Tax Transparency in India: A Catalyst for Sustainable Growth

From Current Affairs Notes for UPSC » Editorials & In-depths » This topic

IAS EXPRESS Vs UPSC Prelims 2024: 85+ questions reflected

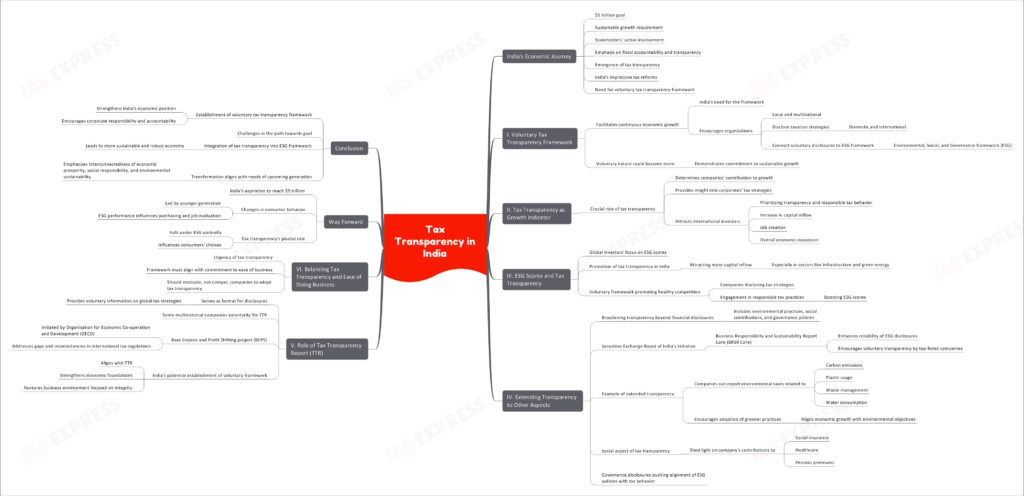

As India strives to cross the $5 trillion mark, the journey entails fostering sustainable growth that requires the active involvement of all stakeholders. Amid the era emphasizing fiscal accountability and transparency, tax transparency has emerged as a significant player for sustainable growth. Despite India’s impressive tax reforms, there is a need for a voluntary tax transparency framework to maintain the current pace of economic expansion.

I. The Need for a Voluntary Tax Transparency Framework

To facilitate continuous economic growth, India needs to establish a voluntary tax transparency framework. This system would encourage organizations, both local and multinational, to:

- Disclose their taxation strategies domestically and internationally.

- Connect such voluntary disclosures to the environmental, social, and governance (ESG) framework.

- The voluntary nature of this framework could eventually become a norm for every company to exhibit their commitment to sustainable growth.

II. Tax Transparency as a Growth Indicator

Tax transparency plays a crucial role in:

- Determining each company’s contribution to India’s growth.

- Providing insight into the tax strategies of corporates.

- Attracting international investors who prioritize transparency and responsible tax behavior, leading to an increase in capital inflow, job creation, and overall economic expansion.

III. ESG Scores and Tax Transparency

Globally, investors are giving considerable importance to ESG scores. The promotion of tax transparency in India could attract more capital inflow, especially in sectors like infrastructure and green energy. A voluntary framework could also promote healthy competition among businesses to disclose their tax strategies and engage in responsible tax practices to boost their ESG scores.

IV. Extending Transparency to Other Aspects

The focus on transparency needs to broaden beyond financial disclosures to include environmental practices, social contributions, and governance policies. The Securities Exchange Board of India has already launched the Business Responsibility and Sustainability Report (BRSR) Core, to ensure the reliability of ESG disclosures by top-listed companies. This initiative should encourage companies to voluntarily adopt transparency.

For example, companies can report environmental taxes related to:

- Carbon emissions

- Plastic usage

- Waste management

- Water consumption

This reporting can encourage businesses to adopt greener practices and align economic growth with environmental objectives. Similarly, the social aspect of tax transparency could shed light on a company’s contributions towards social insurance, healthcare, and pension premiums. Under governance disclosures, the framework can push companies to align their ESG policies with tax behavior.

V. The Role of Tax Transparency Report (TTR)

A Tax Transparency Report (TTR) serves as a format for such disclosures, providing voluntary information on a company’s global tax strategies. While some multinational companies voluntarily file these reports, the base erosion and profit shifting (BEPS) project initiated by the OECD is working to fix gaps and inconsistencies in international tax regulations. In a similar vein, India could establish a voluntary framework for companies along the lines of TTR to strengthen its economic foundations and nurture a business environment focused on integrity.

VI. Balancing Tax Transparency and Ease of Doing Business

While tax transparency is urgent, the framework must align with India’s commitment to ease business practices. It should motivate, not compel, companies to adopt tax transparency.

Way Forward

As India aspires to reach the $5 trillion economic milestone, changes in consumer behavior led by the younger generation are noticeable. These individuals tend to consider a company’s ESG performance while making purchases or evaluating job opportunities. Therefore, tax transparency, falling under the ESG umbrella, will play a pivotal role in influencing these choices.

Conclusion

In conclusion, the establishment of a voluntary tax transparency framework will not only strengthen India’s economic position but also encourage corporate responsibility and accountability. While the path towards this goal poses challenges, the integration of tax transparency into the ESG framework will ultimately lead to a more sustainable and robust economy. This transformation aligns with the needs of the upcoming generation, emphasizing the interconnectedness of economic prosperity, social responsibility, and environmental sustainability.

Practice Question for Mains:

Tax transparency is a catalyst for sustainable growth. Elaborate. (250 words)

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.