1.1 Marshallian and Walrasian Approach to Price determination

I. Introduction to Price Determination Approaches

Overview

- Definition of Price Determination

- Price determination refers to the process by which the market price of a good or service is established.

- It involves the interaction of supply and demand to reach an equilibrium price.

- This equilibrium price is where the quantity supplied equals the quantity demanded.

- Importance in Economics

- Central to understanding market dynamics and resource allocation.

- Influences consumer behavior, production decisions, and overall economic welfare.

- Helps in policy formulation and economic planning.

- Historical Context of Price Determination Theories

- Early economic thought by Adam Smith emphasized the “invisible hand” guiding market prices.

- Classical economists like David Ricardo and John Stuart Mill contributed to the labor theory of value.

- The marginal revolution in the late 19th century introduced the concepts of marginal utility and marginal cost, leading to modern price determination theories.

Marshallian Approach

- Introduction to Alfred Marshall

- Alfred Marshall (1842-1924) was a British economist and a key figure in the development of microeconomics.

- His seminal work, “Principles of Economics” (1890), laid the foundation for the Marshallian approach to price determination.

- Key Principles

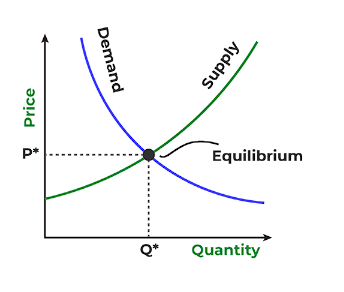

- Demand and Supply Analysis

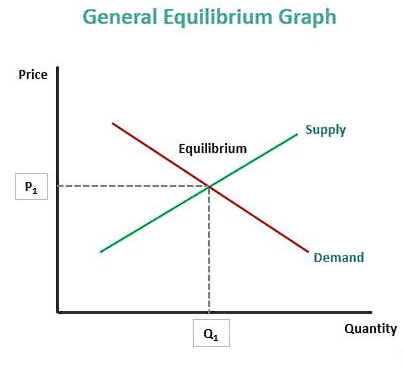

- Price is determined by the intersection of the demand and supply curves.

- Demand curve represents the relationship between price and quantity demanded, typically downward sloping.

- Supply curve represents the relationship between price and quantity supplied, typically upward sloping.

- Consumer Surplus and Producer Surplus

- Consumer surplus is the difference between what consumers are willing to pay and what they actually pay.

- Producer surplus is the difference between what producers receive and their minimum acceptable price.

- Elasticity

- Price elasticity of demand measures the responsiveness of quantity demanded to a change in price.

- Price elasticity of supply measures the responsiveness of quantity supplied to a change in price.

- Demand and Supply Analysis

- Assumptions

- Perfect Competition

- Many buyers and sellers, none of whom can influence the market price.

- Homogeneous products with no differentiation.

- Free entry and exit of firms in the market.

- Supply as Cost

- Supply is determined by the cost of production.

- Firms produce where marginal cost equals marginal revenue.

- Demand as Utility

- Demand is driven by the utility or satisfaction consumers derive from a good or service.

- Consumers aim to maximize their utility given their budget constraints.

- Perfect Competition

Walrasian Approach

- Introduction to Leon Walras

- Leon Walras (1834-1910) was a French economist known for his work on general equilibrium theory.

- His major work, “Elements of Pure Economics” (1874), introduced the Walrasian approach to price determination.

- Key Principles

- General Equilibrium

- Focuses on the simultaneous determination of prices and quantities in all markets.

- Assumes that all markets are interrelated and must be in equilibrium simultaneously.

- Tâtonnement Process

- A hypothetical auctioneer adjusts prices until supply equals demand in all markets.

- No actual transactions occur until equilibrium prices are found.

- Interdependence of Markets

- Changes in one market affect other markets.

- Prices and quantities in one market depend on prices and quantities in other markets.

- General Equilibrium

- Assumptions

- Perfect Competition

- Similar to the Marshallian approach, assumes many buyers and sellers with no market power.

- Rational Behavior

- Consumers and producers are rational and aim to maximize their utility and profit, respectively.

- Complete Markets

- All goods and services are traded in markets.

