Silicon Valley Bank Issue- Recent Developments, Reasons & Significance

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

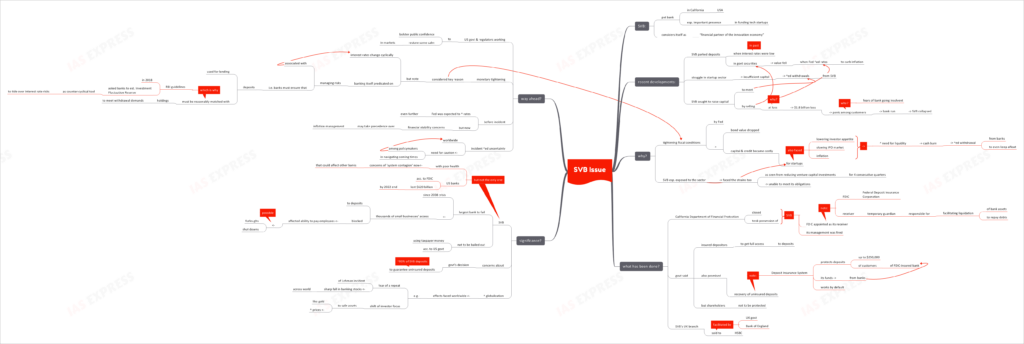

The recent collapse of the Silicon Valley Bank has sent shockwaves, not only in the USA, but across the world.

What is the Silicon Valley Bank?

- Silicon Valley Bank is a private bank based in California, USA.

- It has been especially pivotal in supporting the tech-based startup ecosystem in the country. It considers itself as “financial partner of the innovation economy”.

What are the recent developments?

- In the past, when the interest rates were low in the USA, the bank had parked its deposits in government securities- a safe bet.

- However, with the US Federal Reserve hiking the interest rates as part of its efforts to rein in inflation, the value of the bonds in the bank’s possession fell.

- Meanwhile, the startups have been struggling to generate as much capital as in the past. This led to an increase in demands for withdrawals.

- To meet these demands, the bank announced plans to sell the securities at a loss) given the change in interest rates). The bank’s CEO informed its investors that SVB would be shouldering a $1.8 billion loss.

- This panicked its customers which led to a bank run (i.e. large number of depositors started withdrawing their deposits over fears of the bank turning insolvent), and eventually, the bank’s collapse.

Why did this happen?

- The US Fed’s tightening of the financial conditions triggered the problem. This deteriorated the value of the bonds held by the bank. The tightening conditions also meant that startups’ access to credit and capital became more costly.

- Adding to this, the investors’ appetite for startups was waning after the high during the lockdown period. Also, the slowing IPO market and inflation affected the startups’ liquidity.

- This widespread need for liquidity led a ‘cash burn’ situation in the startup sector. Hence, many companies had to withdraw their deposits from their banks to keep afloat.

- The SVB is particularly exposed to the startup sector. Hence, the strain on the sector was felt by the bank too. It had already experiences 4 consecutive quarters of reducing venture capital investments.

- According to the regulators, the ‘precipitous deposit withdrawal’ meant that the bank was unable to meet its obligations.

What has been done?

- The California Department of Financial Protection closed and took possession of the SVB.

- It appointed the FDIC/ Federal Deposit Insurance Corporation as the receiver. This means that the FDIC would play the role of a temporary guardian. It is responsible for facilitating the liquidation of the bank’s assets to repay outstanding debts.

- Meanwhile, the bank’s management was fired.

- While the insured depositors would be given full access to their deposits, the shareholders of the bank would be left unprotected. Notably, the government has promised the recovery of the even the uninsured deposits.

- Note that the country has a Deposit Insurance System to protect deposits up to $250,000 of customers of FDIC-insured bank. The amount above this limit is uninsured. Banks make payment into the Deposit Insurance Fund and it works by default (i.e. customers needn’t separately purchase insurance for their deposits).

- The UK government and the Bank of England facilitated the sale of SVB’s UK branch to HSBC.

Why is this concerning?

- SVB is the largest bank to fail since the global economic crisis in 2008. Notably, the US government had ruled out the possibility of a complete bailout using taxpayer money.

- The incident has blocked thousands of small businesses’ access to their deposits. This has affected their ability to pay their employees. This could lead to furlough and even shut down of entire enterprises.

- However, it isn’t the only bank with poor health. According to the FDIC, by 2022 end, US banks had lost $620 billion. There are now concerns of a ‘systemic contagion’ negatively affecting other banks in the country.

- The US government’s decision to guarantee even the uninsured deposits raises concerns of moral hazard. Reportedly, some 93% of SVB’s deposits were uninsured.

- Given the high level of globalization, SVB’s sudden collapse is creating ripple effects across the world- beyond the tech and startup sectors.

- Fears of a repeat of the Lehman incident led to a sharp fall in banking stocks across the world.

- Investors shifted focus to safe haven assets like gold, leading to an increase in gold prices.

What is the way ahead?

- The US government and regulators have been working to bolster public confidence and restore some degree of calm in the markets.

- While the monetary tightening is being considered as the key reason behind the SVB collapse, it is necessary to remember that interest rates change cyclically and the concept of banking itself is predicated on managing the risks associated with such changes. Banks must ensure that the deposits that they use to fund their lending are reasonably matched with the holdings to meet withdrawal demands.

- It is for this reason that the RBI’s 2018 guidelines advise banks to use the Investment Fluctuation Reserve as a countercyclical tool to tide over interest rate risks.

- Before this incident, the US Fed was expected to hike its interest rates further. Now, financial stability concerns may take priority over inflation management.

- The incident has heightened uncertainty across the world. Policymakers worldwide need to take care while navigating the upcoming challenging times.

Conclusion:

The SVB collapse is a fallout not only of financial tightening by the Fed, but also of insufficient risk management efforts on the bank’s side. It should serve as a lesson to policymakers on how to navigate the post-pandemic market challenges.

Practice Question for Mains:

Discuss the reasons, significance and learnings from the recent Silicon Valley Bank collapse in the USA. (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.