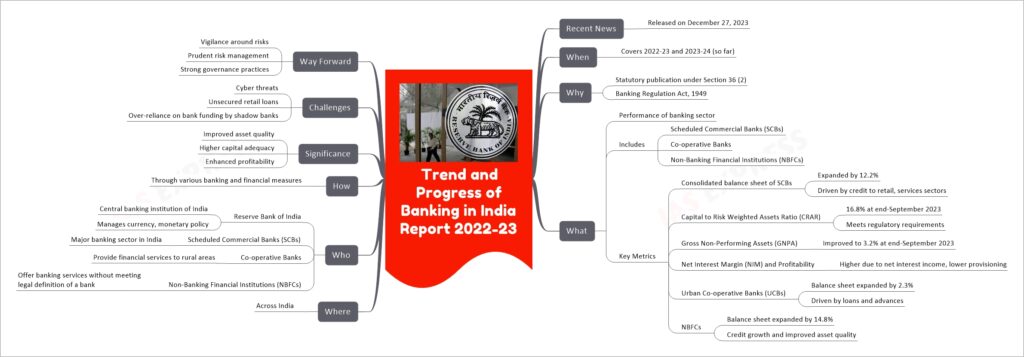

Trend and Progress of Banking in India Report 2022-23

The “Trend and Progress of Banking in India” Report for 2022-23 by the RBI provides an extensive analysis of the banking sector’s performance in India. It highlights the expansion and improvement in various areas such as the balance sheets of commercial and co-operative banks, asset quality, and profitability. The report also emphasizes the challenges such as cyber threats and the need for prudent risk management and governance practices to ensure resilient and inclusive growth in the banking sector.

If you like this post, please share your feedback in the comments section below so that we will upload more posts like this.