- There are no missing markets or externalities.

- Perfect Competition

II. Marshallian Approach to Price Determination

Demand and Supply Interaction

- Demand Curve

- Represents the relationship between price and quantity demanded.

- Typically downward sloping.

- Indicates that as price decreases, quantity demanded increases.

- Reflects the law of demand.

- Influenced by factors such as consumer preferences, income levels, and prices of related goods.

- Supply Curve

- Represents the relationship between price and quantity supplied.

- Typically upward sloping.

- Indicates that as price increases, quantity supplied increases.

- Reflects the law of supply.

- Influenced by factors such as production costs, technology, and number of sellers.

- Equilibrium Price

- The point where the demand and supply curves intersect.

- Represents the price at which quantity demanded equals quantity supplied.

- Ensures market clearing with no excess supply or demand.

- Adjusts in response to shifts in demand or supply curves.

Market Period

- Definition

- The very short run in which supply is fixed.

- Time period too short for producers to adjust output levels.

- Characteristics

- Very Short Run

- Supply remains constant.

- Producers cannot change production levels.

- Constant Supply

- Fixed quantity of goods available.

- No time for production adjustments.

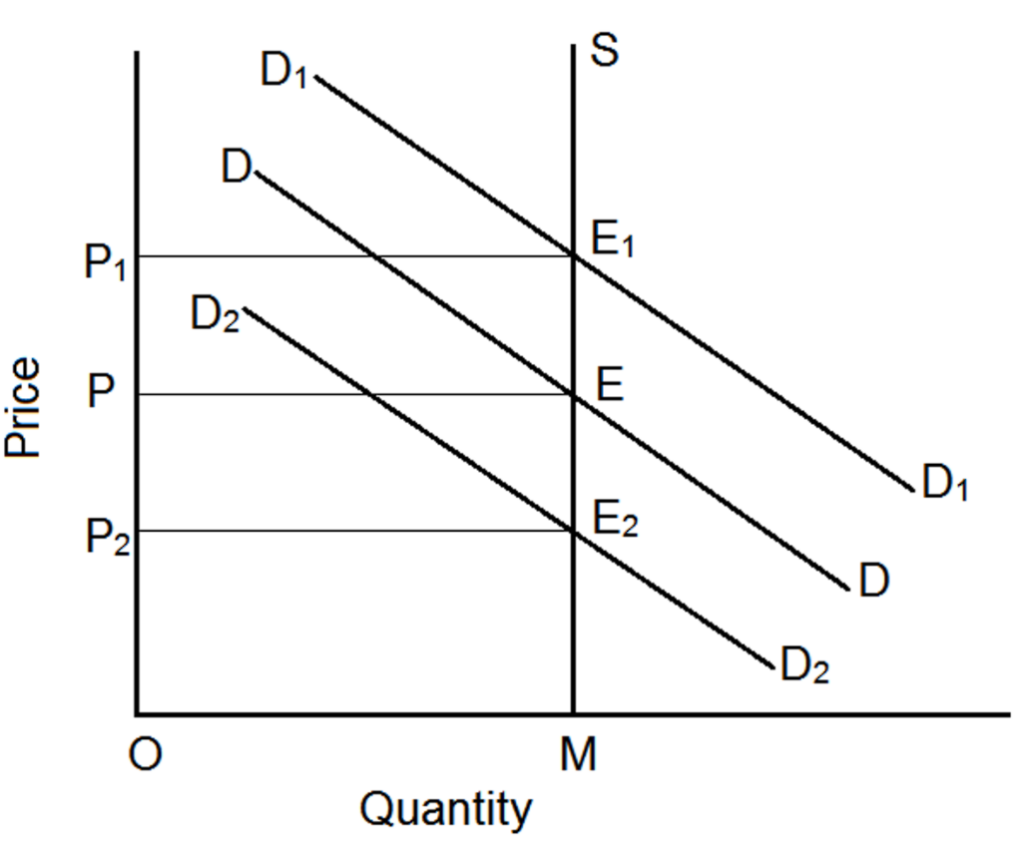

- Variable Demand

- Demand can fluctuate.

- Changes in demand directly affect prices.

