Special Category Status (SCS) in India – Meaning, Benefits, Challenges

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

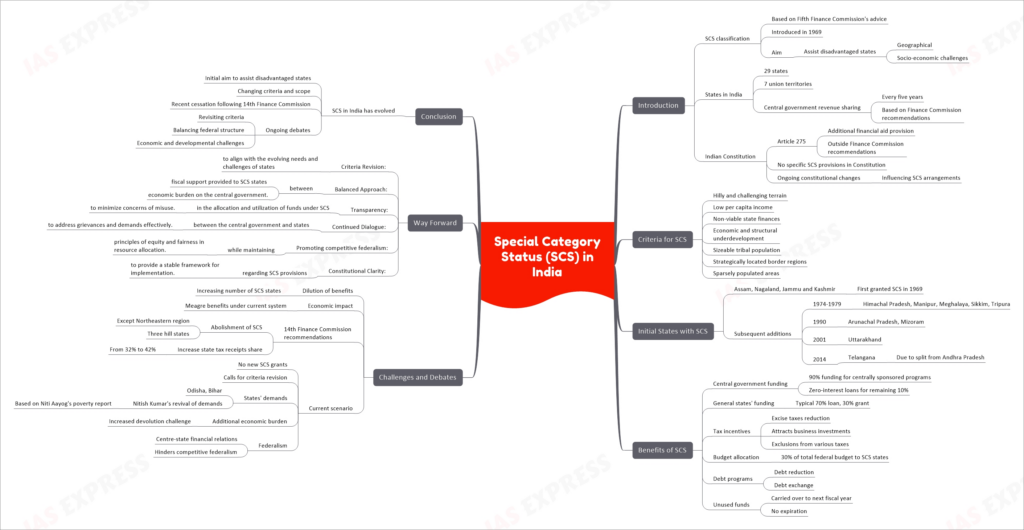

Special Category Status (SCS) is a classification that has been an important aspect of India’s federal fiscal structure. It was introduced in 1969 based on the recommendations of the Fifth Finance Commission. The primary aim of SCS is to assist states in India facing various challenges, both geographical and socio-economic, by providing them with additional financial support. In this article, we will delve into the details of SCS in India, its criteria, the states that have been granted this status, the benefits it offers, and the ongoing debates and challenges surrounding it.

SCS Classification

SCS is a unique classification that sets certain states apart in terms of financial assistance. It is a result of the recommendations made by the Fifth Finance Commission and has been in effect since 1969. The key objective of SCS is to provide additional financial support to states that face specific disadvantages, both in terms of geography and socio-economic factors.

Aim

The primary aim of SCS is to assist disadvantaged states in India. These disadvantages can be broadly categorized into two major areas:

- Geographical Challenges: States with hilly and challenging terrains, strategically located border regions, and sparsely populated areas often require extra financial support to overcome their unique challenges.

- Socio-economic Challenges: States with low per capita income, non-viable state finances, economic and structural underdevelopment, a sizeable tribal population, and other socio-economic challenges also benefit from SCS.

States in India

India consists of 29 states and 7 union territories. The allocation of resources and revenue sharing between these states and the central government is a critical aspect of India’s fiscal policy. This sharing is done every five years based on the recommendations of the Finance Commission.

Indian Constitution

While the Indian Constitution does not have specific provisions for Special Category Status, Article 275 allows for additional financial aid beyond what is recommended by the Finance Commission. This provision gives the central government some flexibility in providing financial support to states facing exceptional circumstances.

Ongoing Constitutional Changes

Over time, there have been discussions and debates regarding the need to incorporate SCS provisions directly into the Constitution to provide more clarity and stability to the process of granting SCS.

Criteria for SCS

The criteria for granting SCS to a state in India are carefully considered, and they encompass various factors that highlight the challenges faced by these states. The main criteria include:

- Hilly and challenging terrain

- Low per capita income

- Non-viable state finances

- Economic and structural underdevelopment

- Sizeable tribal population

- Strategically located border regions

- Sparsely populated areas

States with SCS

When SCS was first introduced in 1969, it was granted to certain states that met the specified criteria. These states included:

- Assam

- Nagaland

- Jammu and Kashmir

Subsequent Additions

Over the years, several other states were granted SCS based on their unique challenges:

- In the period between 1974 and 1979, states like Himachal Pradesh, Manipur, Meghalaya, Sikkim, and Tripura were added to the list.

