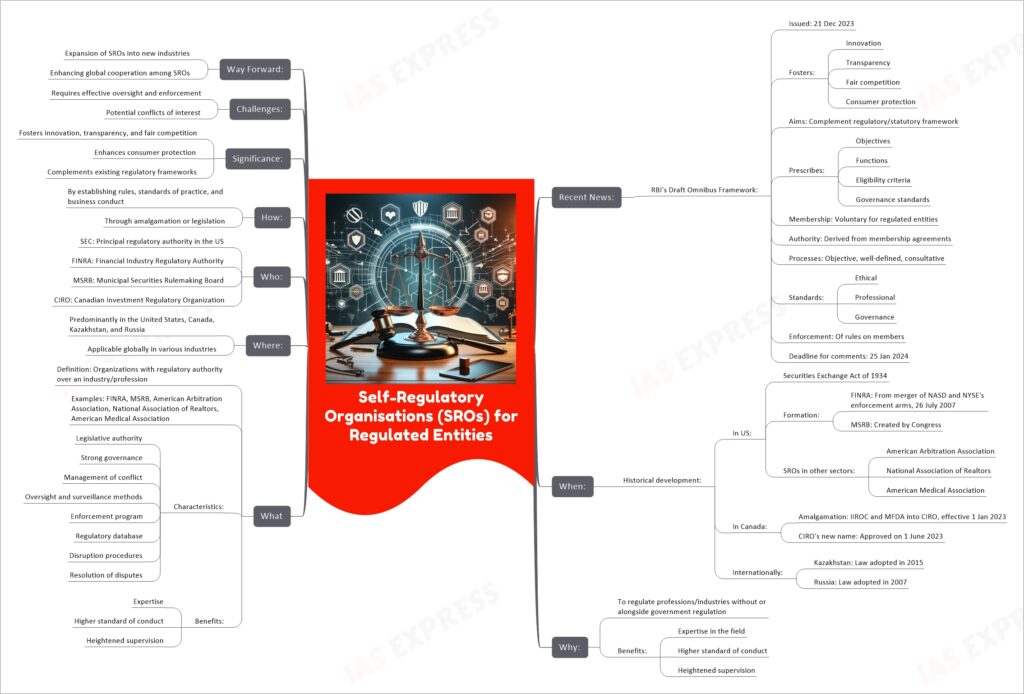

Self-Regulatory Organisations (SROs) for Regulated Entities

Self-Regulatory Organizations (SROs) for Regulated Entities play a crucial role in regulating professions and industries, either in the absence of or alongside government regulation. They are typically non-governmental organizations responsible for setting and enforcing standards, rules, and conduct within their respective domains. SROs like the Financial Industry Regulatory Authority (FINRA) in the United States or the Canadian Investment Regulatory Organization (CIRO) in Canada, offer numerous benefits including expertise in their fields, maintaining higher standards of conduct, and ensuring heightened supervision without direct government involvement. This approach fosters innovation, transparency, fair competition, and consumer protection, complementing the existing regulatory frameworks.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.