- Very Short Run

- Equilibrium Price Determination

- Determined solely by demand fluctuations.

- Fixed supply means any change in demand leads to price changes.

- Example: Agricultural products immediately after harvest.

Normal Period

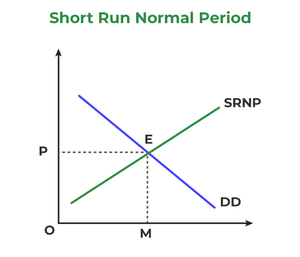

- Short-Run Normal Period

- Characteristics

- Time period long enough for producers to adjust output levels.

- Firms can change production but not all inputs.

- Supply and Demand Changes

- Supply can increase or decrease based on production adjustments.

- Demand can change due to consumer preferences, income, etc.

- Equilibrium Price

- Determined by the interaction of adjusted supply and demand.

- Reflects short-term production capabilities and consumer behavior.

- Characteristics

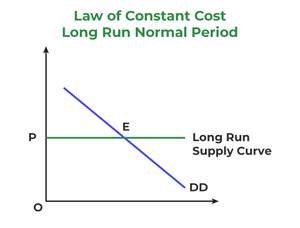

- Long-Run Normal Period

- Characteristics

- Time period long enough for all inputs to be variable.

- Firms can enter or exit the market.

- Supply and Demand Changes

- Supply can fully adjust to changes in production capacity.

- Demand can change based on long-term trends and preferences.

- Equilibrium Price

- Determined by the interaction of fully adjusted supply and demand.

- Reflects long-term production capabilities and market conditions.

- Characteristics

Laws of Cost

- Law of Constant Cost

- Definition

- States that production costs remain constant as output increases.

- Implications

- Supply curve is horizontal.

- Firms can produce more without increasing costs.

- Common in industries with abundant resources and efficient production methods.

- Definition

- Law of Increasing Cost

- Definition

- States that production costs increase as output increases.

- Implications

- Supply curve is upward sloping.

- Firms face higher costs for additional production.

- Common in industries with limited resources or increasing input costs.

- Definition

- Law of Diminishing Cost

- Definition

- States that production costs decrease as output increases.

- Implications

- Supply curve is downward sloping.

- Firms benefit from economies of scale.

- Common in industries with high fixed costs and scalable production.

- Definition

III. Walrasian Approach to Price Determination

General Equilibrium Theory

- Definition

- General equilibrium theory studies the simultaneous determination of prices and quantities in all markets within an economy.

- It considers the interdependencies between different markets and how they reach a state of equilibrium together.

- Importance in Economics

- Provides a comprehensive framework for understanding how different markets interact.

- Helps in analyzing the overall efficiency of resource allocation in an economy.

- Useful for policy-making and economic planning by predicting the impact of changes in one market on others.

- Assumptions

- Perfect Information

- All market participants have complete and accurate information about prices and quantities.

- Ensures that decisions made by consumers and producers are fully informed.

- Simultaneous Equilibrium in All Markets

- All markets in the economy reach equilibrium at the same time.

- Implies that supply equals demand in every market simultaneously.

- Perfect Information

Market Mechanism

- Role of the Auctioneer

- A hypothetical figure who adjusts prices to ensure that all markets clear.

- The auctioneer calls out prices and adjusts them based on excess supply or demand.

- No actual transactions occur until the equilibrium prices are found.

- Process of Determining the Clearing Price

- The auctioneer starts with an initial set of prices.

- If there is excess demand, the auctioneer raises the price.

- If there is excess supply, the auctioneer lowers the price.

- This process continues until supply equals demand in all markets.

- Comparison with Auction Markets

- In real-world auction markets, prices are determined through bidding.

- Unlike the Walrasian auctioneer, real auctioneers facilitate actual transactions during the bidding process.

- Walrasian auctioneer ensures theoretical equilibrium without actual trades until equilibrium is reached.

Interdependence of Markets

- Impact of Related Goods

- Changes in the price or quantity of one good can affect the demand or supply of related goods.

- For example, an increase in the price of tea may increase the demand for coffee as a substitute.

- Impact of Supplementary Goods

- Goods that are used together, such as cars and petrol, have interdependent demands.

- An increase in the price of petrol may decrease the demand for cars.

