders, Export Oriented Units, and Special Economic Zones units, acknowledging their significant contribution to India’s exports. The scheme operates through an automated system, providing rebates on more than 10,500 export items at the 8-digit ITC HS Code level, and is in compliance with WTO trade norms, aiming to provide a level playing field for domestic players in the international market.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.