- In 1990, Arunachal Pradesh and Mizoram received SCS.

- In 2001, Uttarakhand was granted SCS status.

- The most recent addition was in 2014 when Telangana was included, primarily due to its split from Andhra Pradesh.

Benefits of SCS

States granted Special Category Status enjoy various benefits that are aimed at promoting their economic and social development. These benefits include:

- Central Government Funding

- 90% funding for centrally sponsored programs: SCS states receive a significant portion of their funding for various government programs from the central government.

- Zero-interest loans for remaining 10%: The remaining 10% of funding is provided as zero-interest loans, which eases the financial burden on these states.

- General States’ Funding: Typical 70% loan, 30% grant. Unlike SCS states, other states typically receive a larger portion of their funding as loans, which need to be repaid.

- Tax Incentives

- Excise taxes reduction: SCS states enjoy reduced excise taxes, making it more attractive for businesses to invest in these regions.

- Attracts business investments: These incentives help attract business investments, promoting economic growth.

- Exclusions from various taxes: SCS states are often exempted from various taxes, further encouraging economic development.

- Budget Allocation: 30% of total federal budget to SCS states to support their development initiatives.

- Debt Programs

- Debt reduction: SCS states may benefit from debt reduction programs to alleviate their financial burden.

- Debt exchange: Some states engage in debt exchange programs to manage their liabilities effectively.

- Unused Funds

- Carried over to the next fiscal year: Any funds that remain unutilized by SCS states in a fiscal year are carried over to the following year, ensuring that the resources are not wasted.

- No expiration: These funds do not have an expiration date, providing flexibility in their utilization.

Challenges and Debates

While SCS has been instrumental in supporting disadvantaged states, it has also faced its fair share of challenges and debates.

- Dilution of Benefits: One significant concern is the dilution of benefits as the number of states with SCS has increased over time. This dilution has led to questions about whether the original purpose of SCS is still being effectively served.

- Economic Impact: Some critics argue that the benefits provided under the current SCS system are meager and may not be sufficient to address the pressing economic challenges faced by these states.

- 14th Finance Commission Recommendations

- The 14th Finance Commission recommended a significant change in the SCS framework, which stirred up debates and discussions. These recommendations included:

- Abolishment of SCS for all states except the Northeastern region and three hill states: This recommendation raised concerns among states that would lose their SCS status.

- Increase in the state tax receipts share from 32% to 42%: While this increased the share of revenue for states, it also posed challenges in terms of increased devolution.

- Current Scenario: As of now, there have been no new grants of SCS, and the existing status of states remains unchanged. However, there have been calls for revising the criteria for SCS, taking into account the evolving economic and developmental challenges faced by various states.

- States’ Demands: States like Odisha and Bihar have been vocal in demanding Special Category Status, citing their unique challenges. Bihar Chief Minister Nitish Kumar revived these demands based on the poverty report of Niti Aayog, further emphasizing the need for reevaluation.

- Additional Economic Burden: One of the challenges posed by SCS is the increased devolution of funds to these states, which can create an additional economic burden for the central government.

- Federalism: The discussions surrounding SCS also touch upon broader issues related to federalism, including the dynamics of center-state financial relations and how SCS can either support or hinder the principles of competitive federalism.

Way Forward

To address the challenges and debates surrounding Special Category Status (SCS) in India, a way forward involves careful consideration of the following:

- Criteria Revision: Periodic review and revision of the criteria for SCS to ensure that it aligns with the evolving needs and challenges of states.

- Balanced Approach: Striking a balance between the fiscal support provided to SCS states and the economic burden on the central government.

- Transparency: Ensuring transparency in the allocation and utilization of funds under SCS to minimize concerns of misuse.

- Continued Dialogue: Encouraging ongoing dialogue between the central government and states to address grievances and demands effectively.

- Competitive Federalism: Promoting competitive federalism while maintaining the principles of equity and fairness in resource allocation.

- Constitutional Clarity: Addressing the need for constitutional clarity regarding SCS provisions to provide a stable framework for implementation.

By addressing these aspects, India can move forward in effectively utilizing SCS to support the development of disadvantaged states while maintaining a fair and equitable fiscal system.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.