- Walras’s Law

- States that the sum of excess supply and excess demand across all markets must be zero.

- If there is excess supply in one market, there must be excess demand in another.

- Ensures that the economy as a whole is in balance, even if individual markets are not.

Theoretical Contributions

- Tâtonnement Process

- The process by which the auctioneer adjusts prices to find the equilibrium.

- Ensures that no trades occur until the market is in equilibrium.

- Pareto Efficiency

- A state where no individual can be made better off without making someone else worse off.

- General equilibrium theory aims to achieve Pareto efficiency in the allocation of resources.

Mathematical Formulation

- Equilibrium Conditions

- Mathematical equations representing the balance of supply and demand in each market.

- Use of systems of equations to solve for equilibrium prices and quantities.

- Computational Models

- Use of computational techniques to simulate general equilibrium models.

- Helps in analyzing complex economies with multiple interdependent markets.

IV. Comparative Analysis of Marshallian and Walrasian Approaches

Key Differences

- Scope

- Partial Equilibrium (Marshallian)

- Focuses on a single market or a small number of markets in isolation.

- Analyzes the equilibrium price and quantity in one market without considering the broader economy.

- Useful for understanding specific market dynamics and short-term changes.

- General Equilibrium (Walrasian)

- Considers the entire economy and the interdependencies between all markets.

- Analyzes how equilibrium is achieved simultaneously across all markets.

- Useful for understanding the overall economic system and long-term changes.

- Partial Equilibrium (Marshallian)

- Methodology

- Price Adjustment (Marshallian)

- Prices adjust to clear the market, ensuring that supply equals demand.

- Focuses on the interaction between supply and demand curves to determine the equilibrium price.

- Assumes that quantities are fixed in the short run and adjust only in the long run.

- Quantity Adjustment (Walrasian)

- Quantities adjust to clear the market, ensuring that supply equals demand.

- Focuses on the tâtonnement process, where an auctioneer adjusts prices until equilibrium is reached.

- Assumes that prices are flexible and adjust continuously to achieve equilibrium.

- Price Adjustment (Marshallian)

- Market Assumptions

- Perfect Competition (Marshallian)

- Assumes many buyers and sellers, none of whom can influence the market price.

- Assumes homogeneous products with no differentiation.

- Assumes free entry and exit of firms in the market.

- Interdependent Markets (Walrasian)

- Assumes that all markets are interrelated and must be in equilibrium simultaneously.

- Considers the impact of changes in one market on other markets.

- Assumes that all goods and services are traded in markets with no missing markets or externalities.

- Perfect Competition (Marshallian)

Key Similarities

- Role of Demand and Supply

- Both approaches emphasize the importance of demand and supply in determining prices and quantities.

- Both use demand and supply curves to analyze market behavior.

- Both recognize that equilibrium is achieved when quantity demanded equals quantity supplied.

- Importance of Equilibrium

- Both approaches focus on the concept of equilibrium as a central element of market analysis.

- Both aim to understand how markets reach equilibrium and the factors that influence this process.

- Both use equilibrium analysis to predict the impact of changes in market conditions.

- Impact on Price Determination Theories

- Both approaches have significantly influenced modern price determination theories.

- Both provide frameworks for analyzing how prices are set in different market conditions.

- Both have contributed to the development of economic models used in policy-making and economic planning.

| Aspect | Marshallian Approach | Walrasian Approach |

|---|---|---|

| Scope | Partial Equilibrium | General Equilibrium |

| Methodology | Price Adjustment | Quantity Adjustment |

| Market Assumptions | Perfect Competition | Interdependent Markets |

| Role of Demand and Supply | Emphasizes demand and supply interaction | Emphasizes demand and supply interaction |

| Importance of Equilibrium | Central to market analysis | Central to market analysis |

| Impact on Price Determination Theories | Significant influence on modern theories | Significant influence on modern theories |

V. Criticisms and Limitations

Marshallian Approach

Criticisms

- Assumptions of Perfect Competition

- Assumes many buyers and sellers, none of whom can influence the market price.

- Assumes homogeneous products with no differentiation.

- Assumes free entry and exit of firms in the market.

- These assumptions often do not hold in real-world markets where monopolies, oligopolies, and product differentiation exist.

- Static Analysis

- Primarily focuses on short-term market dynamics.

- Assumes ceteris paribus (all other things being equal), which may not hold in reality.

- Does not account for dynamic changes over time, such as technological advancements or shifts in consumer preferences.

- May not adequately address long-term changes and interdependencies between markets.

Limitations

- Applicability to Real-World Markets

- Simplifying assumptions may not capture the full complexity of real-world markets.

- May not be applicable to markets with significant market power, externalities, or public goods.

- Limited in analyzing markets with significant government intervention or regulation.

- Neglect of Inter-Market Dependencies

- Focuses on partial equilibrium, analyzing a single market or a small number of markets in isolation.

- Does not consider the broader economy and the interdependencies between different markets.

- May not provide a comprehensive understanding of the overall economic system.

Walrasian Approach

Criticisms

- Complexity of General Equilibrium

- General equilibrium models are mathematically complex and difficult to apply in practice.

- Requires solving systems of equations representing the balance of supply and demand in each market.

- Simplifying assumptions may be necessary, but these can reduce the accuracy of the models.

- Unrealistic Assumptions

- Assumes perfect information, where all market participants have complete and accurate information about prices and quantities.

- Assumes that all markets are interrelated and must be in equilibrium simultaneously.

- Assumes that all goods and services are traded in markets with no missing markets or externalities.

- These assumptions often do not hold in real-world economies, leading to deviations from the theoretical equilibrium.

Limitations

- Practical Implementation

- The mathematical complexity of general equilibrium models can make them difficult to implement in practice.

- Requires extensive data and computational resources to simulate complex economies with multiple interdependent markets.

- May not be feasible for policymakers and economists to use in real-time decision-making.

- Reliance on Perfect Information

- In reality, market participants often have incomplete or inaccurate information.

- This can lead to market inefficiencies and deviations from the theoretical equilibrium.

- General equilibrium models may not accurately predict real-world outcomes due to information asymmetry and other market imperfections.

VI. Modern Applications and Relevance

Marshallian Approach

Applications

- Microeconomic Analysis

- Used extensively in microeconomic studies to analyze individual markets.

- Helps in understanding consumer behavior, production decisions, and market structures.

- Applied in studying the effects of price changes on demand and supply in specific markets.

- Example: Analyzing the impact of a price increase in the Indian agricultural market on the demand for wheat.

- Policy-Making

- Provides a framework for designing and evaluating economic policies.

- Used by governments to assess the impact of taxes, subsidies, and price controls on markets.

- Helps in formulating policies to achieve economic objectives such as price stability and efficient resource allocation.

- Example: Evaluating the effectiveness of the Minimum Support Price (MSP) policy in India to support farmers.

Relevance

- Understanding Market Dynamics

- Essential for understanding how prices are determined in competitive markets.

- Helps in analyzing the interaction between supply and demand and the resulting equilibrium price.

- Provides insights into the factors that influence market behavior, such as consumer preferences and production costs.

- Price Setting in Competitive Markets

- Crucial for businesses to set prices that maximize profits while remaining competitive.

- Helps firms understand the elasticity of demand and how price changes affect sales and revenue.

- Example: A company in the Indian textile industry using the Marshallian approach to determine optimal pricing for its products.

Walrasian Approach

Applications

- Macroeconomic Modeling

- Used in macroeconomic models to analyze the overall economy and its interdependencies.

- Helps in understanding how different markets interact and reach equilibrium simultaneously.

- Applied in studying the impact of economic policies on the entire economy.

- Example: Using a general equilibrium model to analyze the effects of a change in interest rates on the Indian economy.

- Financial Markets

- Applied in financial market analysis to understand the interactions between different financial instruments.

- Helps in modeling the behavior of stock markets, bond markets, and other financial assets.

- Used to predict the impact of economic events on financial markets.

- Example: Analyzing the impact of a global oil price shock on the Indian stock market using a general equilibrium model.

Relevance

- Comprehensive Market Analysis

- Provides a holistic view of the economy by considering the interdependencies between all markets.

- Essential for understanding the broader economic implications of changes in one market.

- Helps in identifying potential spillover effects and unintended consequences of economic policies.

- Policy Implications

- Crucial for policymakers to design effective economic policies that consider the entire economy.

- Helps in evaluating the long-term effects of policy changes on economic growth and stability.

- Example: Using a general equilibrium model to assess the impact of trade liberalization on different sectors of the Indian economy.

VII. Conclusion

Summary of Key Points

- Recap of Marshallian and Walrasian Approaches

- Marshallian Approach

- Focuses on partial equilibrium, analyzing individual markets in isolation.

- Emphasizes the interaction between supply and demand to determine prices.

- Assumes perfect competition, homogeneous products, and free entry and exit of firms.

- Useful for microeconomic analysis, policy-making, and understanding market dynamics.

- Example: Analyzing the impact of Minimum Support Price (MSP) on the Indian agricultural market.

- Walrasian Approach

- Focuses on general equilibrium, considering the entire economy and interdependencies between markets.

- Uses the tâtonnement process to adjust prices until equilibrium is reached in all markets.

- Assumes perfect information, interrelated markets, and no missing markets or externalities.

- Useful for macroeconomic modeling, financial market analysis, and comprehensive market analysis.

- Example: Using a general equilibrium model to assess the impact of trade liberalization on the Indian economy.

- Marshallian Approach

- Importance of Understanding Both Theories

- Both approaches provide valuable insights into different aspects of economic analysis.

- Understanding the Marshallian approach helps in analyzing specific markets and short-term changes.

- Understanding the Walrasian approach helps in analyzing the overall economy and long-term changes.

- Both approaches are essential for designing effective economic policies and understanding market behavior.

- Implications for Advanced Microeconomics

- Advanced microeconomics builds on the principles of both Marshallian and Walrasian approaches.

- Provides a deeper understanding of market structures, consumer behavior, and production decisions.

- Helps in developing more sophisticated economic models and theories.

- Example: Integrating both approaches to analyze the impact of technological advancements on market equilibrium.

Future Directions

- Potential Areas for Further Research

- Behavioral Economics

- Studying how psychological factors influence economic decision-making.

- Integrating insights from behavioral economics into traditional economic models.

- Market Imperfections

- Analyzing the impact of market imperfections such as monopolies, oligopolies, and externalities.

- Developing models that account for these imperfections and their effects on market equilibrium.

- Dynamic Models

- Developing dynamic models that account for changes over time.

- Studying the impact of technological advancements, policy changes, and global events on market equilibrium.

- Computational Economics

- Using computational techniques to simulate complex economic models.

- Analyzing large datasets to gain insights into market behavior and economic trends.

- Behavioral Economics

- Integration of Both Approaches in Modern Economic Analysis

- Combining the strengths of both Marshallian and Walrasian approaches to develop more comprehensive economic models.

- Using partial equilibrium analysis to study specific markets and general equilibrium analysis to study the overall economy.

- Developing integrated models that account for both short-term and long-term changes.

- Example: Analyzing the impact of a global oil price shock on both individual markets and the overall economy using an integrated approach.

- Compare and contrast the assumptions and methodologies of the Marshallian and Walrasian approaches to price determination. (250 words)

- Critically analyze the limitations of the Marshallian approach to price determination in the context of modern economic markets. (250 words)

- Discuss the relevance and application of the Walrasian approach to price determination in contemporary macroeconomic modeling. (250 words)

The Duel of Markets: A Tale of Marshall and Walras

In a bustling, ancient city, two wise philosophers stood at opposite ends of the grand market. Their names were Marshall and Walras. Both were known for their profound understanding of markets and trade, yet their views on how prices emerged were as different as day and night. They each believed they had discovered the true secret of how value was determined in the market. The city’s traders, merchants, and citizens were eager to see which one could truly reveal the hidden workings of the market.

The Marshallian Bazaar: The Story of Gradual Discovery

Marshall stood by the entrance of the market, watching as buyers and sellers haggled, negotiated, and slowly arrived at agreements. He observed how the dynamics of supply and demand influenced these exchanges. His approach was organic, almost like observing nature take its course.

He gathered a small group of traders and said, “Let the market breathe. Prices emerge naturally when buyers and sellers interact. The equilibrium price isn’t fixed but comes about as a result of the interplay between demand and supply, where both curves cross.”

He laid out two curves: one for supply and one for demand. “See,” he pointed, “as the quantity demanded decreases with higher prices and the quantity supplied increases, they will meet at a balance point.”

In Marshall’s world, price determination was like watching a plant grow—slow and responsive to external pressures. The traders who gathered around him could intuitively see how the gradual adjustment process led to equilibrium, where markets naturally found a price that worked for both buyers and sellers.

This felt like common sense. Marshall’s model mirrored the real-world bazaar where, over time, sellers lowered their prices when demand slackened, and buyers became more eager when goods became scarcer. It was all about partial equilibrium, meaning Marshall focused on one market at a time, assuming other markets stayed the same.

But there was something missing in Marshall’s world—the broader, interconnected reality of the city’s economy.

The Walrasian Auction: The Invisible Dance of Prices

On the opposite side of the market stood Walras, known for his radical ideas. He didn’t believe in waiting for the market to find equilibrium over time like Marshall. Instead, he believed in the idea of an instantaneous market-wide price determination that happened all at once, like the snap of a finger.

In Walras’ view, the market wasn’t a bazaar; it was more like an auction house—an all-seeing auctioneer in the sky calling out prices. Every participant in the market—whether a buyer of spices, seller of fabric, or collector of rare gems—waited for the auctioneer to announce prices that would clear all markets simultaneously. There was no haggling or gradual adjustment.

“Prices,” Walras declared, “are found not through the individual negotiation of buyers and sellers, but by solving a system where every market is interconnected.” He imagined a world where general equilibrium was the rule. Every price in every market was determined together, like an intricate web. If the price of one good changed, it affected the price of every other good.

Walras’ market was complex and mathematical, almost like a puzzle. He believed that through careful calculation, one could determine the prices for all goods that would perfectly balance supply and demand, not just in one market, but in all markets at the same time.

Where Marshall saw equilibrium as a natural process that emerged over time, Walras saw it as something that could be calculated instantly—as if a central mind knew all the preferences, supplies, and demands at once.

The Showdown: Marshall’s Realism vs. Walras’ Purity

The city’s traders watched in awe as these two philosophies clashed. They liked Marshall’s pragmatic approach, which felt closer to their lived experience. After all, they had seen markets slowly adjust to changing conditions, much like the haggling in the city square.

Yet, Walras’ grand vision intrigued them as well. Could there really be an invisible auctioneer coordinating all the prices at once, across all markets? It was a radical idea, but it had an elegance that Marshall’s piecemeal, market-by-market approach lacked.

A wise merchant, well-versed in the ways of both men, finally spoke. “Marshall, your approach captures the reality of how prices evolve in the market. It is dynamic and responsive, but it only focuses on a part of the picture—one market at a time. Walras, your vision is grand, a model of perfect coordination, but it seems detached from the real world, where things don’t change in an instant.”

The philosophers nodded, each respecting the other’s perspective. They both had captured something essential about the market’s workings—Marshall, with his practical approach to partial equilibrium, and Walras, with his theoretical but ambitious idea of general equilibrium.

The Aftermath: Two Roads to Price Discovery

As the city’s traders dispersed, they realized they could learn from both. When thinking about a specific market—like grain, cloth, or spices—Marshall’s method of gradual price adjustment was useful. But when considering the entire economy, where every market is linked to another, Walras’ vision of interconnectedness came to mind.

In the end, the market continued to function, prices still fluctuated, and the wisdom of both Marshall and Walras shaped the way people understood how prices were determined. One through the eyes of the bazaar, the other through the vision of the auctioneer.

Key Takeaways

- Marshallian Approach: Price is determined by the intersection of supply and demand curves in a single market. It’s a gradual, organic process focused on partial equilibrium, analyzing each market individually.

- Walrasian Approach: Prices across all markets are determined simultaneously through a central, coordinating mechanism. It’s a mathematical and system-wide approach to determining general equilibrium, where all markets are interconnected.

This tale of two markets highlights the beauty of these two models—each offering valuable insights into how prices emerge, yet doing so from entirely different perspectives.

Responses